It usually begins with a simple idea: using a free invoicing software to send invoices.

Suppose you’re freelancing or starting a new business and need to send invoices. A quick search includes a free invoice generator, no monthly fee, clean design, and fast setup. It feels like a smart choice.

At first, it works just fine. Then you hit a client limit. Or need recurring billing.

Maybe, you try to connect a payment gateway, only to find it locked behind a paywall. That free invoicing software now wants your card. Or worse, it’s quietly taking a cut from every invoice.

Most users don’t see this part coming:

- Hidden transaction fees.

- Nudges toward premium upgrades.

- Subtle shifts from “free forever” to “pay if you want to grow.”

Your Learning – Free isn’t always free!

So, before you commit to any free billing software, ask yourself: “What’s it really costing you?”

Let’s figure it out!

The Appeal of “Free” Invoicing Tools

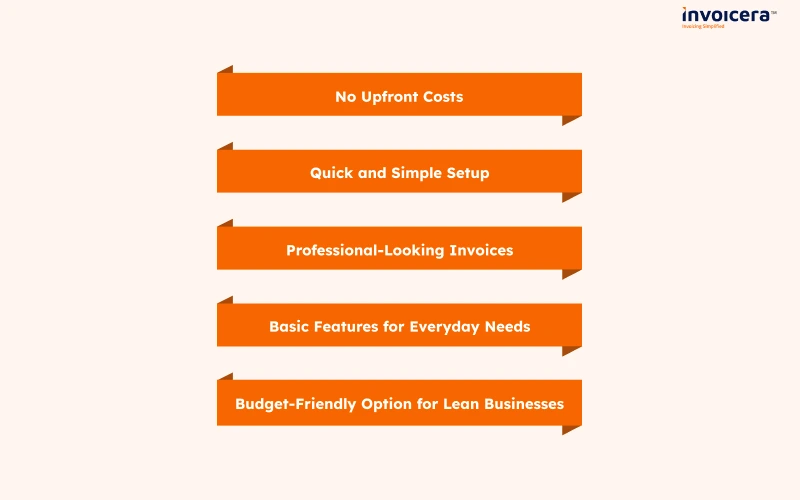

Starting out, free invoicing software seems like the perfect solution. Here’s why they attract freelancers and startups:

1. No Upfront Costs

- No monthly fees or subscription charges.

- Easy to start without financial commitment.

2. Quick and Simple Setup

- User-friendly interfaces.

- Fast invoice creation and sending.

- Minimal learning curve.

3. Professional-Looking Invoices

- Attractive templates included.

- Clean, polished design to impress clients.

4. Basic Features for Everyday Needs

- Standard invoicing functions include sending and tracking invoices.

- Sometimes, include simple payment reminders.

5. Budget-Friendly Option for Lean Businesses

- Helps keep expenses low during early growth.

- Allows focus on core work instead of admin.

While these points make free invoice generator options appealing, weigh them against potential hidden costs and limitations that could later affect your business.

The Real Cost of Free

Once you start using free alternatives of invoice software, hidden costs can quickly add up; sometimes in ways you don’t expect.

Hidden Transaction Fees

- Small charges per invoice that eat into your profits.

- Fees for using built-in payment gateways or processing payments.

Forced Upgrades and Limits

- Caps on the number of clients, invoices, or projects you can manage.

- Key features like recurring billing or time tracking are locked behind paywalls.

Unexpected Branding and Watermarks

- Your invoices carry the tool’s logo, which can look unprofessional.

- Limited ability to customize or remove branding.

Lack of Integrations and Automation

- No connection to your bank, accounting software, or payment processors.

- More manual work and wasted time.

Poor Customer Support

- Free plans often come with minimal or delayed help.

- No priority support when you need it most.

When you add these up, that free invoicing software may cost more in fees, lost time, and missed opportunities than a simple paid plan.

Before choosing a free invoicing option, it’s important to consider what you’re really paying for and what you might be giving up.

