Have you ever wondered how much businesses spend annually on outdated financial tracking methods?

According to recent statistics, inefficient expense management costs businesses 5-10% of their annual budgets.

This emphasizes the critical need for advanced financial planning tools.

Financial tracking software has evolved significantly, offering businesses many options tailored to their specific needs. From simplified cost control software to detailed budget management systems, the market is full of solutions to empower businesses in their financial endeavors.

In the words of a renowned financial expert, ‘Effective expense management isn’t just about cutting costs; it’s about optimizing resources and making informed financial decisions.’

These tools aren’t just about handling costs; they help businesses succeed.

We’ll explore the best business budgeting tools of 2025, their functionalities, user-friendliness, and the value they bring to financial planning.

- Do these tools make a difference?

- How do they simplify complex budgeting tasks?

We’ll explore these questions as we navigate through the top-notch expense management software available in the market.

What Is A Business Budgeting Software?

A small business budgeting software streamlines and enhances the budgeting process, cutting down significantly on the time and manual effort required by finance teams. The specific areas needing optimization can vary based on how your finance team and employees function.

However, irrespective of your company’s size, top-notch budgeting software should encompass key features:

- Real-time expense tracking: Continuous monitoring of budgets in real-time ensures a constant grasp on available funds and expenditures. This prevents businesses from going into financial trouble and provides deeper insights into employee spending habits, allowing for the optimization of expenses.

- User-friendly interface: The analysis of budget reports should be a straightforward task. Often, more than just the finance teams need access to company financial records. Hence, having a comprehensive yet easily understandable overview of spending and budgets is vital to facilitate efficient collaboration among various teams.

- Automation of processes: By streamlining slow manual tasks and removing repetitions, businesses can save substantial time and money while improving overall productivity. Retrieving hours or even days means that finance teams can redirect their focus toward more profitable tasks.

- Cloud-based data: Relying on paperwork or separate spreadsheet files severely limits business growth. Numerous online corporate budgeting software solutions enable access to business finances on the go, whether in the office or on a business trip. Cloud-based software ensures freedom from concerns about losing or misplacing physical documents.

How does budgeting software benefit your business?

Implementing cost control software or budget management software can significantly benefit your business in several ways:

Enhanced Expense Management: Such software automates and simplifies the process of tracking expenses, allowing for more accurate and efficient financial record-keeping.

Improved Financial Planning: By utilizing these tools, businesses can create comprehensive budgets, forecasts, and financial plans, enabling better decision-making and goal-setting.

Real-Time Insights: Financial tracking software provides real-time data and analytics, empowering businesses to make informed and timely financial decisions.

Increased Efficiency: These systems streamline workflows and eliminate manual processes, saving time and resources that can be allocated to other critical aspects of the business.

Cost Savings: Effective expense management software helps identify areas of overspending or inefficiency, enabling businesses to make necessary adjustments and control costs effectively.

10 Best Business Budgeting Tools Of 2025

Discover the top 10 business budgeting tools of 2025 that promise to streamline financial processes and empower companies to navigate their fiscal landscapes with precision and ease.

1. Invoicera

Invoicera stands out for its comprehensive approach, integrating robust budgeting tools with invoicing features. It simplifies financial management by offering a seamless experience for tracking expenses and managing budgets alongside invoicing clients.

| Features | Pricing | Pros | Cons |

|

|

|

|

2. Sage

Known for its reliability and versatility, Sage offers a range of budgeting solutions tailored to businesses of various sizes.

Its strength lies in detailed financial planning, allowing businesses to create precise budgets while providing insightful reporting for better decision-making.

| Features | Pricing | Pros | Cons |

|

|

|

|

3. Freshbooks

Freshbooks excels in user-friendly budgeting tools, catering exceptionally well to freelancers and small businesses.

It provides intuitive features for expense tracking, budget setting, and financial reporting, making it an ideal choice for those seeking simplicity without compromising functionality.

| Features | Pricing | Pros | Cons |

|

|

|

|

4. Xero

Known as a cloud-based accounting software, Xero also offers effective budgeting features.

