Invoicing has always been an integral part of every business. Therefore, it’s important for every business, whether small or big, to manage their business bills well. As we all know that every business wants to be paid on time, but your minor act of negligence in invoicing can give rise to innumerable problems and hence leading to your poor cash flow. Invoicing process can be tedious as it requires dealing with the records of innumerable clients, their transactions, previous records, credit details and so on.

The best way to manage invoices is by adopting a strategy to generate, send, and keep track of your business invoices. There are several invoicing tools available in the market to choose from as per your specific needs. This not only saves your time but also save your mental and physical effort spent in making bills. Moreover, it’s wise to seek advice or tips to buy the best invoicing software for small business from experts when in doubt.

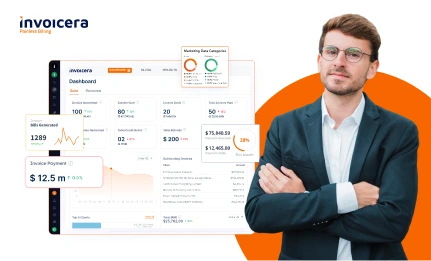

Invoicera has turned out to be the most reliable billing software for small business. It helps you manage your business invoices in a simple and systematic manner. It has many features to ease the process of your business invoice management and hence making them efficient and effective.

Invoicera has more than 3 million users, and it takes pride in providing its indubitable services to over 60 enterprise customers since 2004.

How to Manage Invoices for Small Business:

1. Be aware of the payment schedule

You must have a clear payment schedule depends on the type of project you are working on. You should decide how much you will be paid and when. When having small projects, you must send an invoice for the services you have provided. To ease your understanding, we have given you three invoice schedules to adopt:

Interim invoice

It tends to happen that many clients with small financial capability don’t want to pay at once and look for ways to save money when starting a business. They ask for the payments to be segmented into small installments at particular billing intervals. These intervals are usually based on the elapsed time or when some parts of a project are done. At the end of the project, clients often ask for a final invoice summarizing all the previous billing details.

Final invoice

To outline the overall project work, you can send a final invoice at the end of the project that’s been completed ensuring that you have also sent interim invoices. Details must be mentioned, if those interim invoices have been paid, and you should make a list of the pending final amount. Despite being fully paid, it’s a good practice to send a final invoice clearing all the dues. All these are managed very conveniently and systematically when you go for the best invoice software for small business.

Recurring invoice

Recurring invoice is the ideal strategy to adopt, as it ensures that you have a healthy cash flow. You can have a recurring invoice automatically-generated with the best invoice software for small business if working with the same clients for long, and it will automatically bill the expected payment schedule. Having so, you and your clients will come to terms with a billing interval (weekly or monthly), in which the bill will be generated automatically at the set interval. It will become a part of the client’s routine, thus making them pay on time and faster.

2. Use of Digital Payment System

The invoicing software for small business offers online invoicing and payment collection which is mandatory for every business in this modern era. With this, invoices can be sent in the mail, and you can easily accept payment with the different payment gateways available with Invoicera. Also, integrating your invoicing software with secure QR code generator software will help you provide ease in terms of payment channels.

Ultimately, it will save you time and money when it comes to billing your customers. Moreover, all is stored safely on a single platform, not requiring any files.

3. Not Using Papers for Invoicing

Online Invoicing is the ideal way to keep invoices safe. It’s advised to go for the best invoice software for small businesses to get it done quickly. This invoice management software will allow you to run your whole business and have a healthy cash flow. There are innumerable famous invoices tools like Invoicera, which can help you manage your business invoices. Therefore, you should choose one after a thorough research as per your specific business needs and budget.

Moreover, paper invoices are not only a headache for you, but they are also a nuisance for your customers. It’s almost impossible to properly keep track of all the details like we have sent the invoice or not, or the bill has been paid or not when banking on papers. Therefore, you must choose the paperless invoicing.

4. Not paying attention to delays

The manual process is prone to human error hence avoiding some mistakes can help them get paid faster. Two most common ones are given below:

They must be clear on the terms

It is ethical to lay down your terms and conditions well in advance in order to avoid any conflict in the future. These include the payment intervals, the projected budget, and any other clause protecting it. You must ensure that your clients sign the agreement to allow them to have a physical copy to avoid any issue.

Always contact the right person

Whenever you work for a client, you must make sure that you know very well who will pay your bills. Many times, the person you are in contact with can’t access the funds of the company. In such cases, troubles emerge, so you must send the invoice to the authorized person to ward off unnecessary delays or confusion.

5. Handling the sent invoices

Sometimes, you need to make changes in the invoices sent already. For this purpose, Invoicera, known as the best invoice software for small business, can help you very well with managing those invoices sent before. And, you can make the changes required in the current time by using the software.

Let’s have a quick view of 5 Ways to Manage Small Business Invoicing | Like & Subscribe our channel for more updates

Let’s wrap up

Invoicing and billing process has to be easy. It’s a widely-known fact that some clients will always have more problems than others, but you should adopt a problem-solving strategy, which hits the right target. Having said all this, we advise you to use the above-mentioned strategies to manage the bills of your small businesses.

The finest way to manage is to be dependent on modern billing software for a small business like Invoicera. This robust invoice management software helps its users lessen the payment cycle duration and get paid quickly.

Moreover, this software keeps track of each and every invoice and penny pending from the client’s side and analyze the detailed financial reports at lightning speed. Having so, you will be able to have a clear idea of the status of your clients regarding payments, thus having a strong and pleasant relationship with them by using an efficient small business billing system.