The most important aspect of any business is financial stability.

If you understand your company’s financial health, then only you can make better future decisions ensuring its sustainability.

So, how can you do this?

Cash flow projections help you to predict future finances to a greater extent.

Let’s consider the below quote. It clearly explains how crucial is the cash flow in your business.

Thus, for better cash flow or financial management, you should understand everything about cash flow projections.

Whether you’re a seasoned business owner or a beginner in the field, join us as we break down why you need cash flow projections and how they can be your compass to navigate the financial seas of business.

Let’s get started.

What Are Cash Flow Projections?

Let’s get into a detailed explanation of what cash flow projections are.

Definition

Cash flow projections are like the financial roadmap for your business. They provide you with a clear picture of how money moves in and out of your company over a specified period, typically a month, quarter, or year.

It’s like a detailed forecast that tells you when to expect cash inflows and outflows.

- Cash Inflows: Money that comes in.

- Cash Outflows: Money that you pay out.

You can plan your financial needs with cash flow projections and make better business decisions.

Differentiating Cash Flow and Profit

Profit is what’s left when you subtract all your expenses from your revenue. It’s a measure of your business’s overall financial health.

Cash flow, on the other hand, is primarily concerned with the real money coming in and out of your organization.

For example, your company may be profitable on documents, but if your clients haven’t paid their invoices, you may have a cash flow crisis.

So, while profit is essential, cash flow keeps the lights on.

Why Is Historical Data Not Enough?

No doubt, historical data is necessary to assess your past performance and identify trends, but it is not enough to predict your financial future.

Changes in business conditions, customer behaviors, and unexpected events can disrupt your cash flow. Cash flow projections consider these variables and give you a forward-looking view of your finances.

They help you adapt to the changing landscape and be proactive in your financial management.

How to Create Cash Flow Projections

Learn how you can create cash flow projections so that you always stay above in your business financial game.

Let’s break down the process into essential steps:

1. Collecting And Organizing Financial Data

The very first step to creating cash flow projections is gathering and organizing financial data.

It includes historical financial records like income statements, balance sheets, and past cash flow statements.

Additionally, you’ll require data on your accounts payable, accounts receivable, and any outstanding debts.

The more comprehensive your data, the more accurate your projections will be.

So, you must organize your data in such a way that you can access it easily and update it regularly.

Many businesses use accounting software like Invoicera or spreadsheets to keep their financial information in order.

2. Estimating Cash Inflows

Cash inflows are the money flowing into your business from different channels, such as sales, loans, investments, and other income sources.

To make precise cash flow predictions, you must estimate the timing and amounts of money you anticipate from each source.

This involves taking into account factors like sales cycles, customer payment terms, and when loans will be disbursed.

It’s essential to be realistic and conservative in your estimates, considering potential delays or fluctuations in income.

3. Projecting Cash Outflows

Cash outflows are the money your business spends on various expenses, such as rent, utilities, salaries, and supplier payments.

To project cash outflows, break down your expenses into fixed and variable categories.

Fixed expenses may fluctuate, such as rent, and remain relatively stable, while variable expenses, like materials or utilities.

Estimate when these payments are due and how much they will cost.

Once more, it’s advisable to anticipate cautiously, accounting for unforeseen expense hikes or payment delays.

4. Calculating And Analyzing The Cash Flow Statement

It’s time to generate your cash flow statement now that your data is structured and you have a precise estimate of how much money is coming in and going out.

Known by another name, cash flow forecast, this statement gives you a clear picture of your anticipated cash situation for a given time frame, such as a month, quarter, or year.

You just need to deduct your anticipated cash outflows from your anticipated cash inflows for each period to get your cash flow statement. The outcome will show you if you’ll have enough money when you need it.

Remember, it is very important to update cash flow statements on a regular basis. With this, you can make good financial decisions, adjust your financial plans, and ensure that you always have enough cash to meet business requirements.

Common Challenges In Cash Flow Projections

While cash flow projections act like a powerful tool to manage a business’s financial health, they come with their own set of challenges.

