Introduction

Are you looking for a billing method that suits your business?

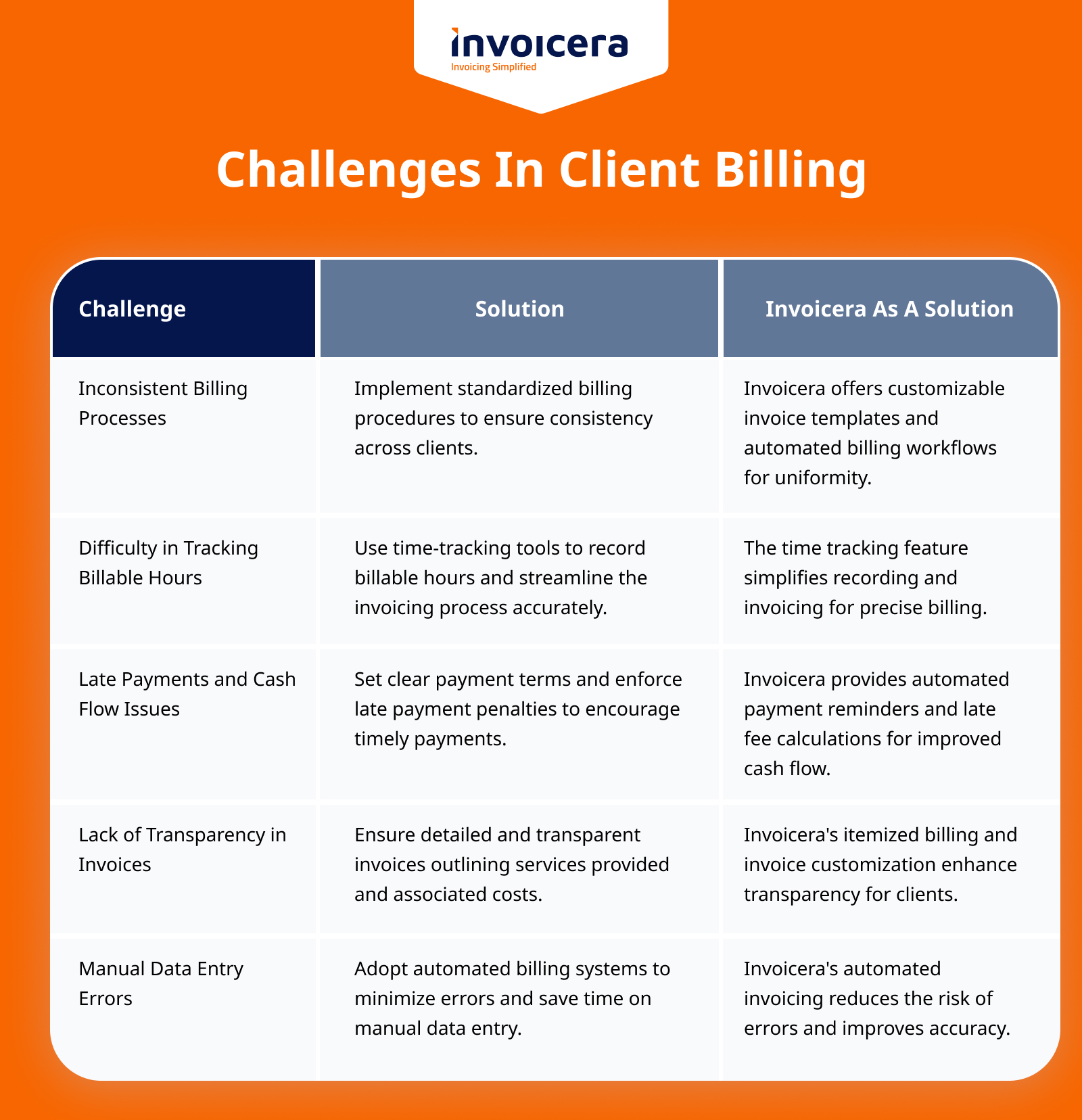

Many businesses face challenges in understanding and implementing effective client billing methods.

