An invoice and a purchase order are two different important documents between a business and a client.

For example, there are two departments in a company: sales and purchasing. Both departments require invoices and purchase orders for internal and external use.

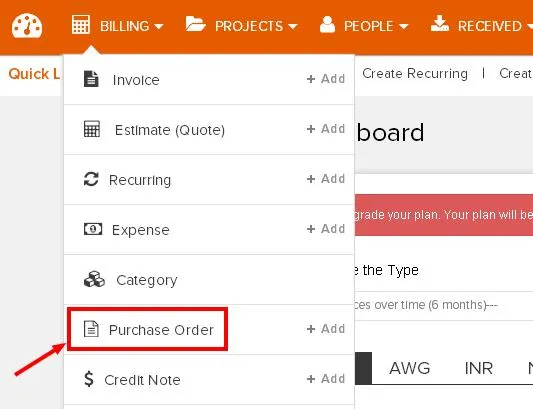

A purchase order is an order a buyer places for the product, while an invoice is a bill a seller raises for payment of that particular product. Although purchase orders and invoices are quite similar in many ways, they are two distinct documents and serve completely different functions. The critical difference between PO and invoice has been depicted as an Infographic. Check the infographic below-

Purchase Order – Detailed Explanation

It is now time to discover more about Purchase Orders, including the Purpose and the Elements.

Definition

A Purchase Order (PO) is an official business document that is used by the buyer to convey the interest of purchasing goods and services from the seller.

Purpose

This is a proof of goods and services which are demanded to avoid any disagreement between the seller and the buyer later.

Components Of Purchase Order

- PO Number: This is the unique identification number of a purchase order. It helps both parties keep track of multiple orders and refer to them easily.

- Vendor Information: This section consists of the vendor details. It has their name, address, contact information, and sometimes their tax ID.

- Item Specifications: This part entails product codes and any other relevant information to clearly identify the goods or services.

- Quantity and Price: This part outlines the quantity of each item ordered and the total cost.

- Shipping and Payment Terms: It specifies the shipping method, delivery address, expected arrival date, and agreed-upon payment terms.

Types of Purchase Orders

1. Standard Purchase Order: This is your go-to PO for one-time, straightforward transactions. It specifies the products or services, quantities, prices, and delivery terms. Use it for routine orders without ongoing commitments.

Use: When you need to order a one-off product or service, like office supplies or a single repair job.

2. Blanket Purchase Order: They work best if you’re looking forward to placing multiple orders frequently from a particular supplier within a given time frame or fiscal year, for instance. Instead of signing dozens of contracts where each retailer or service provider suggests his own terms, this document regulates all the possible future buys, making it easier and guaranteeing fair prices.

Use: When you expect to place several orders from that supplier within a given timeframe, such as cleaning services for your office for one year.

3. Contract Purchase Order: To support long-term collaborations, a contract PO should be employed. It is broader and encompasses all the specifics of the agreement like prices, delivery times, and quality for an extended period, possibly for the entire project or delivery of services.

Use: A Contract PO is your choice for complex, ongoing projects or services that require a clear and long-term commitment, like IT services or a year-long consulting engagement.

Pros And Cons Of Using Purchase Orders

| PROS | CONS |

| 1. Clarity And Specificity: POs offer clear, written records of your orders, specifying items, quantities, and agreed prices, reducing misunderstandings. | 1. Administrative Overhead: Structuring and organizing POs takes time, as it may require some paperwork and manual inputting. |

| 2. Budget Control: POs keep expenditures regulated by setting the amount to be spent on a purchase at a predetermined level. | 2. Rigidity: POs are binding and changing them can be complicated, often requiring amendments or canceling and reissuing.

|

| 3. Tracking And Accountability: POs track orders, ensuring on-time delivery and boosting accountability for both buyer and seller. | 3. Not Ideal For All Transactions: Smaller or routine purchases may not warrant the use of a PO, making it an impractical choice. |

| 4. Efficient Inventory Management: POs improve inventory management, providing insight into incoming orders to prevent stockouts and overstocking. | 4. Limited Supplier Relationships: Relying heavily on POs may hinder the development of more flexible and trusting relationships with long-term suppliers. |

Invoice – Detailed Explanation

Let’s explore Invoice in detail including its purpose and elements.

Definition

An Invoice is a manually or online-created legal document that a seller provides to the buyer demanding payment for goods/services.

Purpose

The main use of an Invoice is to indicate that the buyer needs to pay for the products or services that were agreed in the Purchase Order.

It also acts as a financial record and helps both parties maintain transparent accounting practices.

Components Of Invoice

- Invoice Number: Similar to the Purchase Order, each individual Invoice has a number associated with it and therefore can be easily located in the accounting records.

