Introduction

Imagine you are running an international business and exporting handcrafted furniture to any other country.

So, how are you going to make transactions? Invoices play an important role in completing the transactions between two businesses.

Do you know?

The market share of online invoices is 20.4%, and it is expected to grow by 80% in 2027.

There are two types of invoices: proforma and commercial. Both types have their own significance.

If a wrong invoice is chosen, the whole transactional process will be delayed. For this reason, we have come up with this post.

This blog will discuss Commercial invoice vs Pro forma invoice and cover every small detail about them.

moreover, it will also cover essential tools you can use to automate the process of generating and sending invoices.

Now, let us scroll down and find out their relevance in the business world.

Proforma Invoice

Let’s start with the definition.

Definition:

A proforma invoice is a document consisting of an estimate of the costs associated with a transaction and is issued to the buyer.

A proforma invoice is basically a quote upfront, listing what the buyer will owe for the goods or services.

It’s not a final bill, but it helps both sides understand the costs before anything is shipped or done.

Why Is It Used?

It serves as an introduction to the commercial invoice, which is generated upon delivery of the goods or completion of the services.

Below are some situations where Proforma invoices are typically used:

- International Trade: While exporting or importing goods, customs authorities often provide proforma invoices to review duties and taxes accurately.

- Custom Orders: What is a proforma invoice for customs? Businesses use proforma invoices to tell customers about the expected costs of custom-made or special orders.

- Advance Payments: Businesses also use proforma invoices to secure the order before delivery when requesting advance payments from customers.

- Estimating Costs: Buyers can use proforma invoices to compare costs from different suppliers and make informed decisions.

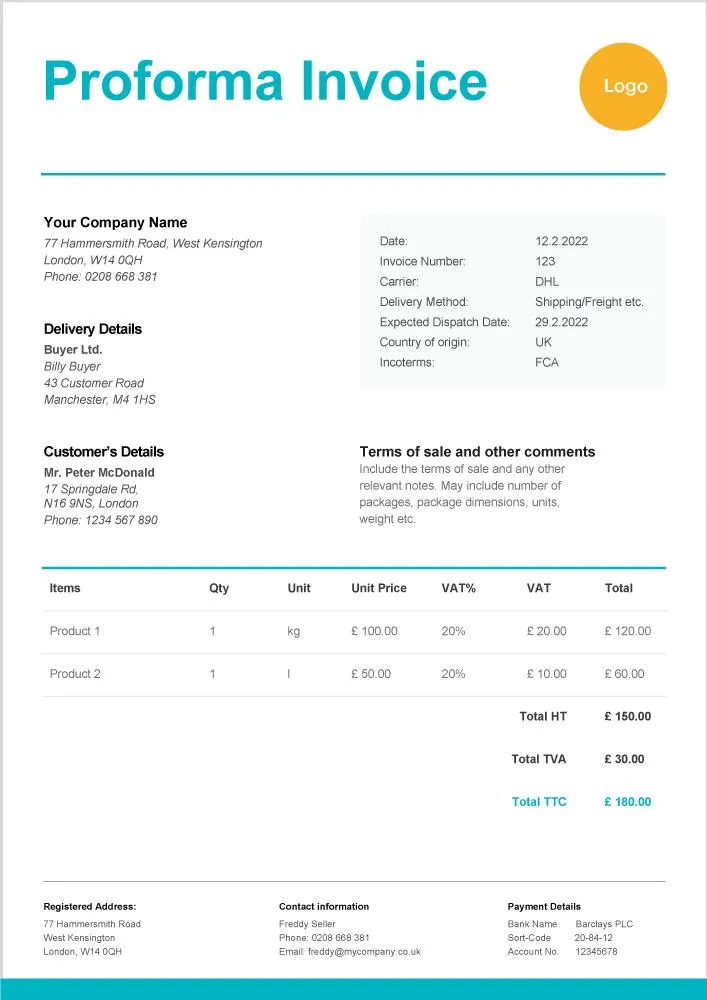

Below is a sample proforma invoice:

Source: Zervant

Commercial Invoice

Begin with understanding the definition of commercial invoice in brief.

Definition:

A commercial invoice is an official document that is issued to the buyer after providing them the goods or services.

It is a legal statement including all the terms and circumstances of that particular transaction. It may include the actual costs, payment due date and other important information like late penalties if any.

The commercial invoice is proof of financial transactions between two businesses.

Purpose Of Commercial Invoice:

The primary purpose of a commercial invoice is to facilitate international trade by providing customs authorities with a detailed record of the transaction.

Commercial invoices are typically used in the following situations:

- Customs Clearance: It is beneficial for customs authorities to have a look at the duties, taxes, and tariffs associated with exported goods.