According to a recent survey by the National Business Association, 65% of businesses encounter issues related to client billing.

This impacts their cash flow and hinders business growth.

Thus, we have come up with a detailed blog post that will discuss different client billing methods. It will help revolutionize your financial interactions and propel your business toward success.

Let’s get started.

What Is Client Billing?

Client billing is the process of charging clients for goods or services provided by a business. It involves detailing costs, specifying payment terms, and establishing a transparent payment method.

Understanding client billing is crucial for both businesses and clients, ensuring fair compensation and fostering trust.

Importance Of Effective Client Billing

Effective client billing is crucial for any business’s financial health and overall success. Understanding the importance of a well-structured billing system is essential for sustainable growth and positive client relationships.

Accurate and transparent billing not only ensures that your business receives fair compensation for the services rendered but also builds trust with clients. It establishes a clear understanding of the value provided, fostering a positive perception of your professionalism and reliability.

Timely and precise billing practices contribute to cash flow management, allowing your business to meet financial obligations, invest in growth opportunities, and maintain operational stability.

A streamlined billing process minimizes the risk of disputes and enhances client satisfaction, as clients appreciate clarity and predictability in financial transactions.

Moreover, effective client billing is a reflection of your commitment to professionalism and customer service. It demonstrates a level of organization and attention to detail that resonates positively with clients, potentially leading to repeat business and referrals. Referral program software can automate and track referrals, making it easier for clients to participate and for you to manage.

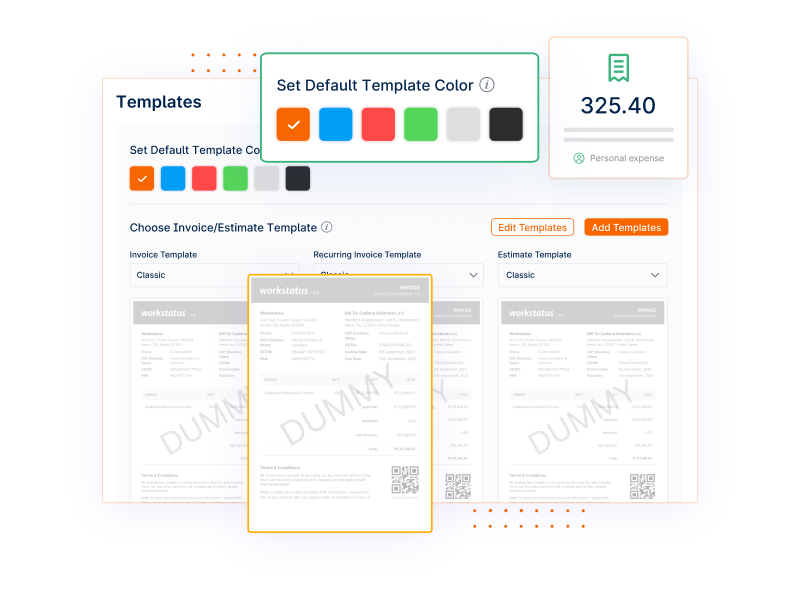

With Invoicera, you can create professional bills with custom templates. In this way, you can leave a good impression on your clients.

Common Client Billing Methods

1. Hourly Billing

Hourly billing is a common client billing method where clients are charged based on the number of hours spent on a project or task. This method provides a straightforward way to calculate fees, especially in industries where the scope of work may vary.

Pros:

- Transparency: Hourly billing offers transparency, as clients can see a direct correlation between the time spent on their project and the charges incurred.

- Flexibility: It accommodates projects with evolving scopes, allowing for adjustments as tasks and requirements change.

- Fair Compensation: For tasks that are difficult to predict regarding time, hourly billing ensures fair compensation for the actual effort invested.

