For most of the small business owners tax time turns out to be the most stressful times. The small business tax tips are helpful in improving the profitability of the company. Taxes can be optimized with very simple tips and tricks, but the planning has to be done in advance.

The year 2017 lowers the income tax rate by 5% for all companies whose turnover is less than Rs. 50 crore. Earlier companies with less than Rs. 50 crore turnover had to pay 30% tax which turned to 25% this year. Also, 96% of the companies gets the benefits of the lower taxation in 2017. The result of the move leads MSME (micro, small and medium enterprises) owners to pay 5 percent less tax that proves more competitive as compared to larger companies.

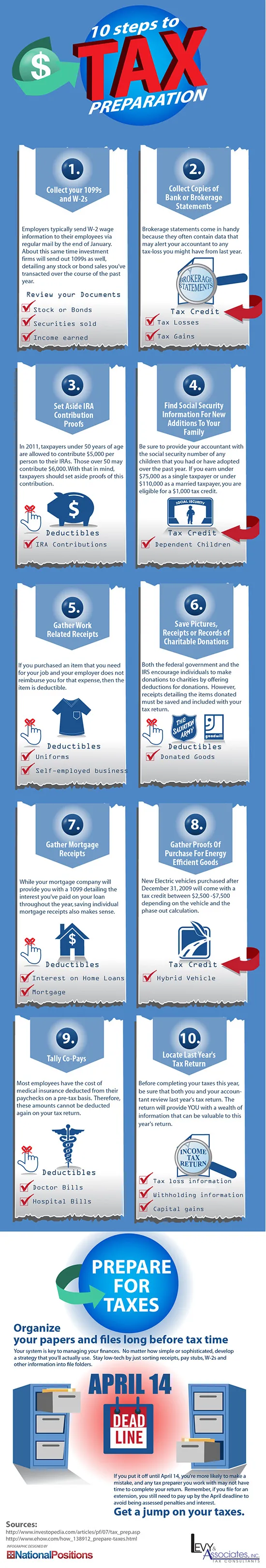

Following are the small business tax tips to help you reduce your stress but also save time and money.

1. Hire Freelancers and Contractors

Hiring freelancers and independent contractors help you save on payroll taxation. Although all employees of the business cannot be independent contractors, you can hire the ones that can be managed easily. This can also help in focusing on the core business activities.

-

Make Use of Tax Deductions

It is important to be aware of all kinds of tax deductions and ensure that all deductible expenses are recorded properly. There are several programs that exist to prove small business tax tips effective.

-

Maintain Financial Records

A hard and soft copy of all expense reports must be maintained. Maintaining all expense records using an expense management solution is helpful. Travel and other expenses if recorded properly will help in easily managing finances.

-

Yearly Review

All methods to reduce the tax burden must be reviewed a month before the year end. Here are some ways to reduce small business taxes, while approaching the year end:

- – Contributions to charity

- – Buying business equipment

- – Shifting income from one year to the next

-

Employee Benefits

There are specific types of employee benefits that are tax deductible. One can plan the employee benefit structure to include such benefits as ‘fringe benefits’ and healthcare so the tax deductions can be availed. Employee benefits can also include such simple but simultaneously essential things such as a virtual scribe giving your employees a greater sense of privacy.

-

New Business Deduction

If you are a startup organization, then the expenses incurred in starting up the organization are tax deductible. The expenses are tax exempted up to a limit of $5000.

-

Lunch Meetings

These are helpful in improving the amount of tax deduction. All internal and external meetings are deductible for up to 50% of the meal costs. This can add to a considerable amount of savings if calculated on an everyday basis.

-

Health Insurance

Health Care premiums of those who own sole proprietorships and partnerships are tax deductible. One can claim the deductions while filing tax returns. Following small business tax tips can remove the stress this tax season.

-

Review all products/services that business pays

Next, small business tax tips include paying total payment once instead of 12 monthly payments. This can be done by contacting your providers for small business taxes. Pre-paying for the entire year keeps your business away from the change in the long run. Be sure to determine that it is valuable for your business before committing for the entire year’s worth of payments.

-

Use proper marketing strategies

Test out new marketing strategies to pre-pay taxes and spend your year-end surplus on marketing and advertising. With the new digital world, small business taxes take advantage of new demographics to market business effectively and inexpensively.

11. Use an online invoicing software

Have the confidence to receive tax on time by opting for the much better alternative. As the small business owner, you are an expert on business expenses and income. That makes you the ideal person to do both business tax return and income tax return. Opt for the small business invoicing software to remove the stress of taxation. Get the detailed analysis of the tax and expense reports and more.

Add tax directly from online invoicing and billing software like Invoicera:

A varied amount of taxes (normal tax, compound tax and Group tax) can be added. Here are few simple steps to add and edit taxes in Invoicera account

Step 1. Simply log in to the Invoicera account

Step 2. Go to settings, from the drop down menu click on tax/ charge/late fee

Step 3: Fill the required details. Easily create a list of taxes that one wants to charge your clients

Thus, the taxes can be added to invoices for individual items or tasks.

12. Expand your business with family

It may be possible to utilize the personal allowances of family members who are able to carry out duties within your business according to the family situation.

13. Work from home

For self-employed businesses, HMRC allows generous tax savings. Make sure you are aware of them. For self-employed business owner can claim for the proportion of council tax, mortgage interest, insurance, heat and light, water and general maintenance. The use of the home claim can be generous indeed.

14. Be Organized

Keep copies of everything, be organized. Don’t fall into the trap. A common reason for HMRC to disallow expense claims or input VAT amounts is when businesses do not keep proper supporting records.

15. Manage time on your business

Are you really the best person to do your bookkeeping or VAT returns? The business will benefit from spending more time working on it. For what you may think you are saving in fees you are probably losing out by not claiming for everything you are entitled to.

16. Know industry standards

Be engaging with trade body or association, attend events and read the newsletter. Most industries have their own special dispensations and allowance approved. Use the trade body or union on your side.

17. Don’t overlook carryovers.

Certain deductions and credits have limitations that can prevent you from using them fully in the current year but could permit a carryover to future years. Keep track of carryovers to help keep track from forgetting to use them in future years.

Examples:

- – Capital losses

- – Home office deduction

- – Net operating losses

- – Charitable contribution deductions

- – General business credits

Conclusion

Consider all the above strategies to make accurate decisions on saving tax. Implement small business tax tips for the better management and economic decisions for your business. There are plenty of options for the small business owner. Consult with the tax advisor and perform some actions to save taxes.

Use An Online Invoicing Solution

An online invoicing solution is helpful in managing small business taxation efficiently and effectively. A solution like Invoicera has the following useful features:

- Expense management and expense recording

- Adding all kinds of taxes to invoices and recording all the taxes

- Tax reports and expense reports for filing of returns and detailed analysis