We all know that cash is king when it comes to running a successful business. But did you know that timely payments are the key to maintaining a healthy cash flow? It’s especially important when you have multiple ongoing projects with different clients.

The problem is that manually managing invoices and payments can be a hassle. It’s time-consuming and tedious, leading to payment delays and cash flow issues.

That’s where online billing software comes in!

Think about it – with online billing software like Invoicera, you can:

- Quickly generate accurate invoices

- Track payment statuses in real-time

- Send automated payment reminders to clients

And because everything is managed on a centralized platform, you can easily keep tabs on your financial transactions.

Top 4 Challenges With Manual Billing System

First, we will discuss major challenges with an existing manual billing system in the form of infographics:

So, let’s move to how the online billing system overcomes these challenges & gets you paid faster.

5 Ways Online Billing Software Can Help You Get Paid Faster

-

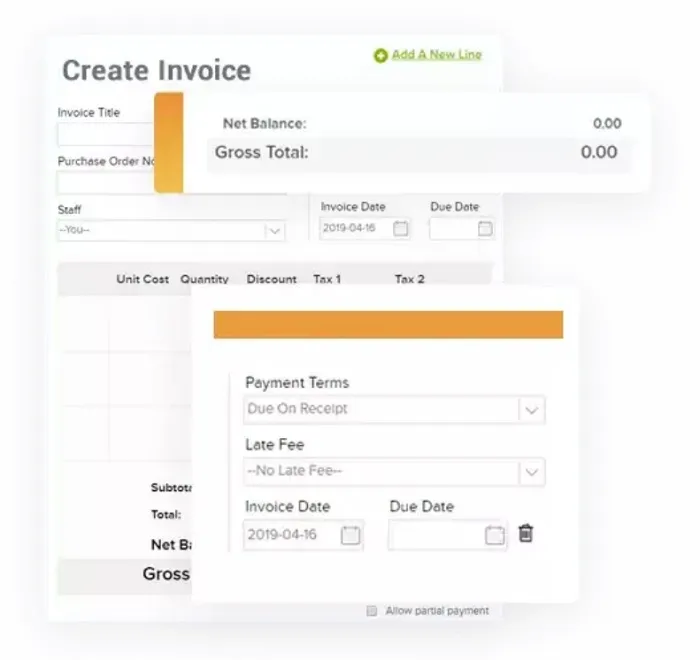

Automate Invoicing

Online billing software can automate your invoicing process. It means you don’t have to spend time creating and sending invoices manually, which can be time-consuming and prone to errors.

Instead, software like Invoicera will automatically generate and send invoices based on your predefined billing cycles or customer agreements.

Key Benefits:

- Review invoice status in real-time

- Easy reporting with filtered reports

- Convert invoices into PDF files

-

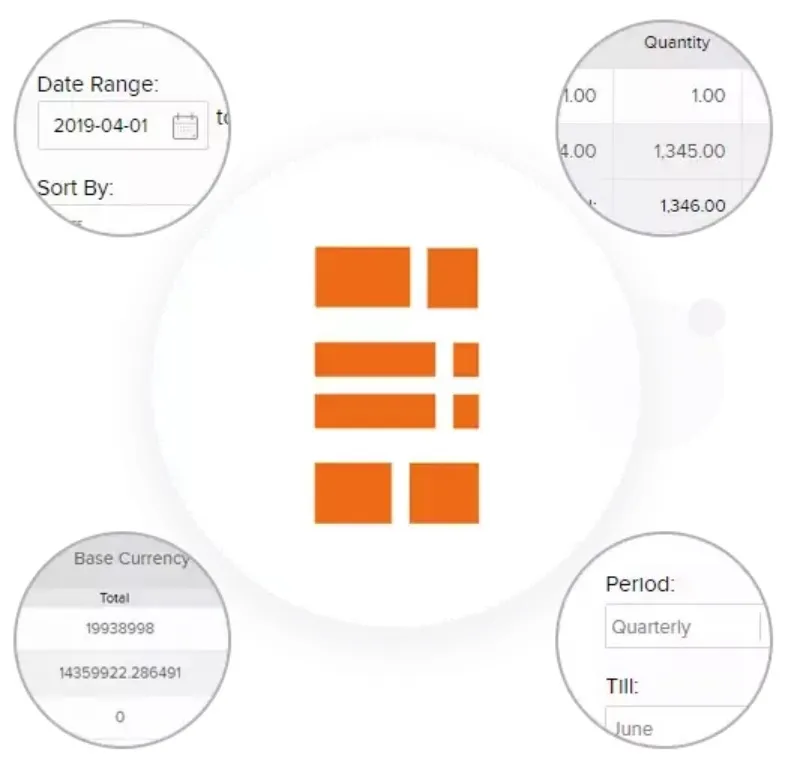

Financial Forecasting

With financial forecasting, companies can predict financial performance based on historical data and other factors.