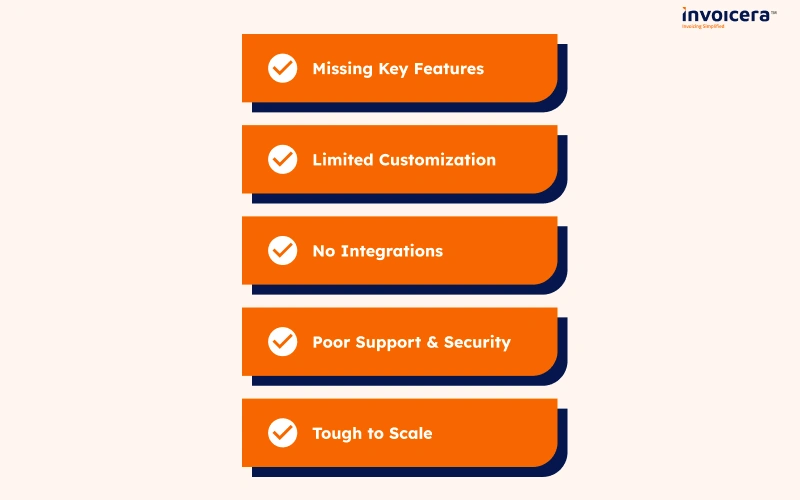

Critical Limitations That Impact Growth

Choosing the right invoicing software for freelancers is about more than just starting; it’s about growing without unnecessary roadblocks. Many “free” tools have critical limitations that can hold your business back.

Missing Key Features

Essential functions like recurring billing, time tracking, and automated reminders are often unavailable in free plans, making invoicing slow and manual.

Limited Customization

Basic templates and forced branding prevent invoices from looking fully professional and unique to your business.

No Integrations

Lack of connection to payment gateways, accounting software, or CRMs means more manual work and higher chances of errors.

Poor Support & Security

Free plans usually come with limited customer support and weaker data protection, leaving you vulnerable and frustrated when problems arise.

Tough to Scale

Limits on clients, invoices, and features force you to upgrade or switch software as your business grows, causing disruption and added costs.

When doing an invoicing software comparison, it’s important to look beyond the “free” label. The right tool should support your growth, not hinder it.

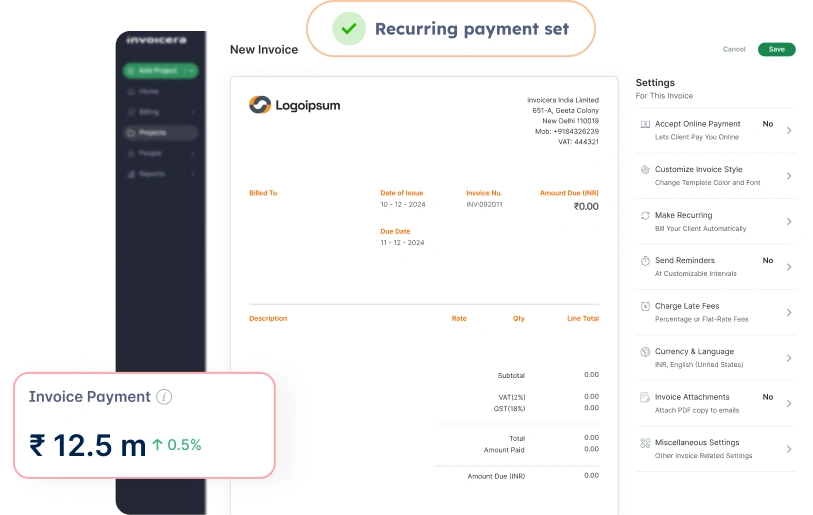

Invoicera: Smart Invoicing Without the Surprise Costs

Some invoicing tools seem free; until the fees start stacking up. Per-invoice charges, transaction commissions, and hidden upgrades can quietly drain your revenue. Invoicera does things differently.

Flat Pricing. Full Access. No Commissions.

With plans starting at just $15/month, Invoicera offers a simple, transparent pricing model. No percentage cuts. No per-invoice fees. Just powerful invoicing; priced to support your growth, not tax it.

Everything You Need, Built In

Whether you’re a freelancer or managing enterprise billing software needs, Invoicera comes packed with:

1. Recurring Billing & Subscriptions: Set up recurring payments for your clients and any subscriptions they may have. All business plans provide this function starting from day one.

