It is becoming more apparent to businesses that GST billing processes can best be handled through automation.

With more than 1.4 crore GST taxpayers registered in India, the trend of using software solutions is evident.

While small and large enterprises work towards achieving proper GST compliance, they can ease the process of tax returns and invoices through digital tools.

It is, therefore, important to note that using these automated systems is not only a means of passing a compliance test but also serves to make the process more effective and accurate.

By automating these processes, businesses save time, minimize human errors, and focus on growth, making GST billing software an essential tool in today’s business landscape.

What is GST Billing Software?

GST billing software is an application intended to generate bills according to GST policies and legislation. These tools calculate taxes, prepare invoices or returns, and perform other legal compliances that can be tiring otherwise.

The software is particularly beneficial for small to large enterprises since it relieves them of the complicated GST procedures and, in some ways, the high risk of human errors.

Many GST billing software also offers additional functions, such as:

- Tax filing

- GST return management

- E-invoicing

- Real-time tracking

Why Invest In A GST Billing Software?

Implementing GST billing software is more than just a tactical decision but a strategic one. It will facilitate effective business functioning and compliance. Here’s why every business needs to make the move:

1. Never Miss a GST Compliance Pace

GST laws continue to evolve, and updating them manually becomes tiresome. GST billing software helps you with your compliance needs and updates your system without penalty charges.

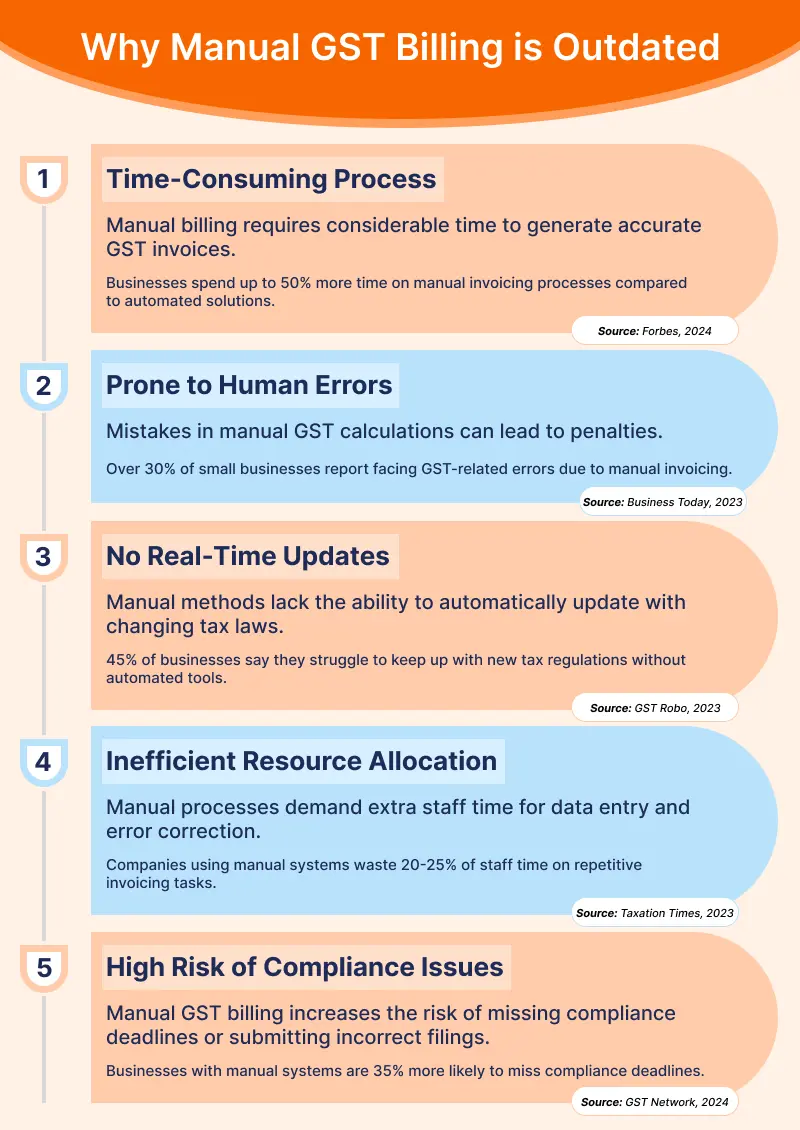

2. Spare Some Time, Make Fewer Mistakes

Manual billing is time-consuming and results in numerous mistakes. To avoid errors in tax aspects, calculations, invoice generation, and record maintenance, automation is best.

3. Get Paid Faster Through Automated Invoicing

Invoicing is just a few clicks easier. GST billing software makes it easier for firms to prepare bills and receipts quickly, enhancing receivable collection for sustainable cash flows.

4. Crystal-Clear Accuracy & Transparency

With the automation of tax calculations and billing processes, your business benefits from 100% accuracy, making audits simpler and ensuring transparency with clients.

