Are there moments when you feel that there is more to accounting than just QuickBooks?

Well, you’re not alone!

A SmallBizTrends latest survey reveals that “85% of business owners are seeking accounting software alternatives.

While QuickBooks has been the ruling king of this domain for a long time, it’s not the only option.

It’s time to pause and explore more contemporary accounting software in this extensive market.

Several robust alternatives are there for attention, each bringing its unique features to the table. Among these, Invoicera stands tall as an ideal choice for many businesses.

This comprehensive guide will delve deep into why and how Invoicera and other alternatives might better fit your business than QuickBooks.

Here are all your queries we will cover about the eight alternatives:

- What are the cost structures of these alternatives?

- What are the distinctive features that set these alternatives apart?

- Do they have integration capabilities with your existing tools?

- What are the security features, and do they protect your data?

- Is customer support available?

The Quest for the Perfect Accounting Software

Every business, irrespective of its size or industry, is required to have an accounting system to manage its financial resources.

Such a system should be reliable, easy to use, and, above all, tailored to cover the business’s needs.

Though QuickBooks has been widely accepted, the emerging requirements in contemporary businesses have to some extent, led to the development of alternatives.

Why Consider Alternatives to QuickBooks?

Despite its popularity, QuickBooks possibly may not address all the individual needs of every business. undefined

- Customization Needs: Every business is distinctive; and so are its accounting needs. A generic approach to solving the issue may not coincide with the specific requirements of a particular company.

- Pricing Concerns: Due to budget limitations, many businesses will be required to look for other options that are cheaper and provide similar or even better features.

- User Experience: An easier-to-use user interface will speed up the process and reduce the employees’ learning curve.

- Specific Features: Some businesses might need specialized features or integrations that QuickBooks doesn’t offer.

Diving Into The Alternatives

Let’s explore some of the top accounting software alternatives to QuickBooks, starting with our ideal choice: Invoicera.

