Introduction

A company’s potential to grow and be profitable over the long run depends on its financial management. You must establish, manage, oversee, and monitor your financial resources to achieve your company’s goals. These eight suggestions help you reclaim control over your finances even though you may believe it difficult and perplexing.

Financial management should be part of your organization’s primary business processes, and your long-term planning should support it. It could help you achieve a competitive edge, fulfill your stakeholder obligations, maximize the resources at your disposal, and position yourself for long-term stability.

The Top 8 Financial Management Strategies For Consultants And IT Companies

Your company may need better financial management, including late or nonexistent employee payments. For advisors and IT firms, consider these eight financial management pointers and strategies to ensure you have the best economic strategy.

1. Keep Your Expenses Low

One of the most crucial things you can do to maintain your financial stability is to cut your spending. Consider quality above quantity when allocating corporate funds. Just make purchases that are essential to operating your firm. A software asset management system can track software investments, ensuring you only pay for what’s necessary and maximize usage.

2. Plan for growth

You’ll need to buy extra office space equipment and hire more staff as your company expands. Ensure that you have a plan in place to cover these costs. Also, expenses related to marketing planning and the cost of building marketing strategies should be considered. Anticipating future costs and planning will help ensure your business doesn’t fall into financial trouble. Importantly, it also helps prevent cash flow issues from slowing your company’s growth. This is where effective financial management comes in—without it; unexpected costs can sneak up on you quickly and slow progress along with them.

For example, poor cash flow management can leave businesses waiting for vendor payments or delayed customer payments instead of spending on essential expenses like payroll or supplies.

3. Track cash flow daily

Most businesses need a sufficient cash flow management system, which causes numerous needless problems. Most consulting firms eventually have to cope with money issues brought on by poor cash flow management. When they ultimately acknowledge they should have taken more initiative with their cash, it’s sometimes too late to prevent significant harm.

Because of this, it’s critical to check your company’s cash status (at least once a week) often. It is advised that you give an internet app a try to monitor all incoming and leaving financial transactions instantly. By doing so, you will always be able to react quickly whenever new challenges arise.

Also Read: 8 Tips to Reduce Errors in Accounts Payable

Make sure your business has a solid financial management system in place in addition to cash flow management. Budgeting, billing, receivables, and accounts payable procedures should be covered. Adopting these tools will help you save money and improve customer relations. Keeping track of these tasks daily can be time-consuming, so consider automating them using an accounting software package or an ERP system.

4. Set realistic budgets

Many companies must pay more attention to how much it will cost to deliver on a project or program. If you don’t know your actual costs, you can over or underbid projects or programs—resulting in an ineffective budget. An effective financial and management accounts system means setting realistic budgets that include enough money to cover unexpected expenses and ensure you aren’t short at month-end.

It also entails ensuring that suppliers receive their payments on schedule so they can offer your business top-notch services. This is called cash flow management, and while it is often disregarded, it is equally crucial for business owners to do as well as prudent financial management.

Keeping detailed records of every expense can assist you in creating a realistic budget by revealing your business’s exact monthly operating costs. Then, use those numbers to set reasonable goals when bidding on projects or programs. If any additional cash flow is left over at month-end, put that in savings or apply it to paying down debt.

Sign up to try the best expense tracker app and always set realistic budgets for your business.

5. Invest in yourself

You must be current with the most recent developments and fashions to compete. It’s critical to invest in both your company and yourself consistently. This means going to training events such as seminars, workshops, and other get-togethers that can help you develop your skills and expertise. It’s a good idea to consider other investment opportunities for your business. For instance, if you own a website, spending money on a high-quality web design would be valuable. Investing in a RapidSSL certificate could be beneficial if you manage an online store. You should also spend money on dependable web hosting to improve your eCommerce website’s speed, functionality, and security.

In addition to becoming educated, you also need to understand how to handle your business’s finances. If you don’t know where your money is going, it might be challenging to reduce unnecessary spending before you run into issues. Another facet of sound financial management is learning how to improve cash flow, such as having a set amount of reserves on hand to help you survive in the case of an unanticipated business slowdown.

6. Diversify your income sources

It’s a good idea to diversify your sources of income in case one of your primary sources of income disappears. Multiple revenue streams will make you less dependent on any one source of income and, hence, less likely to encounter financial issues.