5. Proves to be a Good Investment at a Lesser Expense

The cost of investing in GST billing software is negligible compared to the amount of money, time, and effort that can be saved, as well as the potential penalties that can be incurred for incorrect tax preparation.

How GST Billing Software Helps Small and Large Businesses

Whether you’re a startup with big dreams or a corporation with global reach, GST billing software scales to meet your needs. Let’s explore how it powers both small and large businesses:

Small Businesses

1. Affordable & Simple to Use

Designed with small businesses in mind, GST billing software is budget-friendly and user-friendly, enabling you to manage your invoices and tax filings without hassle or hiring additional staff.

2. Avoid Costly Penalties and Tax Headaches

For small businesses, the risk of making a tax filing mistake is significant. Automated GST filing ensures accuracy, protecting you from penalties and legal complications.

3. Streamlined Billing & Organized Record-Keeping

Manual data entry and record-keeping can be overwhelming. GST billing software organizes everything for you, allowing you to focus on growing your business while keeping your financials in check.

Large Businesses

1. Scale with Easey Multi-GSTIN Management

Many large businesses are located in multiple states, so they must have several GST identification numbers (GSTINs). Multiple GSTINs can be managed effortlessly within GST billing software, and all remain sorted and compliant.

2. In-Depth Reports & Data-Driven Insights

For large businesses, tracking tax obligations requires advanced reporting. GST billing software offers customizable, detailed reports that give you full visibility into your financials and help ensure timely compliance.

3. Integration for Greater Efficiency

Larger organizations often have many different software solutions for various functions including accounting, inventory, and payroll. These tools fit well with GST billing software, guaranteeing that all your processes are interlinked, and data is efficiently shared between applications, Shares Tristan Dupont, COO of Crown heights.

4. Team Collaboration, Simplified

With growing teams, collaboration is key. GST billing software supports multiple users, allowing teams to access, manage, and work together on billing while ensuring that data access is controlled and secure.

Key Features to Look For in GST Billing Software

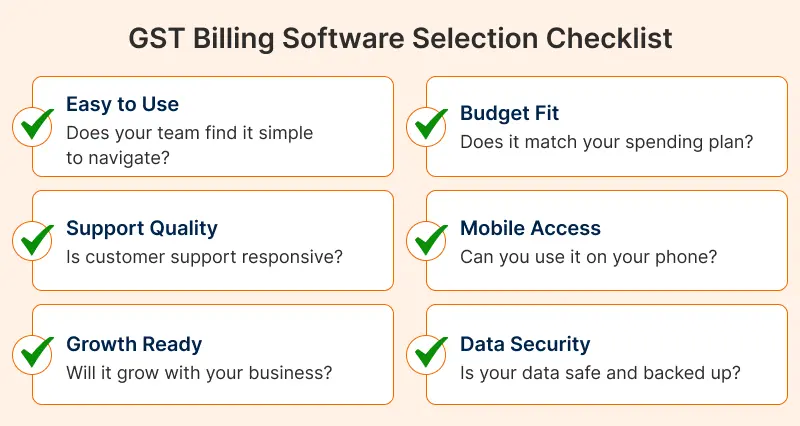

While selecting GST billing software, some points to consider are as follows: It should be able to address your business’s needs and, at the same time, reduce the compliance burden associated with GST. Here are the key features to look for:

GST Compliant Invoices

A good GST billing software should be capable of preparing bills under GST guidelines. This includes:

- Calculating chargeable tax

- Identifying the GSTIN

- Numbering the invoices

Ideally, the software should follow the most updated GST rules to avoid contributing to an expensive mistake.