Understanding and preparing for these challenges is vital to creating accurate and reliable cash flow projections.

Let’s know about some common hurdles you may face:

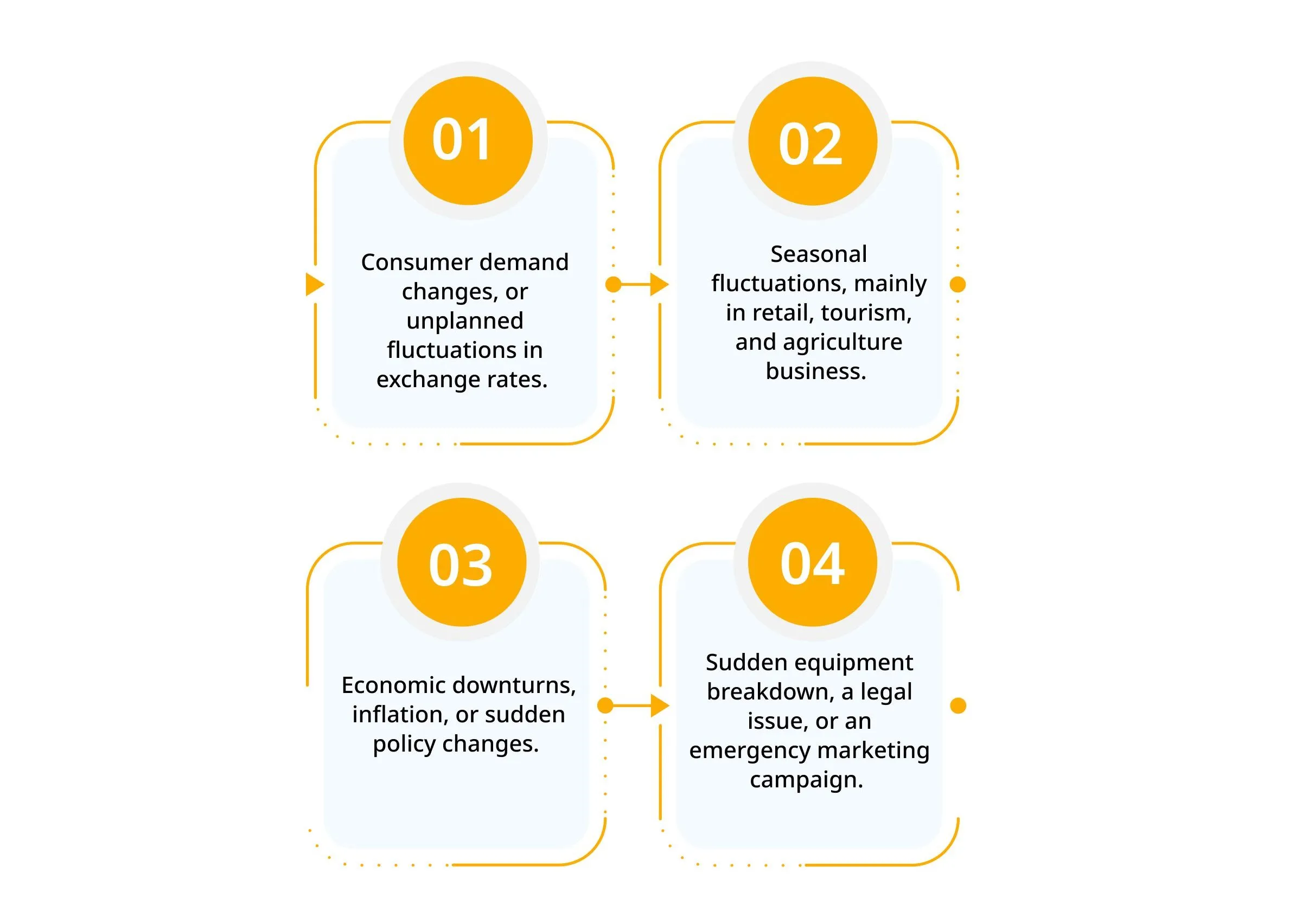

a. Unpredictable Variables

In the changing world of business, certain factors are just impossible to forecast.