Cons:

- Client Concerns: Clients may be concerned about potential inefficiencies, leading to increased costs.

- Lack of Predictability: The lack of fixed costs can make budgeting and financial planning more challenging for clients.

- Incentives for Slow Work: There might be concerns about a lack of incentives for efficiency, as more billable hours mean more revenue.

Suitable Industries for Hourly Billing

Hourly billing is particularly suitable for industries such as:

- Consulting Services: Consultants often utilize hourly billing due to the variable nature of their tasks and the difficulty in estimating project scopes accurately.

- Legal Services: Attorneys commonly use hourly billing, reflecting legal work’s time-intensive and unpredictable nature.

- Freelancers and Creative Professionals: Individuals providing creative services, like graphic designers or writers, often opt for hourly billing to account for the variable nature of creative projects.

2. Project-based Billing

Project-based billing is a billing method where clients are charged based on the scope and requirements of a specific project. This approach is distinct from other billing methods, focusing on delivering a predefined set of services or outcomes within a determined timeframe.

Advantages:

- Clear Scope and Cost: Project-based billing provides clients with a transparent understanding of the project’s scope and associated costs upfront, fostering clear communication and expectations.

- Incentive for Efficiency: This billing method incentivizes efficiency, as service providers aim to complete projects within the agreed-upon scope and timeframe to maximize profitability.

- Predictable Budgeting: Clients benefit from predictable budgeting, as costs are defined at the outset, reducing the likelihood of unexpected expenses throughout the project lifecycle.

Drawbacks:

- Limited Flexibility: Project-based billing may lack flexibility, making it challenging to accommodate changes in project scope or unexpected developments without renegotiating terms.

- Risk of Underestimation: Service providers risk underestimating the resources required for a project, potentially leading to financial losses if additional work is needed beyond the initial scope.

- Client Satisfaction Dependencies: Client satisfaction heavily depends on the accuracy of the initial project scope definition; any deviations may lead to dissatisfaction and disputes.

Industries that Benefit from Project-based Billing

Project-based billing is particularly beneficial for industries characterized by distinct projects with well-defined scopes.

Examples include:

- Consulting Services: Management, strategy, or IT consulting services often have clearly defined projects, making project-based billing suitable for both service providers and clients.

- Creative Agencies: Advertising, design, and marketing agencies frequently adopt project-based billing to align costs with specific campaigns or project deliverables.

- Construction and Engineering: Projects in construction and engineering, such as building construction or infrastructure development, often have predefined scopes, making project-based billing a practical choice.

3. Retainer Billing

Retainer billing is a payment arrangement where clients pay a fixed fee in advance to secure a specified amount of a service provider’s time or expertise over a set period.

Understanding Retainer Agreements

Retainer agreements involve a formal understanding between a service provider and a client, where the client pays a predetermined upfront amount for a specified duration of services. This upfront payment secures the service provider’s availability and ensures a dedicated resource for the client’s needs.

Pros:

- Steady Cash Flow: Retainer billing provides a predictable income stream, enabling better cash flow management for service providers.

- Priority Service: Clients under retainer agreements often receive priority attention, fostering stronger client relationships.

- Financial Stability: For service providers, retainer agreements offer financial stability by guaranteeing a baseline revenue.

Cons:

- Service Overcommitment: There’s a risk of overcommitting resources, especially if the client’s needs fluctuate.

- Client Commitment Concerns: Clients may be hesitant to commit to upfront payments without a clear understanding of the services they’ll require.

Industries that Commonly Use Retainer Billing

Retainer billing is prevalent in industries where ongoing, predictable services are provided. Common sectors include legal services, consulting, marketing agencies, and maintenance services.

How Invoicera Supports Retainer Billing

Invoicera streamlines retainer billing with features designed to simplify the process.

It allows businesses to create and manage retainer agreements, automate recurring invoices, and track retainer balances seamlessly.