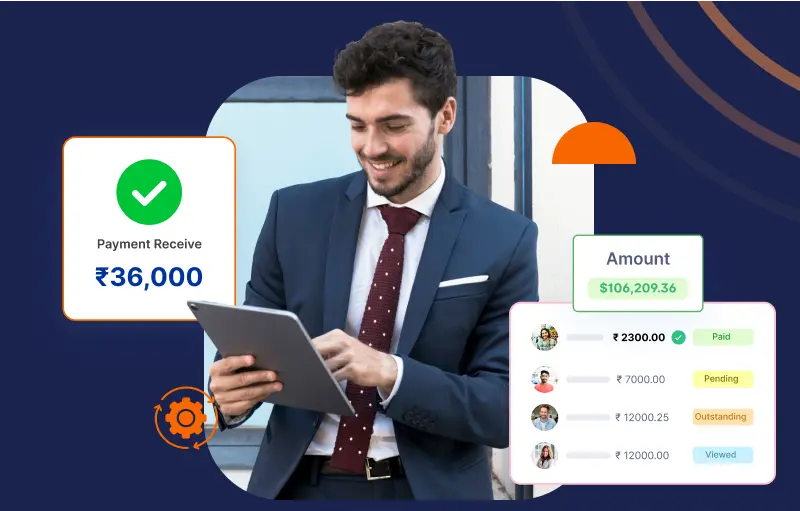

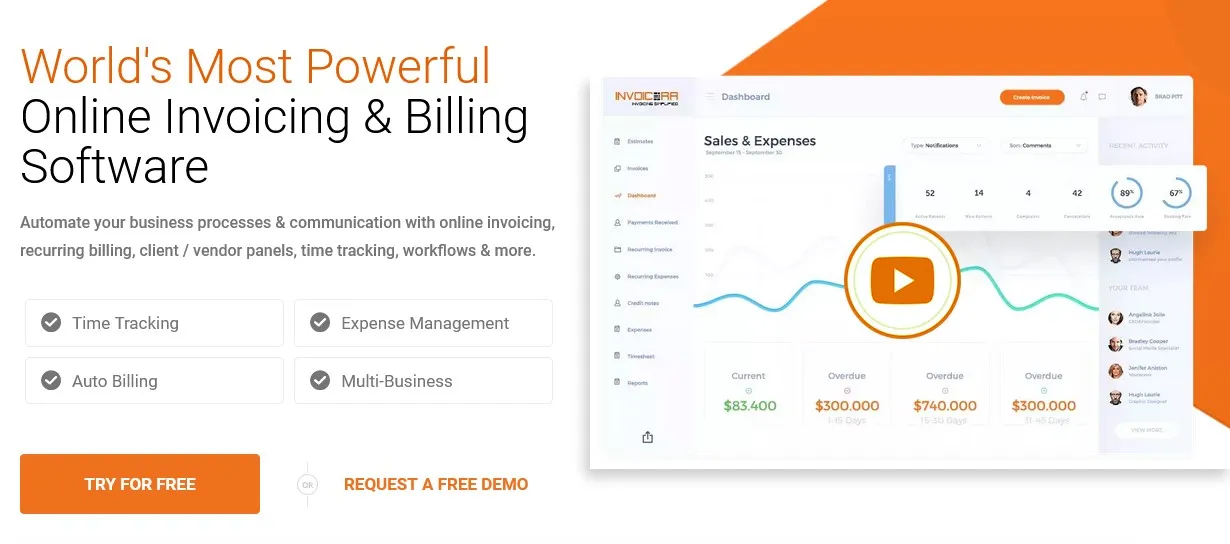

1. Invoicera: The Ideal Accounting Solution

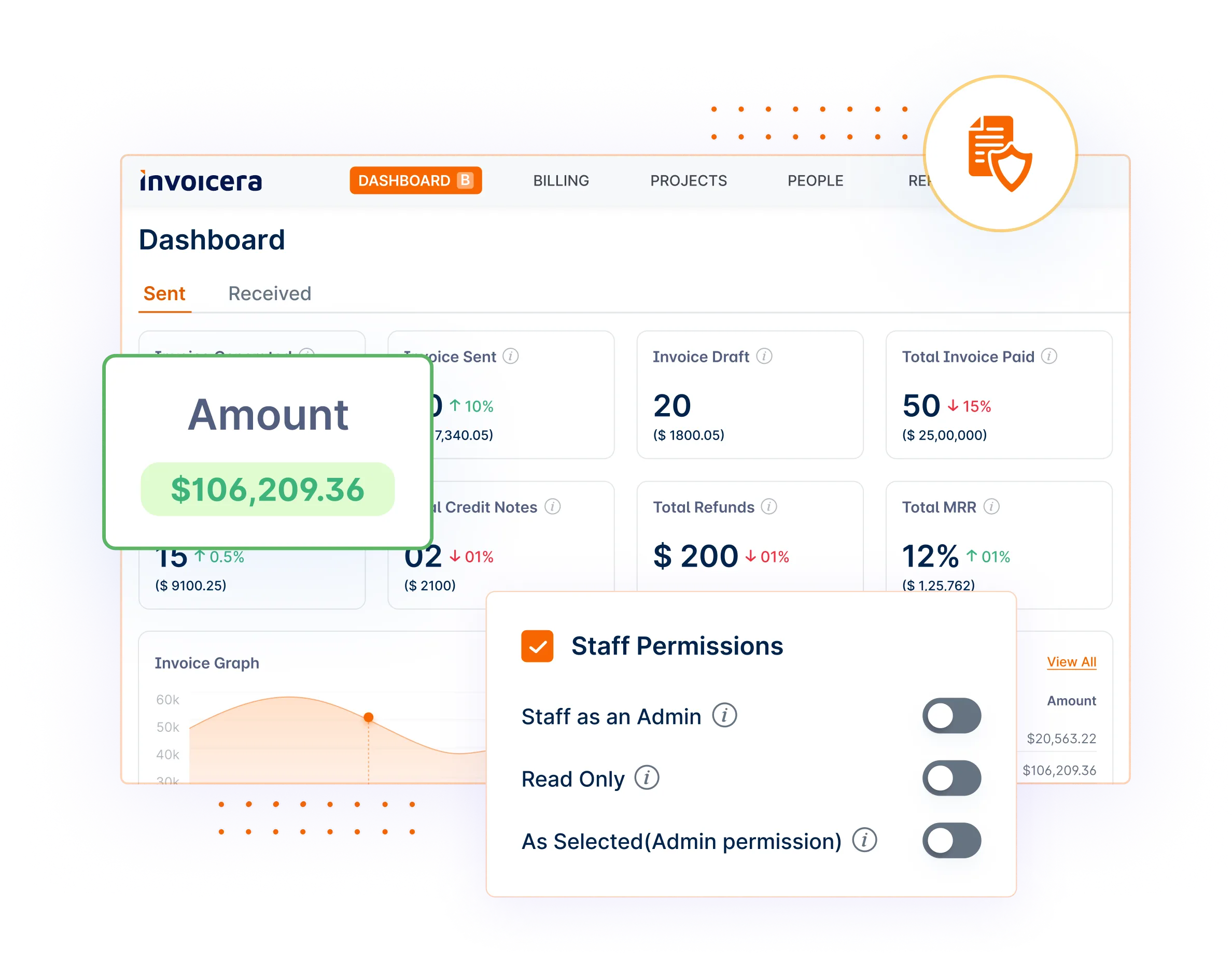

Invoicera is not just a tool; it is your partner in running a profitable and efficient business. It addresses the needs that encompass making your life easier, your work more accurate, and your brand more effective.

Who’s it for?

Companies looking for a complete solution for custom invoicing and integrated business management.

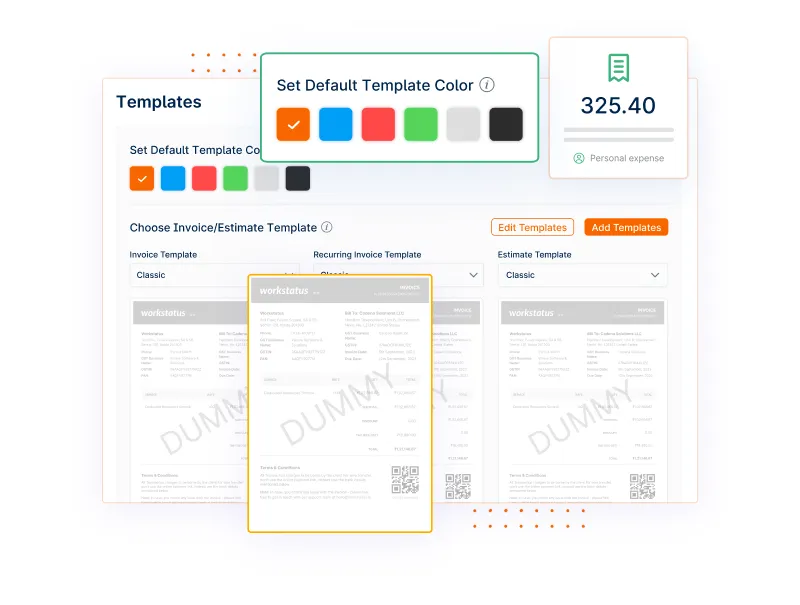

Key Features:

- Custom Invoicing: This Invoicera feature allows you to strengthen the reputation of your brand. You can add your brand logo and you can experiment with colors and fonts to create a unique look for invoices. It increases your level of professionalism and helps you to attract clients.

- Time-Tracking: For billing, accuracy is all that matters. Invoiceer’s time-tracking feature will let you track the time spent on each project in minutes. Thus, no more exaggerations and no more underestimating the outcome of your achievements will take place.

