Introduction

Have the tinted hours of manually overseeing your company’s invoices become your partner? Is it all about the paperwork that just causes confusion and lost payments, and how do we promptly keep up with the bills? If that is exactly your situation, then you aren’t alone too.

For small-sized enterprises, invoice management is a concern and consumes time and resources that can be dedicated to other important tasks but the company’s growth.

Surprisingly, there is research that suggests that small enterprises are occupied with about 120 work hours in the invoicing aspect each year.

This is a valuable period in which you would rather invest in client handling, product development, or entering new markets. Moreover, manual invoice procedures are open to mistakes, and those errors cause delays in payments and also create misunderstandings with clients.

But fear not, there’s a solution to this common problem: Invoicing software. With the appropriate tool, you can automate their invoice workflows, free up time on repetitive tasks, and get easy and timely payments while concentrating on growing the business’s core competencies.

This blog will discuss the points you should consider when choosing an invoicing tool. Moreover, the top 8 billing software for small businesses are also discussed with features that will help you choose the tool easily. Let’s dive in!

What Is An Invoice Management Software?

Invoice management software is a dedicated tool that helps simplify and automate billing, issuing, tracking, and paying invoices. It enables companies to digitize their invoicing workflows, instead of the exhaustive routine, by more efficient and precise automation.

Its major features are:

Invoice Generation: The program allows customers to design high-quality invoices in just a few minutes. It usually includes not only pre-existing templates but also customizable ones to suit the brand and specific needs of the business.

Automated Billing: Invoice management software utilizes billing process technology to assist in scheduling invoices to be sent to regular clients. It will save time and promote more efficient payments for recurring or subscription services.

Payment Tracking: Supplier management software facilitates tracking of the status of invoices with real-time updates on payments, whether received, pending, or overdue. This transparency will always let you know the state of your cash flow, and where you follow up with clients is up to you.

How Does It Benefit Your Small Business?

Time Savings: Through the automated invoicing process, businesses can spare many hours of manual work, which could be used for more constructive activities for their business growth.

Improved Cash Flow: Real-time tracking of invoices and payments enables companies to better manage their cash flow, identify late invoices, and follow up with clients quickly to pay invoices on time.

Reduced Errors: These hands-on invoicing processes often lead to mistakes, including incorrect amounts or vital data omissions. Invoice management software minimizes these errors through standardization of the invoicing process and automated calculations.

Enhanced Professionalism: Professional-looking invoices create an image of a company’s credibility and reliability. Invoice management software contains a wide choice of personalizable templates and branding, allowing businesses to design a sharp, branded invoice that will impress their clients.

Increased Efficiency: Automation helps run the invoicing workflow end to end, from invoice creation to payment tracking, without the burden of manually handling invoices.

Factors to Consider When Choosing Invoice Management Software

- Cost and Affordability: When determining the software’s pricing, consider the varied monthly payments, transactional fees, or advanced features that may cost extra. Settle for a solution that works within your price range without sacrificing vital functionality.

- Features and Functionality: What are the software’s features, like tailored invoices, auto billing service, track payment, and connection with other systems? Identify what features your business must have and pick solutions that meet those requirements so that you don’t have to go back looking for a new addition to your system.

- User-Friendliness: Select software that is friendly and simple to get along with. This will help your team start with little effort and a low learning curve. Sit down with the prospect to have the software demo or trial it. The way the software works may not be experienced, and if you are not convinced already, you won’t commit to the purchase yet.

- Customization and Scalability: Determine the software tool that will fit your business’s needs and growth plans. Make sure the software is scalable enough and able to handle growing volumes of invoices and transactions along with your business growth.

- Security and Compliance: Ensure that the application uses security measures commonly applied in the industry to protect confidential information about finance. Furthermore, ensure that the software abides by regulatory requirements, such as GDPR, if those apply to your business.