A reliable method to estimate future revenue, expenses, and cash flow to make informed decisions.

Invoicera’s financial forecasting helps organizations better plan and manage their finances by providing detailed insights into their financial performance.

Key Benefits:

- Get a summary of outstanding revenue and sales tax

- Get detailed Credit Note reports

- Generate detailed estimate reports

-

Accept Multiple Payment Methods

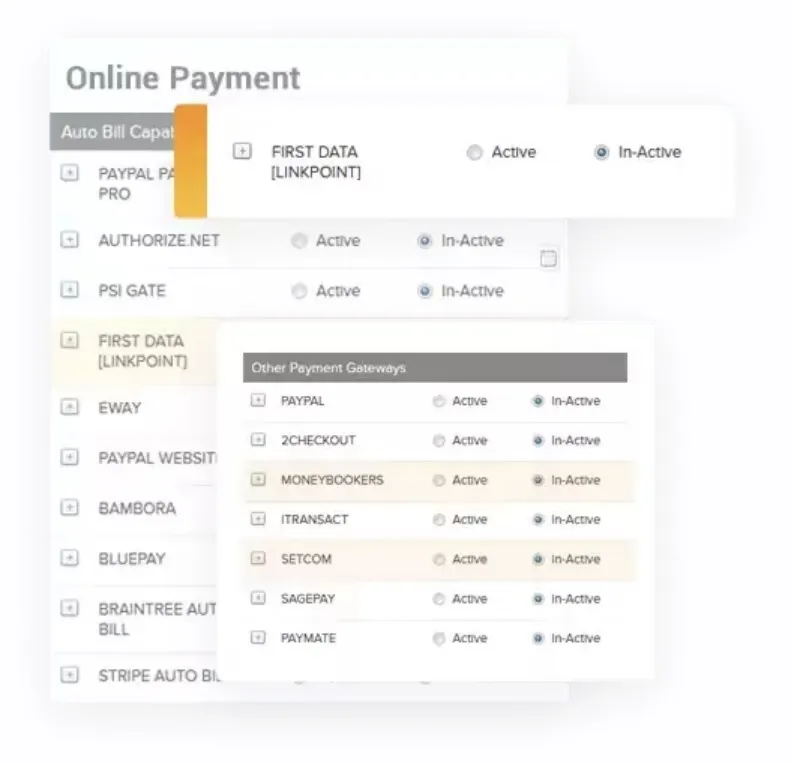

Accepting payments is easier with Invoicing tools. These tools offer multiple payment methods, like credit cards, debit cards, and bank transfers.

Customers can now pay their invoices using their preferred payment method. It improves the payment experience and increases the chances of getting paid on time.

Invoicera lets you receive payments 4x quicker with its integrated payment gateways. It enables customers to make payments directly through the invoice, eliminating manual intervention and reducing payment delays.

Key Benefits:

- 30+ Payment Gateways

- Secure Payments

- Manage Global Clientele

-

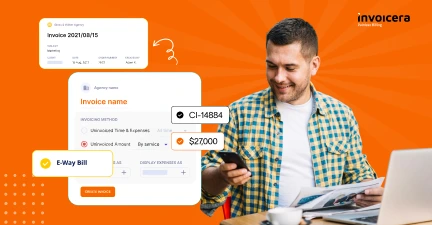

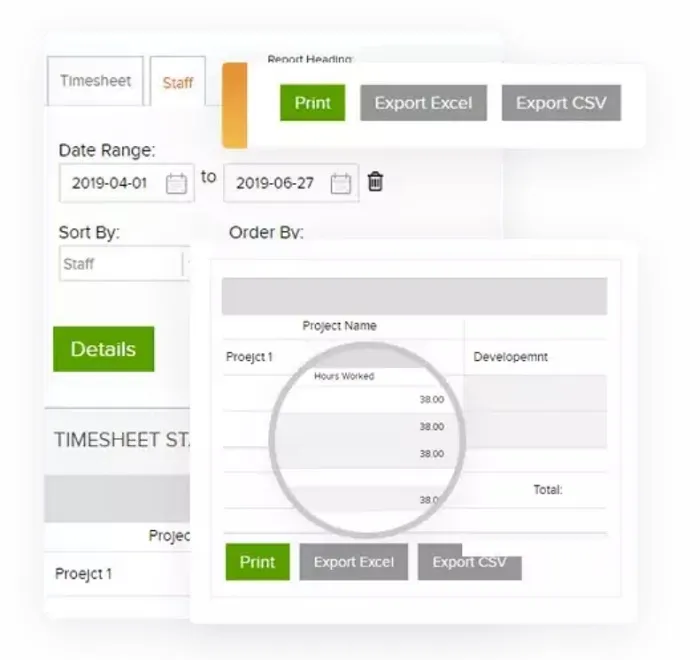

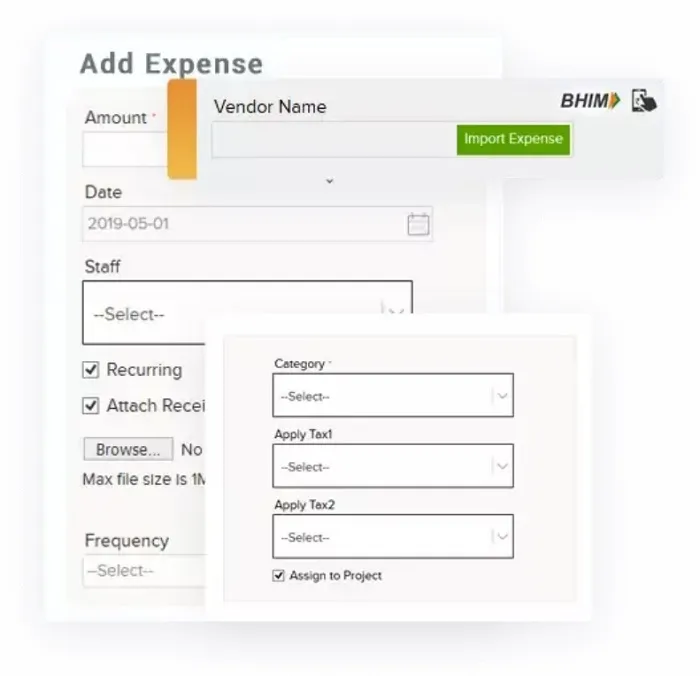

Expense Management

Online billing software accurately tracks your time and expenses.

It means you can easily track expenses associated with your tasks or projects.

Tracking your time and expenses can also help you to identify areas where you can improve your efficiency and profitability.

Invoicera helps companies manage their expenses more effectively by providing a centralized platform for tracking and reporting expenses.

Key Benefits:

- Add expenses to invoices

- Compare profits based on expenses

- Track all incurred expenses on projects

By automating expense management, Invoicera helps businesses to save time and reduce the risk of errors.

-

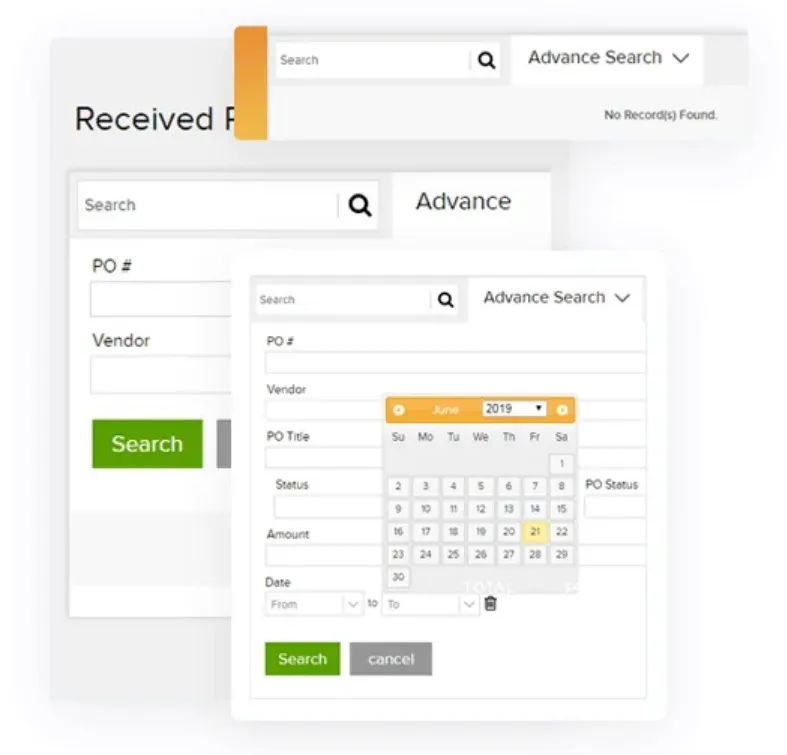

AR & AP Management

Accounts Receivable (AR) and Accounts Payable (AP) management is crucial for the financial health of any organization.