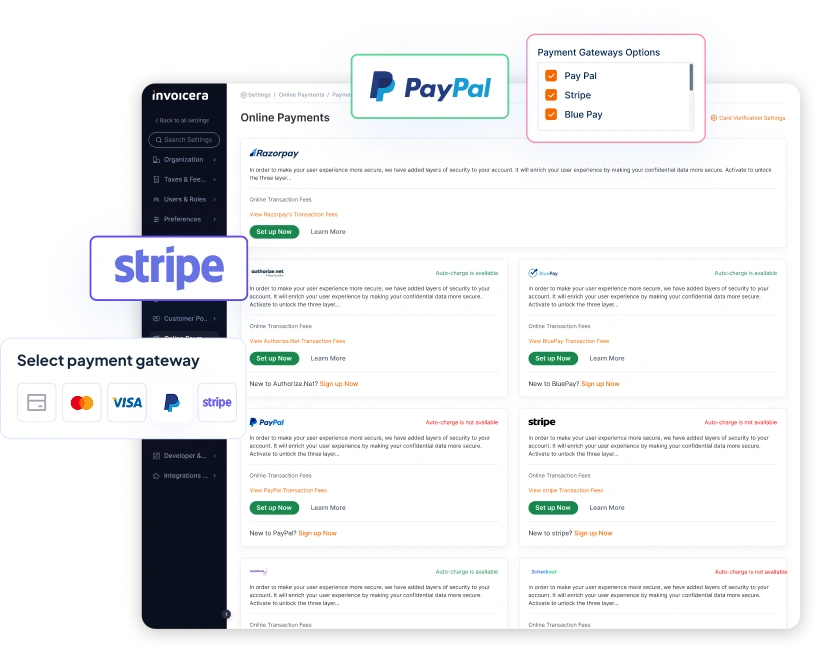

2. 14+ Payment Gateways: Select a trusted gateway such as PayPal, Stripe, Authorize.Net and others. You can connect on the internet at no additional cost.

3. Time Tracking & Project Billing: Directly enter and track your hours, then bill the client from your time records. This is a great system for consultants, freelancers and agencies.

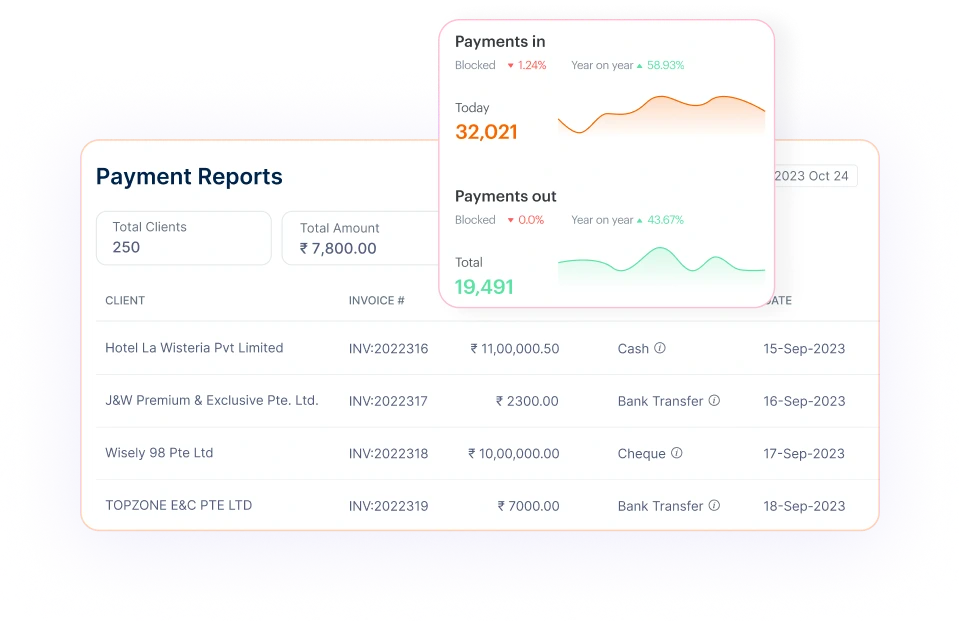

4. Client & Vendor Portals: Offer your clients and vendors an online place to check invoices, make their payments and review the activity since last time without you having to deal with constant calls or emails.

