Introduction

Have you ever been faced with the inconvenience of addressing customer returns or fixing invoice mistakes?

Then you are not by yourself.

Credit notes are essential because businesses frequently have to make corrections to transactions or issue refunds.

Recent industry statistics state that more than 60% of organizations struggle with credit note administration, which could have a negative impact on their financial stability and cause possible disruptions.

This blog article will cover the ins and outs of how to make credit notes. Maintaining efficient and transparent financial transactions depends on this procedure. We’ll dive into a thorough guide to simplify this crucial business administration component, from comprehending the principles of credit notes to offering helpful advice on using them effectively.

We’ll also introduce you to Invoicera, a tool that helps simplify and lessen the difficulties of creating credit notes.

Let’s start by learning how to make credit notes and discover how Invoicera can be your ally in this endeavor.

Understanding Credit Notes

Definition and Purpose

A credit note is like a financial oops-fix-it slip. It’s a document businesses use when there’s a mistake in an invoice or when customers return something.

Think of it as a way to say, “Oops, our bad! Here’s how we’re fixing it.”

A credit note’s primary goal is to make financial matters more clear. It demonstrates that the company is aware of the error and is making the required corrections.

Hence, a credit note is an instrument to ensure that everyone agrees that money matters if a customer feels they were overcharged or wishes to return anything.

Invoice vs. Credit Note

|

Aspect |

Invoice |

Credit Note |

| Purpose | To request payment for goods or services | To correct billing errors or handle returns |

| Content | Lists products, services, and prices | States the amount to be credited or refunded |

| Initiation | Issued when goods or services are provided | Issued in response to a mistake or a return |

| Direction | Asks the customer to pay | Acknowledges an error and adjusts the bill |

| Timing | Issued initially before payment | Issued after an invoice as a correction |

| Role | The primary document for requesting payment | Corrective document to resolve discrepancies |

| Transaction Record | Increases accounts receivable | Adjusts accounts receivable |

When to Issue a Credit Note?

Knowing when to use a credit note is crucial. Imagine someone ordered a shiny new gadget but got two instead, or they were charged the wrong amount.

That’s when you reach for a credit note. Essentially, it’s time to issue a credit note whenever a billing blip or a customer isn’t happy with a purchase.

Process Of Creating Credit Notes

Though it may seem a little intimidating, don’t worry! It’s a systematic procedure that can be divided into easy assignments.

A. Compile the Information You Need

Start by collecting all the important details. This includes information from the original invoice that needs correction. Double-check the customer’s name, the transaction date, and the specific products or services. Accurate information is the key to a successful credit note.

B. Choose the Right Format

Let’s now discuss the format. Selecting the appropriate template for an academic assignment is analogous. Select a format based on what your business requires. Numerous accounting softwares and solutions, such as Invoicera, provide easy-to-use templates that simplify the procedure.

C. Include Essential Details

When you’re crafting your credit note, don’t forget the basics. Include:

- Date: Mention the date when the credit note is issued. This ensures clarity about when the correction is being made.

- Invoice Number: Like every superhero needs a unique identity, every credit note needs its number. It’s the reference point connecting it to the original invoice.

- Customer Details: Double-check and include accurate customer information. This includes their name, address, and any other relevant details. This step avoids confusion and ensures the credit note reaches the right hands.

D. Itemize Products or Services

Break down the products or services involved in the transaction. Imagine you’re making a shopping list. List each item separately with its corresponding quantity and price. This step ensures clarity for both you and your customer.

E. Calculate the Credit Amount

Let’s tackle some math now; it’s nothing too difficult. Subtract the amended or returned items from the total amount of the original invoice to determine the credit amount. This gives you the correct amount that needs to be credited. Precise calculations avoid any confusion down the line.

You’ll quickly become proficient at making a credit notes if you follow these easy steps and pay attention to these little details. Recall that precision and making sure every detail is correct are crucial!

Tips for Creating Effective Credit Notes

Credit notes are vital in maintaining good business relationships and ensuring financial accuracy. To make sure your credit notes are effective, here are some simple yet crucial tips to follow:

A. Accuracy and Clarity in Documentation:

When creating a credit note, precision is key. Double-check all the details, such as the customer’s name, date, and the credited items. Make sure your math adds up correctly to avoid any confusion. Clear and accurate documentation helps in building trust and prevents misunderstandings.

B. Timeliness in Issuing Credit Notes:

Don’t let time slip away. Act promptly as soon as you identify the need for a credit note. Timely issuance helps maintain a smooth flow of transactions and shows your commitment to resolving issues swiftly. Delayed credit notes may lead to frustration for both you and your customers.

C. Communication with Customers:

Keep the communication lines open. Inform your customers about the credit note and explain the reasons behind it. Clear and friendly communication fosters a positive relationship and helps customers understand the process. If there are any changes or adjustments, let them know promptly.

