No one wants to get paid late. Thus, it is crucial to understand the basics of proper invoicing and how you can avoid mistakes while creating them.

Simple and accurate invoicing is the key to receiving prompt payments. However, many businesses avoid this fact and make mistakes when it comes to invoicing. And eventually, it leads to delayed payments.

This blog post will cover seven common invoicing mistakes, tips to overcome them, and how an automated billing software like Invoicera could be beneficial for running a smooth cash flow.

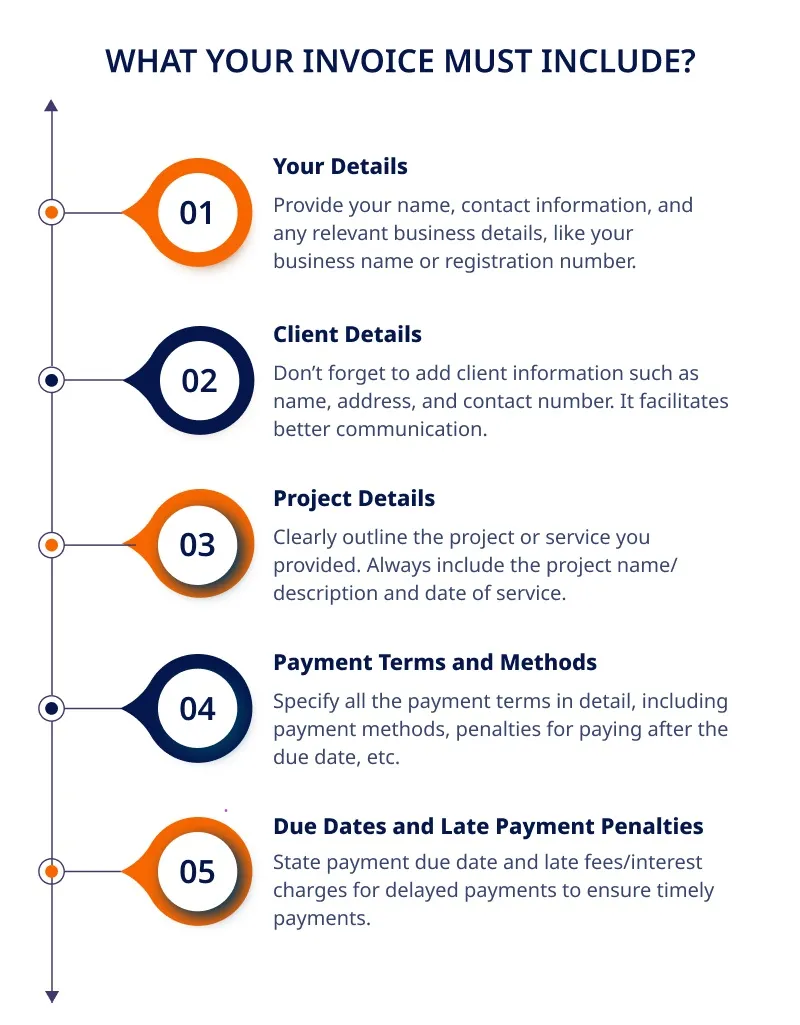

#1: Not Including Essential Information

It can land in confusion and delayed payments, disrupting the cash flow on both sides.

To avoid this, you must ensure the invoice has all the above-stated information.

Also, you can use automated tools like Invoicera for customized invoice creation. The templates provided in this software will help ensure you input all the necessary details and maintain your brand image.

#2: Sending Inaccurate Invoices

You should double-check the invoice details before finally sending it to clients. Ensure you accurately mention all prices, quantities, taxes, or discounts.

You can automate the invoice creation process with Invoicera. Just enter all the details, and it will fetch the price of the product/service whenever you will add it to the invoice.

Automated invoice generation can save you a lot of time.

#3: Providing Late or Delayed Invoices

Sharing invoices days after providing the service or product will eventually lead to delayed payments. This can also have a negative impact on the cash flow and client relationship.

To eliminate this problem, you can opt for any automated invoicing software solution. It can speed up the process of creating automatic invoices.

You may automate recurring invoices using software like Invoicera, so you don’t have to manually create and send invoices every time.

You can also set up reminders to send invoices timely.

#4: Ignoring Payment Terms and Conditions

Not adding payment terms and conditions in the invoices can have a big impact on your business. Because you are not mentioning due dates, policies, or penalties for paying after due dates, your finances will eventually fall as the clients will not take your invoice due date seriously.

You must clearly mention the late fees applicable when clients will not pay on the specific due date.

Invoicera, however, can streamline the process by automatically adding payment terms and conditions, in turn reducing the chances that clients will ignore them.

#5: Not Communicating Well with Clients

The communication gap between you and your clients can again lead to misunderstandings and confusion.

To avoid this mistake, you must:

- Clearly state every minor detail in the invoice

- Be prompt to respond to any questions or concerns of the clients

- Follow up with reminders

Comprehensive invoicing software such as Invoicera can fill the communication gap with the most detailed invoice templates. Don’t let poor communication become a barrier to receiving prompt payments.

#6: Failing to Follow Up on Overdue Payments

Do you need to remind your clients about the payment due date? If yes, this can disturb your payments.

Considering that you are busy with multiple tasks, we have a solution. You can subscribe to any billing software that has an automated reminder feature. Again, Invoicera comes with this feature and never lets you miss any payment.

You can go on working on other essential tasks; Invoicera takes the headache of sending automated reminders to the clients.

This way, you can save time and focus on the priority tasks to grow your business.