With Invoicera, businesses can efficiently handle retainer-based transactions, ensuring accuracy and transparency in financial dealings.

4. Flat-rate Billing

Flat-rate billing is an invoicing method where a fixed fee is charged for a specific service, regardless of the invested time or resources.

In this model, clients are billed a predetermined amount, providing simplicity and predictability in financial transactions.

Advantages:

- Simplicity and Transparency: Flat-rate billing offers a clear and uncomplicated fee structure, making it easy for both the service provider and the client to understand the cost of services.

- Predictable Budgeting: Clients benefit from predictable costs, allowing for easier budgeting and financial planning, as there are no surprises or fluctuations in expenses.

- Incentive for Efficiency: Service providers are incentivized to optimize their processes and workflows, as the fixed rate encourages efficiency and effectiveness in service delivery.

Challenges:

- Risk of Undercharging: Determining an appropriate flat rate can be challenging, and there is a risk of undercharging for services if the scope or complexity of the work is underestimated.

- Limited Flexibility: Flat-rate billing may not be suitable for projects with evolving requirements, as the fixed fee may not adequately account for changes or additional work.

- Potential for Disputes: If expectations are not clearly communicated and defined, there is a risk of disputes arising over whether certain services or deliverables are included in the flat-rate agreement.

Industries Best Suited for Flat-rate Billing

Flat-rate billing is particularly well-suited for industries where services can be standardized and the scope of work is relatively predictable.

Some industries that commonly benefit from flat-rate billing include:

- Creative Services: Graphic design, copywriting, and other creative services often have well-defined deliverables, making flat-rate billing a suitable option.

- Consulting: Certain consulting services, where the project scope is clear and consistent across clients, can benefit from the simplicity of flat-rate billing.

- Routine Maintenance Services: Industries such as IT support or property maintenance, where routine tasks can be standardized, find flat-rate billing advantageous for both providers and clients.

5. Value-Based Billing

Value-based billing is a strategic approach to client invoicing that centers around the perceived value of services rather than the traditional hourly or fixed-rate models. It is a method designed to align the cost of services with the value they deliver to the client.

Benefits:

- Fair Compensation: Clients pay based on the value they receive, ensuring a fair and transparent exchange.

- Incentive for Efficiency: Encourages service providers to deliver efficiently, as the value is tied to outcomes.

- Positive Client Relationships: Aligns pricing with perceived value, fostering trust and satisfaction.

Limitations:

- Subjectivity: Assessing value can be subjective, leading to potential disagreements on pricing.

- Complex Implementation: Requires a comprehensive understanding of client needs and a well-defined value proposition.

Industries that Align with Value-Based Billing

Value-based billing is particularly effective in industries where the outcomes and impact of services are tangible.

This includes:

- Consulting: Clients value strategic advice and tangible results.

- Creative Services: Aligns well with the unique and innovative nature of creative work.

- Technology Solutions: Ties pricing to the effectiveness and efficiency of solutions provided.

Invoicera’s Features for Value-Based Billing

Invoicera, a leading invoicing platform, offers specialized features to support seamless Value-Based Billing:

- Customized Invoicing: Tailor invoices to reflect the unique value proposition of your services.

- Performance Tracking: Monitor and showcase the impact of your services to justify value.

- Flexible Payment Options: Provide clients with convenient payment options based on the perceived value.

6. Subscription Billing

Subscription billing is a business model where customers pay a recurring fee at regular intervals to access a product or service. This method provides a predictable revenue stream for businesses and offers customers a convenient way to enjoy continuous access to desired services.

Pros:

- Steady Revenue: Subscription billing ensures a steady and predictable income for businesses, facilitating better financial planning.

- Customer Retention: The recurring nature of subscriptions often leads to higher customer retention rates as users find value in continued access.

- Convenience: Customers benefit from the convenience of automated payments, eliminating the need for manual transactions each time.