Invoicera allows businesses to manage their outstanding invoices and payments owed to vendors easily.

It helps companies keep track of their receivables and payables to manage their cash flow better and avoid late payments.

Key Benefits:

- Send and receive purchase orders

- Send out all documents with automated reminders

- Easily convert purchase orders into invoices

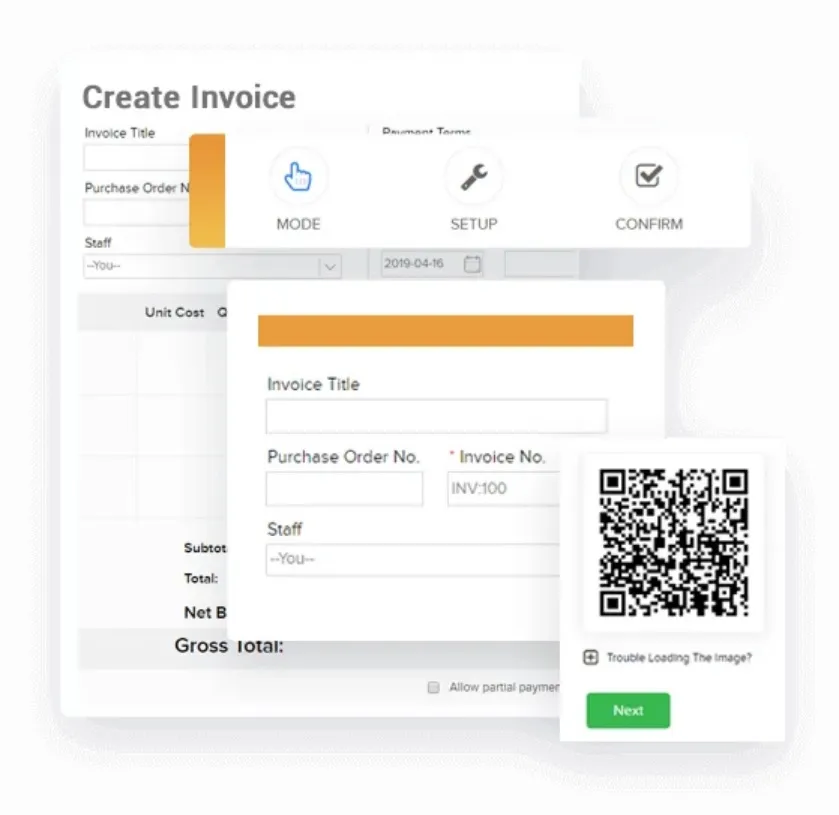

Getting Started With Invoicera is Simple!

Here are five easy steps to help you get started with Invoicera:

- Sign up for an account: Visit the official website of Invoicera. Create your account by providing your name, email address, and password.

- Customize your settings: After signing up, you can add your company information, create invoice templates, and configure payment gateways.

- Add clients and projects: Now, add clients and projects to your account. You can do this by entering their contact information and project details.

- Create and send invoices: After adding clients and projects, you can create and send invoices using the built-in invoicing tools.

- Track Invoices: Track your invoices, payments, and expenses in real time using its reporting tools.

By following these five steps, you can start using Invoicera to streamline your invoicing and payment processes and get paid faster.

Closing Thoughts

At last, online billing software is crucial for organizations that want to streamline their invoicing and payment processes and get paid faster.

By automating payment reminders, accepting multiple payment methods, tracking overdue payments, and saving time on invoicing, you can improve cash flow, reduce errors, and save time.

Online invoicing software like Invoicera is an excellent choice for companies looking to optimize their financial management.

So why wait?

Try Invoicera today and experience the benefits for yourself!

FAQs

Ques. Is there any way to automate payment reminders?

Ans. Yes, online billing software like Invoicera offers automated payment reminders to help you get paid faster. You can set up reminders to be sent at specific intervals, reducing the need for manual follow-ups.

Ques. Can Invoicera help me with accepting multiple payment methods?

Ans. Invoicera lets you provide your clients with various payment options

such as credit cards, debit cards, and bank transfers, to increase the likelihood of quick payments.

Ques. How can I track overdue payments with clients?

Ans. Online billing software can help you track overdue payments by generating reports on unpaid invoices and sending reminders to customers who have missed payment deadlines.

Ques. Can Invoicera help me save time on invoicing?

Ans. Yes, Invoicera can save you time by automating the process of creating and sending invoices. You can set up recurring invoices for regular customers, saving you the hassle of creating invoices manually each time.