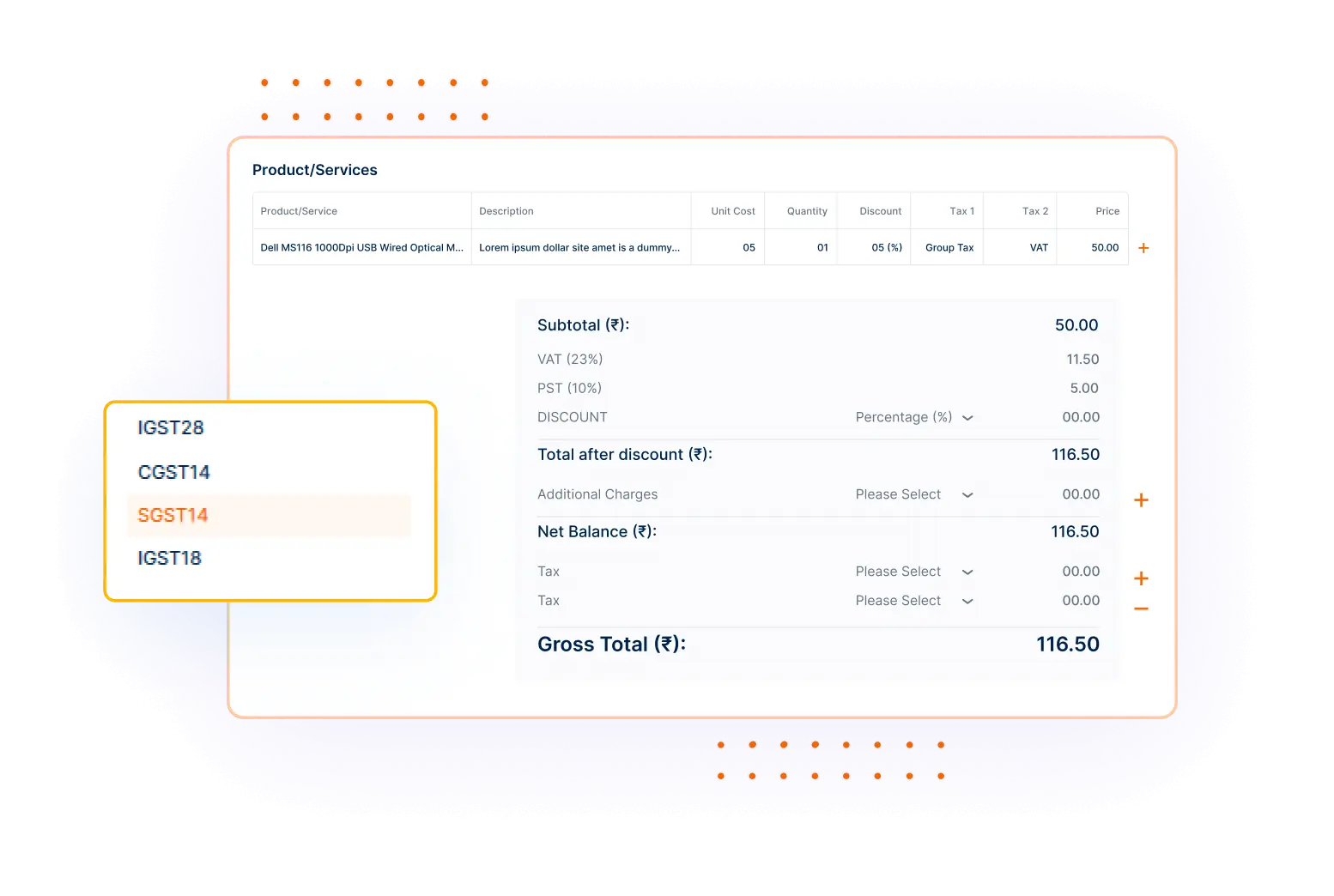

Automatic Tax Calculation and Tax Filing

The software should calculate the GST automatically based on the products/services you sell, including CGST, SGST, or IGST (depending on the transaction type).

Furthermore, it should generate reports that simplify filing returns, minimizing manual work during GST filings.

