Introduction

Efficient records management in any small business is paramount as it ensures healthy cash flow.

The accounts receivables and payables management records have a unique significance in the business world.

Let’s dive into detailed information about Accounts Payable and Receivable Management and their importance.

What is Accounts Payable?

Let’s first understand, what are Accounts Payable. It’s the money that a business has to pay to another business for receiving goods/services from them.

To make it more simple, these are the unpaid bills a company has yet to pay.

It’s required to keep track of all the bills and invoices a company has received. Here, comes the Accounts Payable management.

The management generally includes controlling all the aspects of Accounts Payable.

Paying your bills on time is important! If you don’t, things can go the wrong way – you might miss payments, break trust with suppliers, and even face legal obligations. That’s why tracking your bills is key.

By having invoicing software for handling bills, your company can save money on payments, work out better deals with suppliers you pay on time, and keep everyone happy. Invoicera can help with this by automating payments, keeping track of your spending, and even letting you pay bills online. This makes managing bills easier for any business size.

Importance Of Accounts Payable Management

1. Stronger Vendor Relationships: Let’s put yourself in the vendors’ place. You might feel bad when you don’t get paid.

Similarly, the vendor might have trust issues with you if you miss a payment. By keeping your accounts payable in check, you can avoid late payments and build trust with your clients.

2. Save Money on Late Fees: Late fees and penalties can eat into your profits.

Efficient accounts payable ensures your invoices are processed on time, so you can avoid those extra charges.

3. Ensure Peace of Mind With Better Finances: Accounts payable management practices give you a clear picture of your finances, thus, making it easier for you to plan for upcoming expenses and avoid any unforeseen shortfalls.

4. Identify Errors and Prevent Fraud: Mistakes happen, but they can be costly. A well-organized accounts payable system helps you easily identify errors before they become problems.

It can also make it harder for fraudsters to sneak in fake invoices and steal your money.

What is Accounts Receivable?

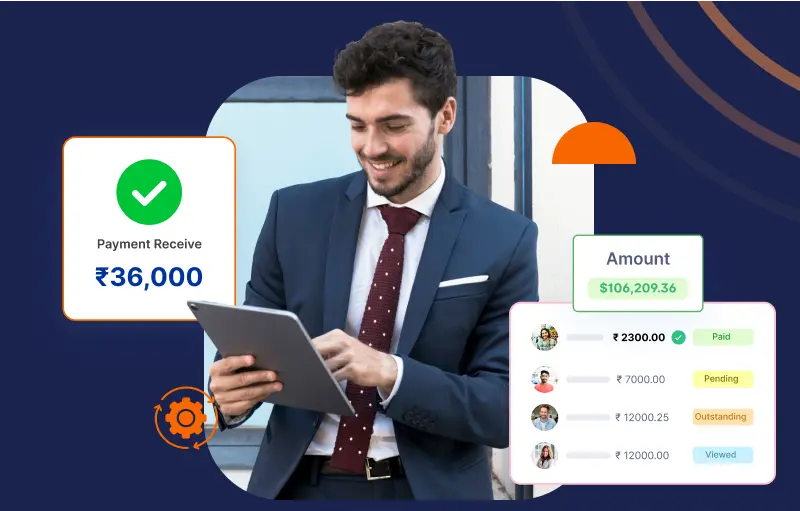

What is receivable management: Accounts receivable management is defined as the practice of managing customer payments that are owed to a business. It entails monitoring unpaid invoices, following up with clients for payments, and account reconciliation.

It can be a hassle to keep track of accounts receivable, but an accounts receivable software like Invoicera can help. Businesses can get paid faster and avoid debt by:

- Setting clear rules on how and when customers can pay

- Sending accurate invoices quickly

- Following up on late payments

- Keeping good records of everything

- Making sure any missed payments are chased up

The above steps can help businesses to have a healthy cash flow.

Importance

- Improved cash flow: An efficient accounts receivable management system helps businesses receive payments faster, reducing the time between invoice generation and payment receipt.

- Reduction in bad debt: Poor accounts receivable management can lead to unpaid debts and bad debts. An adequate system ensures timely payment collection and reduces the risk of non-payment.

- Increased customer satisfaction: An organized and streamlined invoicing process helps maintain a positive relationship with customers by providing precise and accurate payment information.