You must be generating income from several sources. People primarily dependent on one client will likely struggle if something terrible happens to that relationship. Your chances of surviving longer and recovering from unavoidable setbacks are higher if you diversify your income sources.

This is also a terrific technique to ensure that your business continues to operate whether or not something goes wrong in your personal life. It gives you more financial resilience as a whole.

7. Stay disciplined

As a business owner, your primary focus should be growing sales while controlling costs. To that end, you should exercise discipline in your spending while ensuring you have enough cash. You should also know how money moves through your company to determine which areas require more revenue and which are a financial burden. Remember to account for receivables; otherwise, you risk accruing lousy debt.

This is related to one basic financial principle: more money must come in than go out. Should you do so, your business may eventually run out of money. Make sure your bank account balances are constantly positive; if not, take quick action to make them so! Only what you measure can be managed.

8. Invest your money wisely

You must consult a specialist while making investments to make wise financial decisions. Make informed decisions and purchase goods that yield healthy returns for you in the long run.

Speak with a qualified financial advisor to ensure you receive high-quality returns on your assets. Your advisor can assist you in creating an investing strategy that meets your needs both now and on the road. In many situations, making prudent financial investments will save you time and money, even if their services may be paid for.

9. Manage your debt wisely

Reducing the interest you pay on outstanding obligations requires effective debt management. Check your annual interest rate with an Ethereum or credit card calculator. Next, try your hardest to pay off as much debt as possible. Remember that debt repayment takes money away from more profitable investments, hurting cash flow management.

To correctly manage your debt, be sure to monitor all of your outstanding balances. To prevent wasting money, remember when you will hit your credit limit.

With these financial management suggestions, we intend to maintain the stability and health of your company’s finances. You’ll be more equipped to handle any obstacles if you proactively tackle money management.

————————————————————————————————————

Also Read: 9 Best Payment Methods for Freelancers in 2024

————————————————————————————————————-

Streamline Financial Processes With Invoicera

Invoicera is an invaluable asset that enhances consultancy and IT firms’ financial workflows. Its array of features not only simplifies but elevates financial management. It offers a streamlined approach to invoicing expense tracking and generates insightful financial reports.