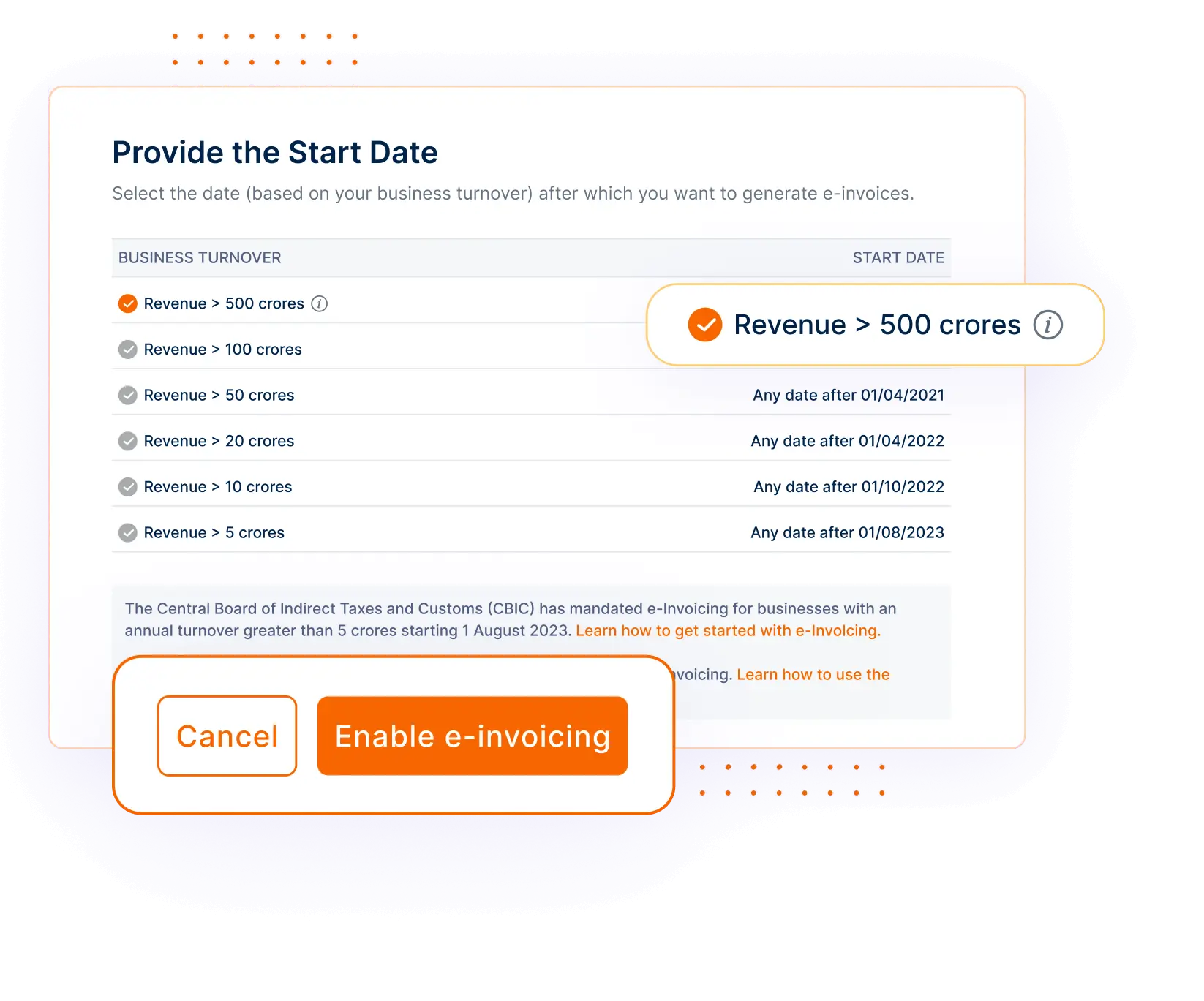

E-Invoicing Integration

The use of e-invoicing has now become mandatory for those businesses with a threshold turnover.

Ideally, your GST billing software must be compatible with the government’s e-invoicing solution, which allows the e-invoices to be created and submitted to the GST portal without much effort Shares Don Evans, CEO of Crewe Foundation Services.

Multi-GSTIN Support

For businesses operating in multiple states, multi-GSTIN support is crucial. A good GST billing software should allow you to manage different GSTINs under one account, making it easier to:

- Generate state-specific invoices

- File returns

- Ensure accurate tax calculations

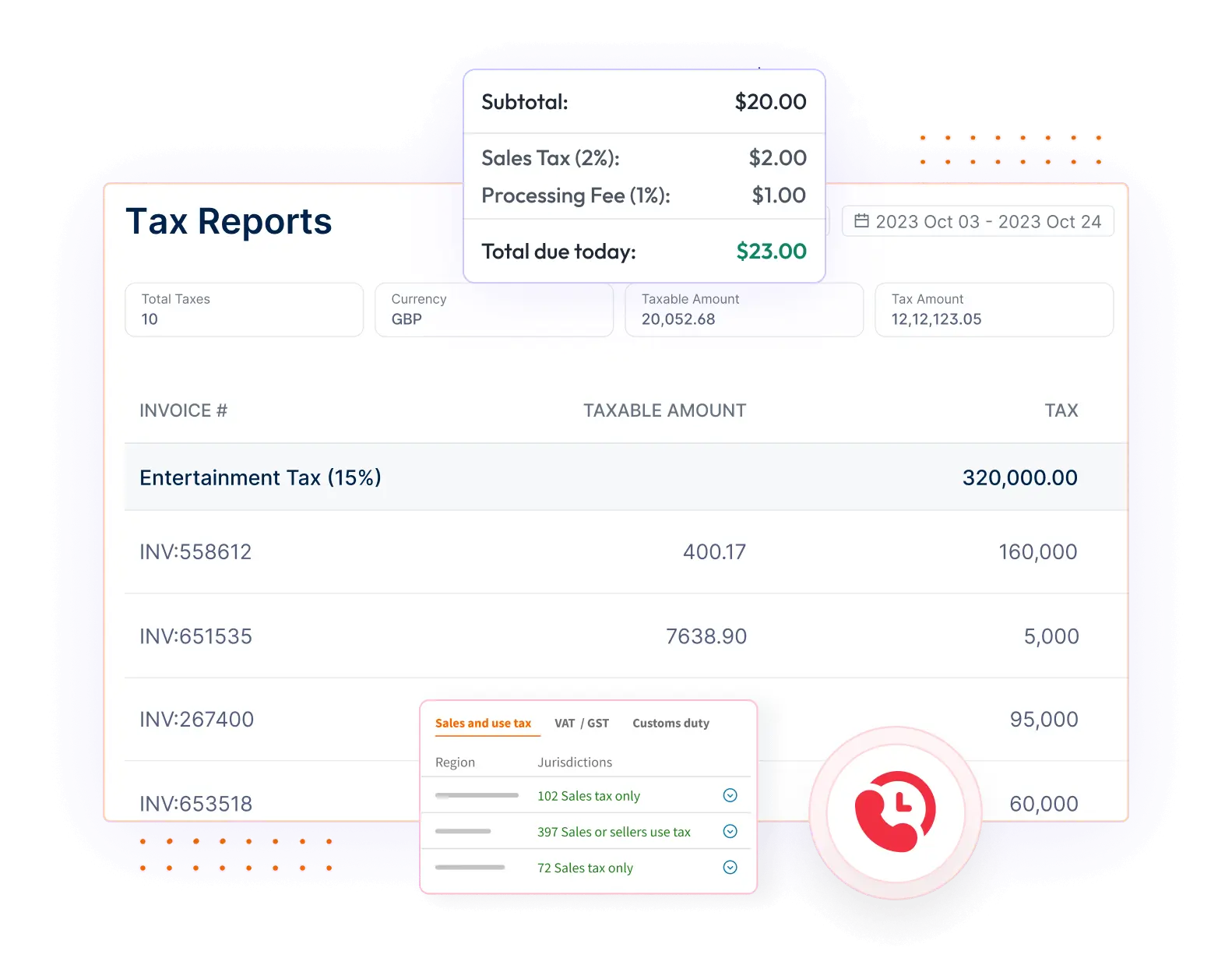

Real-Time GST Reports and Analytics

GST billing software should be capable of instantly generating reports to assist you in tracking your taxes and your business’s cash flow rate.

Some of the advantages of using the software include:

- GST return reports

- Sales/purchase reports

- ITC summaries

- Customer Support and Regular Updates

Look for GST billing software that provides excellent customer support. In addition, ensure the software is updated regularly to keep up with the latest GST rules and regulations, avoiding compliance risks.

Invoicera’s GST Billing Software

Invoicera simplifies GST compliance for businesses with features that streamline tax calculations, invoicing, and return filing, saving you time and reducing errors.