- Payment Confirmation: Buyers use commercial invoices to confirm the amount owed to the seller and process payments.

- Legal Documentation: Commercial invoices serve as legal evidence of the transaction’s terms and conditions in case of disputes or legal issues.

- Financial Record-Keeping: Both buyers and sellers use commercial invoices for financial record-keeping and tax purposes.

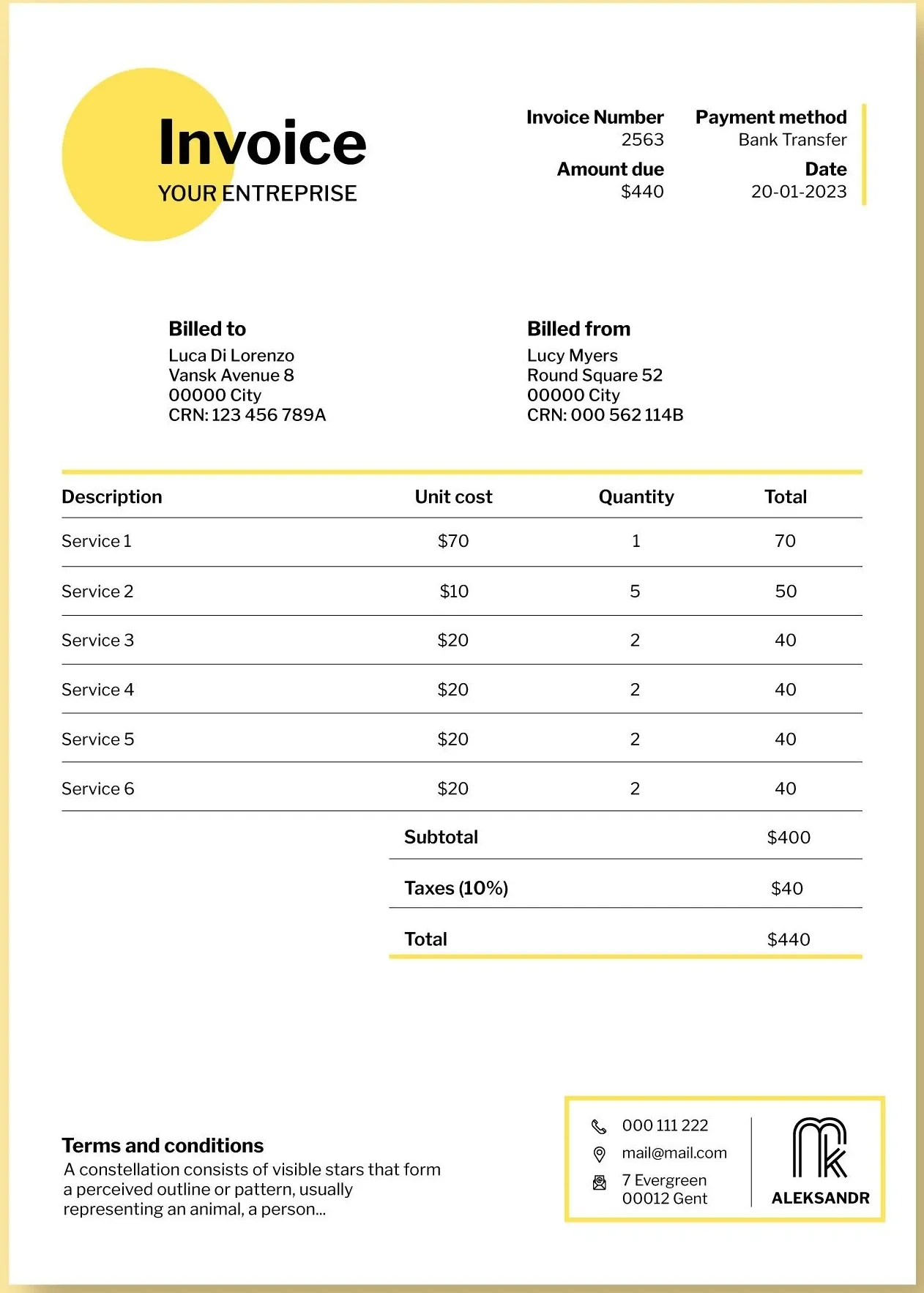

Below is a sample commercial invoice:

Key Differences Between Proforma vs Commercial invoice

| Terms | Proforma Invoice | Commercial Invoice |

| Purpose | Serves as a preliminary estimate or quotation. | Serves as a demand for payment and is used for customs clearance, payment confirmation, and legal documentation. |

| Legal Status | Proforma invoices are not legally binding documents. | Hold both the buyer and the seller accountable for the terms of the transaction. |

| Timing of Issuance | Typically issued before the delivery of goods or services. | Issued after the delivery of goods or completion of services. |

| Payment Terms | Include information on requested or expected advance payments. | Provide clear payment terms and expectations. |

| Tax and Customs | Often used for customs declarations and may influence the calculation of import duties and taxes. | Crucial for customs clearance and accurate assessment of import duties and taxes. |

| Tax Documentation | Not considered primary tax documents for accounting purposes. | Serve as primary tax documents and are essential for accounting and tax reporting purposes. |

That was difference between proforma invoice and commercial invoice!

