Introduction

What is the first step to take when you want to start a business? Some would argue that it’s coming up with an idea and building a prototype. We disagree! The very first thing you need is your financial forecast.

A business financial forecast is a crucial piece of financial information that lenders and vendors often look at before doing business with you. A good financial prediction must be rooted in reality, taken from the company’s previous performance and expenses, and should include a method for future year cost increases or decreases. Creating a business financial forecast is a time-consuming process that requires the entrepreneur to evaluate every line of revenue and expenditure for his company, but it’s essential when making management decisions and applying for loans.

The importance of a financial forecast is to help you develop a better understanding of your company’s future. This can be achieved by creating a plan for what you want to execute next year and then working on the same. Financial forecasts are often created monthly or quarterly, depending on how frequently your company reports its finances.

Don’t know how to create a financial forecast?

Don’t Worry!!

This blog post will provide crucial ways to create a financial forecast for any size business, whether large or small!

What Is Financial Forecasting?

Source: Dreamstime.com

A financial forecast predicts how much money your company will make in the future. It can gauge your current position and establish whether you should invest more money or not.

As an example, if your financial forecast reveals that your business has significant room for growth over the coming year, you might consider allocating funds for marketing campaigns over this time.

The key components of a business’s financial forecast are:

- Cash flow statements

- Balance sheets

- Cost and revenue projections

The most reliable method for producing an accurate financial forecast is to use these historical numbers as a point of reference to project potential future events.

Hold on!!

We understand that you need a clearer picture of how financial forecasting is helping businesses become more successful. Read the following section to know how companies are getting huge benefits from financial forecasting.

———————————————————————————————————————————————————

Also Read: Important Tips for Financial Management in a Business

———————————————————————————————————————————————————

How Financial Forecasting Changes Business Outlook?

Source: Dreamstime.com

Financial forecasts help businesses see into the future and prepare for changes that could potentially affect their business. Businesses become more efficient as they plan and create strategies to adjust for changes in the present market conditions.

- Financial forecasting can predict a range of possible outcomes, which makes it an essential part of planning and budgeting towards an end goal.

- It helps businesses plan and prepares for potential threats and opportunities in the market at present.

- Companies can be more systematic with their resources to find out the issues before they occur. In this way, it can minimize the heavy impact on your business finances.

- You can use financial forecasts as a business management tool that allows businesses to analyze their past figures, using them as reference points for projecting future financials.

For example, if there were changes in revenue or expenses that affected the company’s bottom line last year, it can be used to determine future financials.

Financial forecasting is changing the way businesses are managed because it allows companies to make more efficient decisions on their management strategies, costs, and revenues. Financial forecasts are essential for making crucial business decisions. Businesses use these predictions of financial figures that can correlate with past performance or industry standards to see if there is a need for adjustments that can help grow the company.

Follow-up question: How to create a financial forecast?

Let’s move to the next section for the answer-

How to Create a Financial Forecast for any business?

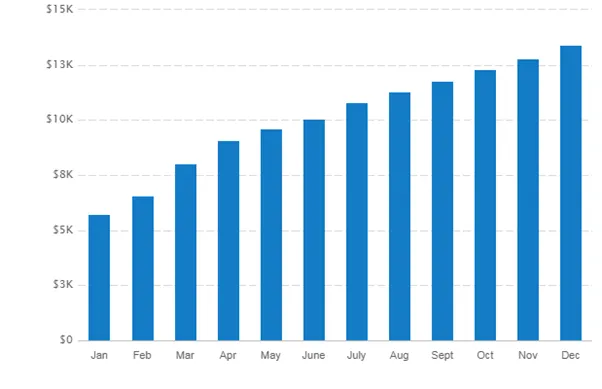

Source: Bplans

1. Collect all information available about the historical sales results of your business at regular intervals. This includes revenue generated over a specific time period.

2. For the position, you are in now, estimate how much will be generated in the future based on your business plan for this year. Many factors decide the future revenue of your company, which includes-

- Business development activities.

- Sales pipeline at a certain level of progress expected to close during the same time period.

- Customer base so far and future customer prospects with detailed information of each prospect at hand with realistic conversion rates to aid your market share analysis.

