Financial management represents a major challenge for small business operators. Business paperwork accumulates when owners need to track payments alongside deadline completion and tax management.

Traditional invoicing methods; such as manual entries, paper records, and offline spreadsheets often result in:

- Billing errors and inconsistencies

- Delayed payments

- Limited visibility into cash flow

But the way businesses manage finances is evolving.

More small business owners are now choosing cloud-based invoicing; with a good reason. It’s faster, more secure, and more efficient for handling billing, payments, and records. Whether it’s a cloud based invoicing tool or a full cloud based invoicing system, the advantages are clear:

Anywhere access to invoices

Faster payments with automated reminders

Real-time cash flow tracking

Lower admin burden

This blog explores why cloud based invoicing for small business is quickly becoming the future of financial management.

Let’s dive into it!

Common Small Business Invoicing Issues

First, let’s understand the common issues with invoicing.

1. Missing Invoices

Your clients are dealing with all kinds of operational issues, just like you are. So, it’s natural for them to misplace or forget about an invoice from time to time. This can cause delays in payments (more on that later) or even accounts payables neglected.

In some cases, some business owners might not have their own copies of these invoices. Other times, the duplicate gets buried somewhere only to never be found again.

2. Late Payments

54% of small businesses experience late invoice payments. And with late payments come all kinds of operational problems, such as operational deficits, cashflow problems, and unnecessary stress and anxiety for business owners and their finance teams.

It takes one late payment to cause a domino effect of late invoices. When left unchecked, the business could start losing money because of poor payment-chasing rhythms. Sometimes, relying on human talent to pursue late payments might not always be the best solution. They’ll run out of creative ways to pursue invoices and occasionally forget one or two follow-ups.

