Imagine a steady stream of income flowing in month after month, providing your business with financial stability and the freedom to focus on what truly matters – delivering value to your customers.

Isn’t it like your business has reached heights?

This can become true if you master cash flow in your business. It’s the fine art of balancing incoming revenue with outgoing expenses, ensuring a seamless financial rhythm that hums your business.

This comprehensive guide talks extensively about cash flow management for subscription-based businesses. Whether you have just started or looking to optimize your existing strategies, we’ve got you covered.

We’ll delve into the common pitfalls that can trip you and the proactive measures you can take to steer clear of cash flow woes.

Are you ready to unlock the secrets of mastering cash flow?

Let’s start!

Cash Flow and Its Importance in Business Growth

Cash flow is the movement of money in and out of a business or individual’s financial accounts during a specific period. It represents the net amount of cash generated or consumed by a business.

Cash Flow Types

- Operating Cash Flow: It reflects the cash generated or used in the core operations of a business. It is the cash received from customers and paid to suppliers, employees, and other operating expenses. An organization can generally raise money through regular business operations.

- Investing Cash Flow: The cash used to buy or sell long-term assets like investments, equipment, or property. Positive investing cash flow suggests that a company is investing for its future success; however, negative investing cash flow may indicate divestment or asset sales.

- Financing Cash Flow: The cash inflows and outflows depend on the company’s financial activities. It includes issuing or purchasing stock, taking loans, paying dividends, etc. Financing cash flow shows how a company raises capital and manages its financial structure.

Inflow and Outflow of Cash

Inflow of Cash: The cash flowing into a person’s or company’s financial accounts, including earnings, investments, loans, or any other cash source.

Outflow of Cash: The money that goes out from a person or company’s financial accounts, including costs, purchases, loan repayments, dividend payments, and any other cash-related activities.

Cash flow is directly linked to the growth potential of your subscription-based business.

Funding and investment are also important aspects of any organization. Thus, balancing raising capital and maintaining a positive cash flow is essential.

Cash Flow Challenges in Subscription-Based Businesses

Subscription-based businesses have gained huge popularity in a few years, offering companies a convenient and reliable revenue stream. However, despite their advantages, these businesses often face unique cash flow challenges that can impact their financial stability and growth prospects.

Have a look at the following challenges:

1. Acquiring New Subscribers vs. Retaining Existing Ones

While acquiring new customers is essential for growth, the initial costs can strain cash flow, especially when considering marketing, onboarding, and promotional expenses. Simultaneously, maintaining a high churn rate can erode profits and make it difficult to predict cash inflows accurately.

Solution: You must focus on customer retention by providing exceptional customer service, personalized content, and exclusive offers to existing subscribers. Implement data-driven marketing campaigns to optimize customer acquisition costs and ensure you are targeting the most profitable customer segments.

2. Upfront Costs and Delayed Revenue

Unlike traditional businesses that receive immediate payment for products or services, subscription-based businesses often face delays in revenue recognition. Customers pay upfront for future services, leading to an initial cash influx, but the revenue recognition is spread over the subscription period.

Solution: Implement effective billing and invoicing systems to ensure timely collections, offer incentives for longer subscription commitments, and maintain a strong financial reserve to cover immediate operational expenses.

3. Seasonal or Cyclical Fluctuations

Certain subscription-based businesses experience seasonal or cyclical fluctuations in demand, leading to irregular cash flow patterns. These fluctuations can create challenges in managing operational expenses, especially during slow periods.

Solution: Diversify your product or service offerings to cater to different customer needs throughout the year. Additionally, consider implementing flexible pricing models or offering seasonal promotions to attract customers during off-peak periods.

4. Scaling Infrastructure

As subscription numbers grow, businesses may need to invest in scaling their infrastructure, such as servers, bandwidth, or customer support teams. The upfront investment required to accommodate increased demand can lead to temporary cash flow constraints.

Solution: Plan for scalability from the outset and monitor subscribers’ growth closely. Gradually invest in infrastructure upgrades to align with the increasing customer base and explore cloud-based solutions offering flexibility and cost-effectiveness.

5. Payment Processing and Failed Transactions

Subscription-based businesses risk payment failures due to expired credit cards, insufficient funds, or other issues, leading to delayed cash flow and potentially increased churn.

Solution: Optimize your payment processing system to minimize failed transactions. Regularly update customer payment information, send automated reminders for upcoming renewals, and offer multiple payment options to reduce the chances of payment failures.

Strategies for Improving Cash Flow

1. Optimizing Pricing and Packaging Strategies

One of the most impactful ways to improve cash flow is through strategic pricing and packaging of products or services.

Consider implementing the following tactics:

- Value-driven Pricing Strategies: Align your pricing with the perceived value of your offerings. Highlight the unique characteristics and benefits that make your goods and services stand out.

- Showcase Distinctive Features: Offer multiple packages or tiers that cater to different customer segments.

- Seasonal Pricing: Offering discounts during slow periods or charging premium prices during peak seasons can help maximize revenue.