- Seller’s Information: Seller data contains the name, address, telephone number, and sometimes taxes of the selling enterprise.

- Buyer’s Information: Another element of the Invoice is the details of the buyer, which obviously points to whom the payment should be made.

- Itemized Products/Services: Details of all the products or services supplied to the buyer which should include details on the purchase order.

- Total Amount: This is the total sum that one is supposed to pay with other charges like taxes or even discounts factored.

- Payment Terms: The due date of payment and method for payment is also mentioned in the invoice as payment terms.

Types of Invoices

Here’s a rundown of various invoice types:

1. Pro Forma Invoice: This type serves as a preliminary bill, often used for customs purposes. It details the expected costs before the final transaction, providing clarity to both parties about what to expect.

Use: A Pro Forma Invoice is of more use when one is sending goods to another country to clarify the costs and goods to the customs.

2. Commercial Invoice: It is the most frequently used invoice. It is usually sent after delivering goods and services. The basic elements of this invoice are costs, due dates, taxes, and payment terms.

Use: When you are sending your goods and services across borders, you have to clarify the costs for customs clearance. This is where a commercial invoice is mostly used.

3. Recurring Invoice: This is the process of regularly sending the same invoice to a retaining client for subscription or rental-based services.

Use: Recurring Invoices should be used for regularly rendered services, like software subscriptions, rent, or retainer agreements. They keep the billing process smooth and predictable.

Advantages And Challenges Of Using Invoices

|

ADVANTAGES |

CHALLENGES |

| 1. Flexibility: Invoices are flexible documents and can be used for all sorts of transactions, whether it is a single sale or multiple transactions based on services and subscription billing. | 1. Billing Errors: Any mistake made on an invoice may cause some conflict or delay in the payment process. One must ensure that each of the invoices is accurate or in other words, double-checked. |

| 2. Timely Payments: Invoices contain due dates that help to ensure that you are paid by the agreed or required time.

|

2. Vulnerable to Fraud: Invoice fraud is possible since the fraudster can either forge the invoice or modify a genuine one. |

| 3. Payment Tracking: A few online invoice software comes up with the feature using which you can track the invoice status when it is opened, viewed, and paid. | 3. Variability: Invoicing must be customized on a customer-to-customer basis or based on certain preferences. |

Why Understanding the Difference Matters

A. Legal and Financial Implications

Differentiating between purchase orders and invoices has significant legal and financial implications.

A purchase order is a commitment to buy, with terms and conditions that protect both parties. Not following PO terms can lead to legal issues and financial liabilities.

On the other hand, invoices demand payment. Ignoring invoice payment terms can result in late fees, strained vendor relationships, and even legal action.

To stay compliant and financially sound, understanding this difference is crucial.

B. Inventory Management

Distinguishing between POs and invoices is vital for effective inventory management.

A purchase order sets your inventory needs, preventing over-ordering or under-ordering, saving costs, and satisfying customers.

Invoices record delivered goods or services. Matching them to POs ensures precise inventory tracking, saving money, and meeting customer demand.

A. Dispute Resolution

Clear understanding of POs and invoices streamlines dispute resolution. Discrepancies between the two become easier to identify and resolve.

Well-documented POs and invoices simplify dispute resolution, helping both parties agree on fair resolutions when conflicts arise.

Common Misconceptions

1. Mistakenly Treating Invoices as POs

Another mistake that most individuals make is confusing invoices with purchase orders.

But, it is imperative to make a distinction between the two. A purchase order is an official business document that serves as a request for goods or services. An invoice is a document that seeks payments for products that have been supplied or services that have been rendered.

2. Confusion in Record-keeping

Proper record-keeping is central to good financial practices. It becomes difficult and confusing when you start intertwining POs and invoices within your records.

To avoid confusion about records, create a method that will enable the proper filing and storing of your POs and invoices.

How To Match POs With Invoices

- Matching the Purchase Order (PO): Start by comparing the details on the invoice with the corresponding purchase order. Ensure that the quantities, descriptions, prices, and other terms align.

- Matching the Receiving Report: If your organization uses receiving reports, confirm that the items listed on the invoice were actually received and that the quantities match.

- Matching the Invoice: Finally, check the invoice itself. Ensure that the amounts, payment terms, and any applicable discounts or taxes are in line with the Purchase Order and Receiving Report.

Resolving Discrepancies

Discrepancies are not uncommon in the matching process, and it’s essential to have a system in place for resolving them:

- Communication: Keep in touch with your vendors whenever there are any discrepancies. Try to resolve their issue as soon as possible. Often, these discrepancies are small errors in calculations that you can easily resolve through communication.