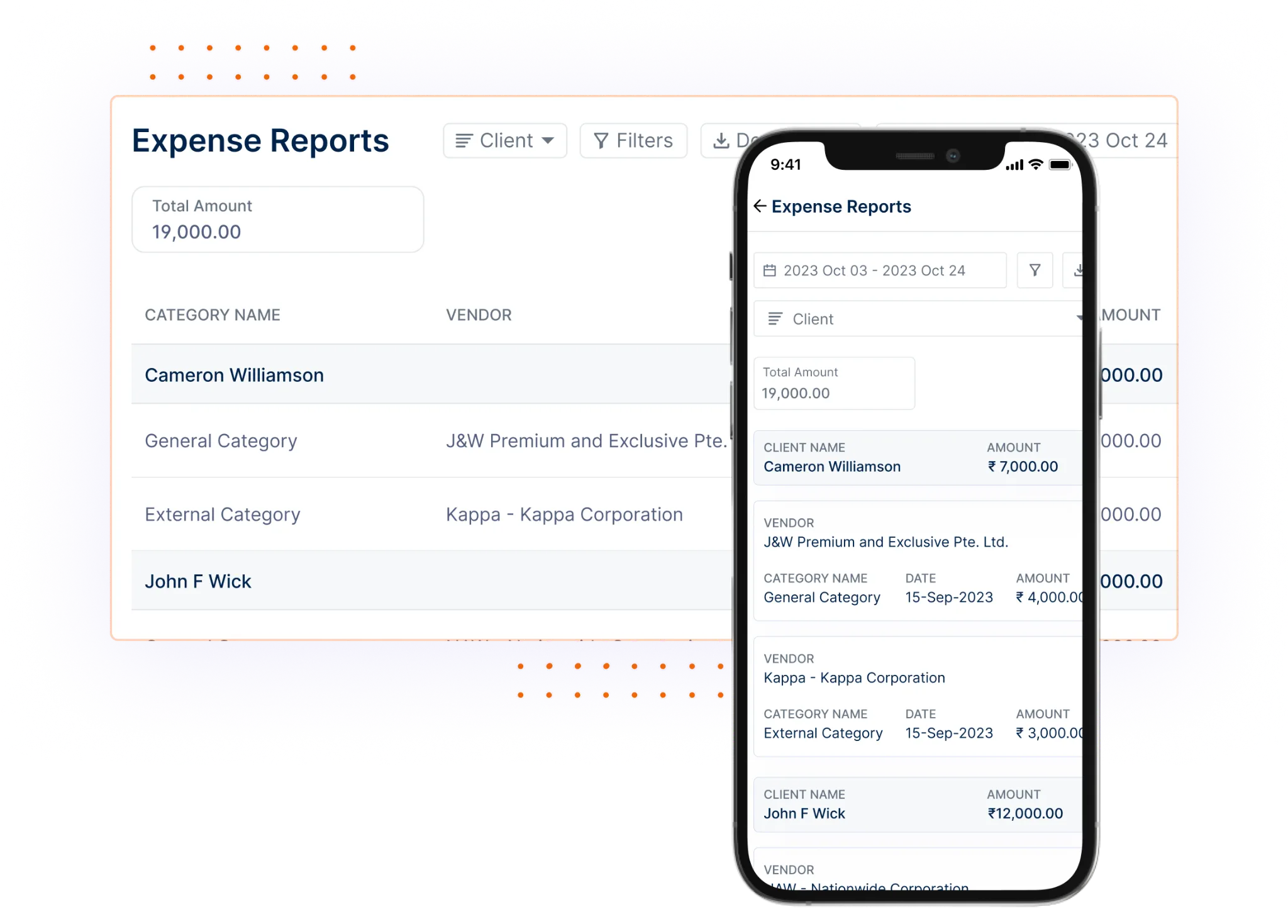

- Expense Management: Following up on business expenditures can be cumbersome. Additionally, within the expense management feature area, you will have a dedicated hub for all your business expenses. It’s like having a financial assistant who collects everything in one neat pile.

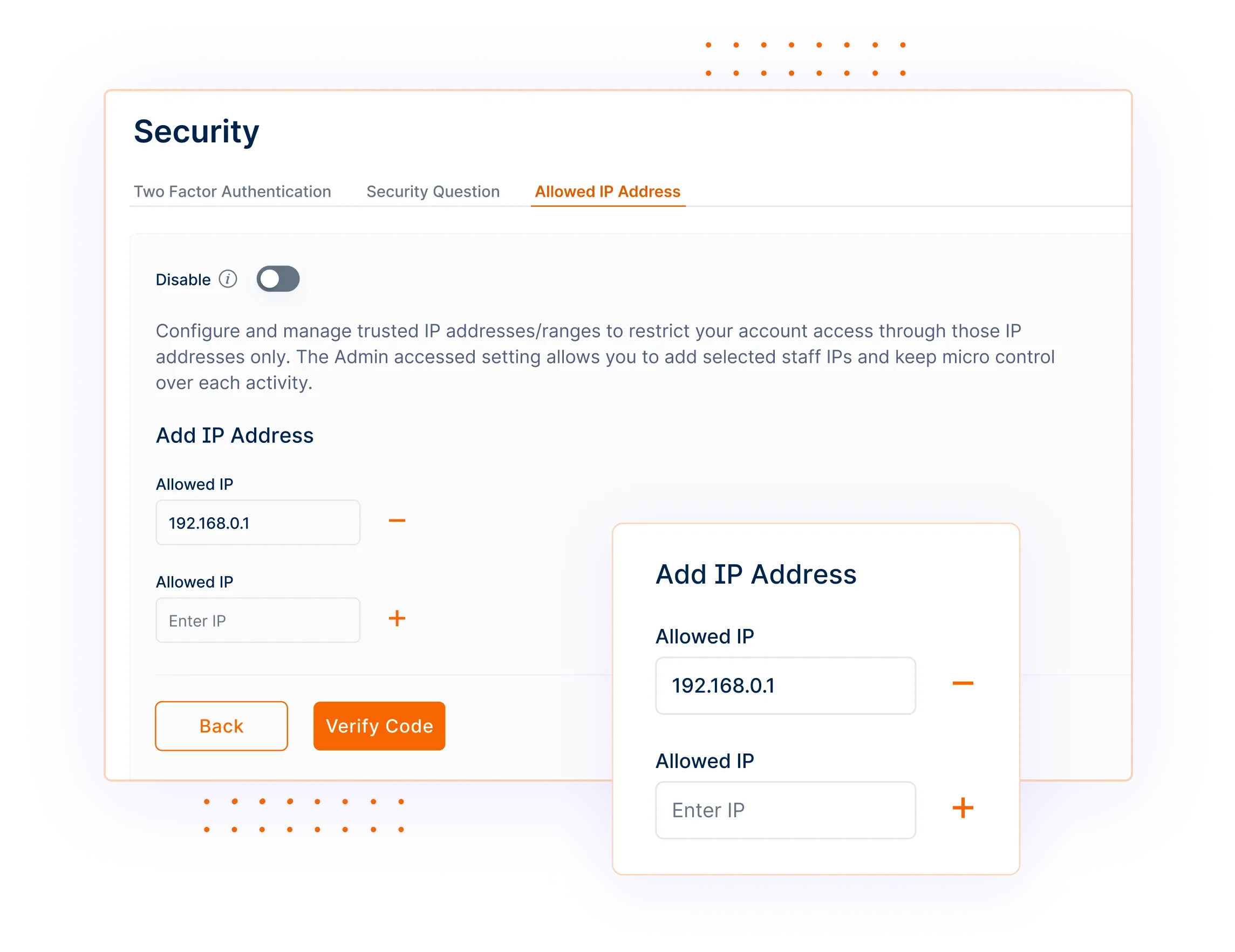

- Security: Security becomes the key factor when handling confidential financial information. Invoicera takes this seriously. They’ve designed a multi-level security system that secures your information.

- Automated Workflow: Time is scarce in any business, and Invoicera has realized it. The automated workflow capability simplifies tasks and processes. The reminder feature does save you time and helps you to focus on other priorities.

- Payment Integrations: Invoicera provides for a number of payment integrations with over 14 payment gateways. This implies you and your customers have many ways of making transactions. Whether it’s PayPal, Stripe, or your preferred payment method, you are covered.

What Sets It Apart?

Custom Workflow Automation is one of the features that Invoicera provides. It allows you to create and run different business workflow models bespoke to your business for invoice and billing purposes and ensures a high level of customization.