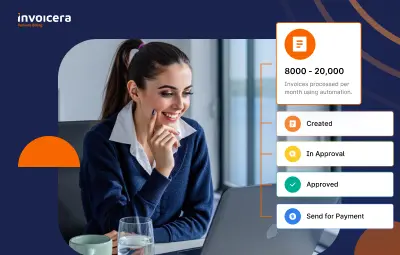

2. Implementing Effective Billing and Invoicing Processes:

A well-optimized billing and invoicing process can significantly impact cash flow by reducing payment delays and improving collection times. Here are some steps to consider:

- Clear & Transparent Invoices: Easy-to-understand, transparent, and include all necessary details.

- Prompt Invoicing: Send invoices quickly after providing products/services.

- Multiple Payment Options: Offer various payment methods for customer convenience.

- Automated Reminders: Set automated payment reminders to avoid late payments.

3. Encouraging Upselling and Cross-Selling to Boost Cash Flow:

You can increase transaction value and generate revenue from existing customers by upselling and cross-selling. Consider the following approaches:

- Product Bundling: Combine related items, offer at a discount, and boost revenue per sale.

- Personalized Recommendations: Use customer data for targeted upsells, cross-sells, and higher conversion.

- Loyalty Programs: Reward loyal customers with exclusive deals and encourage repeat purchases and referrals.

4. Utilizing Discounts and Promotions Without Compromising Cash Flow:

Discounts and promotions attract new customers and boost sales, but they should be used strategically. Here’s what you can do:

- Limited-Time Offers: Create urgency with time-limited discounts for instant cash flow.

- Minimum Purchase Thresholds: Set minimum spend for discounts to boost sales.

- Seasonal Sales: Attract customers during specific periods for cash flow spikes.

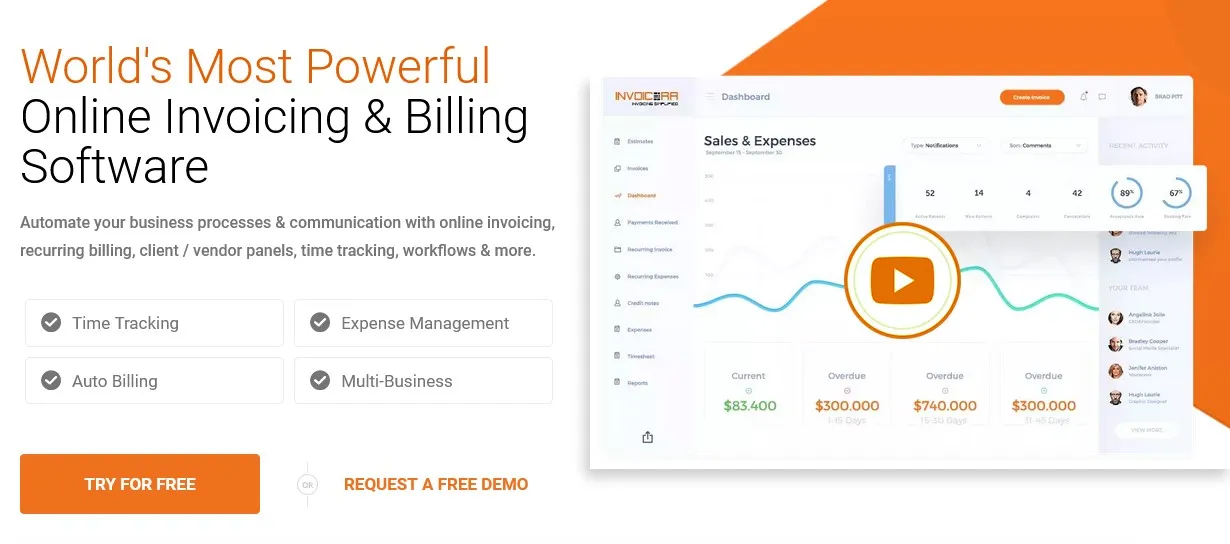

Invoicera – The Best Recurring Billing Solution

Invoicera is a top choice for businesses seeking efficiency and convenience in managing their billing cycles. It benefits you with:

- Improved Cash Flow Management

- Enhanced Customer Experience

- Time and Resource Savings

- Real-time Financial Insights

- Scalability and Flexibility

Features of Invoicera

Features of Invoicera

- Recurring Billing Automation: Invoicera automates the recurring billing process, saving businesses valuable time and effort. It allows users to set up and customize recurring invoices, ensuring clients are automatically billed at defined intervals.

- Subscription Management: The platform offers robust subscription management capabilities, enabling businesses to handle multiple subscription plans seamlessly. Whether it’s monthly, quarterly, or annual billing cycles, Invoicera allows for easy plan creation, modification, and cancellation, providing flexibility and control.

- Online Payment Gateways: It integrates with 14+ online payment gateways, enabling clients to pay conveniently and securely.

- Automated Late Payment Reminders: Late payments can disrupt cash flow and hinder business growth. Invoicera comes equipped with automated late payment reminders that gently nudge clients to settle their dues promptly.