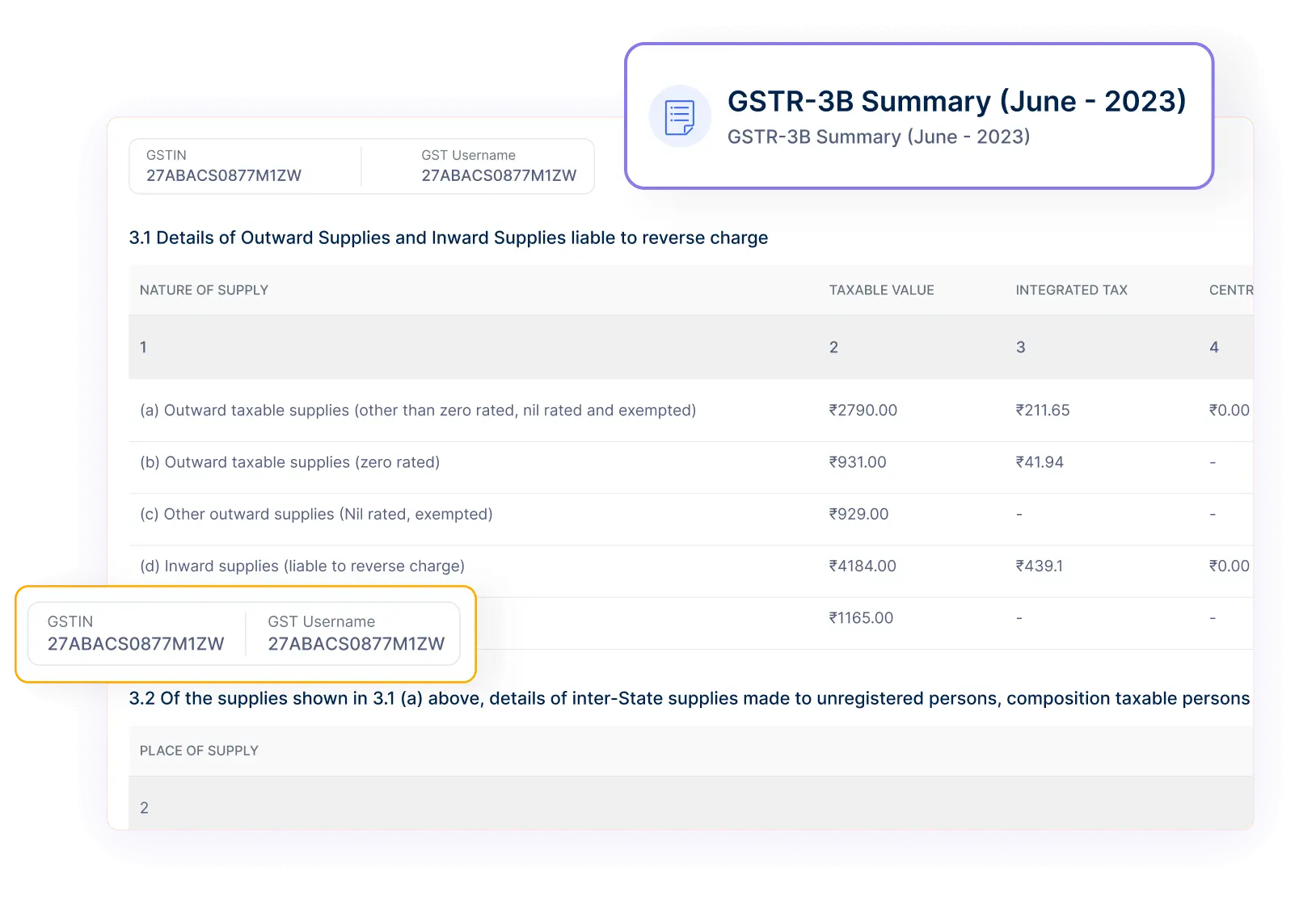

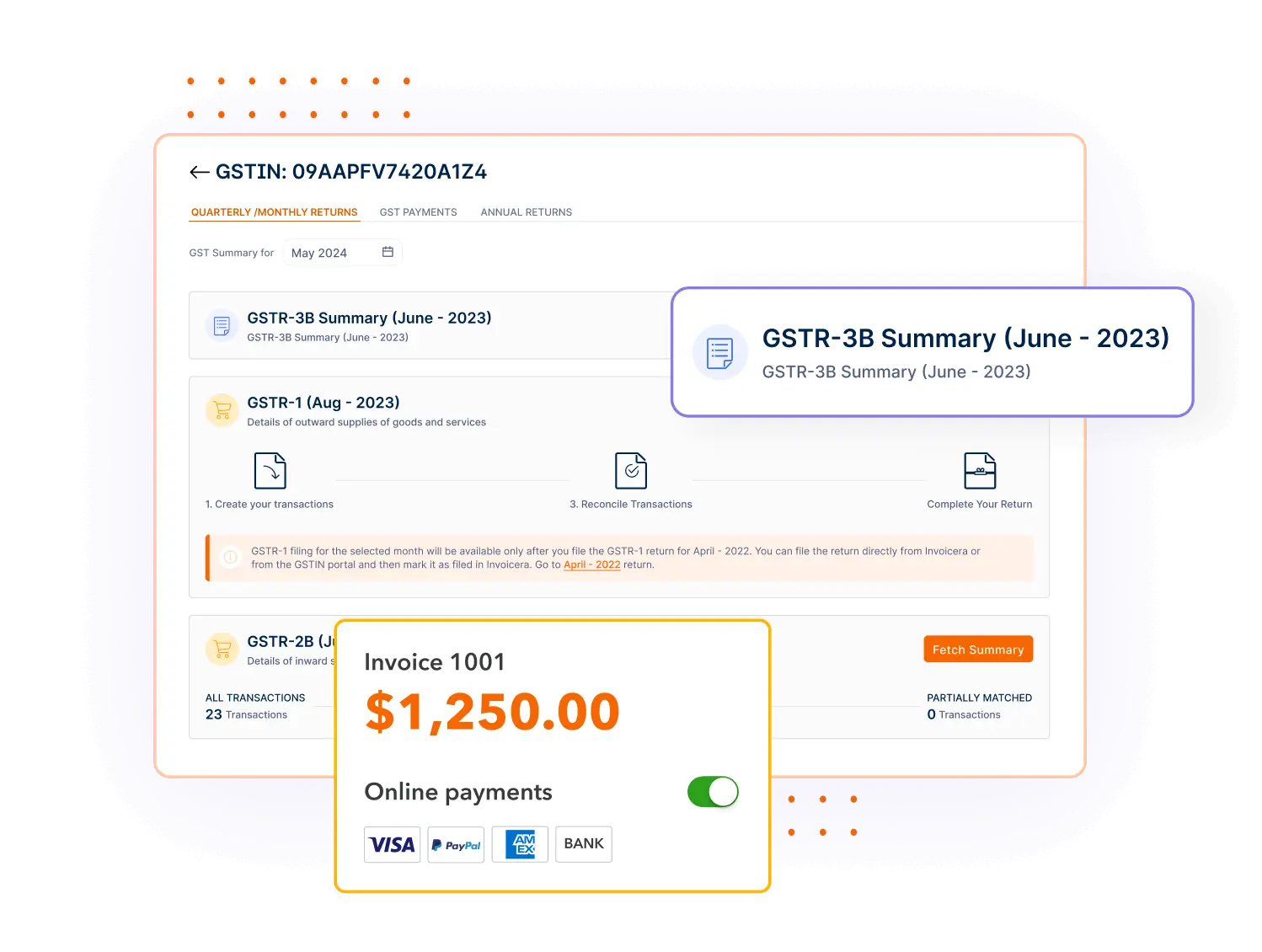

File GST Returns Online in Minutes

Enter your GSTIN and starting date, and Invoicera automatically compiles taxable transactions for easy and quick GST return filing, reducing manual effort.

