The rapid move of the world towards digital technology is making it essential for businesses to take a more strategic approach to handling their business activities.

Cash flow management is one crucial task that any business needs to handle carefully. Accounts payable and accounts receivables should be recorded carefully in order to have a clear track of cash flow.

What are Accounts Payable?

When a business purchases goods/services on credit before making payment, an accounts payable liability is created. The supplier or vendor issues an invoice specifying the amount owed and the terms of payment. The business then records this amount as accounts payable in its financial records until the invoice is paid.

Although managing accounts payable can be complex and time-consuming, you can optimize the process to make the job easier and more efficient.

Automating the accounts payable process can help you reduce costs and improve cash flow and accuracy.

This blog post will cover brief information about accounts payable, benefits, and the top 5 ways on how to manage accounts payable effectively.

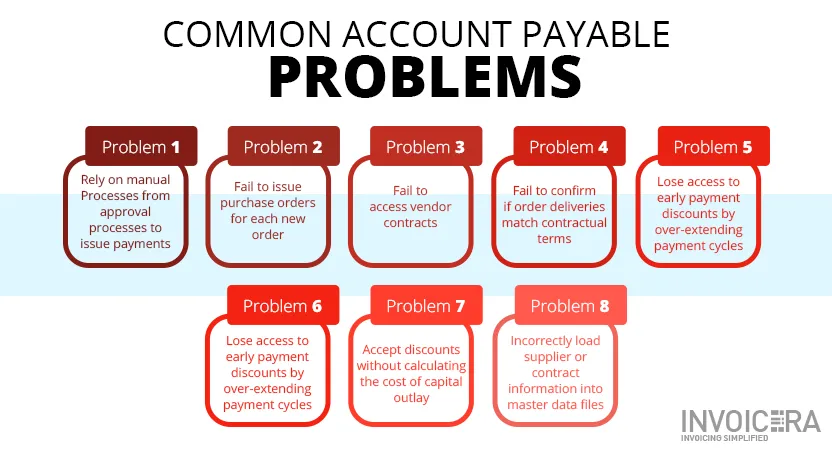

Challenges in Accounts Payable

Managing accounts payable can be a complex task, and businesses often encounter common challenges, such as

- Late payments

- Errors in invoice processing

- Difficulties in tracking expenses

Manual data entry and a lack of standardized processes can lead to inefficiencies, making it challenging to keep up with the volume of invoices.

Businesses may also face issues with misplaced or lost invoices, leading to delayed payments and strained relationships with suppliers.

These accounts payable problems affect the day-to-day operations and can impact a company’s overall financial health and reputation.

Impact of Inefficient Accounts Payable Processes

Inefficient accounts payable processes can have far-reaching consequences.

- Late payments may result in strained vendor relationships, jeopardizing the supply chain.

- Errors in invoice processing can lead to financial discrepancies and damage the company’s credibility.

- Additionally, the lack of streamlined processes can hinder decision-making, as accurate and timely financial information is crucial for effective strategic planning.

- Businesses may also incur unnecessary costs due to missed opportunities for early payment discounts and face regulatory issues if compliance is not maintained.

Need for Optimization to Overcome Challenges

Recognizing the challenges in accounts payable is the first step towards improvement.

Optimization is crucial to address these issues and streamline processes for better efficiency. By embracing automation, businesses can reduce manual errors, enhance accuracy, and ensure timely payments.

Adopting best practices, implementing robust technology solutions, and providing training for accounts payable teams are essential components of optimization.

The need for accounts payable optimization goes beyond operational efficiency; it is a strategic move to strengthen financial stability and foster positive relationships with suppliers.

Here is the list of five main strategies, if optimized, that can get cash fit and strengthen the working capital.

1. Adopt Self-Service Portals

Set up a centralized portal for suppliers to track orders, deliveries, payments, etc. These portals streamline the process that can help you to gain proper business insights, track invoices, and help speed up the time to approve invoices.

A few benefits of using this portal are:

- Enhances communication between you and any organization

- Maintains transparency between you and your client to avoid any disputes

- This leads to better supply management.