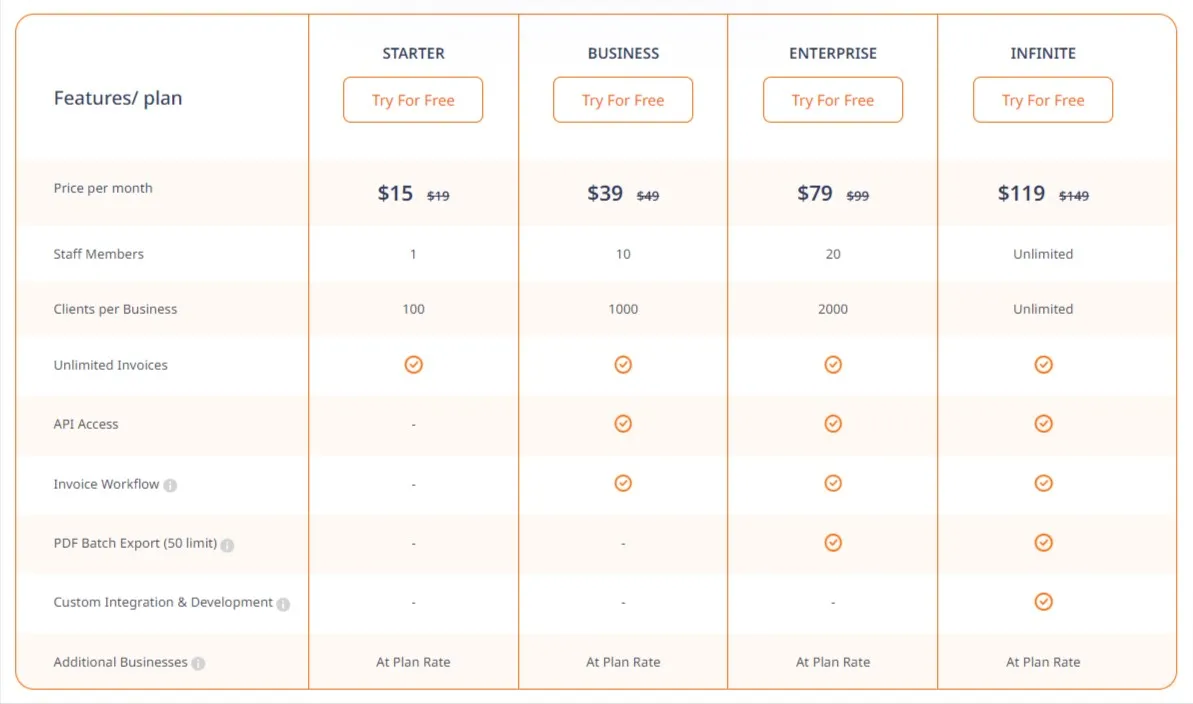

Pricing:

While Invoicera provides a free plan, the paid plans are competitively priced to guarantee businesses are getting their worth.

- The ‘Infinite’ plan offers everything unlimited at ₹14999/Year.

- The most popular ‘Enterprise’ plan costs ₹9999/Year.

- Small and medium-sized businesses can choose a ‘Business’ plan at ₹4999/Year.

- The ‘Starter’ plan is for startups or very small businesses at ₹2499/Year.

2. Xero: The Intuitive Choice

Xero provides bank connections, project tracking, and payroll management for enhanced financial control.

Who’s it for?

Small to midsize businesses seeking a user-friendly platform.

Key Features:

- Efficient Inventory Management: You can keep track of your stock; it helps you never run out of important items and always have the items for customer needs.

- Punctual Bill Payments: Xero makes the billing process really simplified, ensuring that all your bills are settled promptly, thereby helping you avoid late fees and maintain a solid financial track record.

- Seamless Invoicing: Xero gives you enough time to do other things apart from invoicing as it speeds up the whole invoicing process. Send out invoices that look professional and impress your clients so they pay faster. Faster payments translate to better cash flow for the business.

- Exceptional User Experience: Xero is highly valued for its user-friendly dashboard that simplifies accounting jobs for accountants with different backgrounds. Even a person with basic accounting knowledge can use Xero without any issues.

- Efficient Payroll Management: It acts as a time-saver by being integrated with payroll functionalities. It is making sure that all your employees are getting paid correctly every time.

What Sets It Apart?

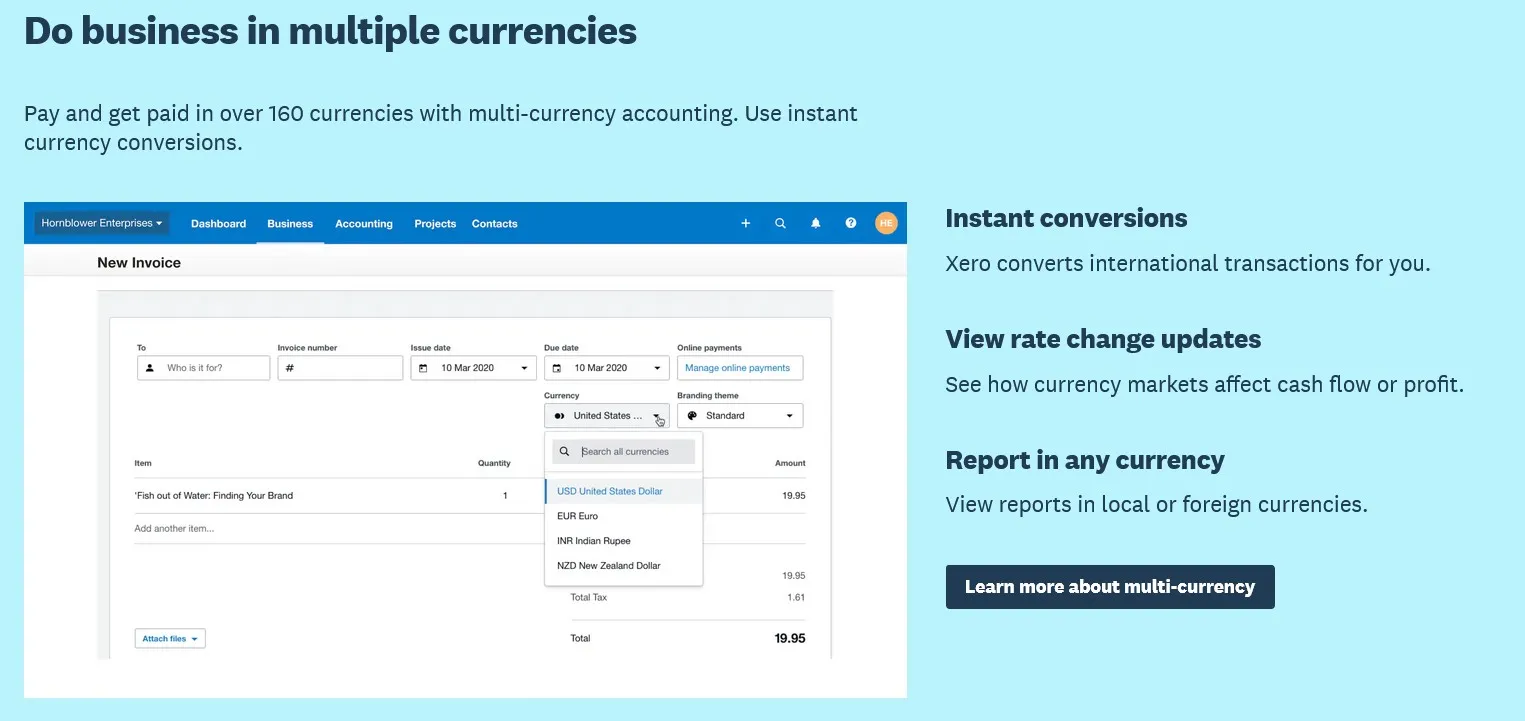

Xero offers excellent Multi-Currency Support, making it a top choice for businesses mostly engaged in international transactions. You can invoice, record expenses, and manage finances in multiple currencies seamlessly.