Top 10 Best Invoice Management Software

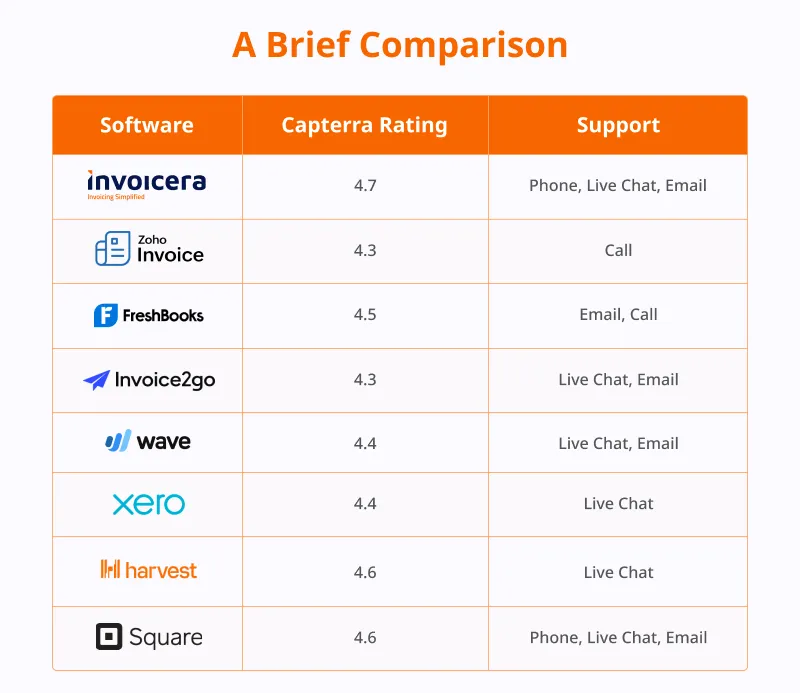

1. Invoicera

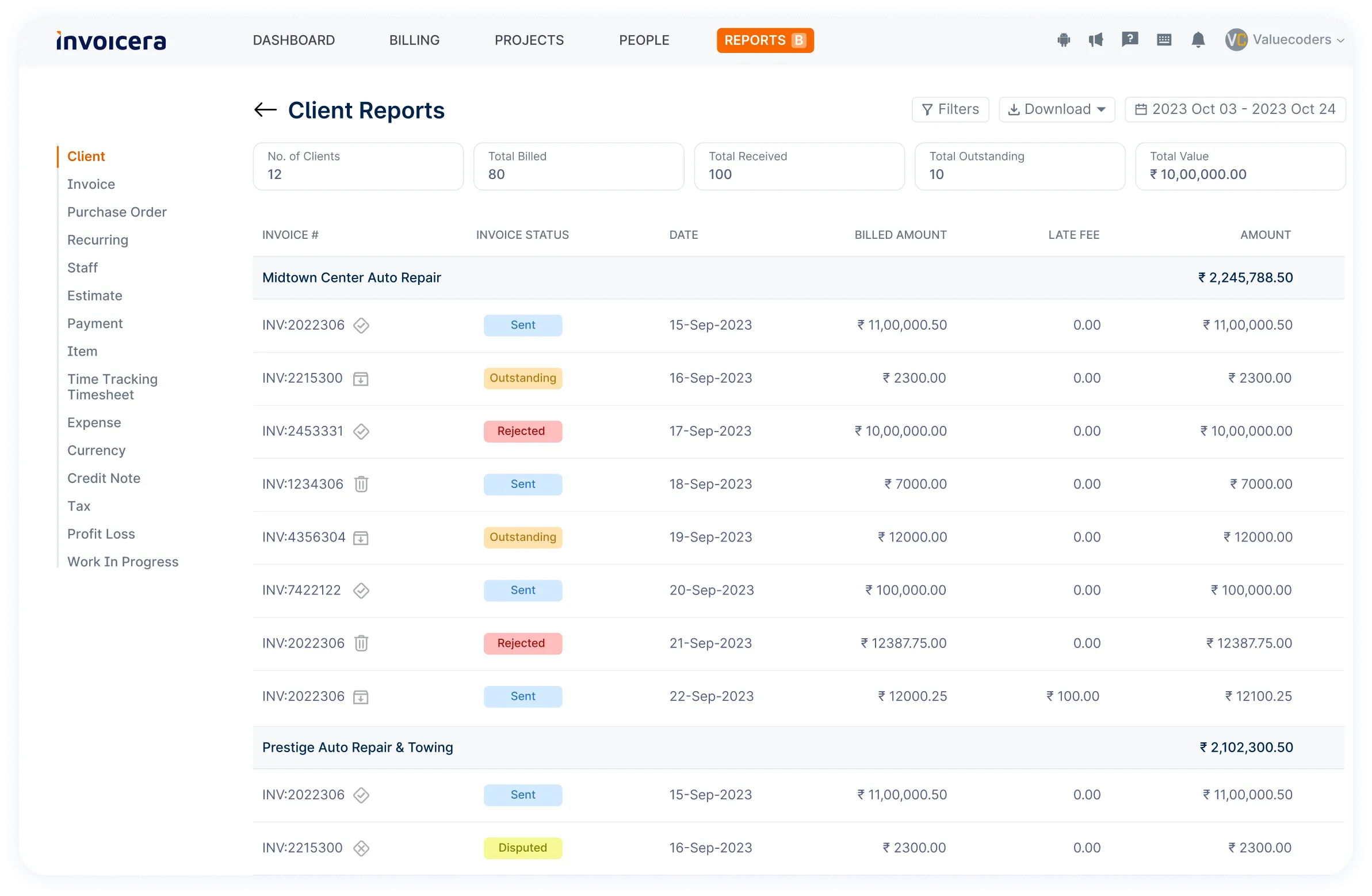

Based on multiple parameters, Invoicera is a comprehensive invoicing and billing solution that considers the special demands of small-scale businesses. The user-friendly interface and the features like sending automated invoices make it the best software. Through Invoicera, invoices can be ideally designed to be professionally appealing and customizable in 15+ different languages. Your clients will appreciate a seamless experience.

Invoicera synchronizes with the most modern accounting software, such as QuickBooks, bringing about seamless traffic of financial records and making obsolete the need for manual data entry. It also allows online payments through 14+ payment gateways, making the payment process easy and safe for your customers. Moreover, it offers Android and iOS apps that operate excellently – this feature will not hinder your billing management on the go.

Invoicera pricing starts at $19/month for the basic plan. You can also get custom pricing by talking to our salesperson.

2. Zoho Invoice

The Zoho Invoice is a full invoicing solution for small businesses that makes creating and sending invoices and bills easy. It provides convenient tools to constantly improve your invoicing process smoothly. You can issue invoices and estimates that can be branded correctly and have a professional look and feel.

It includes features like automatic payment reminders and offers online integration with popular payment gateways. With Zoho Invoice, you can access the inventory management system, where you can control stock, manage orders, and handle inventory from multiple locations on one platform.

Besides, Zoho Invoice synchronizes very well with other Zoho apps like Zoho Booking and Zoho CRM for accounting and customer relationship management, where you can perform all the necessary operations from one platform. Powerful analytics tools and real-time reporting allow you to keep track of your financial performance. Therefore, you can reach conclusions based on the data, which will help you to make well-considered decisions.