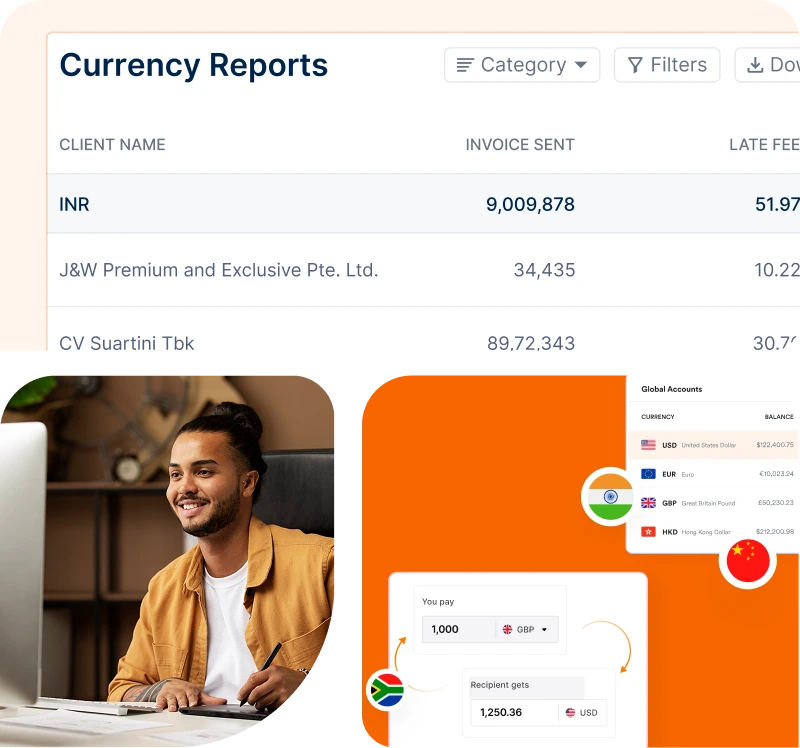

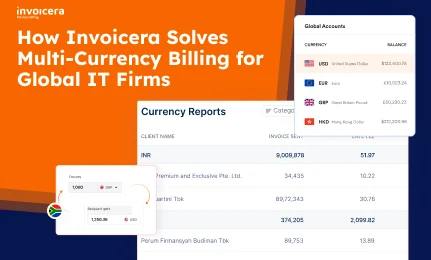

5. Multi-Currency & Multilingual Support: You can send invoices and quotes in different currencies and languages your clients require. Good for companies with employees in different countries and remote locations.

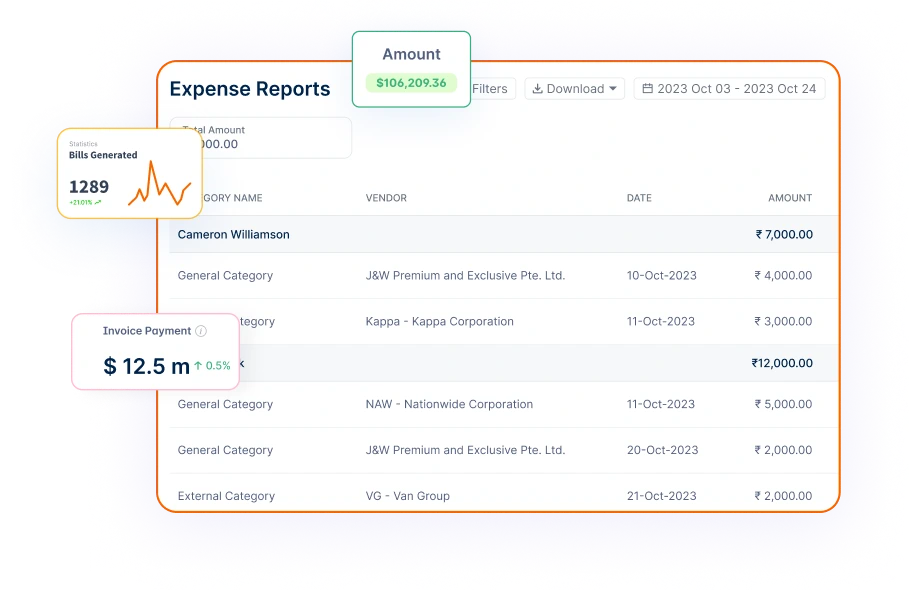

6. Estimates & Expense Management: Convert approved estimates to invoices in one click and effortlessly track project-related expenses.

7. Tax Management: Automate tax calculations by region or client type. Stay compliant with built-in GST/VAT support.

8. Custom Workflows & Approval Automation: Design invoice approval flows tailored to your internal processes. Available in professional and enterprise plans.

