Bills payable management has a vital role in ensuring a business’s stability and financial health. Whether it’s a small or a large-scale entity, neglecting bills payable can bring consequences and several hurdles in growth.

However, it might be challenging to handle this process effectively, especially if you have hundreds of invoices.

So, what is the solution to managing Bills Payable and multiple invoices simultaneously?

Before getting straight to the solution, it is better to understand what Bills Payable are and the challenges in managing these payables. This blog post covers everything about bills payable and the solution to manage them efficiently.

We will also discuss a comprehensive tool, Invoicera, that would make Bills Payable management easier.

Let’s dive in.

Understanding Bills Payable

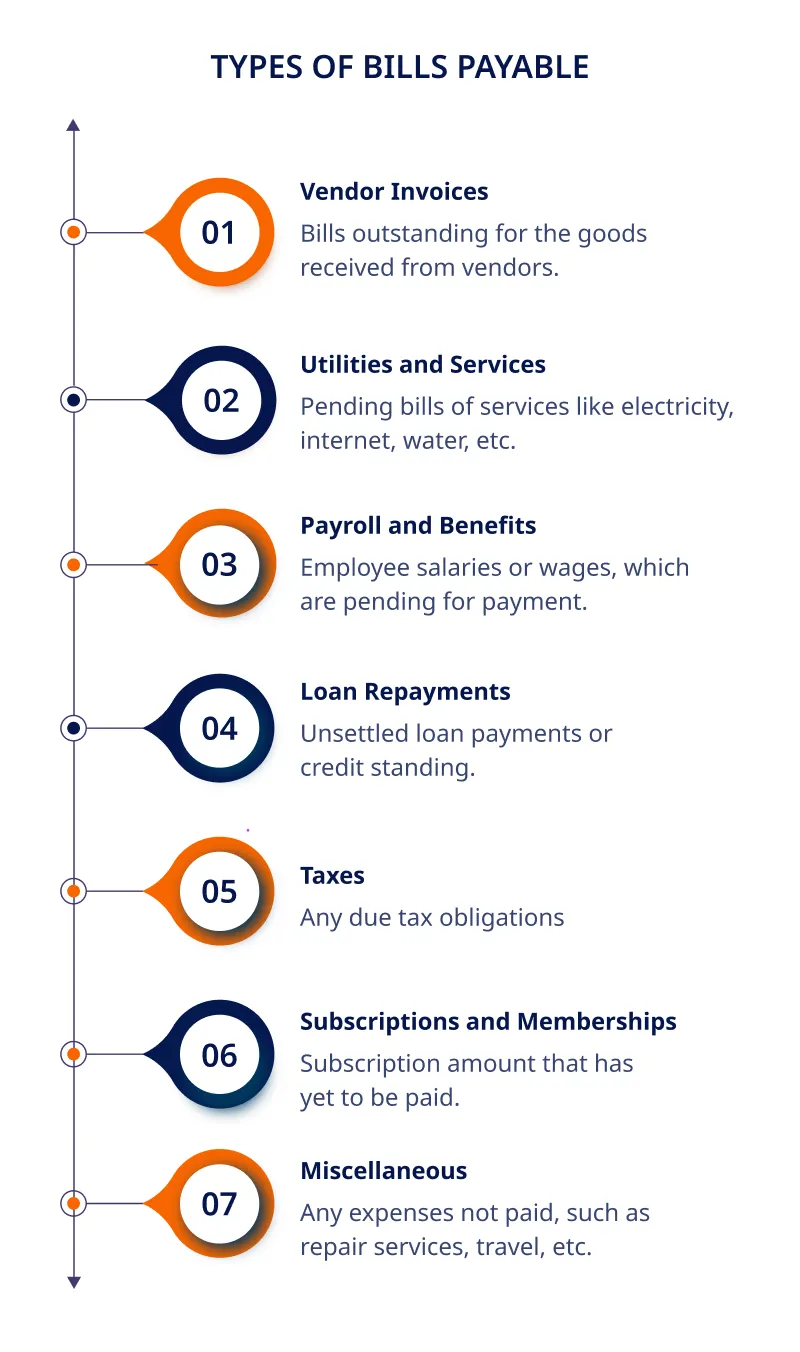

Bills Payable, also called account payables, are the outstanding invoices a business owner has yet to pay to its vendors or service providers. It includes the amount the company has to pay for the services received.

Importance of Timely Bill Payment

Importance of Timely Bill Payment

Timely bill payment is crucial for maintaining healthy relationships with vendors and suppliers. It ensures a steady supply chain, avoids late payment penalties, and helps businesses maintain a good credit rating. Moreover, timely payment fosters trust and credibility, strengthening business partnerships.