Pricing:

The following image represents the Starter, Standard, and Premium plans features, respectively

Xero operates on a monthly subscription model and also offers a free trial.

- Early plan – $25 per month

- Growing plan – $40 per month

- Established plan – $54 per month

Exciting offer: Xero currently offers 50% off for the first 3 months of service for US clients.

3. FreshBooks: The Freelancer’s Friend

Who’s it for?

Who’s it for?

Freelancers and small businesses.

Key Features:

- Time Tracking: You can monitor the hours spent on each project. It helps you easily convert hours spent into invoices.

- Invoicing: Through Freshbooks, promptly create professional invoices and send them to your clients while you salvage your time.

- Expense Tracking: Do not forget about your business costs and make wise choices.

- Dashboard: Freshbooks provides clients with a user-friendly dashboard accessed which contains key financial information, metrics, and insightful information on how your business is doing financially.

What Sets It Apart?

offers Double-Entry Accounting, making it stand out in the invoicing software market. This feature allows for more accurate financial tracking and helps businesses comply with more advanced accounting practices.

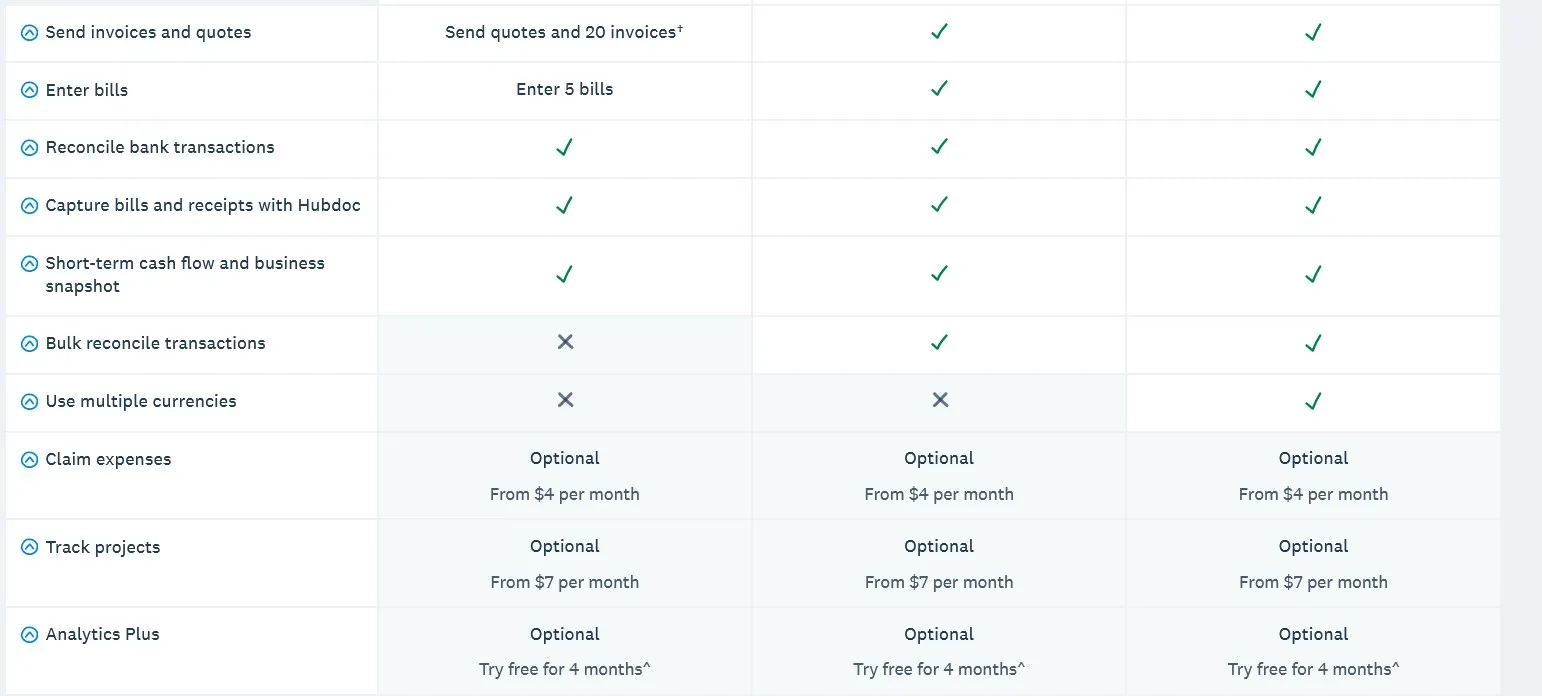

Pricing:

FreshBooks offers tiered plans to cater to different business needs. Here is a brief overview of the plans. You can view detailed features on their website.

- Lite – $8.50 per month

- Plus – $15.00 per month

- Premium – $27.50 per month

Exclusive offer: 50% off for 6 months and a 30-day money-back guarantee.

4. Zoho Books – Making Finances Easy for You

Who’s it for?

Small businesses who want an intuitive platform.

Key Features:

- Automated Workflow: You can automate various tasks and processes within your organization. It helps you reduce manual work by automating repetitive actions, notifications, and approvals.

- Inventory Management: Zoho is one of the best solutions to oversee and control your stock. With Zoho, you can track product levels, restock important items, and more.

- Banking Integrations: Zoho Invoice offers APIs for integrating with legacy systems and other Zoho Suite products, ensuring seamless data exchange and real-time synchronization.

What Sets It Apart?