D. Legal Considerations and Compliance:

Keep yourself inside the law. Learn about the legal ramifications of credit notes in your area and sector. Make sure your credit notes abide by all applicable laws. By doing this, you not only safeguard your company but also assure your clients that you conduct yourself with integrity and responsibility.

E. Keeping Thorough Records:

The organization is your ally. Keep thorough records of every credit note that is given or received. This contains the invoice numbers, quantities, and justifications for the credit note’s issuance. These records serve as a valuable reference in case of audits or disputes, offering a clear trail of your financial transactions.

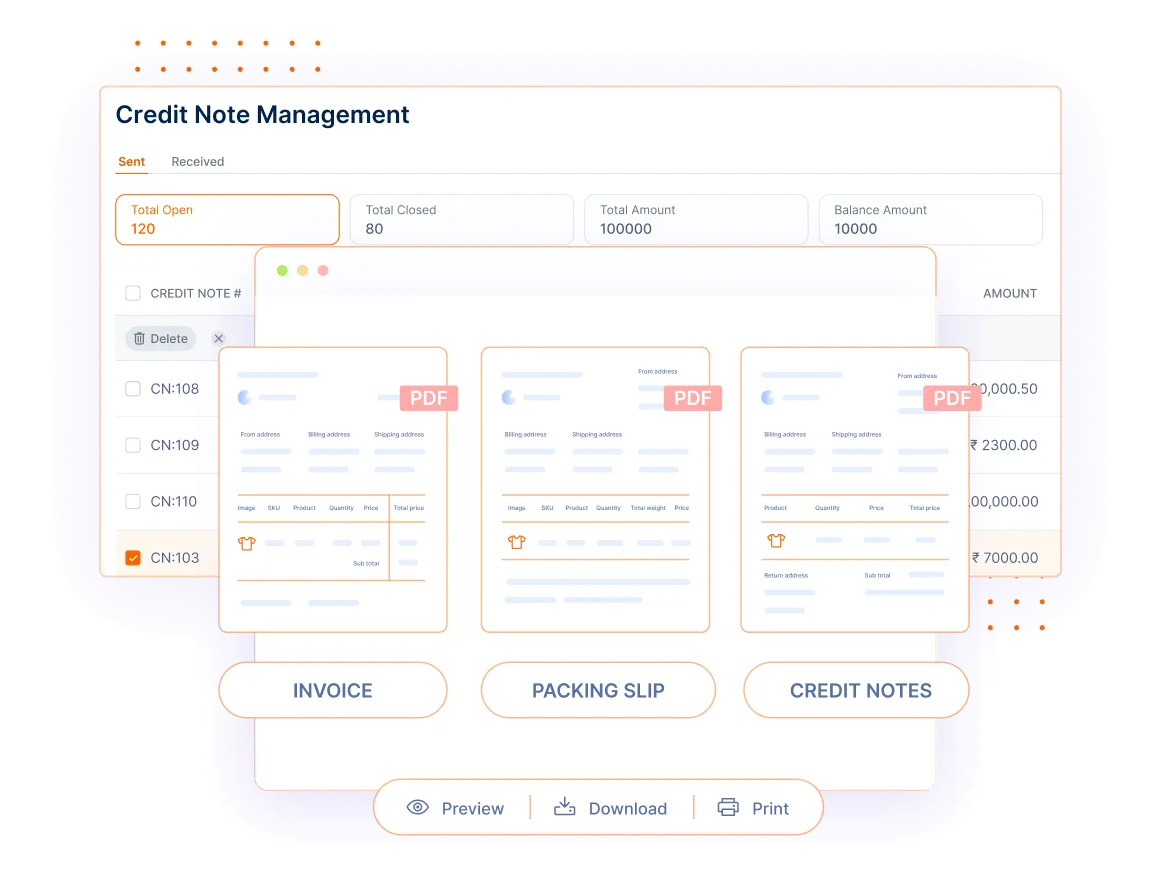

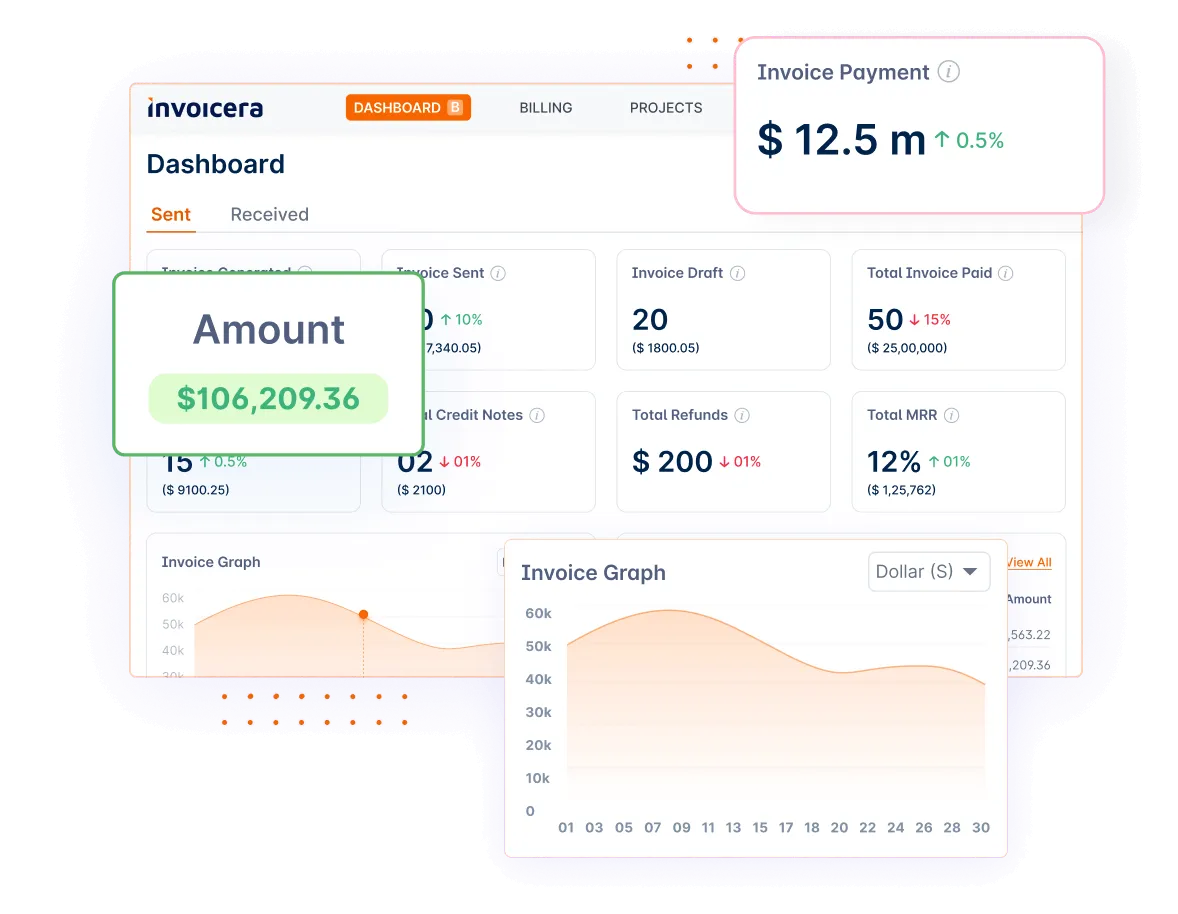

Invoicera: Streamlining Credit Note Processes

Invoicera is like a helpful friend for your business finances. It’s an online tool that makes dealing with invoices and credit notes much easier.

Regardless of the size of your organization, Invoicera is made to make money management easier for you.

Features that Facilitate Credit Note Creation

Invoicera has features that take the stress out of creating credit notes. Here are a few salient points:

- Simple Setup: No technological expertise is required. You may use Invoicera immediately, and it’s quite simple to set up.

- Customization Options: Personalize the appearance of your credit notes. Invoicera lets you customize your credit notes to match your business style.

- Automation Magic: Invoicera can do things automatically for you. It can fill in details, calculate amounts, and even send timely credit notes, saving you much effort.

- User-Friendly Interface: The Invoicera dashboard is simple and user-friendly. You can navigate easily and find what you need without any confusion.