Cons:

- Customer Commitment: Some customers may be hesitant to commit to ongoing payments, impacting initial adoption rates.

- Flexibility Challenges: Depending on the subscription model, adapting to changing customer needs can be challenging.

Industries Embracing Subscription Billing Models

Subscription billing has gained widespread adoption across various industries, including:

- Streaming Services: Platforms like Netflix and Spotify thrive on subscription models, providing continuous entertainment.

- Software as a Service (SaaS): Many software companies offer subscription-based access to their products, ensuring users get the latest updates and support.

- E-commerce: Subscription boxes and services have become popular in the retail sector, offering curated products on a recurring basis.

Integrating Invoicera for Subscription Billing

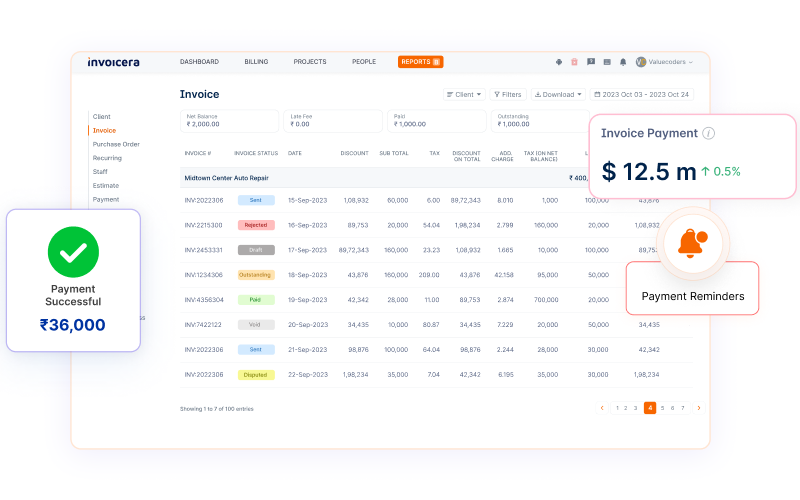

Invoicera offers a comprehensive solution for businesses looking to implement subscription billing seamlessly.

With robust features such as automated invoicing, payment reminders, and customizable billing cycles, Invoicera streamlines the subscription billing process.

The platform ensures accuracy, transparency, and efficient management, allowing businesses to focus on delivering value to their subscribers.

7. Combination Billing

Combination billing involves integrating multiple billing methods to create a versatile and adaptive system. This approach recognizes that different clients may have varied preferences and needs regarding billing structures.

By combining various billing methods, businesses can tailor their approach to accommodate diverse client requirements, ultimately enhancing client satisfaction and optimizing revenue streams.

Customization and Flexibility

- Customization and flexibility are integral components of an effective combination billing strategy.

- Tailoring billing methods to suit the unique needs of individual clients allows for a more personalized and client-centric approach.

- This fosters stronger client relationships and positions your business as responsive and adaptable to evolving client demands.

- Flexibility in billing structures accommodates changes in client preferences or project scopes, ensuring that your billing methods remain aligned with the dynamic nature of business relationships.

- Customization and flexibility in combination-billing empower businesses to navigate the intricacies of client engagements with precision and responsiveness.

Invoicera For Client Billing

Invoicera stands out as a comprehensive solution for efficient and streamlined client billing. It is designed to simplify the invoicing process, offering businesses a robust platform to manage their financial transactions seamlessly.

How Invoicera Enhances Billing Processes

Invoicera enhances billing processes through a combination of user-friendly design and powerful features. The platform streamlines the entire invoicing cycle, from creating invoices to receiving payments, offering businesses a seamless and efficient financial management solution.

- Time Efficiency: With its automated billing and invoicing features, Invoicera significantly reduces the time and effort required for manual financial tasks. This allows businesses to focus more on core operations and less on administrative processes.

- Improved Accuracy: The automation features not only save time but also contribute to increased accuracy in billing. By minimizing the chances of human error, Invoicera ensures that invoices are precise and in compliance with business policies.