Invoicera is an online software that helps you automate the accounts payable process by tracking and reporting each activity in the invoicing process. It ultimately results in saving costs and increasing accounts payable efficiency.

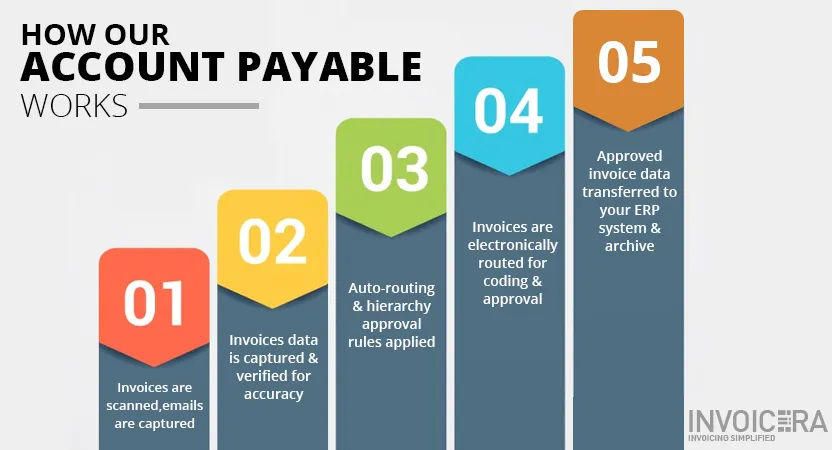

2. Automate Your Accounts Payable Process

AP automation gives you the power to enjoy faster payments and healthy cash flow. Since the process is automated, all the documents and payments are exchanged in an automated environment without manual processes.

All the financial reports are available for analysis, be it outstanding payments, invoice aging, estimates, purchase orders, taxes, and more. It helps lower the cost of processing each invoice.

A tool that is incredibly useful to automate the AP process is Invoicera. Once you integrate this tool into your business accounting system, invoicing will be no more a maddening task. It will reduce manual efforts, eventually helping you focus more on strategic initiatives in your organization.

3. Match Invoices with Purchase Orders

The role of AP is to manage an organization’s outgoing transactions and forge strong relationships with suppliers.

By ensuring that invoices align with the corresponding purchase orders, you can easily track and reconcile payments, reducing the risk of errors and discrepancies.

Consider these strategies:

- Issue PO for each new order so you can validate any invoices received and track invoices against PO.

- Explore offerings such as early payment discounts, volume rebates, etc.

- Track outstanding payables by vendors.

- Set clear accounts payable metrics.

- Negotiate longer payment terms to increase working capital and reduce risk.

4. Create managerial workflows

Workflows provide a detailed view of the operations accounts payable department performs.

There should be guidelines for determining the best ways of dealing with paying different types of suppliers.

So, here is what you can do:

- Involve relevant stakeholders, accounts payable staff, managers, and vendors.

- Create custom workflows to prevent losing discounts, incurring penalties for late payments, and more.

- Implement invoice and payment approval workflow to reduce the risk of fraud or duplicate payments.

Invoicera is helpful when it comes to creating effective managerial workflows. You can optimize the AP processes and reduce costs while improving accuracy.

5. Track and Report Invoicing process

Keep all the financial reports up-to-date to reflect the current accounts payable balances. Improve the real-time reporting capabilities by automation and ensuring that they remain current.

To bolster the process, follow these steps:

- Properly track all payments

- Select a method of payment

- Validate invoices contract terms

- Ensure billing accuracy of Purchase Orders

Importance of Compliance in Accounts Payable

Overview of Regulatory Compliance

Regulatory compliance in accounts payable refers to adhering to laws and regulations governing financial transactions and reporting. This includes tax regulations, financial reporting standards, and industry-specific compliance requirements. Non-compliance can result in financial penalties, legal issues, and damage to a company’s reputation.

How Compliance Impacts Accounts Payable?

Compliance is integral to the integrity of accounts payable processes. If you fail to comply with regulations, it can lead to financial misstatements, jeopardizing the accuracy of financial reports. It can also expose the company to legal risks and regulatory scrutiny, impacting its ability to operate smoothly.