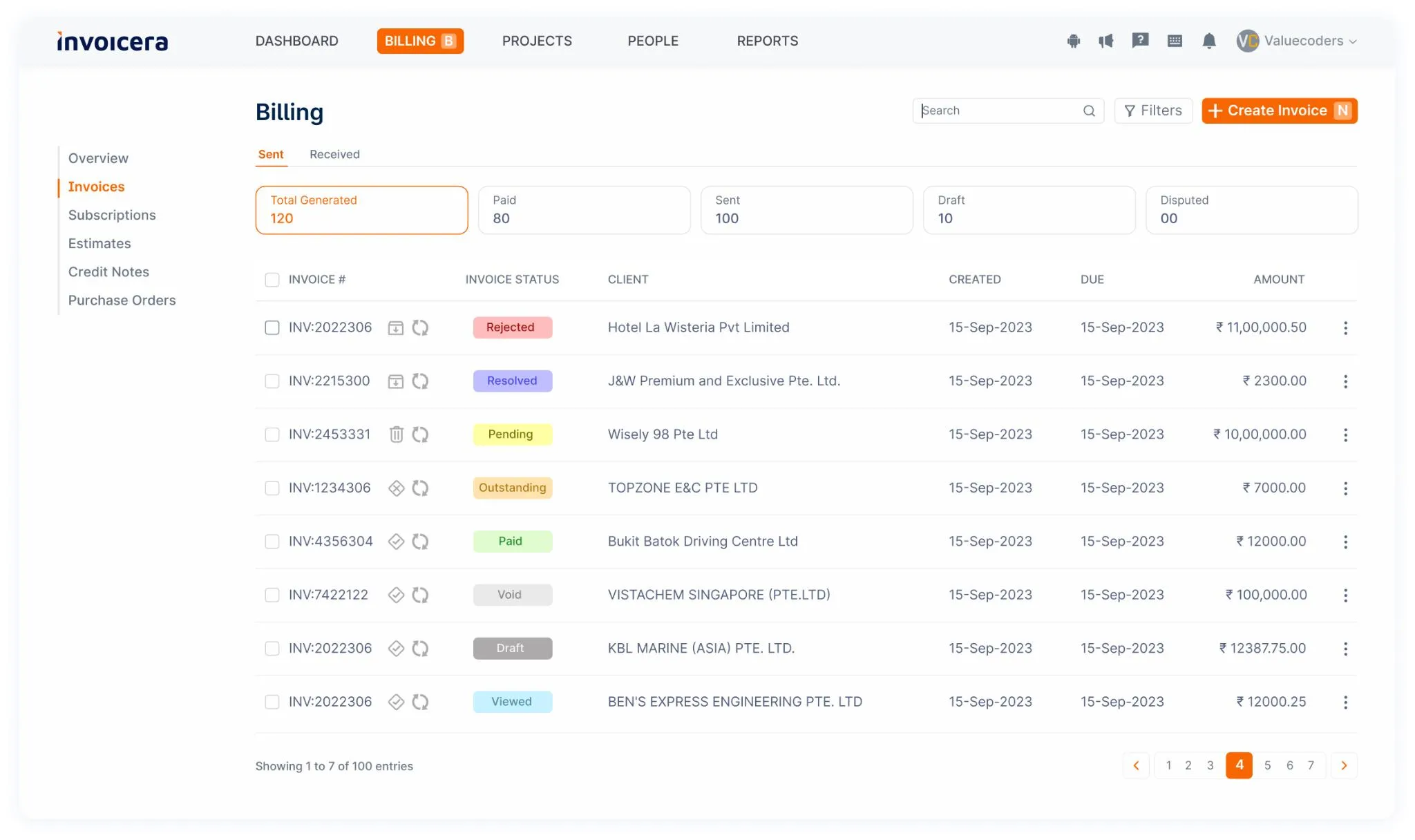

Invoicing And Billing

Make your invoicing process easy

Invoicera’s user-friendly interface completely transforms the invoicing process. It enables users to create and edit invoices quickly, lessening administrative work and guarantee on-time delivery.

Customize templates and automate billing

The adaptable templates offered by Invoicera meet the needs of individual clients. Its automated billing system guarantees punctuality and accuracy, minimizing errors and shortening the billing cycle.