- These could be modifications to the state of the market, adjustments to consumer demand, or unplanned fluctuations in exchange rates.

- To address these challenges, it’s essential to incorporate a degree of flexibility in your projections.

- Regularly updating your cash flow forecasts and considering various scenarios can help you adapt to unforeseen changes in your business landscape.

b. Seasonal Fluctuations

Seasonal fluctuations cause revenue and expenses for many sectors, such as retail, tourism, and agriculture, to fluctuate significantly over the year.

Here, the difficulty lies in precisely foreseeing these variations and making plans in response.

By analyzing historical data and identifying seasonal patterns, you can create seasonal cash flow projections that allow you to allocate resources wisely during both peak and off-peak periods.

c. Economic Uncertainties

The broader economic landscape can have a significant impact on your cash flow.

- Economic downturns, inflation, or sudden policy changes can disrupt your projections.

- You cannot control the economy, but you can mitigate the impact by staying informed about economic trends, diversifying your revenue streams, and having plan B in place.

- These measures can help you navigate economic uncertainties more effectively.

d. Dealing with Unexpected Expenses

It doesn’t matter how well you plan; unexpected expenses are bound to arise.

- It could be a sudden equipment breakdown, a legal issue, or an emergency marketing campaign to address a competitor’s move.

- To tackle these challenges, it’s crucial to maintain a financial cushion.

- Reserve funds or a line of credit can provide the necessary buffer to cover unforeseen costs without throwing your entire cash flow off balance.

Tools And Resources For Cash Flow Projections

Having the correct tools and resources at your service when it comes to cash flow estimates can make all the difference.

Let’s look at some of the important alternatives for properly managing and forecasting your cash flow.

Cash Flow Projection Software

Cash flow projection software is a valuable asset for business. These specialized tools make the cash flow forecasting process easy. They allow you to input financial data, create forecasts, and generate reports with ease.