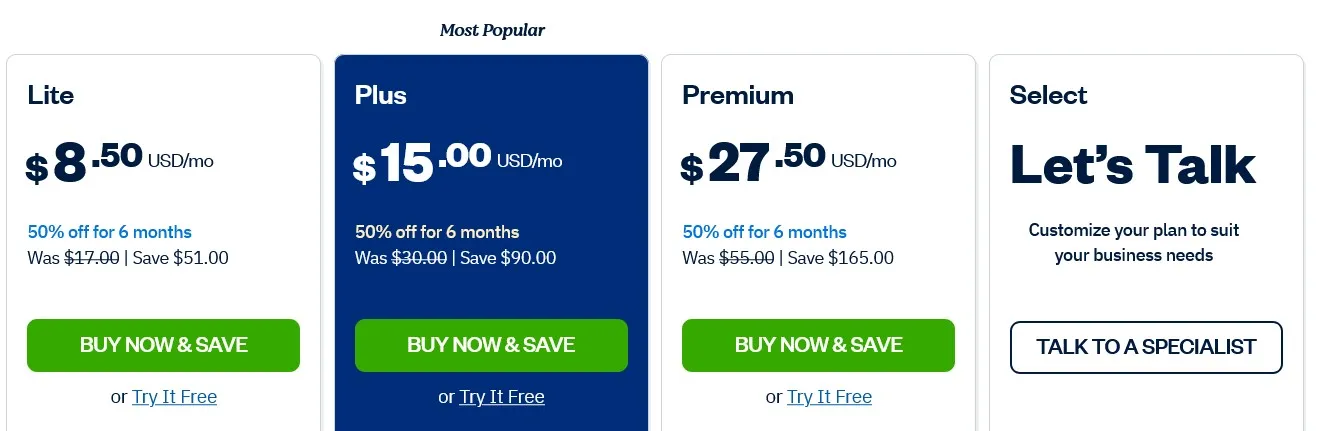

Pricing:

Get a monthly subscription with a free trial. The monthly plans are below:

- Standard – INR 1300 per month

- Professional – INR 2100 per month

- Enterprise – INR 3000 per month

- Ultimate – INR 3200 per month

If you go for a yearly subscription, you can save money up to 34%. The below image describes the yearly distributed plans.

Note: Choose the yearly plan wisely after getting full knowledge of the software to invest in the best.

5. Wave – Free and Flexible Finance

Wave provides a range of services, including free invoicing, accounting and bookkeeping, as well as receipt scanning. It is easy to use and particularly suitable for beginners.

Who’s it for?

Freelancers, small-sized businesses, and self-employed.

Key Features:

- Free Invoicing: Wave has an invoicing package free of charge with basic functionalities utilized by small businesses.

- Accounting and Bookkeeping: Wave offers simple bookkeeping functionalities such as accounting expenses and reports with the aim to help you manage your finances in an accountable manner.

- Receipt Scanning: You may upload receipts and attach them to respective invoices for convenient bookkeeping.

- User-friendly Interface: Whether you are technically a wiz kid or not, you can still operate Wave because it allows for an easy-to-use interface.

What Sets It Apart?

Wave tops the chart because all its Free Accounting and Invoicing services are available online and are miraculously accessible. It’s a perfect tool for freelancers and small businesses that might wish to control their funds without having to pay any initial costs.

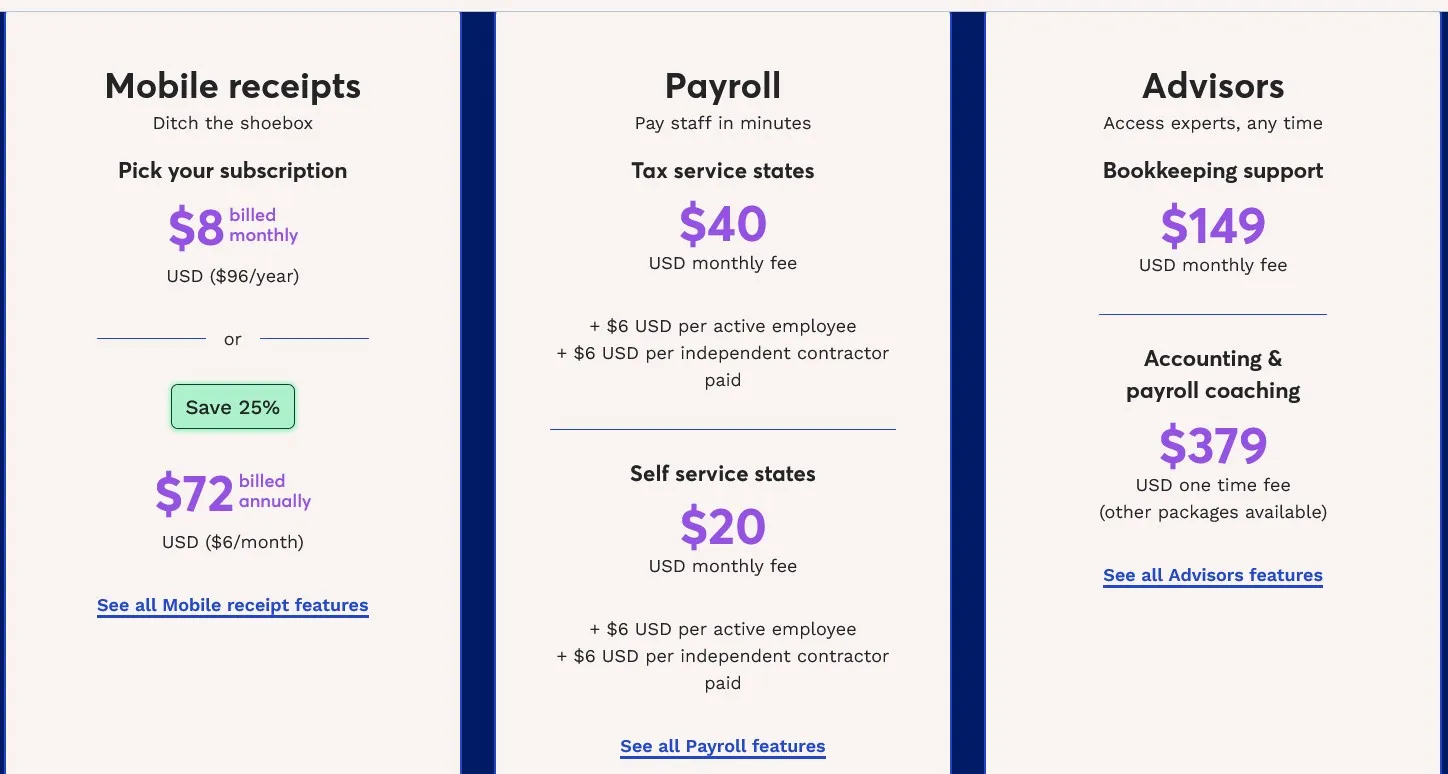

Pricing:

Here is the transparent pricing structure of Wave:

- Get Invoicing and Accounting features 100% free.

- There is a certain amount of charges deducted on a transaction as visualized.

Find out the best plan that suits your needs.

6. Sage – The Enterprise-Level Financial Maestro

Who’s it for?

Who’s it for?

For all – small, medium, and large businesses

Key Features:

- AR & AP Management: It is very easy to track your receivables and payables with Sage. Tracking of your cash flow becomes simpler when you know the money coming in and out.