Compliance in accounts payable ensures transparency, accountability, and ethical business practices. It instills confidence in stakeholders, including investors, suppliers, and regulatory bodies, contributing to the overall credibility of the business.

Implementing Best Practices for Regulatory Adherence

To maintain compliance, businesses need to implement accounts payable best practices such as regularly updating processes to align with changing regulations, conducting internal audits, and staying informed about industry-specific requirements.

Investing in technology solutions like Invoicera that automate compliance checks and provide real-time updates on regulatory changes can significantly contribute to maintaining a compliant accounts payable function. Training accounts payable teams on compliance requirements is equally crucial to ensure that everyone involved is well-informed and follows established protocols.

Auditing and Risk Mitigation in Accounts Payable

Regular audits in accounts payable are like check-ups for your business’s financial health. They ensure that your money matters are in good shape and that there are no hidden issues. Think of it as a way to catch any financial “bugs” before they become big problems.

By conducting audits, businesses can

- Double-check that all payments are accurate and legitimate.

- Confirm that invoices match the goods or services received.

- Identify and correct any errors in the accounting system.

- Ensure compliance with regulatory standards and internal policies.

Identifying and Addressing Potential Risks

In the world of accounts payable, risks are like potholes on a road. If you don’t see them coming, they can lead to a bumpy ride. It’s crucial to identify and address potential risks early on to keep your financial journey smooth.

Common accounts payable risks include:

- Errors in invoicing or payment processing.

- Fraudulent activities, such as fake invoices or unauthorized payments.

- Non-compliance with financial regulations.

To address these risks:

- Implement a system of checks and balances to catch errors.

- Train staff to recognize and report suspicious activities.

- Stay up-to-date on regulatory changes and adjust processes accordingly.

Strategies for Fraud Prevention in Accounts Payable

Fraud prevention is like putting up a security fence around your finances. It keeps unwanted intruders out and protects your hard-earned money. Here are some simple yet effective strategies:

Segregation of Duties:

- Divide responsibilities among different team members.

- For example, the person approving payments should be different from the one processing them.

Regular Training:

- Educate your team about common fraud schemes.

- Teach them to verify the legitimacy of invoices and payments.

Use of Technology:

- Implement fraud detection tools and software.

- Regularly update and patch your financial systems to close security loopholes.

Manage your AP process with Invoicera

Invoicera, the online invoicing software, is beneficial for you to manage the accounts payable. It increases processing accuracy, optimizes payment timing to automatically check discounts, and more. The online invoicing software optimizes the total service cost and creates agility for profitable growth through an integrated and industry-led approach.

The built-in accessibility to track project timing helps to calculate the time spent on any project, and you can charge clients accordingly.

Final Thoughts

These are the few basic yet effective steps to help manage the AP functions more effectively. The accounts receivable and payable process impacts the trust between an organization and its suppliers.

The right partners ensure to maintain operating margins and support bottom-line performance. When approached effectively, it can build up corporate cost management, minimize risks, reduce proper complexity, and enhance vendor contract compliance.

FAQs

Why is optimizing accounts payable important for businesses?

Optimizing accounts payable is crucial for businesses to enhance cash flow management, streamline processes, and improve overall financial efficiency. Organizations can achieve cost savings and maintain healthy financial liquidity by minimizing errors, reducing processing times, and negotiating favorable terms with vendors.

How can technology, such as automation, play a role in optimizing accounts payable?

Technology, especially automation, plays a pivotal role in optimizing accounts payable. Automated systems can streamline invoice processing, reduce errors, and provide real-time insights into financial data. This not only increases efficiency but also allows staff to focus on more strategic tasks, ultimately saving time and resources.

What strategies can businesses adopt to negotiate better payment terms with vendors?

Negotiating favorable payment terms with vendors is essential for optimizing accounts payable. Businesses can leverage their payment history, establish strong relationships, and explore early payment discounts. Additionally, effective communication and a clear understanding of both parties’ needs can contribute to mutually beneficial agreements, improving overall cash flow management.