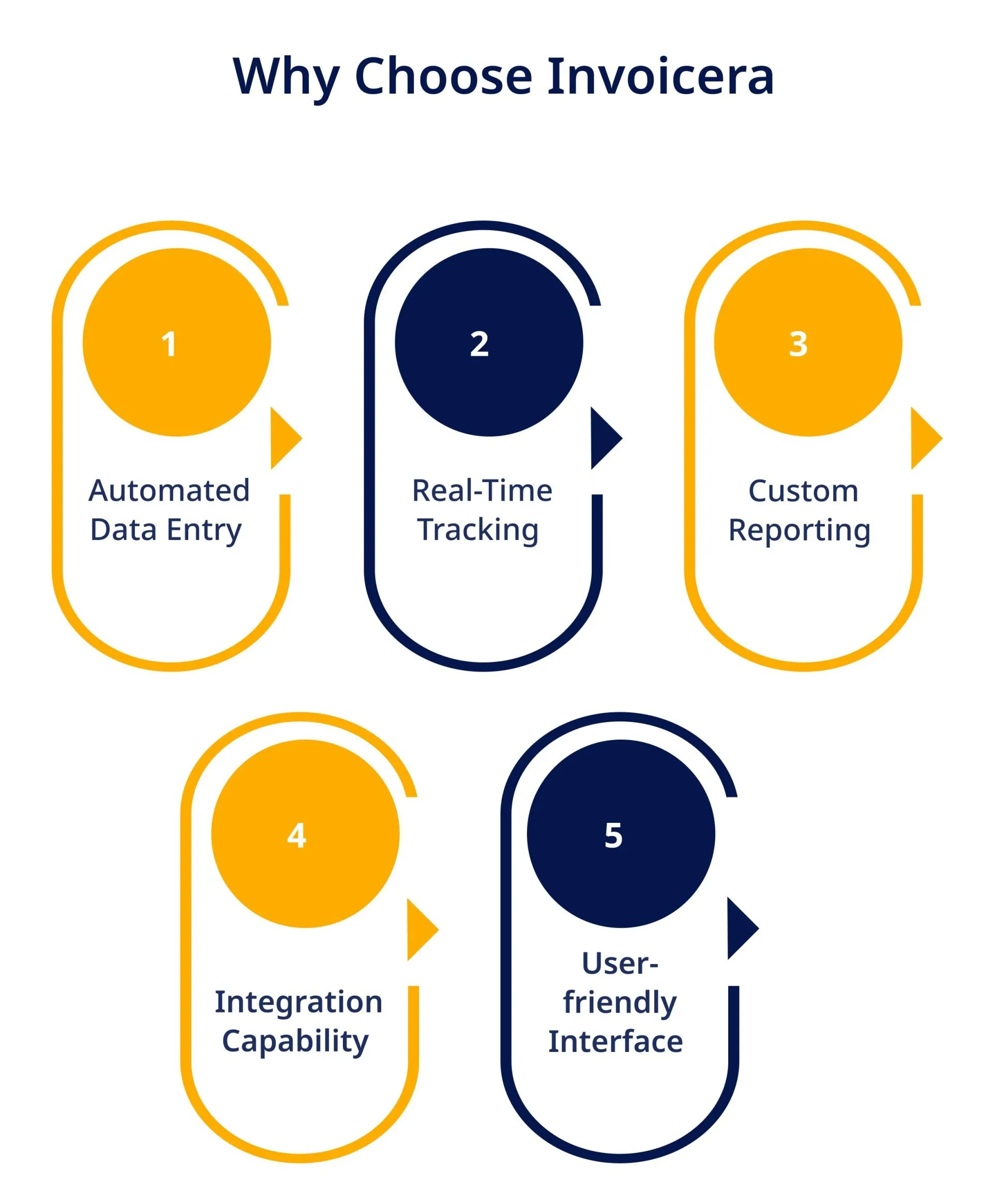

One of the standout options in this category is Invoicera.

Invoicera is a comprehensive accounting and invoicing software that can significantly simplify your cash flow projections. With it, you can track income, expenses, and accounts receivable and create accurate projections.

With its user-friendly interface and powerful reporting capabilities, Invoicera can help you gain better control over your financial data.

Excel Templates And Spreadsheets

Excel templates and spreadsheets can be a practical and cost-effective solution for businesses just starting with cash flow predictions.

However, excel sheets do not offer advanced features as compared to accounting software.

The Role of Accounting Software

These software solutions can integrate easily with your bank accounts and other financial systems, allowing for real-time updates and easy reconciliation.

The Invoicera accounting software, in particular, offers various features that help you manage your finances efficiently.

Invoicera – Best Accounting Software

Let’s delve a bit deeper into how Invoicera plays a crucial role in cash flow projection.

Here’s how it can assist you:

- Automated Data Entry: Invoicera automates the entry of financial data, reducing the chances of human error in your projections.

- Real-Time Tracking: Invoicera offers real-time tracking of income, expenses, and accounts receivable. It helps you to stay updated with your financial health to predict more precise cash flow.

- Custom Reporting: Invoicera provides custom reporting features, enabling you to generate detailed cash flow reports that suit your specific needs. It makes it easy to visualize and analyze your financial future.

- Integration Capability: You can easily integrate Invoicera with your already existing accounting software and generate the most up-to-date estimates with relevant information.

- User-friendly Interface: Any business can use Invoicera easily, be it a small or large organization. Even if you are a beginner in cash flow management, you can easily access it.

Hiring Financial Professionals For Accurate Projections

While software solutions like Invoicera can be incredibly valuable for cash flow projections, there are times when it’s beneficial to consult with financial professionals.

- Accountants and financial advisors can offer expert insights and help you fine-tune your projections for the best possible results.

- They can also assist in identifying potential financial risks and opportunities.

Tips for Projecting Cash Flow

When it comes to calculating projected cash flow for an organization, consider these guidelines:

Have A Clear Vision For Future Actions

Your cash flow projection’s accuracy is dependent on your understanding of the organization’s upcoming actions.