- Payroll: The payroll function offered by Sage eliminates the hassle of paying your employees accurately and timely and puts you in a place to streamline your HR and finance functions. It’s a convenient platform that guarantees your workforce gets paid justly without stress.

- Advanced Reporting: Sage provides advanced reporting functionalities that help you understand your business data and gain insights. By gaining the right information about money, it will be easy for you to make good financial decisions, learn how to spot opportunities, and prepare for the future.

- Time Tracking: With Sage’s time tracking function, you can effortlessly register and monitor your crew’s work hours. It’s perfect for both productivity management and accurate compensation calculation for each employee’s time and effort.

- Inventory Management: Sage’s inventory management application helps you track your stocking levels and orders. This prevents failure to have proper items, and the business can be ready to serve the customers without a problem.

What Sets It Apart?

Sage provides Advanced Reporting and Analytics capabilities. It is the means to make the most of the company’s accounts data, strategy preparation and prospect forecast.

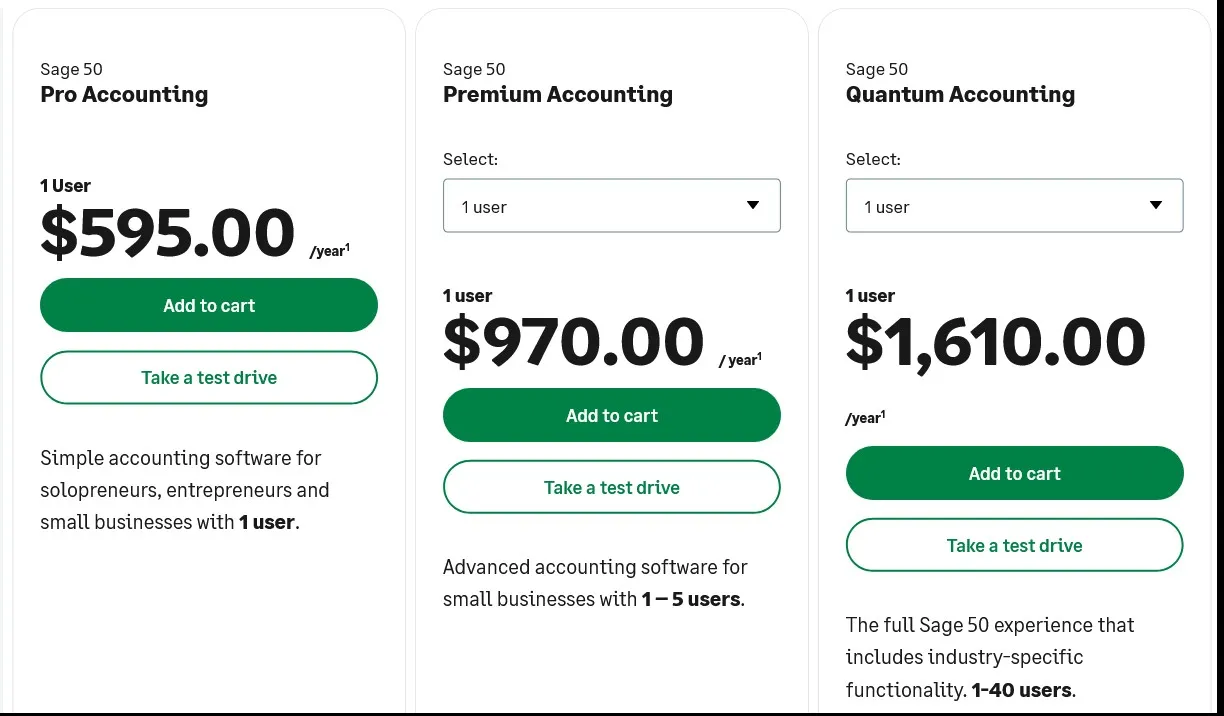

Pricing:

Sage offers three plans based on different business needs.

- Pro – $58.92 per month

- Premium – $96.58 per month

- Quantum – $160 per month

If you choose a yearly subscription, you get an approximately 16% discount.

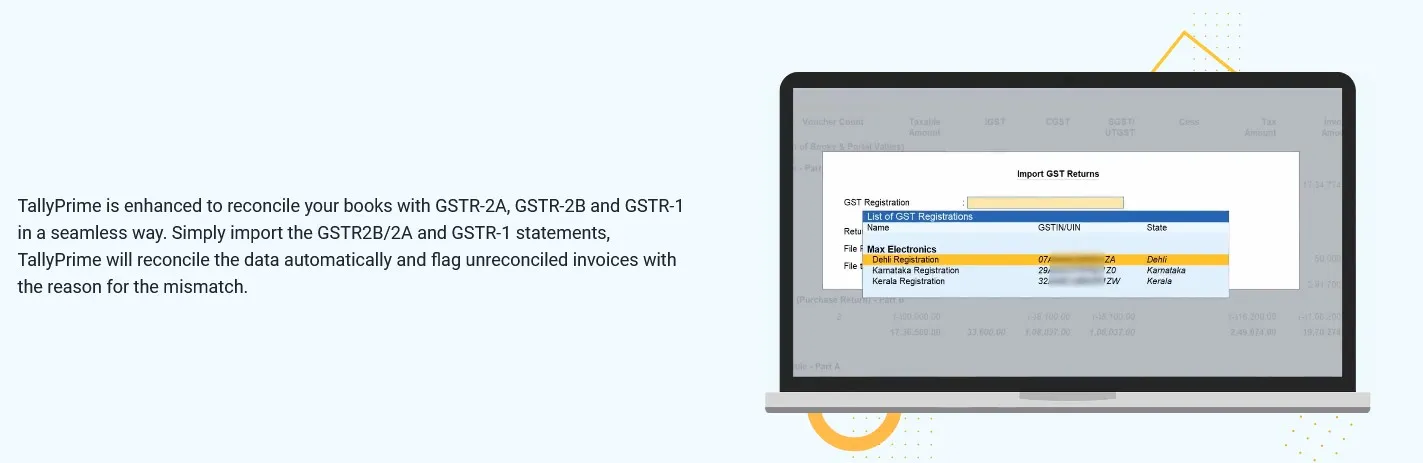

7. Tally Solutions – The Trusted Accounting Partner

Tally Solutions offers integrated accounting and financial management, inventory monitoring, and multilingual support.

Who’s it for?

Designed for businesses in GST regions.

Key Features:

- Accounting and Financial Management: Tally Solutions provides with an entire management of the accounting and financial features.

- Tax Compliance: Automatic tax calculation and reporting in compliance with tax laws.

- Inventory Tracking: Simplify your inventory management and render invoices to your customers effortlessly.

- Multilingual Support: Tally supports a number of languages to contribute to global operations.

- Point of Sale (POS) System Integration: Tally can integrate with POS systems to ease up retail billing and inventory management.

What Sets It Apart?

