The accounting world is shifting toward collaboration!

Collaborative Accounting is a transformative approach to reshaping how CPAs and clients work together.

Collaboration unlocks success in the accounting profession, fostering stronger relationships and delivering exceptional results.

Traditionally, the CPA-client relationship has been characterized by a one-sided flow of information, resulting in inefficiencies and missed opportunities.

Statistics indicate that nearly 65% of clients wish for more collaboration with their accountants, recognizing its potential to drive better outcomes and understanding.

Through collaboration, accountants and clients form a cohesive partnership, pooling their expertise and insights for more informed decision-making.

This approach streamlines workflows and strengthens trust, enhancing client satisfaction and loyalty. Let’s learn more about collaborative accounting!

The Traditional CPA-Client Dynamic

Traditional Accounting Practices – An Overview

Traditional accounting practices have long followed a one-way street, where CPAs handle the financial aspects while clients provide the necessary information.

This method often involved minimal client involvement beyond data submission and occasional consultations.

CPAs independently managed accounts, leading to a lack of real-time collaboration and limited client understanding of their financial status.

Challenges Faced By CPAs And Clients

| CPAs | Clients |

| Accessing timely data becomes a challenge due to irregular updates from clients | Limited access to real-time data hinders client understanding of financial health |

| Delayed data from clients affects advice quality | Managing invoices and expenses becomes difficult for clients |

| Managing invoicing and accounts across different systems causes inefficiencies | Challenges in coordination with CPAs impact daily operations |

Invoicera, a comprehensive invoicing and accounting software, offers a solution bridging the gaps in traditional accounting practices.

It facilitates seamless collaboration between CPAs and clients by providing a centralized invoicing, expense tracking, and financial management platform.

With Invoicera, CPAs and clients can effortlessly share and access real-time financial data, improving transparency, communication, and efficiency.

What Is Collaborative Accounting?

Collaborative Accounting is a modern approach that combines CPAs (Certified Public Accountants) and their clients in a more unified and cooperative manner.

Unlike traditional methods, where the accountant handles everything, collaborative accounting fosters teamwork and active involvement from both sides. It’s about sharing information, insights, and responsibilities to achieve better financial outcomes.

In this model, CPAs and clients work hand in hand, communicating openly, sharing data, and aligning their goals. It’s not just about numbers; it’s a partnership built on trust and mutual understanding.

Collaborative Accounting leverages technology and smart tools like Invoicera to streamline workflows, enhance transparency, and ultimately elevate the quality of financial decision-making.

Benefits For CPAs And Clients

| CPAs | Clients |

| Enhanced Efficiency: Collaborative Accounting reduces the burden on CPAs by distributing tasks and sharing data, allowing them to focus on value-added services. | Increased Involvement: Clients gain a deeper understanding of their financial status, allowing for more informed decision-making. |

| Deeper Client Relationships: It fosters stronger connections as CPAs actively involve clients in the accounting process, leading to better understanding and trust. | Transparency and Control: Collaborative Accounting gives clients real-time access to their financial information, fostering transparency and a sense of control. |

| Improved Accuracy: CPAs can ensure more accurate and timely financial reporting with direct client input and access to real-time data. |

Customized Solutions: Clients can collaborate on tailored solutions with CPAs, addressing specific needs and optimizing financial strategies. |

Key Elements Of Collaborative Accounting

Several fundamental pillars of collaborative accounting transform how CPAs and clients work together. Let’s know about them:

1. Communication Strategies

The core of collaborative accounting thrives on efficient communication. It’s about more than just exchanging information; it’s about actively listening, clarifying doubts, and fostering an open dialogue.

Regular, clear, and concise communication channels ensure that CPAs and clients are on the same page, leading to better understanding and alignment in their financial endeavors.

2. Shared Access And Transparency

Transparency is key in collaborative accounting. Shared access to pertinent financial data, documents, and reports fosters trust and transparency between CPAs and clients.

When both parties have access to the same information in real time, it streamlines decision-making processes and minimizes misunderstandings.

3. Coordinated Goal Setting

Collaborative accounting thrives on setting shared objectives and working collectively toward achieving them. CPAs and clients collaborate to define clear, achievable goals, aligning their efforts and resources accordingly.

This shared goal-setting approach ensures everyone is working towards the same financial milestones.

4. Trust And Confidentiality

Trust forms the foundation of the CPA-client relationship. Collaborative accounting emphasizes building and maintaining trust through confidentiality and integrity.

CPAs handle sensitive financial information with the utmost care, ensuring data security and client confidentiality.

5. Role Of Invoicera In Facilitating Collaboration

Invoicera is pivotal in enabling seamless collaboration between CPAs and clients. Its user-friendly interface and robust features streamline invoicing, expense management, and time tracking.