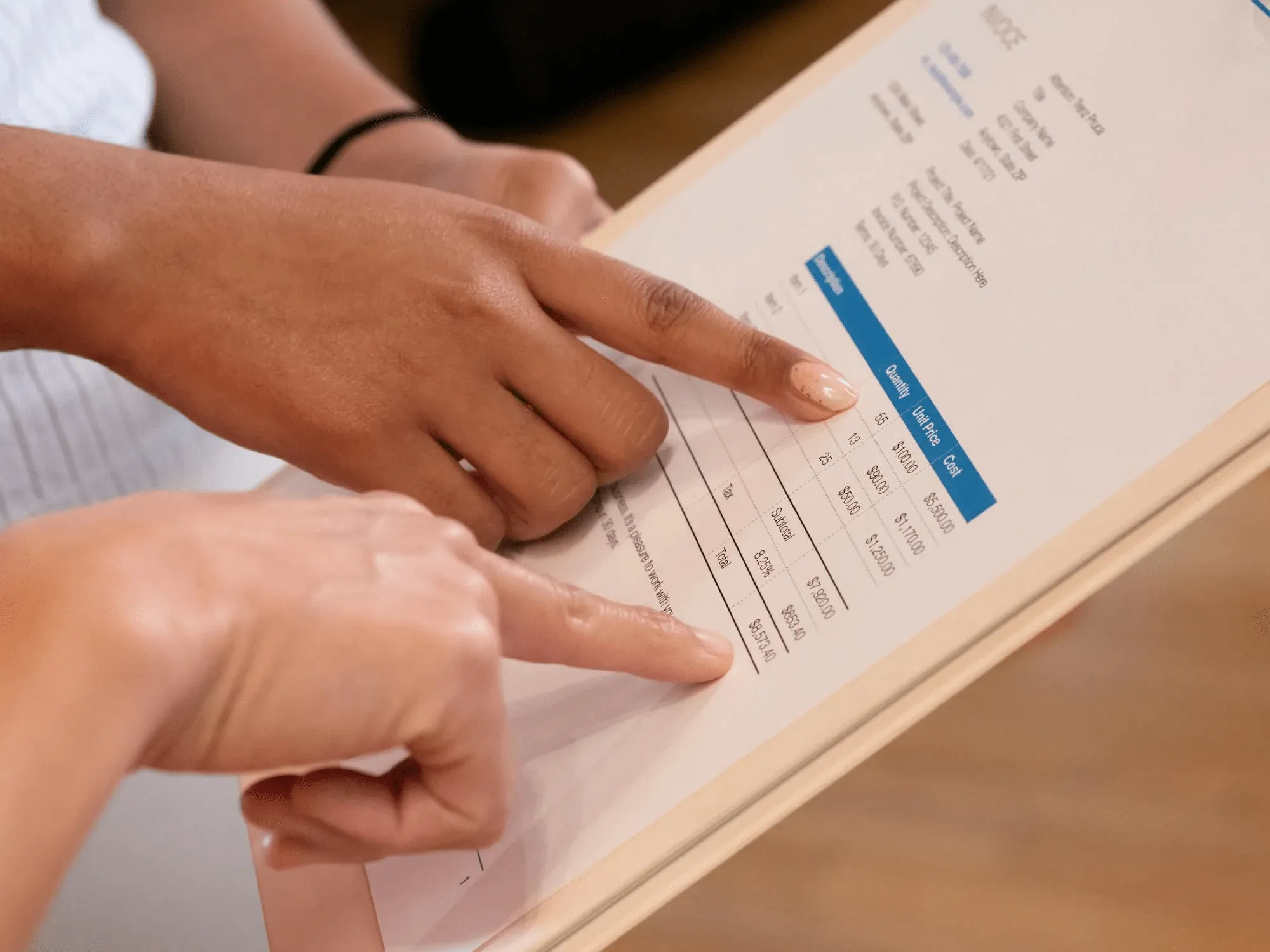

3. Invoice Errors

Very much connected with late payments, invoice errors can be another common invoicing problem for small businesses. Typographical errors, wrong computations, and other errors will result in non-payment, which will delay your invoicing.

If the client doesn’t double-check, you can also have several accounting problems when they underpay or overpay you. Plus, it will lower your credibility and trustworthiness when clients and customers find out they paid the wrong amount because of a supplier-side error.

4. Slow and Complex Finance Processes

Legacy payment systems, complex finance processes, and so on add unnecessary work to finance committees and staff. What could be a five-minute billing task could become hours if your systems aren’t as streamlined as they should be.

The worst attitude towards these invoicing problems is to say, “They’ve always been this way, so might as well take it as it is.” Cloud-based invoicing has several solutions to these recurring pain points..

Top Cloud-based Invoicing Features for Small Businesses

1. Automated Invoice Creation and Dispatch

You can set up recurring billing for clients with your cloud-based invoicing software. You can schedule intervals on when to send invoices automatically. With this, invoices and—concurrently—payments go out as scheduled with little to no manual intervention. This saves your time and reduces the chances of human error, and ensures invoices are sent on time.

2. Customizable Templates

Customizable invoice templates are available on most cloud-based invoicing tools. You get to add and use your own business logo, information, payment terms, and more. Using templates helps you maintain brand consistency and professional appearance while accommodating different billing scenarios.

3. Integrated Payment Processing

It’s always best to go for an invoicing system that Includes built-in capabilities to accept payments directly through the invoice. Examples are credit cards and bank transfers. You can also include a PayPal option, which has over 426 million active accounts at the end of 2023.

4. Real-Time Financial Reporting

Financial reporting lets you project revenues for the future, make better money decisions, and celebrate past performance. Invoicing systems have financial reports generated automatically based on invoice data. That can include profit and loss statements, expense reports, and tax summaries.

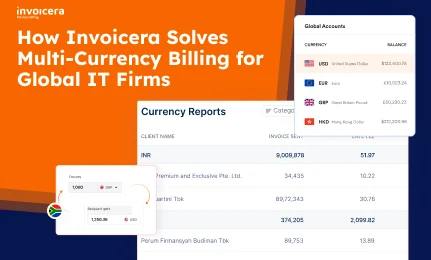

5. Multi-Currency and Language Support

As the world globalizes, you need to consider billing global clients in their local currencies to win them over. Invoicing in multiple currencies and languages opens businesses up to international markets. This expands your market reach while enhancing customer satisfaction and compliance with local requirements.

6. Data Security and Backup

Invoicing software should always come with security measures like data encryption and regular backups to protect sensitive financial information. Many of these fintech companies go through the security process with a fine comb to ensure top-level data and financial security. Knowing your business data is secure and can be recovered in case of failure or cyberattack gives you peace of mind.

7. Customer Management

Many invoicing and billing tools integrate with tools for managing customer information. You can connect your system to CRMs that handle contact details, billing history, and payment preferences. The clear benefit of this is the streamlined customer interactions you’ll have with paying clients. The integration also provides valuable insights into customer behavior and payment patterns.

Pros and Cons of Using Cloud-based Invoicing

Here’s a breakdown of the key benefits and drawbacks of cloud based invoicing software:

Pros

Access From Anywhere

- Create and send invoices from any internet-enabled device.

- Ideal for remote teams and on-the-go business owners.

Real-Time Updates

- See when invoices are sent, opened, and paid.

- Improves tracking and cash flow visibility.