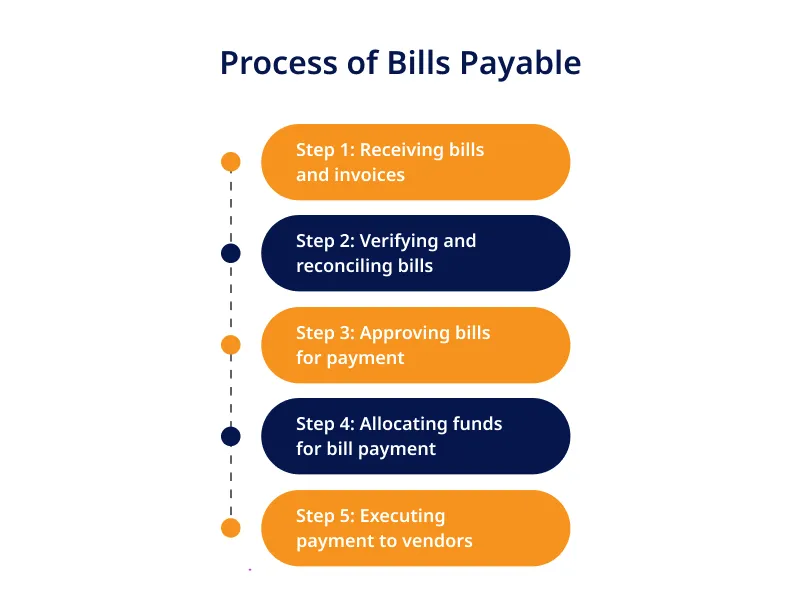

Process of Bills Payable

- Receiving bills and invoices: First, a company gets invoices or bills from vendors or suppliers, including pending amounts with due dates.

- Verifying and reconciling bills: The company then verifies them with purchase orders to avoid discrepancies.

- Approving bills for payment: Once verified, they go to employees or managers involved in the approval process.

- Allocating funds for bill payment: Accountants allocate funds considering their company’s cash flow.

- Executing payment to vendors: At last, payment is executed for the respective invoices.

Benefits of Efficient Bills Payable Management

Let’s explore the benefits of managing your bills payable effectively.

Improved Cash Flow Management

Whether you are receiving a small service or ample goods, you must ensure you are paying invoices on time. You will always have financial stability when an invoice is paid on time. Moreover, early payment discounts can be like a cherry on top.

Efficient bills payable management will eventually enhance overall profitability.

Enhanced Vendor Relationships

It helps build trust with vendors if you pay the invoices on-time. Paying bills consistently leads to stronger business partnerships.

In turn, this can help with negotiations in the future, such as extended payment periods or discounts. It can also result in long-term association with the vendors.

Streamlined Accounting and Reporting

Efficient Bills Payable management enables businesses to maintain accurate tracking of all payments done. Moreover, properly generated financial reports reduce the likelihood of errors.

It also efficiently contributes to simplified tax compliance. Accurate record-keeping and timely payment of bills help businesses meet their tax obligations and avoid penalties.

Challenges in Bills Payable Management

Managing Bills Payable can be daunting for businesses, often presenting several challenges. In this section, we will explore some of the common obstacles that arise in Bills Payable management and how you can overcome them with the help of Invoicera.

Manual Processes and Paperwork

The first challenge every company will face while creating manual invoices is time-consuming data entry and document handling.

The traditional way of preparing an invoice is more time-consuming and prone to errors. For example, if by mistake you entered the wrong data and the invoice amount is more than the actual amount, it can drastically affect your relationship with the client, leading to disputes.

How is Invoicera helpful here?

It provides a centralized platform for:

- Storing and organizing bills, invoices, and payment records

- Ensuring easy access

- Minimizing the risk of lost paperwork

Invoice and Payment Discrepancies

Discrepancies between invoices and payments can be a significant headache for businesses. Resolving these issues requires careful record-keeping, vendor communication, and time-consuming analysis.

However, manually managing records could lead to accurate oversights, thus making it easier to rectify discrepancies in time.

Invoicera eliminates discrepancies by:

- Automatically matching invoices with corresponding payments

- Maintaining accurate audits and records

- Generating detailed credit note reports

Lack of Visibility and Control

It can be challenging to track multiple bills and due dates. Also, it can lead to missed payments, late fees, and damaged client relationships.

With centralized software, tracking, and managing approvals is easier, and this eventually leads to delayed payments.

- Enhanced visibility and control over Bills Payable

- Centralized dashboard to track and monitor bills and due dates

- Providing stakeholders the option to review and authorize payments

Best Practices for Effective Bills Payable Management

To optimize Bills Payable management, you must implement best practices that enhance efficiency and accuracy. Invoicera can be a valuable tool in achieving these goals.

Some recommended practices are:

- Implementing a bills payable policy: Develop a clear policy covering aspects such as invoice verification, approval workflows, and payment terms.

- Leveraging technology for efficiency: Embrace technology like Invoicera to automate and streamline your payable processes. Its features, such as automated invoice processing, payment reminders, and real-time reporting, can significantly reduce manual efforts, enhancing efficiency.

- Monitoring and continuous improvement: Regularly monitor and evaluate your bills payable processes. Try to identify the areas that require improvement and take proactive steps.

Conclusion

Effective bills payable are crucial to running smooth financial operations. You must stay organized, maintain accurate records, and implement effective payment strategies to avoid pitfalls in the payable process.

Remember, clear communication with suppliers, timely payments, and proactive financial management is essential in building solid relationships while ensuring long-term business success.

So, stay informed, stay proactive, and keep your bills payable in check.

And remember to try Invoicera and streamline your bills payable management process.

FAQs

Q: How do I keep track of my bills payable?

You must maintain a centralized system such as accounting software like Invoicera to keep track of your bills payable. It helps you record each bill’s vendor, invoice number, due date, and payment status.

Q: What happens if I miss a payment on a bill?

Try never to miss or delay a payment. But in case you missed it, vendors can apply late payment penalties, leading to strained relationships with them. You can set up reminders for prompt payments.

Q: Are there any legal obligations associated with bills payable?

The vendor may file an action against you if you don’t pay in accordance with the terms and conditions stated in the invoices. Therefore, it is crucial to understand and adhere to the payment terms specified in the bills.

Importance of Timely Bill Payment

Importance of Timely Bill Payment