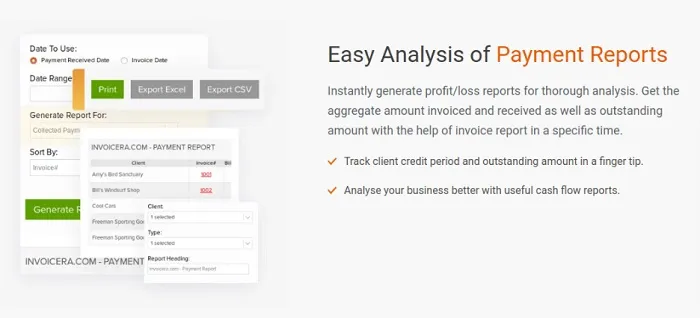

#7: Neglecting Invoice Record-Keeping or Tracking

When you send invoices to multiple clients, they need to be recorded, tracking, and analyzed so that you know the status of the payment. This could be a time-consuming task, and you might have to neglect other essential tasks in order to maintain the invoicing workflow.

Therefore, it makes sense to choose the right software that automatically records all the invoices sent.

With Invoicera, you can easily manage and track invoices. Moreover, it makes the process easier as you can view the payment status and history too.

How to Choose the Right Invoicing Software?

Finding the ideal invoicing software for your company’s needs can be overwhelming with all the alternatives available.

Let’s look at some crucial steps to consider when selecting invoicing software:

Step 1 – Assess Your Business Needs

You need to assess your particular business needs before investing in invoicing software. Consider aspects like how many bills you process monthly, how many clients you service, how complicated your invoicing is, and what integration features you want.

Key Features to Look for

You must check for features like recurring billing automation, multi-currency compatibility, and connectivity with payment gateways.

Step 2- Explore Software like Invoicera

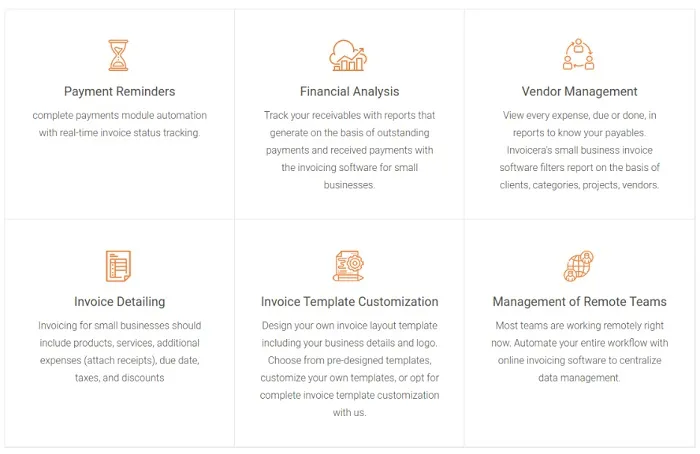

Powerful cloud-based invoicing software Invoicera has helped many enterprises all around the world. Let’s explore its distinguishing qualities:

- Customizable Invoice Templates: Invoicera has a wide selection of well-crafted, editable invoice templates that let you add your brand’s identity and keep your communications consistent.

- Automated Recurring Billing: Invoicera helps you manage frequent customer payments with less time and effort by automating recurring billing cycles.

- Multi-Currency Support: Invoicera, best for international businesses, provides multi-currency support, making it simple to invoice customers and collect payments in different currencies.

- Integrated Payment Gateways: With Invoicera, you can quickly integrate well-known payment gateways, allowing your customers to pay invoices and cutting down on the time it takes to process payments.

Step 3 – Make a Decision

Step 3 – Make a Decision

Revisit your business needs, budget, and the specific features that align with your goals and make a decision.

Selecting the right invoicing software is critical in streamlining your business operations and ensuring a healthy cash flow.

The appropriate invoicing software must be employed to optimize corporate processes and have a healthy cash flow. Therefore, before making a decision, it is crucial to take into account all of the aforementioned aspects.

Final Thoughts

Invoicing is the most critical aspect in running smooth cash flow in any business.

We are not saying that you are making every mistake mentioned here, but a single one can be enough to affect your cash flow.

The mistakes mentioned above and the robust solutions suggested could be a new chapter in maintaining the financial stability of your organization.

So, remember to follow the tips and streamline your invoicing process.

And try Invoicera, an all-in-one tool that will resolve all billing issues, whether mentioning accurate information, setting up reminders, or tracking the invoices.

FAQs

Q: How can I improve my invoicing to avoid inaccuracies?

Ensure to record all information precisely to prevent errors, including item descriptions, quantities, prices, and taxes. An automated invoicing system like Invoicera can automate the procedure and reduce human mistakes.

Q: How does Invoicera help in preventing late or delayed invoices?

Invoicera offers automated invoice scheduling and reminders to make sure that invoices are sent on time and that clients are informed of the dates by which payments are due. So, there are fewer risks of payments being late or delayed.

Q: What happens if I do not mention payment terms and conditions while invoicing?

Disagreements and strained client relationships may result from disregarding payment terms and conditions. Due to unmet expectations, clients can doubt your professionalism and put off or dispute payments.

Q: How can proper communication with clients improve invoicing efficiency?

Clear communication with clients assures agreement on the project’s details, payment procedures, and delivery dates. Maintaining a free flow of communication makes it easier to respond quickly to complaints and speeds up the resolution of disputes, improving the billing process’s efficiency.

Step 3 – Make a Decision

Step 3 – Make a Decision