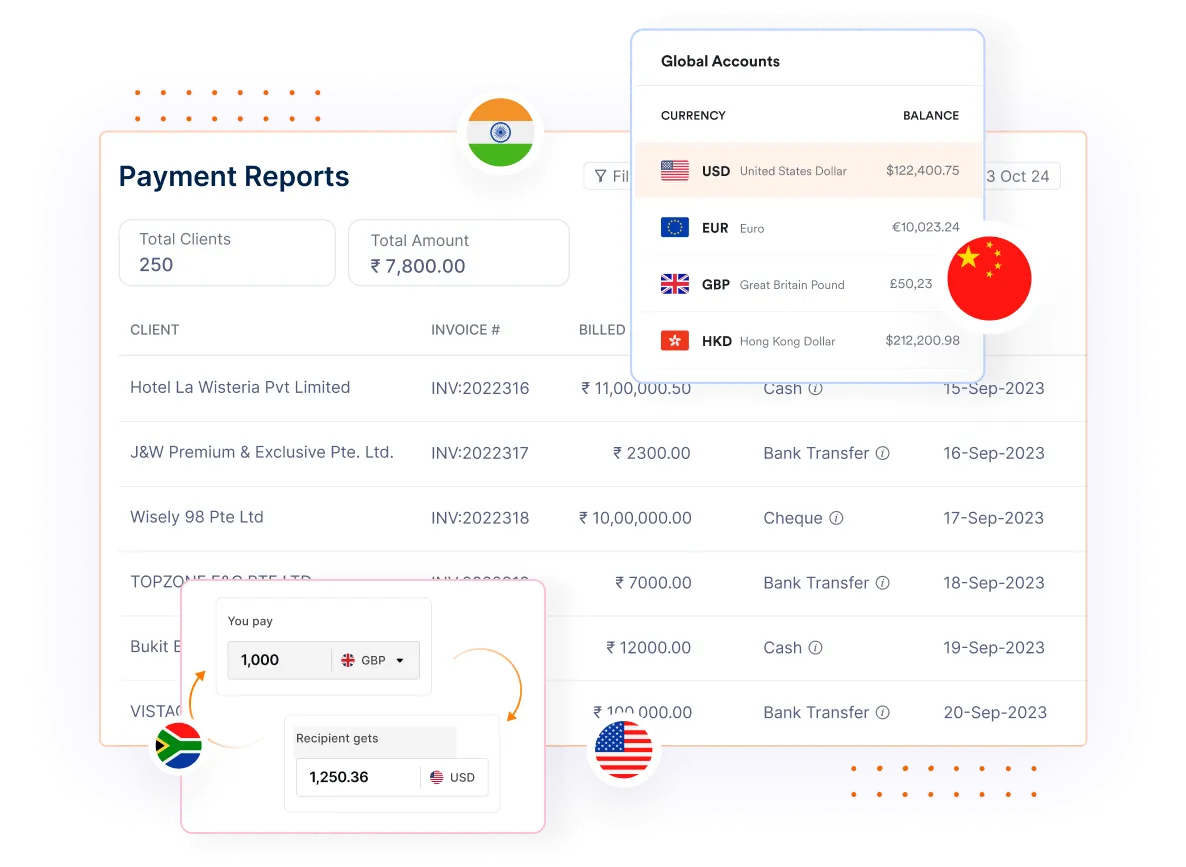

- Global Currency Support: Invoicera offers global currency support, allowing you to effortlessly create credit notes in multiple currencies for seamless international operations.

Common Challenges And Solutions

A. Identifying challenges in credit note creation:

- Incomplete or Inaccurate Information: Handling incomplete or inaccurate information on invoices is a common source of trouble when writing credit notes. Transactions may be challenging to correct without all the necessary information, which could cause delays and misunderstandings.

- Manual Calculation: The manual calculation of credit amounts poses another significant challenge. This procedure is prone to mistakes in addition to taking a long time. Miscalculations run the possibility of producing disparities in the issued credit notes, which could affect the transactions’ financial accuracy.

B. How Invoicera addresses these challenges:

- User-Friendly Interface: Invoicera’s interface has been developed to facilitate correct data recording for users. Because of the user-friendly style, there is less chance of inaccurate or missing data because users can enter the required information quickly.

- Automation: One of Invoicera’s biggest features is its ability to automate operations. Thanks to Invoicera’s automated calculation procedure, finding the right credit amounts takes much less time and effort. This increases productivity and reduces the possibility of mistakes from doing computations by hand.

C. Additional tips for overcoming hurdles:

- Clear Communication: Maintaining transparent communication with customers is crucial. Promptly informing them about issues and providing clear solutions fosters trust and helps resolve concerns amicably.

- Thorough Record-Keeping: Keeping detailed records of transactions is fundamental. It helps keep track of credit notes and acts as a point of reference for subsequent transactions. Ensuring that firms maintain a thorough financial history is contingent upon robust record-keeping.

- Team Training: Regular training sessions on credit note processes and tools for your team are essential. Ensuring everyone is well-versed in the procedures and proficient in using the tools, including Invoicera, promotes consistency in credit note creation and management.

Conclusion

To summarize, creating credit notes doesn’t have to be a headache. Invoicera steps in to make things smooth with its user-friendly setup and automation features. It tackles challenges like incomplete info and manual calculations.

Businesses can create a seamless credit note process using Invoicera, adopting clear communication, keeping thorough records, and training your team.

It’s not just about solving problems; it’s an investment in efficient, trustworthy financial transactions.

So, embrace these tips, explore Invoicera, and make credit note management a breeze for your business!

FAQs

Why do businesses need credit notes?

Credit notes are necessary for error correction, refunding payments, and keeping precise financial records for returns and adjustments.

Is Invoicera appropriate for small companies?

Yes, Invoicera is made to work with companies of all sizes, providing flexibility and scalability to meet a wide range of requirements.

Can Invoicera handle multiple currencies?

Yes, Invoicera supports 125+ currencies, making it suitable for international business transactions. This feature adds flexibility for companies with global operations.