- Expense Tracking and Reporting: Besides invoicing and billing, it offers robust expense tracking and reporting features. Businesses can effortlessly monitor expenses, generate insightful reports, and gain valuable financial insights.

- Multi-currency Support: Managing multiple currencies can be complex for businesses operating globally. Invoicera addresses this challenge by supporting various currencies, simplifying international transactions, and reducing currency conversion hassles.

Top Mistakes to Avoid in Cash Flow Management

1. Delayed Invoicing and Collections

One of the most significant things businesses need to improve is delaying invoicing their clients or customers. This delay can result in delayed payments, impacting the company’s cash flow.

Implement a streamlined invoicing system that generates and sends invoices promptly. Set clear payment terms and follow up on overdue payments to ensure timely collections.

Invoicera is a comprehensive invoicing and billing software that automates the invoicing process. Customizable templates and automated reminders ensure that invoices are sent on time, reducing the risk of delayed payments and improving cash flow.

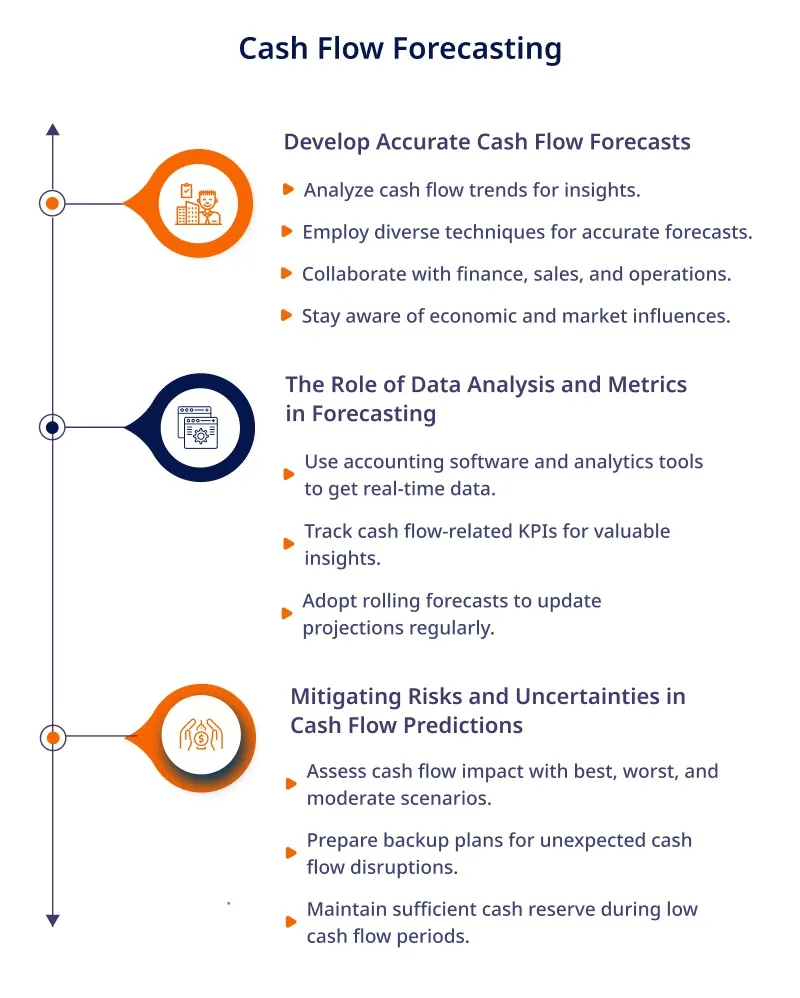

2. Poor Cash Flow Forecasting

Without accurate cash flow forecasting, businesses may face unpredictable cash flow fluctuations. Failing to anticipate periods of low cash flow can lead to an inability to meet financial obligations.

You must regularly analyze historical cash flow data to identify patterns and trends. Use this information to create realistic cash flow projections considering revenue and expenses.

Invoicera offers robust reporting and analytics features that provide valuable insights into your cash flow trends. By leveraging these tools, you can make better financial decisions and proactively plan for future cash flow requirements.

3. Overestimating Revenue and Underestimating Expenses

Over-optimistic revenue projections and underestimating expenses can lead to unrealistic financial expectations. This mistake can leave businesses with insufficient funds to cover operational costs and hinder growth plans.

Be conservative in revenue forecasting and take into account potential risks and uncertainties. Conduct a thorough assessment of all expenses, including fixed and variable costs.

Expense tracking features of Invoicera allow you to monitor and analyze your expenses accurately. This data can help you refine your financial projections and make necessary adjustments to avoid cash flow shortfalls.

Conclusion

As businesses navigate the complexities of cash flow management in subscription-based models, proactive financial planning, scenario analysis, and risk management should become integral parts of their strategies.

By mastering cash flow, subscription-based businesses can maintain financial stability, pursue growth opportunities, and ultimately achieve long-term success in the ever-evolving business landscape. With a keen understanding of their cash flow dynamics and the implementation of best practices, these businesses can confidently face challenges and build a strong foundation for a prosperous future.

Features of Invoicera

Features of Invoicera