- Better financial planning: Effective accounts receivable management helps businesses track their payment collections and forecast their cash flow, enabling better financial planning.

- Competitive advantage: An efficient accounts receivable management system helps businesses gain a competitive advantage by improving their financial stability, allowing them to invest in growth and expansion.

Invoicera, an online invoicing software, provides businesses with advanced features for accounts receivable management, including automated invoice reminders, customizable payment terms, and real-time payment tracking. With Invoicera, businesses can streamline their invoicing and payment collection processes, improving their overall financial management.

Accounts Payable and Accounts Receivable

| Accounts Payable | Accounts Receivable | |

| Definition | Money that a company has to pay for received services or goods. | Money that a company has to receive for their services. |

| Who pays to whom? | Company pays to vendors | Vendors receives from company |

| Liability or Asset? | Liability | Asset |

| What are the effects? | Decreases company’s cash | Increases vendor’s cash |

Records on ledgers

Accounts Payable Management –

- The purchase a business has made

- The amount of money payable for services and goods the company ordered, including other costs.

- The total amount payable in the end of the month with additional charges for debtors

What is Accounts Receivable Management?

- The sales a business has made through invoice

- The total amount of money that the company claims for goods or services, including other charges

- The variation of the amount owed at the end of the month for debtors

Payment terms

The amount that one pays is received by the other as the cost of service, the company has offered. That is the reason the payment terms are same for both. The thing that differs is – the product recorded in AR ledger will lead to inflow of money and if it is in AP ledger then it will lead to outflow of money.

Other than that, the basic term that both Account payable and Account Receivables has to obey is “Net 30 days”. This term implies that the payment is due at the end of the month or 30 days, from the day the order is placed. After that, the debtor fee is applicable on the payable or receivable amount.

The payable company has no restriction for paying the debt amount before debt date. It’s up to receivable business organization whether they want that debt amount from the payable organization or are offering concession according to the terms they agreed at the time of invoice.

In case of early payment to a receivable business organization, the payable company is sometimes offered discounts. This is applicable in special cases when the service provider has declared in advance or just wants to have long-term relations with that business organization for mutual benefits.

Duration Analysis

The service providers maintain a detailed debtor book, which is categorised as – 90 days, 60 days, 30 days, current or longer. As a client orders something, they use to analyse that client by categorising them according to payment terms. Same record is maintained by payable companies to categorise the service providers according to quality of services.

Invoicera Features for Accounts Payable and Receivable Management

Invoicera offers numerous features to help with Accounts payable and receivable management. Check out some mentioned below:

- Automatic invoicing and payment reminders

- Customizable payment terms and schedules

- Integration with multiple payment gateways

- Online invoice tracking and reporting

- Creation of credit and debit notes

- Automated recurring billing for regular customers

- Multiple currency and language support

- Advanced security features for secure transactions

- Real-time synchronization with accounting software

Conclusion

After the above detailed description and differentiation, here we conclude that account receivables and payable are two interrelated records and close monitoring of both is highly necessary. If as an organization, you’re keeping a close eye on cash flow it will make many other tasks run smoother. All the above mentioned differences clarify the need of better management for healthier business relations.

Invoicera is world’s most powerful online invoicing and billing software. It offers customised accounts receivable & accounts payable solutions to more than 3 million businesses associated with it. Dedicated spreadsheets make offline cash record easy apart from the online automatically added records. It helps you easily access important information about how and when you like with the help of an integrated mobile app.

FAQs

1. What are the main challenges faced in accounts payable management?

Accounts payable management comes with multiple challenges, such as

- Invoice processing delays: Handling a large number of invoices might cause processing delays, which might result in late payments and strained supplier relationships.

- Discrepancies and errors: To prevent payment disputes and guarantee seamless transactions, confirming invoice correctness and swiftly addressing any anomalies is essential.

- Cash flow management: It can be challenging to balance keeping enough cash on hand with paying suppliers on time, especially for companies with erratic revenue streams.

2. How do payables and receivables management impact a company’s financial health?

The health of a company’s finances is significantly impacted by accounts payable and receivable. By guaranteeing on-time cash inflow, efficient accounts receivable management enhances cash flow, liquidity, and profitability. On the other hand, effective management of the accounts payable process contributes to preserving solid vendor relationships, which may result in improved credit terms, discounts, and decreased financial stress.