- The market development plan for the current year includes an existing or new product line, launching promotional campaigns, etc.

3. Plot these two projections side by side on a graph.

4. The resultant curve will be your financial forecast for the next year or more (if required) with two essential components- Revenue projection and Profit projection. It is always better to incorporate both projections in one diagram as they are interlinked if you want to create an effective forecasting model.

5. You may need to make minor changes in the methodology for building a financial forecast after about 3-4 months of projecting your business. Some of the changes may include-

- If revenue is rolling in much faster than expected, it might be time to revisit your near-term projections. Increased sales activity could signal a need to adjust your forecast upwards.

- Deal closures may become more difficult in the event of significant market changes. Should this occur, be ready to modify your forecasts to take into account the altered circumstances.

- Adjust your projections for the current quarter and possibly the next one, depending on how much time has passed, if you’re not gaining the anticipated number of customers or if many are turning into losses.

- Update your financial forecast as soon as the business environment shifts, without hesitation. Maintaining up-to-date projections guarantees that the decisions you make are grounded in the most recent data.

6. This is an essential aspect that you must understand about forecasts. You can use the revised figure with the required modifications for future forecasting sessions, which will give you a very realistic picture of your business.

In addition to that, it must be remembered that the more detailed and granular you are about the forecast-building process, the better your financial forecast. In the case of more precise forecasts, small changes can have a significant impact on both your business’s revenues and profit projections. However, detailed forecasts also require a lot of time and patience as you need to crunch vast volumes of data.

———————————————————————————————————————————————————

Also Read: 5 Secrets No One Tells You About Small Business Finance Management

———————————————————————————————————————————————————

In the end, you must understand that financial forecasts should not be taken literally. Forecasts only serve the purpose of protecting your business into the future so that you can either stay prepared or take important decisions accordingly.

Now, you might have found creating a financial forecast a time-consuming task. You need more time to focus on your business goals and other productive areas.

So, you might be wondering-

Is it possible to automate financial forecasting? Is there any tool that can generate all financial reports with accuracy and precision? With this, the time has come to move to the next section to know the answer-

Which is the best-known tool to automate financial forecasting?

Invoicera is the best-known forecasting tool on the market. It helps you forecast with accuracy and scale – from a small one-person shop to large industries with thousands of users across dozens of countries.

What sets Invoicera apart from most other vendors in this space is that its solution is purpose-built for revenue recognition and reporting – using a set of integrated analytic modules that provide business analysts with the information they need to make accurate forecasts at any level in your organization – whether pricing, sales volume, competition analysis or even gross margin.

Invoicera can quickly generate financial projections. It is easy to use, and it’s specifically designed to take some of the stress out of this task. Being an excellent online invoice system, Invoicera can instantly generate forecasts based on existing customer invoices and expenses, so the initial work you need to do is minimal.

Invoicera is not only limited to financial forecasting but also comes with exciting features like-

- Automated invoicing

- Accounts receivable and payable management

- Legal billing software

- Multi-currency accounting software

- Project management

Closing Thoughts

Financial forecasting is a method to predict the future of business by examining past data. This process can be applied to any company, regardless of size or industry. Companies need to have this information to know what their financial position will look like in the coming months and years ahead. It also helps managers decide how much money they should spend in various areas before their cash runs out.

As you already know that Invoicera can automate the creation of forecasts. It’s easy enough for anyone!! This tool was designed specifically for businesses that need more control over their finances without financial background knowledge. If you’re looking to automate your forecasts, then request a free demo of Invoicera today!

Have a wonderful day ahead!

Thanks for reading!!

FAQs

How often should I create a financial forecast?

Monthly or quarterly forecasts align with reporting periods and adapt to changing business conditions.

Can financial forecasting be automated?

Yes, tools like Invoicera automate forecasting by analyzing data and generating accurate reports, saving time and ensuring precision.

How accurate are the financial reports from Invoicera?

Invoicera’s financial reports are highly accurate and provide reliable insights into revenue, expenses, and a business’s financial health. More than 4 million users trust Invoicera for its precision in forecasting and reporting.