Zoho Books offers a range of pricing, starting with a free tier for one user and one accountant, Standard at $15/month, Professional at $39/month, Premium at $79/month, and a free trial.

The Elite version comes for $239/month.

3. Freshbooks

FreshBooks provides simplified invoicing and accounting software mainly for small businesses and the self-employed. The application is very easy to use because of its simple interface and full range of features. For this reason, it is ideal to manage your invoicing and billing processes well.

It helps to create professional, customizable invoices in a few minutes only. This makes your brand image worth a shot. The software provides automated invoices, recurring billing, and online payment portals and sends late payment reminders, making the payment process prompt and smooth.

FreshBooks enables you to have time-tracking facilities, through which you will be able to easily track your billable hours and expenses to avoid any over or undercharged situations on the invoice and the project.

Lite starts at $7.60 per month, Plus is priced at $13.20 monthly, and Premium, tailored for growing businesses, begins at $24.00 monthly. The selected plan comes with custom pricing options.

4. Invoice2go

Invoice2go is a mobile-first billing software for small businesses and freelancers. Its “easy to use” interface and “all in one” functionality are perfect for keeping your invoices under control wherever you are.

Considering Invoice2go, you can make professional invoices customizable from your mobile, and wherever you are, you will get all invoice options. The software enables the dispatch of recurring invoices, automatic billing reminders, and integration with payment gateways such as PayPal to allow all the payments to be collected on time and in a simple manner.

