Introduction

Are you finding it difficult to get prompt payments for the services offered to clients? Or are you sick of overdue invoices and wondering if there is any secret to a faster paycheck?

If yes, you need to learn the art of effective invoicing, eventually changing the whole game of managing business finances.

A study by MarketInvoice says 71% of SMEs face late payment issues that ultimately lead to financial strain and operational hiccups.

But you need not worry as we unravel the invoicing best practices with proven results. We’ll also explore the digital revolution’s impact on invoicing and how automated systems like Invoicera can improve the whole process.

Get ready to unlock the secrets to faster payments and embark on a path to financial success. Are you ready to start your invoicing game? Let’s dive in!

Importance Of Effective Invoicing

We bet you are now wondering how well the invoicing process can work towards boosting your cash flow.

To run your business in the right manner, smooth invoicing is a vital parameter and helps in timely payment collection.

It can be so easy to scale your business up, provided you understand the invoicing at a level of detail.

Furthermore, it provides positively to your business networking with clients and peers at a professional level.

The rather, by sorting and keeping your financial transactions in check, you can easily monitor your revenue & expense structure.

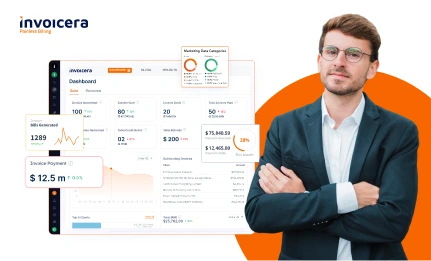

Automating Invoicing Process With Invoicera Features

With a suite of features specially designed to improve the overall billing process, Invoicera is a choice for more than 4 million users. Let’s explore its features that can change the way you manage your invoices.

1. Customizable Invoice Templates

The first impression is important and a well-designed invoice is able to cast a good image in the client’s mind. Invoicera provides customizable invoice templates that help you to tailor the look and style of your invoices according to your business requirements.

Your invoice will become your marketing tool where you can add your company logo, colors and any relevant details to help build your brand identity.

2. Recurring Invoices

Building invoices for the second-by-second delivery of services for the same recurring services or products can be time-consuming for businesses. From the auto-generated and automated invoice feature of Invoicera, you can set up how often each invoice is scheduled to be sent by putting the frequency at a specific interval.

This actually means that you save time for your invoicing schedule but also gives you a high level of consistency in your invoices.

3. Automated Payment Reminders

Late payments will disrupt your cash flow cycle, and you may find it hard to run your business normally when that happens. Invoicera system resolves this problem alongside our automated payment reminder features, which send gentle reminders to clients before and after the due date.

These reminders are simply polite alerts that urge you to settle payment obligations as soon as possible.

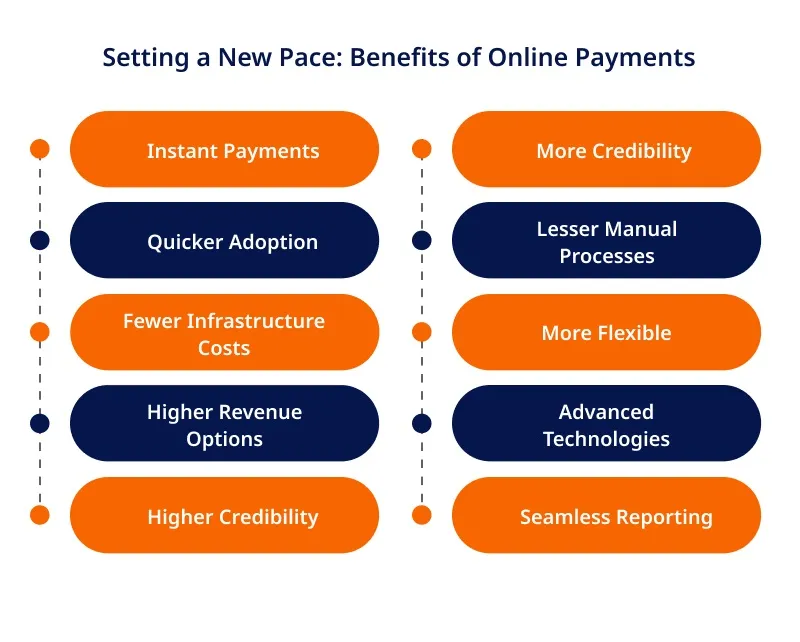

4. Integration with Payment Gateways

Invoicera eases the payment process through the use of integrated payment gateways, so users can add any payment gateway necessary without problems. Integrating the payments feature means that your customers may now pay directly from your invoice using methods of their choice.

This facility can be taken advantage of by the service, thereby improving the payment processing period instantly.

Best Practices for Creating Invoices That Get Paid Faster:

1. Be Clear And Concise: However, during invoice generation, an exemplary clarity approach is necessary. Describe the goods or service in terse terms and specific and compatible dates and numbers.

The more you make the invoice more transparent for your client, the more time he/she will save on its examination and approval.

2. Set Clear Payment Terms: The payment terms may vary depending on the type of business you are running. Hence, you need to make sure that they are transparent and well-explained. Make the date that payment is due highlighted on the invoice, and additionally specify what the penalty will be if payment is made late.

Being specific on expectations, in the beginning, develops the mentality of customers to pay their dues first.

3. Use Professional Invoice Templates: Professional invoice templates are worth investing in not only for trustability but also for simplification of line items and invoicing the entire business.

Online platforms provide a wide range of ready-to-use templates that you can customize to fit your brand while making sure that the important details of events are clearly visible.