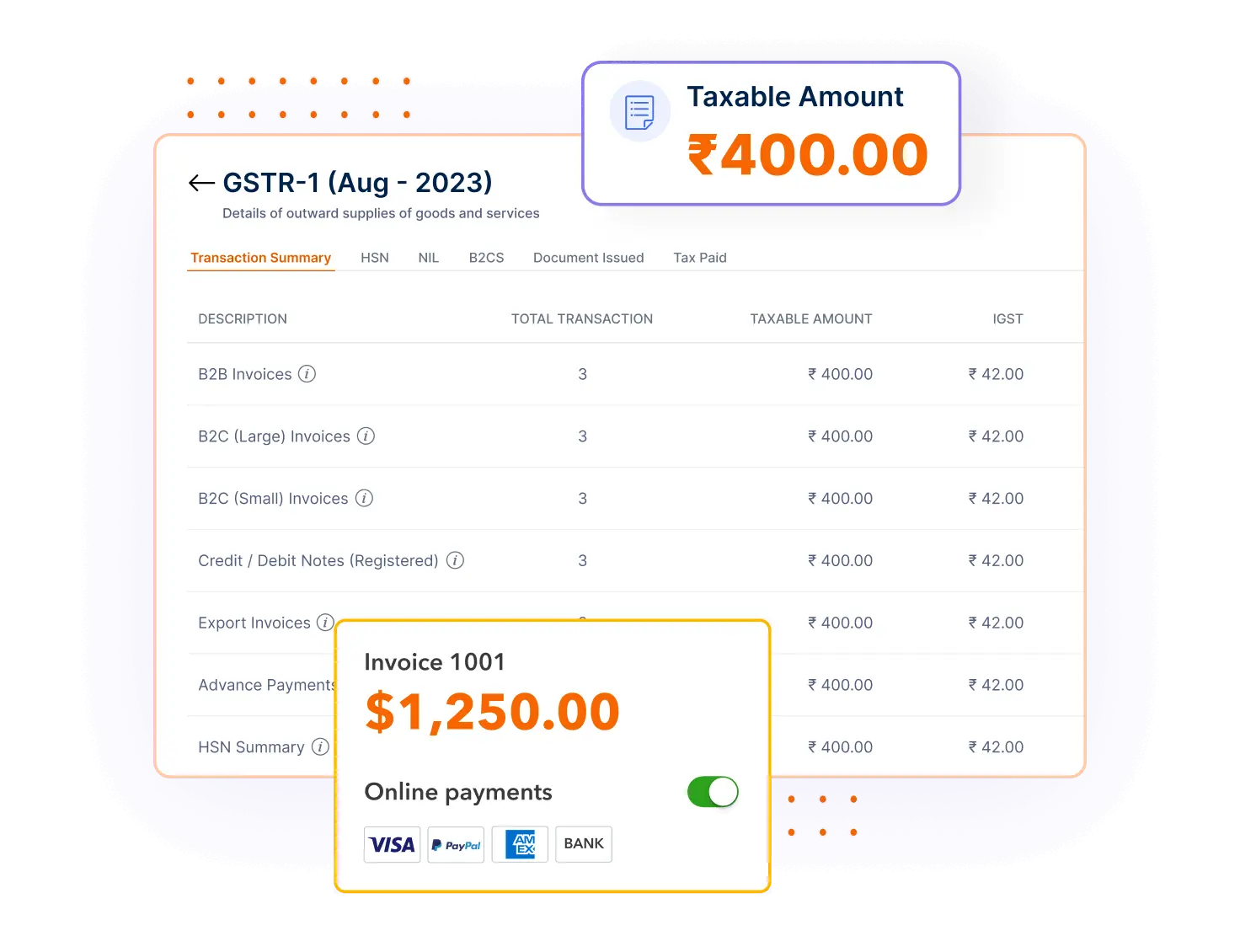

Auto-Populate GST for Transactions

Invoicera auto-calculates tax components for all transactions by associating contacts with their GSTIN, ensuring accuracy and easing your compliance efforts.

Classify Goods and Services Accurately

Easily label items as goods or services with HSN/SAC codes, ensuring correct tax calculations and simplifying classification within the platform.

Customized GST-Compliant Invoices

Create branded GST invoices automatically including GSTIN, HSN/SAC codes, and tax rates, ensuring compliance while maintaining your company’s identity.