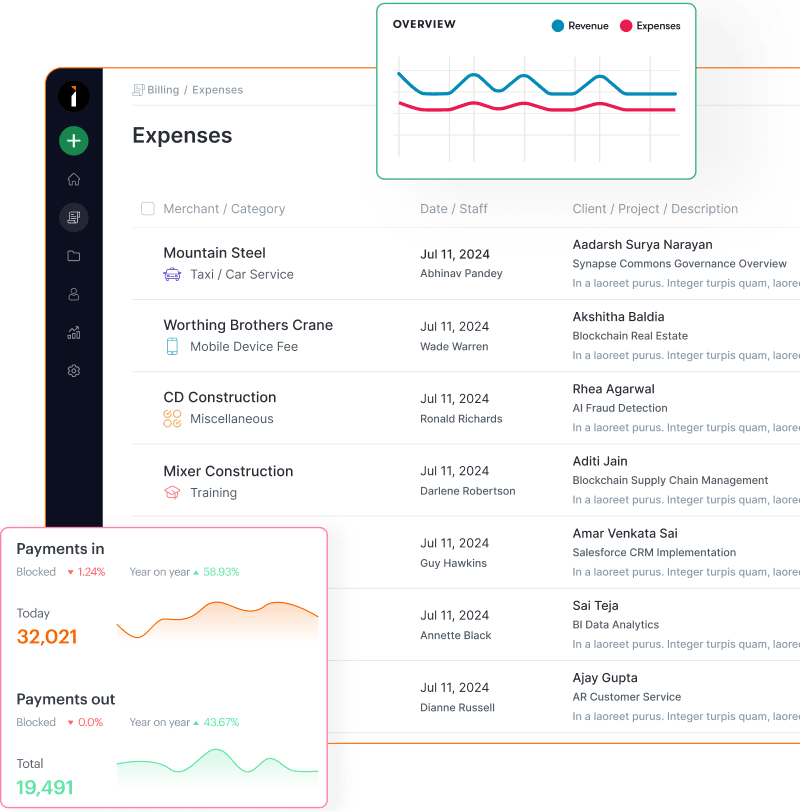

9. Reporting & Analytics: Access visual dashboards and downloadable reports to monitor cash flow, outstanding payments, and performance metrics.

All are included in your plan, with no hidden costs or feature gating.

Scalable Solutions, Serious Flexibility

From freelancers to global teams, Invoicera offers unmatched flexibility. Whether you’re a solo user or need enterprise billing software, Invoicera adapts with you. Custom integrations? Covered. Middleware support? Absolutely.

Do the Math: Free Isn’t Always Free

If you’re invoicing $50,000/month and your free invoicing software takes 0.4% + 30¢ per invoice, that’s $1,400/month; over $17,000/year.

With Invoicera, that business could run on a $149/month enterprise plan, with zero per-invoice fees.

Make the Smart Switch

If transparent pricing, complete control, and revenue protection matter to you, Invoicera is worth a closer look. No surprises. Just smart invoicing.

Is “Free” Worth the Risk?

Free invoicing software may seem appealing; until hidden costs creep in. Fees per invoice, upgrade traps, and feature limitations can hurt your business.

Here’s what you risk with a “free” tool:

1. Per-Invoice Fees

Many free tools take a percentage of every transaction. That “free” invoice could cost you 0.4% to 1%, plus fixed fees.

2. Limited Functionality

Need recurring billing, workflow approvals, or client portals? Key features like subscription billing software often require costly upgrades.

3. Data Ownership & Portability

Some platforms restrict access to your own billing history or make it difficult to migrate later.

4. Lack of Scalability

As your business grows, your invoicing needs become more complex. Free tools rarely grow with you, forcing a costly and time-consuming switch later.

5. Support Gaps

Free tools usually come with limited or no customer support. When something breaks, you’re on your own.

Why Invoicera Makes More Sense

With pricing plans starting at just $15/month, Invoicera offers a fully loaded invoicing platform from day one; no surprises. You get transparent pricing, advanced features, and the flexibility to scale without hidden fees draining your revenue.

When you do an invoicing software comparison, Invoicera stands out with transparent pricing, strong features, and flexibility to scale.

Closing Thoughts

In conclusion, free invoicing software can look good on paper; but once fees, limits, and upgrade pressures set in, they often cost more than you expected. If you’re losing revenue just to get paid, it’s time to rethink what’s really “free.”

With Invoicera, you get straightforward pricing, powerful features, and no surprise charges; just smart invoicing that grows with your business.

Because real value means keeping more of what you earn.

FAQs

Ques: What hidden costs should I watch for in free invoicing software?

Ans: Most free accounting software takes a cut from each transaction, restricts how many bills you can send or requires you to pay for upgraded tool sets.

Ques: How does Invoicera’s pricing compare to “free” tools?

Ans: Invoicera does not charge per invoice or commissions; you pay $15 each month to ensure the best value.

Ques: Do free invoicing tools limit features like recurring billing or payment gateways?

Ans: Yes. A lot of these tools prohibit sending regular invoices, get in the way of automated payment or allow only a single user, so you have to purchase premium plans as you progress.

Ques: Can switching from a free tool to Invoicera save money long term?

Ans: Absolutely. For high-volume billing, Invoicera helps you save a lot of money as you no longer pay for chemical fees and you don’t need to purchase expensive upgrades.

Ques: Does Invoicera offer all features upfront, or are they tiered?

Ans: Customers can access all the features Invoicera has without any delays and there are no upgrades required.