Tally Solutions is known for its Robust GST Compliance features, particularly in regions where GST is a significant taxation framework. It ensures accurate and hassle-free tax compliance.

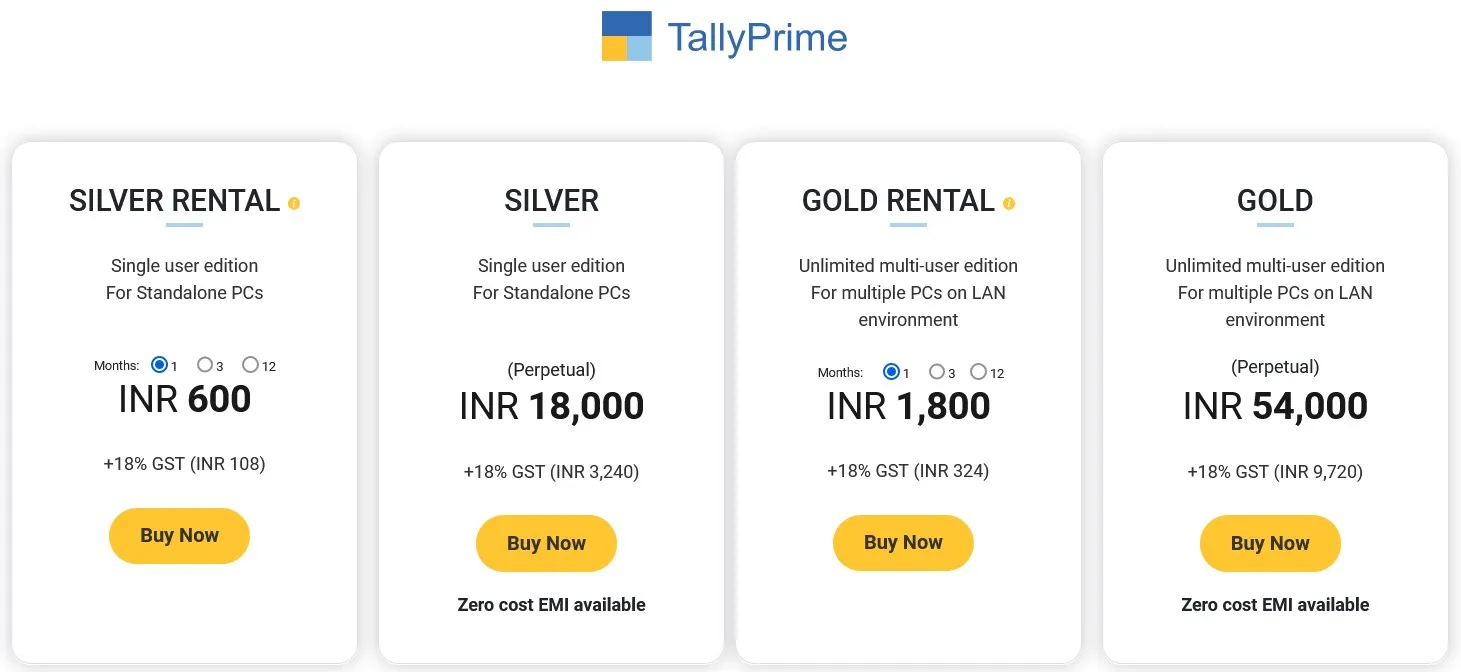

Pricing:

Tally Solutions offers Silver and Gold plans; features vary for both categories:

- Silver Rental: INR 600 per month

- Silver: INR 18000 for unlimited access

- Gold Rental: INR 1800 per month

- Gold: INR 54000 for unlimited access

You can contact their support team for any query related to more offers.

8. Finly – Your Financial Companion

Finly automates billing, offers approval workflows, and manages expenses and vendor information for streamlined financial processes.

Who’s it for?

For SMEs and Large Enterprises

Key Features:

- Automated Billing: Finly automates the billing process, which results in the reduction of error ground and also saves a lot of valuable time.

- Approval Workflows: Set up multilevel approval workflows for the invoices, which will help maintain accuracy and control over payments.

- Expense Management: Keep track of and manage expenses and allow for proper reimbursement and billing. Skip the quote

- Vendor Management: Keep an up-to-date data system of vendors, along with the specific billing requirements of each vendor.

- ERP Software Integration: Finly is able to work with ERP systems, allowing financial information to be synchronized.

What Sets It Apart?

Finly goes beyond standard invoicing by offering Automated Expense Management. It allows you to streamline the entire expense reporting process, making it easier for your employees to submit expenses and for finance teams to review and approve them efficiently.

Pricing:

Finly’s pricing plan is distributed into three categories. You can explore the features on their website.

But to access information about the pricing plans, you need to contact their support team.

Making the Right Choice

Choosing the appropriate accounting software is a decision that can significantly impact your business’s financial management.

When choosing the software comparable to Quickbooks, consider the following:

- Business Size: Some software caters specifically to freelancers, while others are better suited for larger enterprises.

- Features: List the essential features you need and see which software offers them.

- Budget: Ensure the software fits within your budget without compromising essential features.

- Integration: Check if the software can easily integrate with other tools you use.

Final Thoughts

In the vast accounting software market, finding the one that exactly matches your business needs can be daunting.

However, you can find the perfect fit with thorough research and a clear understanding of your requirements.

Whether it’s the comprehensive features of Invoicera or the freelancer-friendly interface of FreshBooks, there’s a solution out there for every business.

The key is to look beyond the obvious and explore the possibilities.

Frequently Asked Questions

Why are these alternatives to QuickBooks accounting software superior?

These accounting software similar to Quickbooks provide special features and functionalities to meet a range of corporate requirements.

For instance, Freshbooks excels at double-entry accounting, whereas Xero strongly supports many currencies.

Tally Solutions is renowned for its extensive features related to GST compliance, which can be a game-changer for companies who operate in areas with a framework for Goods and Services Tax.

Are freelancers and small enterprises able to use these alternatives?

Of course! Because of their flexible pricing and user-friendly interfaces, many software options—like Freshbooks and Wave—are especially well-suited for small enterprises and independent contractors.

They provide features tailored to smaller businesses’ unique requirements, like expense management, invoicing, and financial reporting.

Is it easy to migrate data from QuickBooks to these alternatives?

Although it can vary in complexity, it is generally possible to migrate data from QuickBooks to these alternatives.

For data migration, each software supplier normally provides advice and assistance.

They should speak with their customer service or resources to ensure a seamless transfer.

Remember that your data’s degree of customization and detail could affect the migration procedure.

How do I choose the best accounting software alternative for my business?

The particular requirements and tastes of your company determine the best decision.

Think about things like the size of your company, requirements unique to your industry, financial limitations, and desired features.

Before choosing, it’s beneficial to utilize these options’ free samples and demos to gain a sense of their functionality and user-friendliness.

Who’s it for?

Who’s it for?

Who’s it for?

Who’s it for?