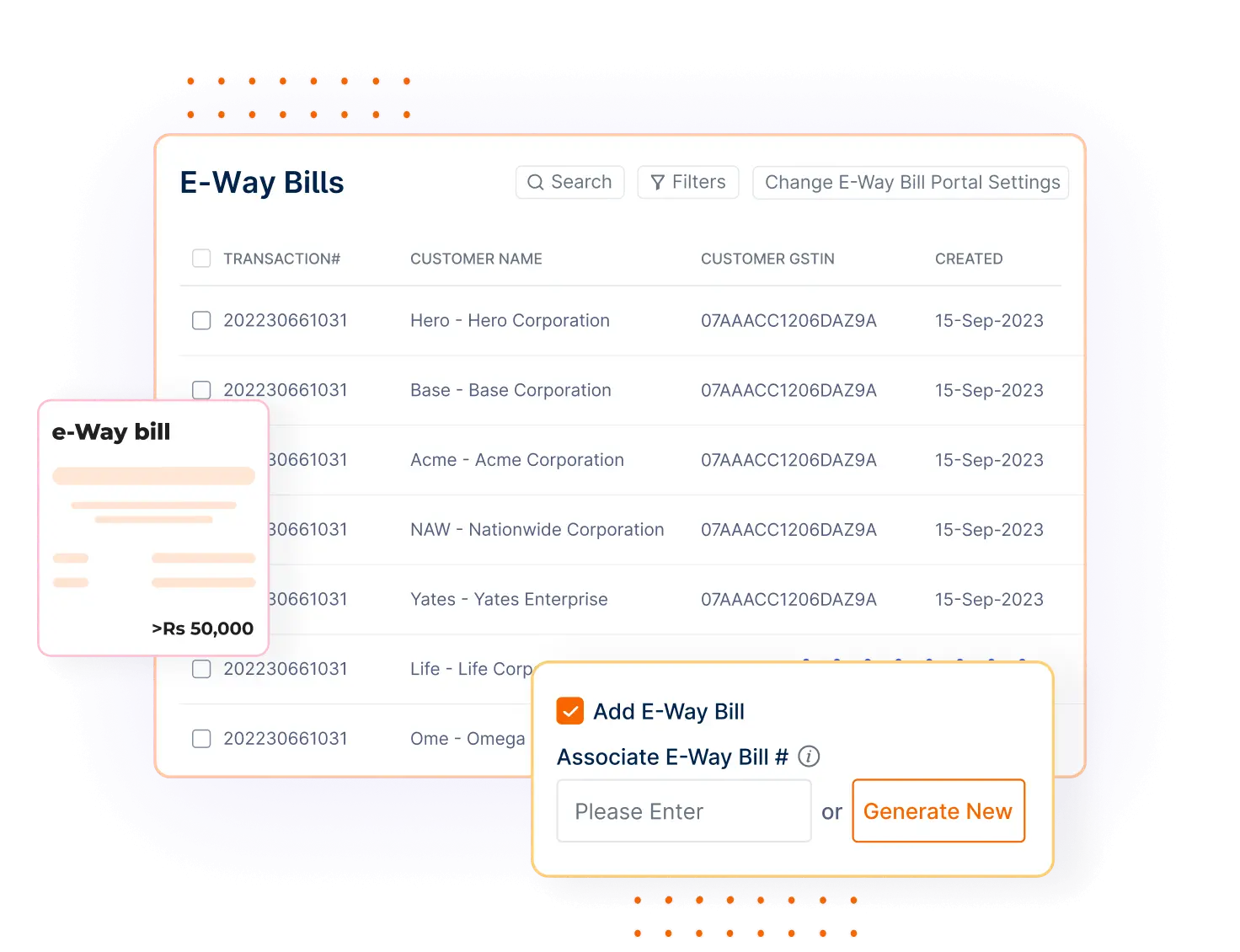

Quick E-Way Bill Generation

Automatically generate e-way bills for required transactions based on GST rules, ensuring seamless compliance with transportation regulations.

Secure E-Invoicing via GSTN

Switch to GSTN-authenticated e-invoices for better security and transparency, reducing manual paperwork and ensuring valid B2B transactions.

Error-Free GST Return Filing with Approval Workflow

Set up an approval process for reviewing GST returns before submission, minimizing filing mistakes and improving accuracy.

Our GST billing software, Invoicera assists businesses to remain compliant and deal with the complicated procedures of GST easily.

Conclusion

Thus, looking forward, GST billing software is no longer limited to compliance and generating invoices.

With the help of artificial intelligence and machine learning, these solutions are evolving into proactive tools that can estimate the tax burden, recognize possible compliance risks, and provide advice on the most beneficial tax-saving measures.

New innovations, such as the addition of block chain to GST, are helping to improve the security and transparency of transactions, and cloud-based software is helping to connect multiple locations. Invoicera is one such example of an all-in-one GST billing software for your business.For businesses that are planning to invest in GST billing software, the time is right—not only to address the current issues with compliance but also to be prepared for the future of taxes.

FAQs

Ques. Is it possible to change the existing billing software with a new GST billing software mid-year?

Ans. Yes, you can switch at any time. Almost all GST billing software comes with the feature to import data from your old system. However, implementation is advised to be done at the beginning of some financial quarters so that it can easily be reconciled.

Ques. What happens if there are changes in GST rates or rules?

Ans. Quality GST billing software providers push automatic updates whenever there are changes in GST rates or rules. These updates are typically included in your subscription, ensuring your business stays compliant without manual intervention.

Ques. Am I safe with cloud-based GST billing software for my business data?

Ans. Leading GST billing software vendors use practices like encryption, data backup, and authentication similar to those used by banks. Nevertheless, you must always check whether the provider has security certificates and data protection policies.

Ques. Can I separate B2B and B2C transactions in the software?

Ans. Yes, GST billing software can differentiate between B2B and B2C transactions, apply the correct tax computations, and create the right invoice types for both types of transactions.