- Enhanced Professionalism: Customizable invoices and a professional interface contribute to an enhanced image of professionalism. Businesses using Invoicera can present themselves in a polished manner, reinforcing trust and credibility with their clients.

Key Features

- User-Friendly Interface: Invoicera boasts a user-friendly interface that ensures ease of navigation and accessibility. This feature is particularly beneficial for businesses looking to simplify their billing processes without compromising on functionality.

- Customizable Invoices: One of Invoicera’s standout features is its ability to create fully customizable invoices. Businesses can tailor the invoice format to align with their brand identity, promoting a professional and consistent image in all financial transactions.

- Automated Billing: Invoicera automates the billing cycle, saving time and reducing the likelihood of errors. Automated recurring billing options allow businesses to set up and send invoices at regular intervals, ensuring a consistent and timely revenue stream.

- Expense Tracking: The platform offers robust expense tracking capabilities, enabling businesses to monitor and manage expenses effectively. This feature provides transparency and accountability in financial transactions.

- Multi-Currency Support: Invoicera recognizes the global nature of business and accommodates international transactions by providing multi-currency support. This is a valuable feature for businesses engaging in cross-border transactions.

How To Choose The Right Billing Method?

Choosing the right billing method is a critical decision that directly impacts your business’s financial success and client relationships.

To make an informed choice, consider the following factors:

Nature of Services:

Evaluate the type of services your business offers. For project-based work, a fixed-rate or project-based billing method may be suitable. For ongoing services, hourly or retainer-based billing could be more appropriate.

Client Preferences:

Understand your clients’ preferences. Some may prefer the predictability of a fixed rate, while others may appreciate the flexibility of hourly billing. Communicate with your clients to align your billing method with their expectations.

Complexity of Work:

Assess the complexity and variability of your projects. If tasks are straightforward and well-defined, a fixed rate may be straightforward. For more unpredictable work, hourly billing allows for flexibility.

Industry Standards:

Research industry standards to ensure your billing method aligns with common practices. This helps in setting reasonable expectations for both you and your clients.

Cash Flow Considerations:

Consider your business’s cash flow needs. Some billing methods, like upfront payments or retainers, can provide a more steady income stream, while others may involve waiting until project completion.

Technology and Automation:

Leverage technology to streamline your billing processes. Automated systems can simplify tracking billable hours, managing subscriptions, and generating invoices, saving time and reducing errors.

Legal and Regulatory Compliance:

Ensure that your chosen billing method complies with legal and regulatory requirements in your industry and jurisdiction. This is essential to avoid complications and maintain a positive business reputation.

Flexibility and Adaptability:

Choose a billing method that allows for adjustments as your business evolves. Flexibility is key to accommodating changes in services, pricing structures, or client needs.

Conclusion

It’s important to know how you can charge clients for your work. Whether you go with hourly rates, fixed fees, or value-based pricing, each has pros and cons.

Make sure to pick a method that fits your services and makes your clients happy.

Understanding these billing methods helps you understand costs, strengthens client relationships, and ensures a fair pay system. It’s not just about money—it’s a smart choice that can boost your success in your job.

Consider using tools like Invoicera to simplify your invoicing process and manage your billing efficiently.

FAQs

How do I determine which billing method is best suited for my services?

Consider the nature of your services and your client’s preferences. Hourly rates work well for tasks with variable time requirements, while fixed fees are suitable for projects with defined scopes. Value-based pricing aligns with the perceived value of your services.

How can I enhance transparency in my billing process?

Maintain open communication with clients about your billing method, provide detailed breakdowns of services rendered, and consider using invoicing tools like Invoicera to generate clear and professional invoices.

Can I switch between billing methods for different clients or projects?

Yes, you can tailor your billing method to each client or project based on their specific needs and the nature of the work. Flexibility in choosing billing methods can contribute to better client relationships.