It’s renowned for its ease of use and real-time financial insights, enabling businesses to set, monitor, and adjust budgets seamlessly while maintaining accurate records.

| Features | Pricing | Pros | Cons |

|

|

|

|

5. Zoho Books

Zoho Books is a comprehensive accounting suite that includes robust budgeting features. Its strength lies in its user-friendly interface and the ability to streamline budget creation and monitoring.

It could be an excellent choice for businesses seeking simplicity without sacrificing functionality.

| Features | Pricing | Pros | Cons |

|

|

|

|

6. Wave

Wave offers free accounting and enterprise budgeting software, making it an attractive option for startups and small businesses.

Its intuitive interface and basic budgeting tools provide a solid foundation for managing finances without the burden of subscription fees.

| Features | Pricing | Pros | Cons |

|

|

|

|

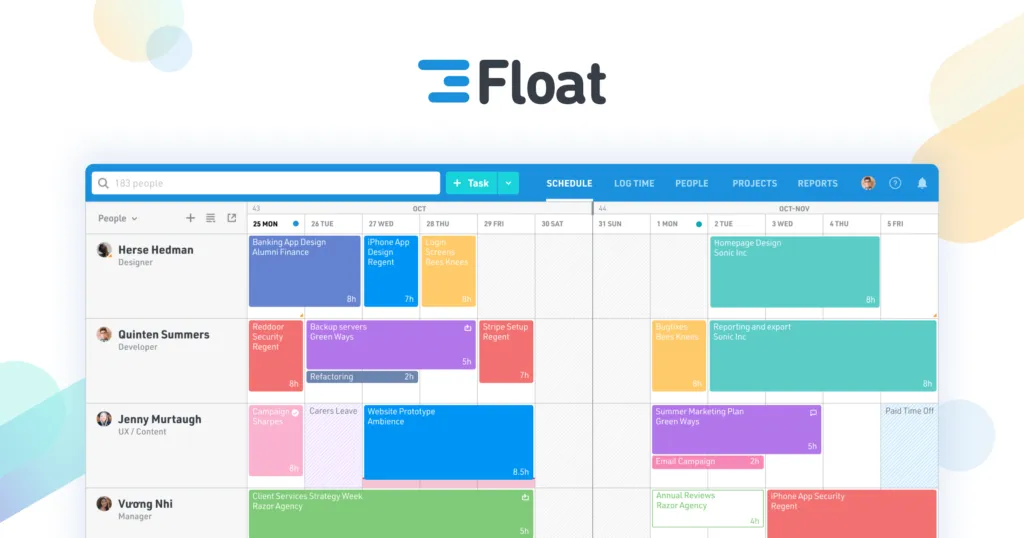

7. Float

Float specializes in cash flow forecasting and budget management, providing businesses with accurate predictions and insights into future financial trends.

Its visual interface and proactive approach to budgeting make it a valuable asset for businesses aiming to stay ahead financially.

| Features | Pricing | Pros | Cons |

|

● Set limits, track expenses, and gain performance insights ● Integrates financial data from diverse sources ● Create multiple financial scenarios to forecast outcomes ● Generates detailed, insightful reports on budget performance

|

|

● Quick and responsive interface with easy filtering ● Search/filter abilities |

● No way of actually tracking time spent ● Lacks desktop app |

8. Centage

Centage stands out for its focus on intelligent budgeting solutions using AI-driven analytics.

It offers dynamic budgeting tools that adapt to changing business scenarios, providing accurate forecasts and recommendations for optimal financial planning.

| Features | Pricing | Pros | Cons |

|

● Integration with various third-party tools and apps ● Handling intricate budgeting, forecasting, and financial planning ● Simple-to-use analytics tools for generating valuable reports

|

|

● Easy-to-use ● Secure and robust ● Good customer support

|

● Difficult to set up for the first time ● Features are limited |

9. Spendesk

Spendesk offers a modern approach to expense management and budget control.