Understanding key future actions, such as purchasing new equipment or expanding into overseas markets, can considerably improve the accuracy of your expenditure forecasts.

Include All Expenses

While you might deem certain minor expenses as inconsequential for your cash flow projections, it’s generally important to account for all of them.

Even small expenses can accumulate over time and potentially lead to inaccurate projections.

Consult With All Departments

Have conversations with those who could influence the organization’s cash inflows or outflows from different departments.

This collaborative approach is especially important for larger firms, as it can be difficult for one individual to obtain accurate and thorough information from several sources.

Example of Cash Flow Projection

Let’s explore an example of a cash flow projection:

ABC Tech Solutions is preparing a cash flow projection for a nine-month period. The expected sources and amounts of cash inflow are as follows:

- Sales Revenue: $250,000

- Investor contributions: $100,000

- Loan proceeds: $50,000

- Income from interest: $2,000

- Total: $402,000

The expected expenditures include:

- Payroll and employee benefits: $140,000

- Operating costs: $60,000

- Marketing and advertising expenses: $12,000

- Loan repayments: $35,000

- Total: $247,000

With these figures, you can calculate the cash flow for a respective nine-month period as follows:

$402,000 – $247,000 = $155,000

With this example, you learn how to compute projected cash flow based on expected inflows and outflows over any particular time period.

You can make better financial decisions with this way of calculating cash flow projections and ensuring the health of your operations.

Predict Success With Cash Flow

Cash flow projections are your financial crystal ball, helping you anticipate how much money will be coming in and going out of your business over a specific period.

It’s not just about recording past transactions; it’s about seeing where your ship is headed in the stormy seas of commerce.

“Making more money will not solve your problems if cash flow management is your problem.” – Robert Kiyosaki

Robert Kiyosaki’s quote highlights that successful businesses focus on smart cash management, not just boosting revenue.

This principle applies to both small businesses and large corporations.

Lacking a firm grasp of your cash flow, financial challenges can persist even if your income increases.

Invoicera understands the critical role that cash flow projections play in the success of businesses.

By integrating Invoicera into your financial workflow, you can gain greater control over your finances with a clear vision.

With Invoicera, you can:

- Create detailed cash flow projections with ease.

- Organize and effectively track your payments, expenses, and invoices.

- View your financial health in real-time.

- Receive valuable insights and reports to make data-driven decisions.

So, as we delve deeper into the world of cash flow projections, remember that Invoicera is here to support your journey toward financial stability and prosperity.

Key Takeaways

In conclusion, understanding and implementing cash flow projections is vital for the health and success of any business.

We’ve learned

- Cash flow projections are more than simple estimates; they’re a guide to aid you through your company’s financial journey.

- You can plan ahead, make well-informed decisions, and guarantee the security and expansion of your company by regularly projecting your cash flow.

You must keep in mind that you are ultimately responsible for your organization’s financial health.

FAQs

What is the difference between cash flow projection and cash flow forecast?

Cash flow projections and forecasts are often used interchangeably, but there is a subtle difference. A projection typically looks at future financial trends based on historical data, while a forecast is more focused on short-term predictions, often for the coming month or quarter.

Why is managing cash flow so crucial for businesses?

Managing cash flow is crucial because it ensures you have enough money to cover your expenses, pay bills, and seize opportunities. Without effective cash flow management, a profitable business can face financial troubles.

Can I create cash flow projections without specialized software?

Absolutely! While specialized software can make the process more efficient, you can create cash flow projections using simple tools like Excel or pen and paper. The key is to update and review your projections to keep them accurate regularly.

How often should I update my cash flow projections?

It’s best to update your cash flow projections regularly, preferably every month. It allows you to adapt with the changing circumstances and make timely decisions to keep your finances in check.

Can cash flow projections help in managing and reducing debt?

Yes, cash flow projections are incredibly helpful in managing and reducing debt. By having a clear picture of your future cash flow, you can plan how to allocate resources, pay off debts strategically, and avoid taking on more debt than your business can handle. Effective cash flow projections can be a powerful tool in your debt management strategy.