When To Use Performa Invoice

New Customer Relationships

Performa invoices are helpful when you are dealing with fresh customers by providing them a detailed cost estimate before they decide to opt for services.

It can help build client trust and transparency in the initial stages of a business relationship.

Custom Orders

Proforma invoices are useful when handling custom orders or projects with variable costs.

They allow you to communicate the expected expenses to the customer and receive their approval before proceeding.

When To Use Commercial Invoice

Goods Or Services Delivery

Commercial invoices should be used once the goods have been delivered using appropriate routing software, or once services have been completed. This is a legal requirement to confirm the final cost of the transaction.

International Trade

When engaging in international trade, commercial invoices are necessary for customs clearance. They provide the required details to assess import duties and taxes accurately.

Real-World Examples

Know where proforma and commercial invoices are used. Consider the real-world examples below.

Proforma Invoice

A manufacturing company providing a quote for a bulk order of custom-made machinery to a new client.

The proforma invoice outlines the estimated costs, including the machinery’s specifications and price per unit.

Commercial Invoice

An e-commerce business selling a shipment of electronic gadgets to a foreign buyer.

The commercial invoice is issued after the goods are shipped and contains the actual cost of the products, including shipping and import duties.

Importance Of Accurate Invoicing

Using the wrong type of invoice can lead to several negative consequences:

- Customs Delays: Using a proforma invoice when a commercial invoice is required in international trade can delay customs and potentially hold up your shipment.

- Payment Issues: If you issue a proforma invoice when a customer expects a commercial invoice, it can create confusion and payment delays.

- Legal Implications: Failing to use the correct invoice type by local regulations can have legal implications, including fines and penalties.

Tips For Creating And Handling Invoices

Best Practices For Creating Proforma Invoices

- Clear Description: Provide a detailed description of the goods or services to avoid misunderstandings.

- Include Payment Terms: Specify any advance payment requirements and payment deadlines.

- Use Professional Templates: Utilize professional invoice templates to maintain a consistent and organized look.

- Include Contact Information: Ensure that your contact information and that of the buyer are accurate and up to date.

Best Practices For Creating Commercial Invoices

- Accurate Pricing: Ensure the prices on the commercial invoice match the actual transaction cost.

- Detailed Product/Service List: Include a comprehensive list of products or services delivered, specifying quantities and unit prices.

- Payment Terms: Clearly outline payment terms, including due dates and accepted payment methods.

- Compliance: Ensure the commercial invoice complies with local and international trade regulations.

Tips For Record-Keeping And Organization

- Digital Storage: Store electronic copies of invoices for easy access and retrieval.

- File Naming: Use a consistent and logical file naming system for invoices to facilitate quick searches.

- Backup: Regularly back up your invoice data to prevent loss.

- Organization: Maintain a well-organized system for both digital and physical invoices to track payments and for tax purposes.

How Invoicing Software Helps Generate Invoices?

Choosing the right online invoicing software is crucial for managing your pro forma and commercial invoices. Invoicera is a very useful online invoicing software that helps with sending online proforma invoices and commercial invoices.