Automation Features

- Automate recurring invoices and payment reminders.

- Reduces manual work and billing errors.

Enhanced Data Security

- Benefit from encryption and automatic backups, and VPN safety.

- Safer than storing physical or local files.

Easy Integrations

- Connect with accounting, CRM, and payment tools.

- Streamlines overall financial operations, while also helping businesses optimize cloud costs.

Cons

Dependence on Internet Connectivity

- Needs a stable internet connection to access data.

- Connectivity issues may delay invoicing tasks.

Ongoing Subscription Costs

- Involves monthly or yearly fees.

- Can add up for very small businesses.

Learning Curve for New Users

- May require onboarding and training time.

- Initial setup can slow down adoption.

Data Privacy Concerns

- Financial data is stored off-site in the cloud.

- Risk of breaches if security is not properly managed.

Thus, selecting the right cloud based invoicing software helps mitigate these risks.

Best Practices When Using Cloud-based Invoicing

To make the most of your small business cloud based invoicing solution, follow these practices:

1. Choose a Reliable Platform

- Look for proven online invoicing software with strong uptime and support.

- Prioritize platforms offering automation, integrations, and mobile access.

- Check for customer support and regular system updates.

2. Customize your Invoices

- Add your business logo and contact details for a professional look.

- Use consistent formatting with clear item descriptions.

- Highlight payment terms and due dates clearly.

3. Set Clear Payment Terms

- Define standard payment periods (e.g., Net 15, Net 30).

- Clearly list accepted payment methods.

- Include late fee policies to prevent delays.

4. Automate Where Possible

- Set up recurring invoices for repeat clients.

- Enable automatic reminders for upcoming or overdue payments.

- Use auto-calculation for taxes and discounts.

5. Track Invoice Status Regularly

- Monitor paid and overdue invoices through your cloud based invoicing tool.

- Use dashboard alerts or reports for follow-ups.

- Act quickly on overdue payments to maintain cash flow.

6. Use Secure Access Controls

- Assign user roles based on job responsibilities.

- Restrict sensitive financial data to authorized personnel.

- Enable two-factor authentication where possible.

7. Back Up Data and Monitor Reports

- Ensure automatic backups are active for all records.

- Review reports using your saas billing software for insights.

- Use analytics to identify trends or issues.

8. Keep Client Information Up To Date

- Regularly verify billing addresses and contact emails.

- Update client payment preferences if they change.

- Remove outdated or inactive contacts from the system.

8. Review and Reconcile Monthly

- Match invoices with bank transactions or payment records.

- Look for duplicate charges, errors, or missed payments.

- Keep records organized for tax season and audits.

Following these tips ensures that cloud based invoicing for small business delivers its full value.

Closing Thoughts

In conclusion, small businesses that adopt flexible operations, quick financial practices, and speed now understand cloud based invoicing for small business as an essential standard rather than a passing trend; it’s becoming the new standard. Cloud-based invoicing handles daily billing routines, offering better cash flow insights and streamlined manual processing.

Tools like Invoicera offer robust, scalable solutions, making the shift easy with features for workflow automation, client management, and integration with popular business systems. Whether you’re just starting out or scaling up, free cloud based invoicing for small business options are also available to help you begin without high costs.

Adopting cloud-based invoicing represents more than competent practice; it’s the future direction for business operations in quick-moving markets.

FAQs

Ques: What are the benefits of cloud-based invoicing software for small businesses?

Ans: It helps small businesses manage their finances efficiently with the following:

- Automate creating and dispatching invoices

- Integrate payment processing

- Offer real-time financial reporting

- Give better security for your files

Ques: What are the best practices for utilizing this tool?

Ans:

- Secure your account with strong passwords and 2FA (two-factor authentication)

- Reflect your brand identity by customizing invoices

- Comply with legal and tax requirements

- Maintain financial records

Ques: What should small business consider in choosing an invoicing solution?

Ans: It’s different for each business needs, but here are some important factors to consider:

- Ease of use

- Customization options

- Integration with your existing systems

- Security features

- Cost of the system and your budget

Ques: Is cloud-based invoicing secure for small businesses?

Ans: Yes, most cloud invoicing platforms use advanced encryption, secure servers, and regular backups to protect your financial data. Choosing a trusted provider with strong security protocols ensures your information stays safe.

Ques: Can cloud-based invoicing work for freelancers or very small teams?

Ans: Absolutely. Cloud-based invoicing is ideal for freelancers and small teams because it’s easy to set up, cost-effective, and scalable. It helps streamline billing without the need for complex accounting software.