Invoice2go further includes tools for inventory management as it lets you control stock levels, input purchase orders, and track stocks in different locations. Besides this, it offers comprehensive reporting and analytics tools, which allow you to draw intelligent conclusions about your business metrics right from where you are.

You can take advantage of a free trial to test the software. Paid plans start at $5.99 per month, with options for Professional at $9.99/month and Premium at $39.99/month.

5. Wave

Wave is free accounting and invoicing software tailored to meet the needs of small business owners and solopreneurs. It has it all, no matter whether it is unlimited invoices and receipt scanning or the affordable price and accuracy of these features.

With a simple click, customers can write invoices, estimates, and receipts in a couple of seconds, and they can automate recurring bill collection. Wave app, which gives you the power to send auto-payment reminders to your customers, also helps you keep an eye on invoices and payment status, which, in the end, results in effective tracking.

The same also allows you to speed up the payment settlements with credit cards within two days.

Wave is cost-free, which gives it an edge in the market for small businesses and freelancers looking for software that will enable them to conveniently perform their financial duties without additional costs.

6. Xero

Xero is closely connected with accounting, bookkeeping, and payroll issues, the most significant on the list of business specialties. Small business owners who rely heavily on automation can speed up the most routine daily tasks like sending invoice notifications, harassing late payments, and bank reconciliation can save valuable time.

Xero, one of the cloud-based software programs, allows you to reach/access/gain your financial information remotely, anytime, anywhere, on any connected devices. It allows for remote collaborations and delivers financial information from time to time.

Also, it allows you to tailor your plans based on the place and features, such as project management and inventory tracking, which can be added as your business expands.

Xero, in particular, is the best choice for freelancers, fresh startups, and small businesses focused on simplicity and ease of use for managing accounting and invoicing.

7. Harvest

Harvest does not only confine to invoicing. It is also an efficient way of time-tracking and billing. Thanks to its intuitive connectivity, Harvest can convert billable hours into professional invoices without any hassle. Its user-friendly interface and analytical tools give you much-needed insight into your profitability, thus making it a perfect choice for freelancers and businesses.

Users can manage invoicing, time tracking, expenses, and projects on one platform. Harvest you to click on invoices, see how clients view them, and have a smooth billing experience. It also provides Stripe and PayPal integrations for easy client transactions and automatic payment reminders to ensure the project runs on schedule.

Harvest’s $10.80 per user per month makes it a suitable option even for small-sized companies.

8. Square Invoices

Square Invoices also comes under the best invoicing software, especially for freelancers and smaller businesses. Its strongest point remains its ease of use. Square Invoices’ most significant advantage is the fact that it has a free plan that offers unlimited invoices and estimates.

No processing fee is due from you as long as your customers continue to pay online via Square (only 2.9% + $0.30 is charged).

The Square Invoices application is mobile-compatible, and you can deal with all your invoices and payments from the phone via an easy app. Square Invoices easily slots into place, enabling you to oversee everything from one central interface.

Whatsoever the free plan provides, the paid plans from $20 per month onwards offer advanced features like recurring invoices, customer portals, and inventory management.

Square Invoices is designed for freelancers, solopreneurs, and small business owners who require a straightforward and cheap invoicing approach.

9. Field Promax

Field Promax provides an innovative invoicing solution designed specifically for field service businesses. This software makes the billing process effortless by making invoice creation effortless – directly from job details! With Field Promax you can generate professional, branded invoices instantly!

Automatic reminders ensure timely payments with real-time invoice tracking allowing for real visibility into all invoice statuses, so you know when an invoice has been viewed or paid for.

Field Promax’s mobile interface enables you to easily create and manage invoices anywhere with access to an internet connection. Integration with QuickBooks/Xero ensures seamless sync-ing of invoices/payments/dunning notifications/error correction. This saves both time and prevents costly mistakes from being committed when creating and processing payments/invoices manually.

Field Promax provides a free trial so you can explore its invoicing capabilities, with flexible pricing plans designed to fit the unique requirements of your business. Invoicing will no longer be an obstacle preventing growth; with Field Promax’s hassle-free invoicing solutions you can focus on expanding it instead.