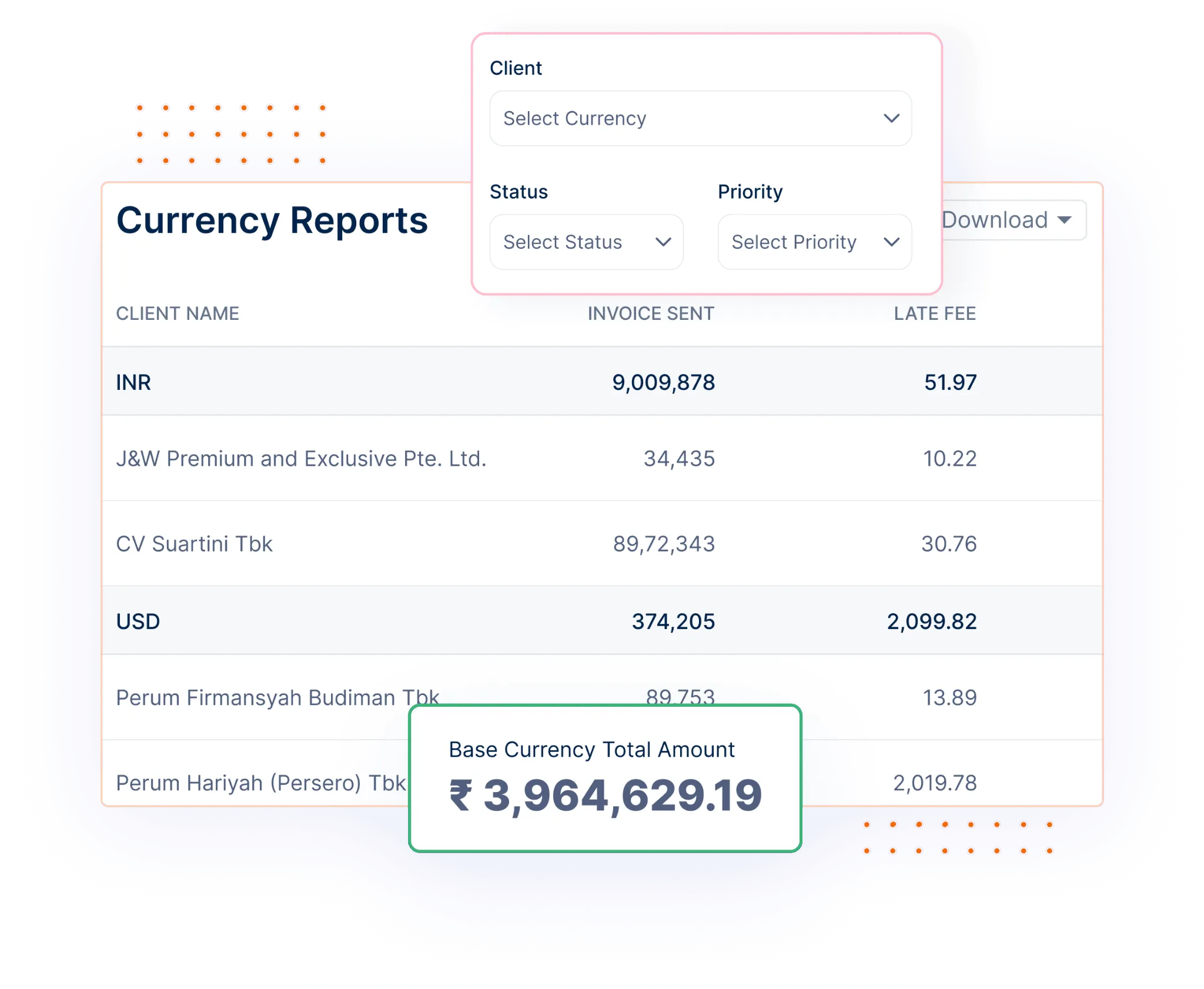

You can easily use the estimates feature of Invoicera to send in your pro forma invoices. The complete payment cycle of your import and export business can be easily managed using this helpful tool.

Apart from just creating and sending invoices, it also helps in the easy management of day-to-day business activities. The inbuilt features of staff management and automated currency conversions let you know about the currency’s profits and losses easily.

FAQs

What is the purpose of a proforma invoice?

The goal of Pro forma invoices is to save the customer from any unanticipated charges, These are sent to the buyer before delivery of goods or services. Most proforma invoices provide the buyer with an exact selling price. A pro forma invoice requires only enough information to allow Customs to determine the required duties based on a general examination of the goods included.

Can payment be made on a proforma invoice?

No, A proforma invoice is not responsible for the payments. A standard invoice, on the other hand, is responsible for the payments. An invoice is a document issued to the customer once all the details have been clarified and a payment date has been set. It is a legal document that describes the products and services sold and the amount owed.

Is GST applicable on a proforma invoice?

No, GST is not applicable on proforma. A Proforma invoice does not indicate a transaction that has taken place or will take place. Therefore, according to GST law, it is not an invoice and not an obligation to pay GST.

Does a proforma invoice need to be signed?

Once the final proforma invoice is accepted by the buyer, it should be signed by the authorized buyer/importer and returned to the exporter.

Is a pro forma invoice a tax invoice?

The purpose of the tax invoice is to inform the buyer that payment is due. The proforma invoice is used to give the potential customer an overview of the price, type of goods, and other terms of sale in advance. Thus, on the basis of the proforma invoice, the potential customer can decide whether or not to buy the goods.