Expense Management with Invoicera

Track expenses efficiently

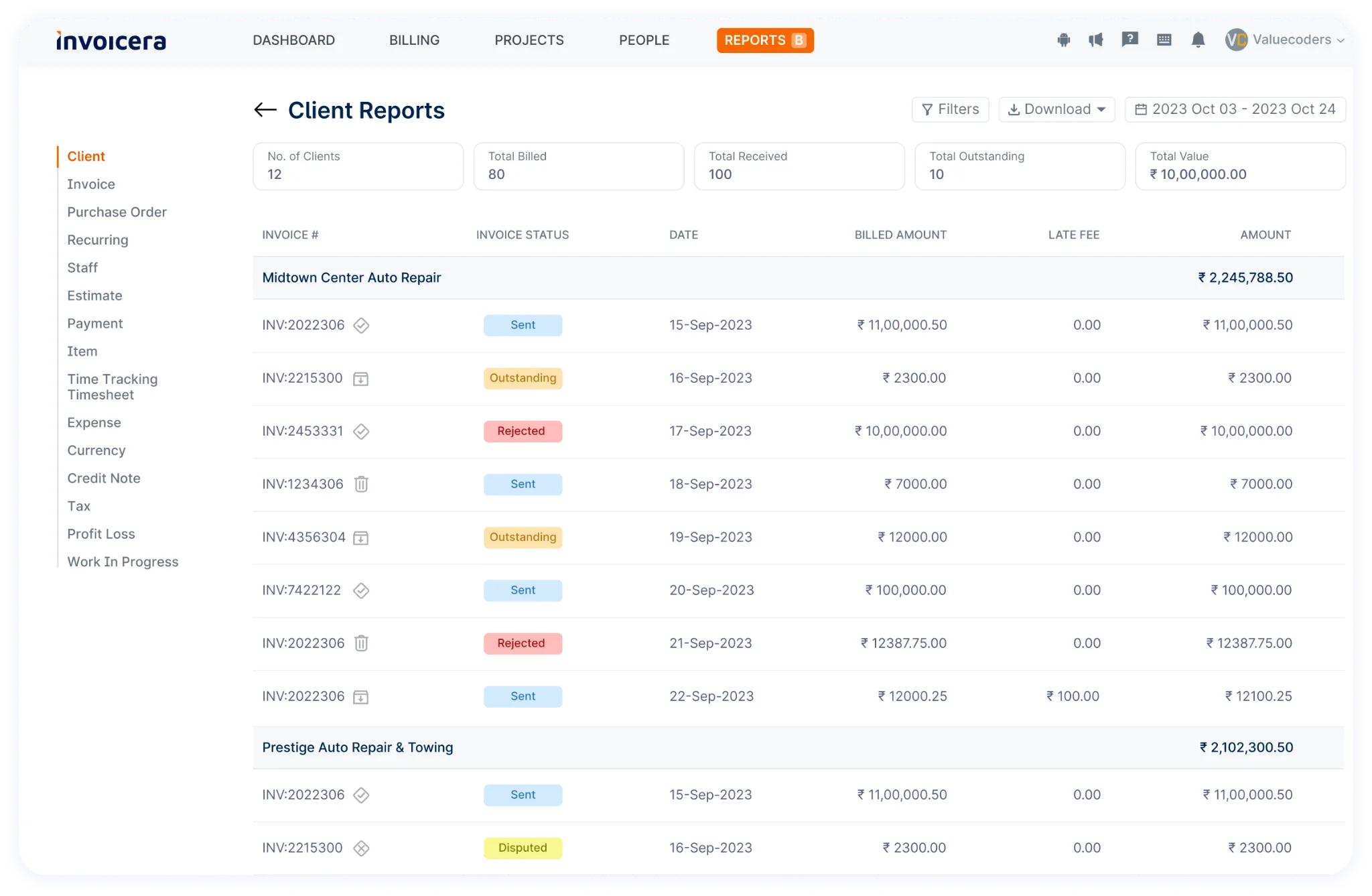

Invoicera makes the expense tracking process more accessible by allowing users to categorize expenses and monitor spending in real-time. This functionality promotes meticulous expense management, ensuring financial control.

Integrate expense data into financial reports

Seamlessly integrating expense data into comprehensive financial reports empowers informed decision-making. Invoicera’s feature ensures that expense data contributes to a holistic financial overview.

Advanced Financial Tips And Best Practices

A. Risk Management Strategies

Determine and reduce the industry’s financial risks.

Thorough risk evaluations assist in detecting any financial hazards that consultants and IT companies may encounter. You can reduce risks and prepare for unforeseen difficulties by taking proactive steps.

Create a robust risk management plan

Craft a robust risk management plan that involves detailed risk analysis, assigning responsibilities, and developing contingency strategies. This ensures readiness to address any financial turbulence effectively.

B. Investment and Growth Strategies

Make smart investment choices

Informed investment decisions, backed by research and aligned with business objectives, pave the way for sustainable growth. Focusing on technology, talent, and strategic partnerships often yields fruitful returns.

Scale strategies for sustainable growth

Sustainable growth demands strategic scaling while maintaining stability. Diversifying, expanding services, and nurturing customer relationships contribute to consistent, long-term growth.

Closing Thoughts

If you’re trying to streamline your finances and work in IT consulting or any other IT field, the financial management tips and tactics we’ve covered in this blog post are a wonderful place to start. But, like any business venture, there needs to be a financing strategy that works for everyone. For this reason, we advise you to use business finance management software to improve how you handle your finances. You can monitor your expenditures and budget by using the program.

If you’re ready to take your finances to the next level, business finance management software may help you build customized reports and dashboards that clearly show your company’s financial health.

Are you prepared to begin?

Use the best financial software to manage small business money successfully and efficiently.

Thanks for reading!!

FAQs

What is consulting in finance?

What are some common financial pitfalls for consultants and IT firms to avoid?

Overlooking cash flow management, underestimating project costs, and failing to diversify revenue streams are common pitfalls. Mitigating these risks is essential for long-term success.

How can IT companies control costs without compromising quality?

Efficient resource allocation, strategic vendor partnerships, and leveraging technology for automation cut costs and enhance quality and innovation within IT operations.

How can financial planning benefit consultants in project management?

Planning finances aid in realistic budgeting, identifying potential risks, and ensuring adequate resources throughout a project. It’s the backbone of successful project execution.