Invoicera’s Bonus Features For Small Businesses

In addition to its core invoicing capabilities, Invoicera offers several bonus features tailored to the needs of small businesses:

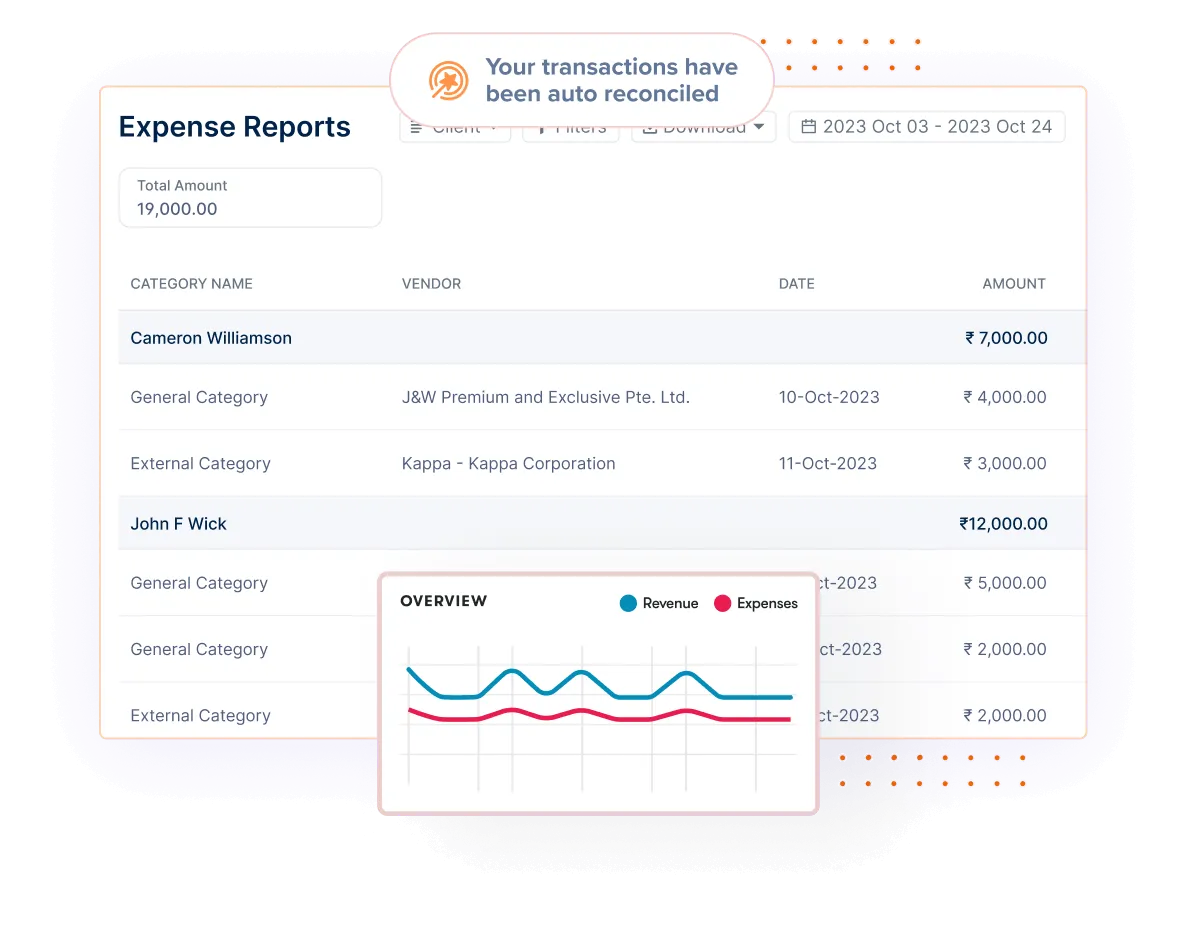

- Expense Tracking: You can easily keep tabs and sort your costs to have up-to-date information and simplified expense management processes.