- Documentation: You must maintain a record of all the discrepancies. This documentation can be valuable for auditing and tracking the resolution process.

- Approval Workflow: In some cases, you may need to involve higher management for approvals if the discrepancies involve significant amounts or contractual matters. Ensure you have a workflow for seeking these approvals.

- Adjustments: Ensure that you make corrections in the financial section of your records to try and fix the discrepancies.

Best Practices For Handling Purchase Orders And Invoices

Efficient Record-keeping

Efficient record-keeping is the foundation of successful PO and invoice management. Here are some friendly tips:

- Digitalization: Embrace digital tools and software to store and manage your POs and invoices. It makes retrieval and tracking easier and more environmentally friendly.

- Consistency: Establish a standardized naming and filing system. Make sure everyone in your organization follows it, making documents easy to locate.

- Backups: Regularly back up your digital records to prevent data loss.

Communication with Vendors

Good vendor communication can help prevent issues before they arise:

- Clarity: It is important to be as specific as possible in the purchase order regarding what is expected. Do not use the terms that can result in misunderstandings.

- Timely Updates: Inform your vendors on any change that has occurred in the purchase order or the delivery schedule. This can help avoid any last-minute discrepancies.

- Feedback: Always give feedback to your vendors whenever there is any issue. It helps in improving future transactions.

Software and Automation

Leveraging technology and automation can greatly enhance your PO and invoice management:

- Use Accounting Software: Invest in accounting software that streamlines the entire process. It can automate tasks like data entry and reconciliation.

- Email Alerts: Set up email alerts for due dates, discrepancies, and approvals.

- Regular Updates: You must keep your software updated to get benefits from the latest features.

Legal Implications and Regulations

Key considerations include:

- Mandatory Information: Ensure that invoices and purchase orders include items such as the buyers and sellers’ identity, the goods or services sold, the price, and terms of payment.

- Tax Compliance: Abide certain tax laws like using tax identification numbers and ensuring that taxes are computed and applied correctly.

- Data Retention: Comply with local regulations for retaining invoices and purchase orders for audit and legal purposes.

How Non-Compliance Can Affect Your Business

Failure to meet legal requirements can result in:

- Financial Penalties: Fines and penalties imposed by tax authorities.

- Disputes and Delays: Disputes with customers or suppliers, leading to payment delays.

- Tax Troubles: Tax audits and potential additional tax liabilities.

- Reputation Damage: Harm to your business reputation and partnerships.

Which On-Demand Invoicing Software Can Generate Both PO And Invoices?

Invoicera is an online invoice generator software with over 18 years of expertise that manages Purchase Order Management for more than 4 million firms globally. The invoicing software aids in the preparation and management of every business purchase order and Invoice. It also allows you to capture all your communications to keep a thorough track of all your documents.

You may also keep a record of all your conversations and documents with this tool. It can automate the following areas of your business –

- Online time tracking

- Auto invoicing and payments

- Expense management

- Recurring/subscription billing

- Workflows

- Client/vendor panels

- Multilingual & multi-currency support

- 14+ Online payment gateways

- APIs for 3rd party integration

- Subcontractor billing and time management

- Purchase order management

- Financial reporting & analysis

- Staff permissions

Connect with us today to know more about our intelligent billing solutions. We look forward to working with you soon!

Sign up today to try Invoicera for free here.

Must Watch this video for a difference b/w Invoice and Credit Memo.

Also, Like & Subscribe to our Youtube channel to get notified for more business tips and tricks.

FAQs

Ques. What is one major difference between a purchase order and an invoice?

Ans. PO number is a unique identifier for each purchase order. The invoice number, on the other hand, is used to identify each Invoice.

Ques. How will you differentiate between Invoice and receipt?

Ans. An invoice is created first, followed by a payment request. On the other hand, a receipt is generated after cash has been paid as proof of service to show that money was received.

Ques. What is the difference between a PO invoice and a non-PO invoice?

Ans. When a purchase requisition procedure is in place, the purchase will be activated by a pre-approved purchase order (PO) sent to the supplier.

A non-PO invoice, also known as an expense invoice, will be delivered by the supplier when purchases are made outside of the authorized purchasing process.

Ques. What information is conveyed by Invoice and PO?

Ans. The Invoice confirms that the sales have occurred, whereas PO defines the terms of the sale.

Ques. Does Invoicera support auto invoicing and PO management both?

Ans. Yes, Invoicera supports both auto invoicing and PO management. It is online invoicing software for small businesses, including invoicing, billing, time tracking & more. Invoicera is compatible with Mac & PCs, iOS & Android device management.