4. Offer Convenient Payment Methods: Provide a wide range of payment services to suit your client’s requirements. Use our artificial intelligence (AI) writing assistant to unlock your full potential as a writer. In contrast to the manner of bank transfers, take into account deal making through online payment gateways, mobile payment systems, and credit cards.

5. Send Invoices Promptly: Often, timing is essential for billing: it determines if the bill is paid timely. Therefore, your bills must arrive as soon as the work is done or the product is supplied. By the timely invoice of the prompt, the payments could be made as quickly.

6. Follow Up On Overdue Invoices: Don’t hesitate to follow up on overdue payments. Sometimes, clients might simply overlook an invoice amidst their responsibilities. A polite yet assertive reminder can jog their memory and prompt them to settle their outstanding balance.

Tips For Following Up On Late Payments

Delay payments almost become a common issue for businesses, but the way you do is going to decide whether the relationship with the customer is hampered or the balance sheet has a different ending.

Here’s how you can master the art of following up on late payments:

1. Be Prompt

As the debt goes overdue, the quick response should result in immediate actions follows. Make a friendly phone call or send a polite email to the client, gently reminding him/her to cast this vote.

Punctuality reveals that you are on time with your payments, and the customer may be forced to sit on the go to make the payment to finish.

2. Personalize Your Communication

Avoid generic, automated reminders. Reference specific details about the project, the services provided, and the due date.

Personalization demonstrates that you value the business relationship and are genuinely engaged.

3. Stay Polite And Professional

Late payments can be frustrating, but maintaining a calm and professional tone in your communications becomes vital.

Avoid sounding aggressive or confrontational, as this could strain your relationship with the client.

4. Offer Assistance Or Payment Solutions

Sometimes, clients might be facing their own financial challenges. Instead of immediately demanding payment, offer assistance.

Discuss potential payment plans or alternative arrangements to make settling the dues easier for the client.

5. Follow Up Regularly

If your initial reminder doesn’t yield results, feel free to follow up regularly.

Politely remind the client about the outstanding payment and any agreed-upon solutions. Persistence can often lead to a resolution.

6. Escalate If Necessary

Consider escalating the matter if all your efforts fail and the payment remains overdue. This could involve sending a formal demand letter or involving a collection agency.

While it’s a step you’d prefer to avoid, protecting your business interests is sometimes necessary.

Bonus Tips to Improve Payment Processes and Cash Flow

Offer Early Payment Incentives

Sometimes, a little motivation can go a long way in expediting payments. Consider offering early payment incentives to your clients.

Discounts or other perks for settling their invoices ahead of schedule can encourage them to prioritize your invoice over others. This can significantly reduce the time you take to receive your funds.

Implement A Late Payment Policy

Though you expect punctual payments, it makes sense for you to be ready to encounter a possible situation whereby payments are delayed.

Developing a sound late payment policy is an excellent way of drawing clear lines for your clients and is a strong tool to emphasize the significance of honoring receipt deadlines.

Ensure that you disclose the consequences, including referral to the debt collection bureau if the clients choose to pay later than their bills fall due.

Improve Communication With Clients

In order to keep a strong bond with your clients, you have to stay completely honest and transparent with the communication event.

It is imperative that you continuously update the customers about the invoice status. Make sure that customers have adequate knowledge about the payment steps and clear out all of their concerns.

This proactive approach demonstrates professionalism and minimizes misunderstandings that could lead to payment delays.

Conduct Regular Cash Flow Analysis

A thorough understanding of your business’s cash flow patterns is essential for effective invoicing. Regularly analyze your cash flow to identify trends and potential areas of improvement.

This analysis will empower you to adjust your invoicing strategy according to your business’s financial needs.

Utilize Cash Flow Forecasting Tools

The cash flow forecasting tool means a lot in money management as it helps you to watch your money keenly.

These tools bring this data into future cash flow projections taking into consideration the pattern data from the past and the projected routine activities of the business.

This helps to identify the high and low periods of cash flow this way, you can adjust your inviting schedules, aiming in advance to maintain financial pressures.

Negotiate Favourable Payment Terms With Suppliers

Just as you focus on how efficient your payments are to your clients, you need to look at different ways for you to enhance your payment terms as well.

Growing your “carrot or stick” in terms of longer payment terms or early settlement discounts is a strong point to ease your cash flow and structural stability.

Final Thoughts

The mastering of the skill behind top-notch invoicing is just what any business or freelancer needs to ensure their cash-flow is good and the money comes in on time.

The tips reviewed in this blog post have the high ability to increase the speed of payment and ensure positive client relationships with your company.

Recall, invoicing is not only the run of the mill administration work; instead, it plays an important part in your overall business strategy.

Detailed, fancy free and accurate invoices reflect professionalism and also help in gaining customers trust hence they will be more likely to arrange your bills first.

Frequently Asked Questions

What details should I include in an invoice?

You must include these details:

- Your contact information

- Client’s contact information

- Invoice number

- List of products or services offered

- Quantity and unit price

- Total amount owed

- Payment conditions and alternatives

Why are payment terms important to mention in an invoice?

Payment terms specify the period within which the client should make the payment. They are essential as they set clear expectations for both parties and help prevent payment delays. Common terms include “Net 30” (payment due within 30 days) or “Due on receipt” (payment due immediately).

How often should I send invoices?

The frequency of sending invoices depends on your business model. For ongoing services, you might send invoices monthly. For one-time projects, send the invoice as soon as the work completes or the product is delivered.