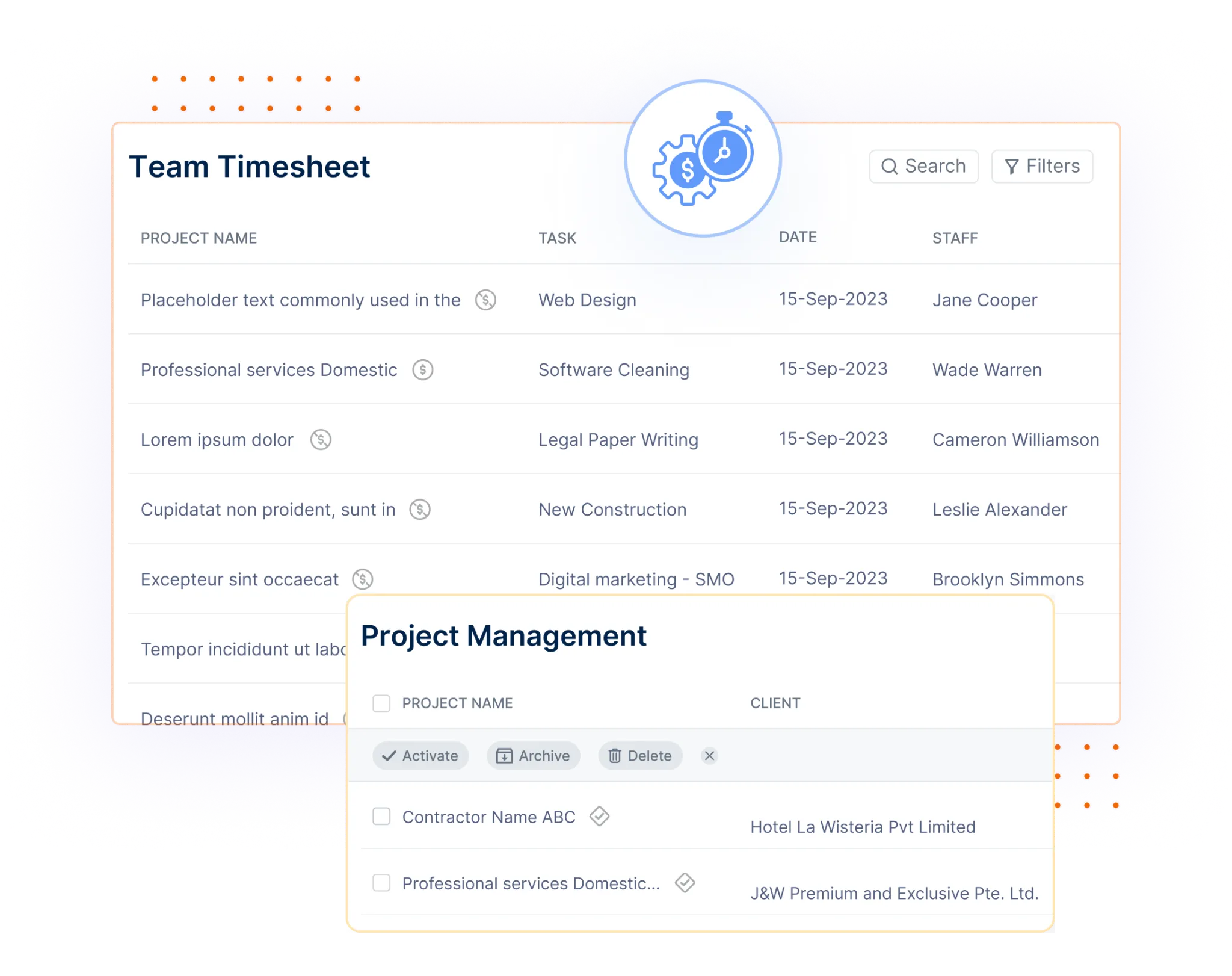

- Time Tracking: You can track the billable hours and ensure the time is spent adequately and invoices are prepared correctly to manage projects effectively.