It integrates expense tracking, approvals, and budget oversight, providing businesses with a centralized solution for managing spending efficiently.

| Features | Pricing | Pros | Cons |

|

● 360-degree visibility consolidates all expenses ● Effortless collaboration invites team members and assigns budgets ● Receipt capture simplifies invoice uploading and reading ● Integrated credit cards streamline expense management |

● There is a free plan for four users. ● For Plus plans, you can contact their sales team. |

● Simple to utilize and configure ● Seamless integration with various tools ● Robust automation functionalities |

● Auto-filing feature lacks smoothness ● Validation and approval of documents are time-consuming ● Restricted range of functionalities |

10. Prophix

Prophix is a robust financial planning and budgeting software designed for midsize to large enterprises.

Its comprehensive features, including scenario modeling and advanced analytics, empower businesses to create accurate budgets and make informed strategic decisions.

| Features | Pricing | Pros | Cons |

|

● Proficient in intricate financial reporting and analytics ● Sleek interface presenting data through graphs and charts for clarity ● Ability to delve deep into data at a detailed level

|

|

● Enhances overall efficiency ● Capability to generate diverse dimensions and accounts

|

● Front-end usability requires enhancement

● Slows down when multiple users access simultaneously

|

Make Budgeting Easier With Invoicera

Budgeting can be a complex and time-consuming task for businesses of any size. However, Invoicera’s integrated budgeting tools make managing your finances more straightforward and efficient.

- Integrated Platform: Enjoy the convenience of managing budgets seamlessly within an integrated platform that combines budgeting and invoicing functionalities.

- Customizable Budgets: Create and tailor budgets to match your specific business needs, whether you’re a freelancer, a small business, or a large enterprise.

- Real-Time Monitoring: Monitor budget progress in real-time, keeping track of expenses and receiving instant insights into your financial health.

- Expense Tracking: Effortlessly track and categorize expenses to ensure accurate budget allocation and analysis.

- Detailed Reporting: Generate comprehensive reports offering detailed insights into spending patterns and budget performance, aiding in informed decision-making.

- Integration Capabilities: Seamlessly integrate with other accounting and financial management tools for enhanced compatibility and data synchronization.

- Collaborative Tools: Enable multiple team members to access and contribute to budgeting efforts, fostering transparency and efficient collaboration.

- Automation Features: Automate repetitive tasks and set up recurring budgets or expenses, saving time and reducing manual effort.

- Customizable Alerts: Set up personalized alerts and notifications to stay informed about budget milestones or overspending.

- Security Measures: Ensure data security with robust measures to protect sensitive financial information and maintain confidentiality.

- Collaborative Tools: Enable multiple team members to access and contribute to budgeting efforts, fostering transparency and efficient collaboration.

- Automation Features: Automate repetitive tasks and set up recurring budgets or expenses, saving time and reducing manual effort.

- Customizable Alerts: Set up personalized alerts and notifications to stay informed about budget milestones or overspending.

- Security Measures: Ensure data security with robust measures to protect sensitive financial information and maintain confidentiality.

Conclusion

Good financial management is key to success!

The top budgeting tools of 2025 aren’t just packed with features; they actually change the game by helping create budgets, track expenses carefully, and keep finances in check.

Among these tools, Invoicera stands out for its seamless integration of budgeting and invoicing, simplifying financial control within a single platform.

These tools aren’t just tools—they’re game-changers. They help businesses make smarter decisions and stay financially strong, even in a constantly changing market.

