This article has been written in light of the recently agreed EU-UK trade deal of 2020. It contains complete information and its impacts on businesses in and around the UK.

Brexit has certainly dropped from the radar of most people in the UK. The recent YouGov poll revealed that in January only 34% of respondents found Brexit as an important issue facing the country in January 2021. Whereas almost twice more respondents felt its importance in December 2020. But for businesses, adapting to changes post Brexit is still a challenge. The case seems to be critical in coming years too as both, EU and UK are implementing new legislation and cooperative technologies.

Starting January 2021, businesses also started gripping over the Trade and Cooperation Agreement(TCA) announced before Christmas 2020, along with the EU-UK agreement. The free trade agreement is also referred to as a trade deal in generic terms.

Today we will attempt to outline points and answer the most commonly asked questions related to Brexit. We will particularly address queries related to VAT and customs, and other major adaptations businesses need to adapt now with Brexit.

The goal is to aid you in your further transformational process in your organization. But, this article cannot be substituted for any legal or specific advice by the government.

You might find a reference to Great Britain quite often. Please note, it comprises England, Wales, and Scotland. Not the same as the UK because it does not include strategies and implications of Northern Ireland. The necessary trade implications in Northern Ireland are different as compared to Great Britain.

Find Answers to the Following Questions here:

1. What is Brexit?

On 23rd June 2016, in a referendum, the UK electorate voted to leave the European Union. From that period the transition began that finally ended on 31st December 2020. The outcome of this particular transition is that Great Britain is no longer a member of any of the EU’s market and customs union.

It will now enable state members of the EU to function as a sole trading area with no border checks or tariffs, little to no requirement of export/import documentation, and a combined VAT system. From now on, Great Britain will have custom borders with the European Union. They will now be operating from cross locations such as Dover and Holyhead, with a separate VAT system.

Just before the final transition, both, UK and EU agreed on 100% preferential treatment. This means that no custom tariffs and no quota will be applicable. However, there will be a requirement for customs documentation, along with a changed VAT accounting requirement.

Please note, according to Nothern Ireland protocol, NI will still remain part of EU customs for goods. There will still be a free flow of goods between the UK and NI with conditions applied.

2. How will Brexit affect trade and your business?

Industries other than farming and medical research, businesses will have to revise the following areas of their activities:

- Export and import from EU countries, including VAT payments and refunds.

- Exports and imports from NI will have their own rules

- State aid with block exemptions and grants

- Change in transportation and logistics, including fulfilment.

- Change in copyright, patents, and copyright.

- Industrial standards for the environment including emissions.

3. What will be the preferential tariff rates post Brexit?

It could have been possible that custom duties were applied to every import in Great Britain. And even custom duties could have been applied to all the exports from the UK, post they arrive at their destination in Europe.

To avoid this situation, both, EU-UK agreed on a free trade agreement in December 2020. In this, both the parties agreed that goods that moved freely during the membership of the UK will continue to move freely with a 0% tariff and will not be restricted by quotas.

This is also referred to as preferential treatment and symbolizes that there will be no restriction on goods and quantity of goods imported and exported between the EU and UK.

But, this comes with Brexit’s trade deal rule of origin. Goods can still be imported or exported without meeting the guidelines of this rule but then World Trade Organization’s Most Favoured Nation (MFN) rules apply. This implies that goods coming into the UK might have custom duties applied as per UK global tariff.

And, goods exported from the UK to the EU will have common external tariffs applied under the same circumstances. The quantity might also be limited to traded goods.

Also Read- Benefits of Efficient Online Invoicing for Small Businesses

4. How can you import from the EU post Brexit?

Importing goods from the EU to Great Britain will change considerably now. Post-Brexit and the end of the transition era, there will now be customs and VAT considerations.

For customs, you will require the following for importing goods from the European countries.

- Firstly, you must have an EORI number starting with GB. if you want to make declarations of your customs or receive custom decisions in an EU country as well, you need to apply for an EORI number there as well.

- It will be mandatory for you to know the classification, origin, and custom value of goods. This will also hold importance when you have to claim your preferential rate of duty.

- You should be aware of the goods are controlled, or excise duty is applied to them with customs because with controlled goods delayed declarations will not be possible.

- From 1st April 2021, there will be additional rules applied on animal origin products, plants or plant products. Therefore, submit your documents before that.

- You will have to declare your goods when they enter Great Britain.

5. How will you export to the EU post Brexit?

To export goods to the UK, from January 2021, the rules will be similar to those used in exports to other non-EU countries. But as you need EORI for imports, businesses that trade will EU countries will now need to make customs declarations. Again here, you can choose a UK-based freight forwarder or parcel forwarder to ease out administrative requirements for you.

Along with this, some goods will also require certificates and export licenses.

The simplified declaration process: this means you need to provide some documents instead of all documents for pre-shipment advice declaration.

Declarant’s records entry: you can also make an entry in your records, but it is only limited to goods that do not come under the category of pre-departure declaration. In this case, you will need to submit a C2 form through the National Export System.

In any of these cases, it is mandatory to share your customs export information after 14 days as a supplementary declaration.

For an easy declaration, you will have to be authorized by HMRC and registered to use the national export system.

Finally,

While now Brexit has become less concerning for common people in Great Britain, Its impact on businesses has started coming into existence from January 2021. Slowly the mandates are changing and coming to power and you as a business owner need to make amendments and even bear some extra costs.

It is difficult to understand every change, with Brexit, in one go. But, we have tried to resolve the top 5 queries for you. If you want to know more, comment below.

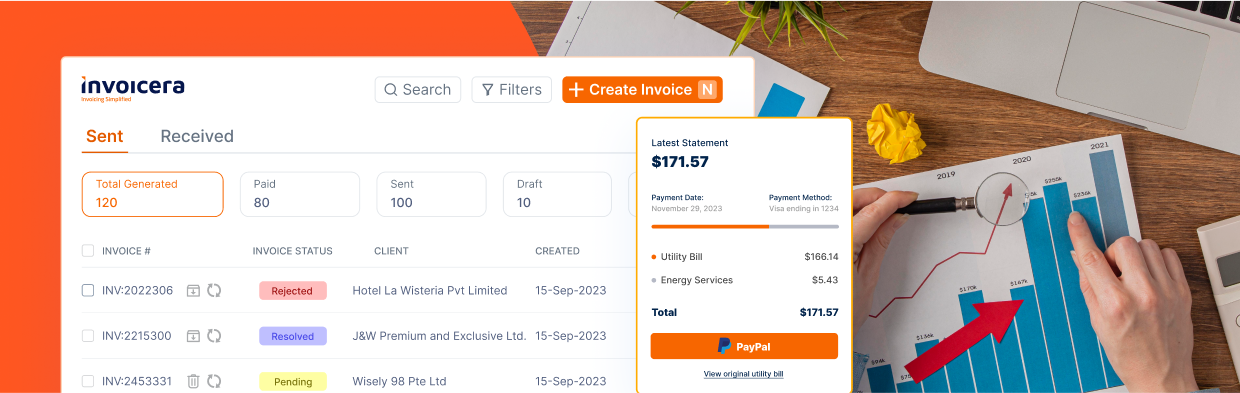

Invoicera has digitized your invoicing process and We have also worked to inculcate new changes in the software. Customize and add columns in your invoices as per your business needs. Save your records in clouds and even access them on the go with mobile invoicing software. Everything is easy, seamless, and clear.

Signup for free now.