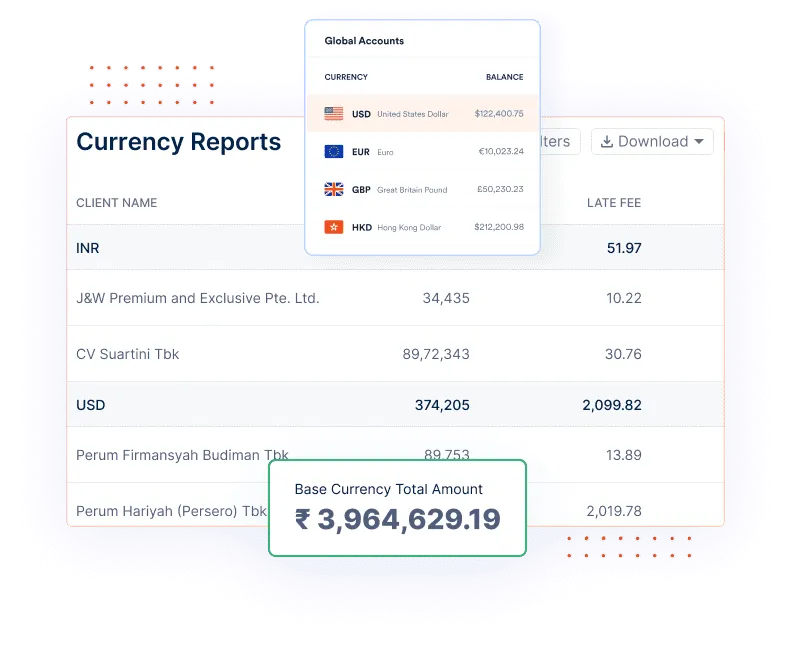

- Customizable Reports: With Invoicera, you can render detailed reports on invoicing, expenses, and project performance to obtain information on the business’s financial welfare and make strategic Multicurrency

- it-Currency Support: Transacting wormulticurrencyulticurrency support means that clients can be billed in their respective currencies, and people doing business internationally will find their daily routines simplified.

- Client Portal: With the help of a secure portal, the client can see invoices, check project progress, and connect with his team to reach ultimate customer satisfaction and transparency.

How To Implement Invoice Management Software?

Implementing invoice management software in your small business involves several key steps:

- Research and Select: Match up choices by comparing features, price, and user view to find the one that suits you best.

- Sign Up and Onboard: Sign up for the targeted software and learn how to use its interface via created training videos or manuals.

- Customize Settings: Personalize the software according to your unique requirements, such as invoicing templates, preferred payment terms, and alert notifications.

- Import Data: Transfer the customer data, product/service data, and available outstanding invoices to ensure a smooth transition.

- Train Employees: Train the team on the proper methods of using the software for invoice creation, tracking payments, and report generation tasks.

- Integrate with Existing Systems: Connect the software to existing accounting, CRM, and other programs to streamline operations.

- Monitor and Optimize: Evaluate and analyze the efficiency of current software solutions often, making the necessary adjustments to improve effectiveness and meet business needs.

Final Thoughts

Adapting the right invoice management software helps you get rid of time-consuming billing. The optimal invoicing platform automates laborious manual work, optimizes for fewer mistakes, and gives visibility into the cash flow. It results in getting back the misplaced time and resources.

The variety of choices is indeed abundant. However, evaluating your business needs, budget, and growth plans is essential when choosing software that will support your long-term goals. Solutions providers such as Invoicera, Zoho Invoice, and FreshBooks come with a full set of features that are finely tuned to suit the needs of small and medium-sized companies.

Whether you decide for or against it, incorporating invoice management software is a wise investment that automatically brings the company to order. By choosing the appropriate software, manual invoicing becomes a nightmare that no longer exists.

In summary, allocate the necessary time framework to investigate the different choices, make the most of the free trials, and use the services of your colleagues or other professional persons. Finally, the proper invoice management software will promote your small business relative to efficiency, income, and customer satisfaction.

FAQs

How secure is invoice management software for handling sensitive financial data?

Look for software like Invoicera that uses encryption, secure cloud storage, role-based access controls, and other best security practices to protect your financial data. Check if they are compliant with relevant data privacy regulations. Invoicera is GDPR compliant.

Can invoice software integrate with my existing accounting/ERP system?

Most reputable invoice software like Invoicera provides integrations or API connections to sync data with popular accounting software and ERP systems. Check their list of pre-built integrations during evaluation.

How difficult is the implementation and user training process of any invoicing software?

Leading solutions provide resources like knowledge bases, training videos, and professional services to smooth onboarding. Check their implementation approach, training assets, and customer support channels.

Can the invoicing software support multi-currency and multi-lingual requirements?

If you have an international client base, ensure the software supports invoicing in 125+ currencies and 15+ languages. This becomes critical for expanding businesses.