FAQs

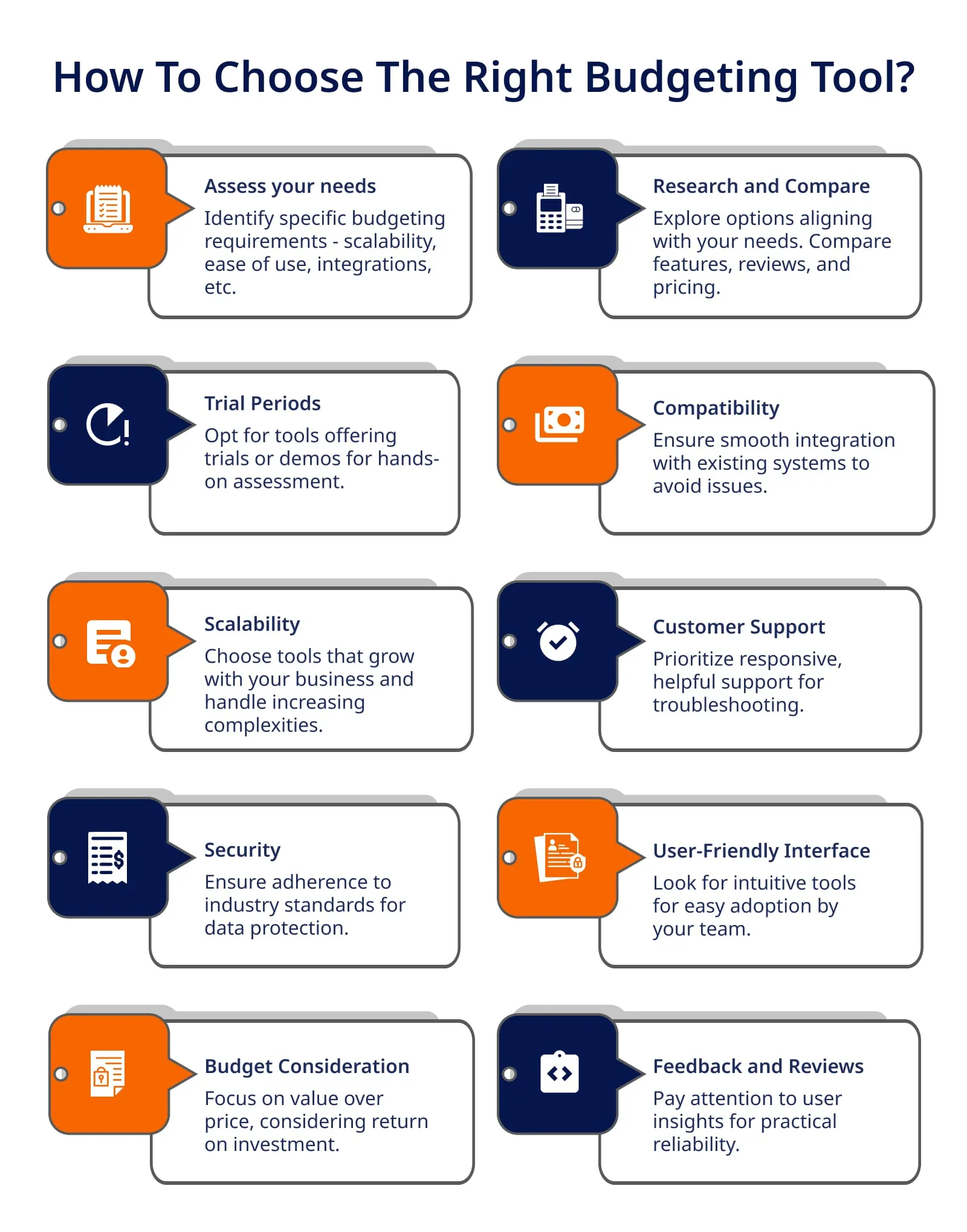

Are these budgeting tools suitable for small businesses as well?

Absolutely! Many tools cater to freelancers and small businesses by offering scalable solutions and user-friendly interfaces.

How do these tools ensure data security?

The top tools prioritize data security by implementing robust measures to protect sensitive financial information, adhering to industry standards.

Are there trial periods available to test these tools?

Many providers offer trial periods or demos, allowing businesses to experience the tools firsthand before committing.

Invoicera offers a 7-day free trial to check out all its features and functionalities.