Invoicera acts as a centralized platform, allowing easy sharing of financial documents, facilitating real-time communication, and ensuring that financial tasks are executed efficiently.

Implementing Collaborative Accounting Practices

Implementing these practices requires commitment and a willingness to embrace change. Here are some actionable insights for CPAs and clients alike:

Tips For CPAs And Clients

For CPAs:

- Communication is the key: Foster open lines of communication. Encourage clients to share their insights, questions, and concerns openly.

- Educate and Guide: Offer guidance on collaborative tools and methods. Educate clients on the benefits and how it streamlines processes.

- Transparency Builds Trust: Maintain transparency in all dealings. Provide clear explanations and ensure clients understand the steps being taken.

- Regular Check-Ins: Schedule periodic check-ins to assess progress and address any issues promptly.

For Clients:

- Active Participation: Engage proactively with your CPA. Share relevant information promptly and respond to queries to facilitate smoother collaboration.

- Embrace Technology: Be open to using collaborative tools suggested by your CPA. Familiarize yourself with these tools for better engagement.

- Clearly Define Expectations: Communicate your needs and goals clearly. This helps CPAs tailor their services to meet your specific requirements.

- Feedback Loop: Offer constructive feedback to your CPA. Share what works well and what could be improved for a more effective collaboration.

Tools And Technologies

Collaborative Platform:

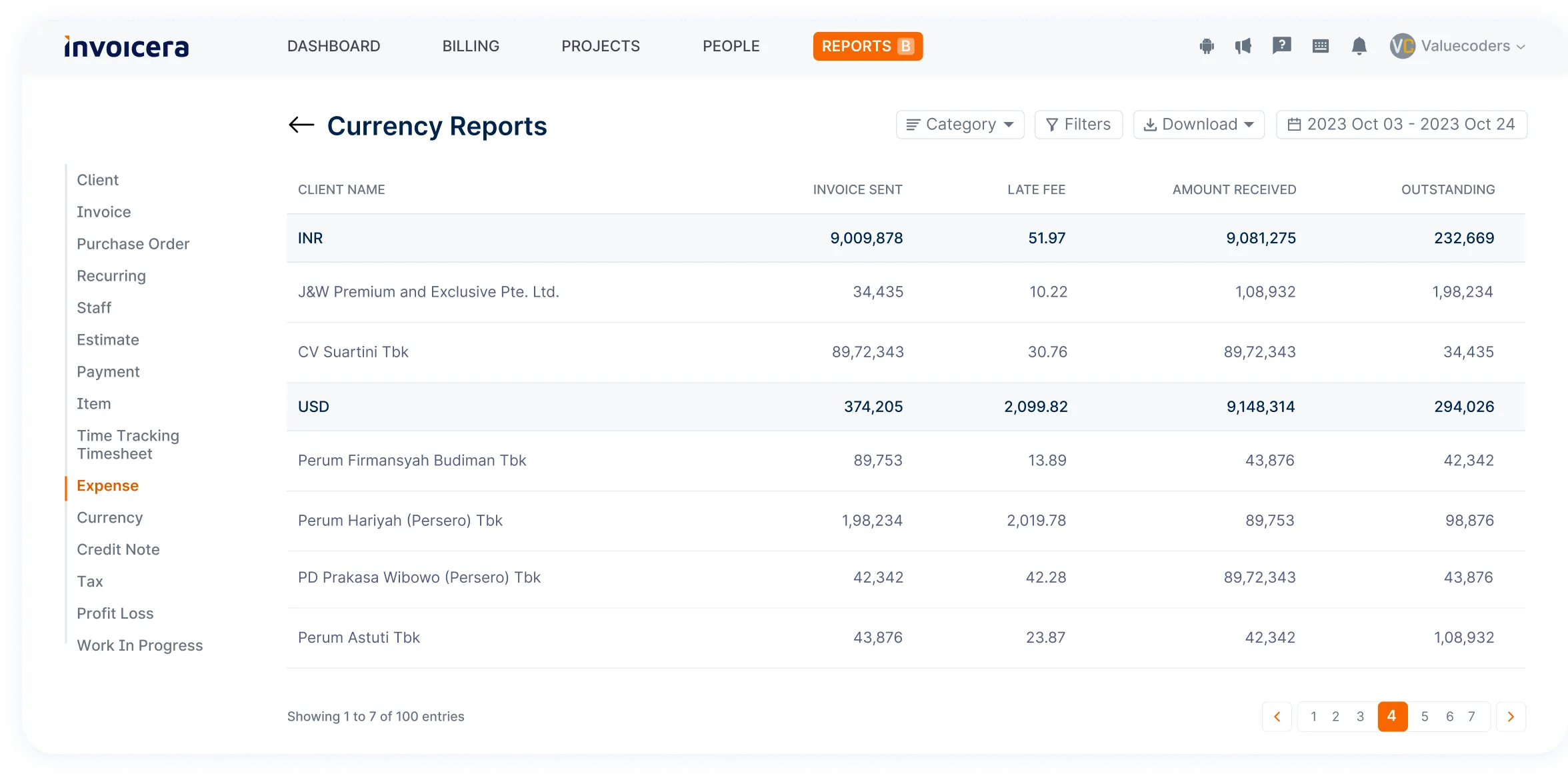

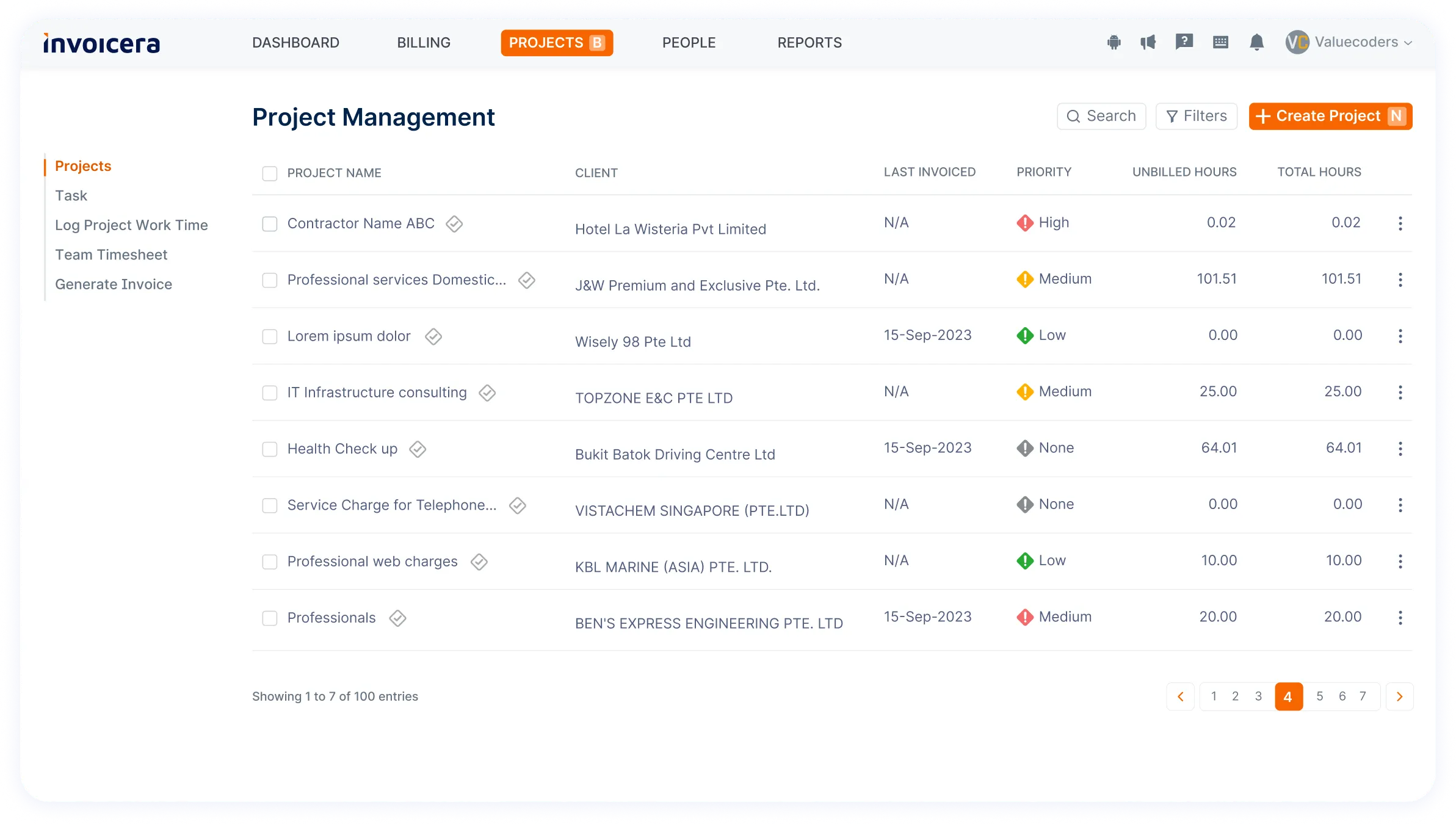

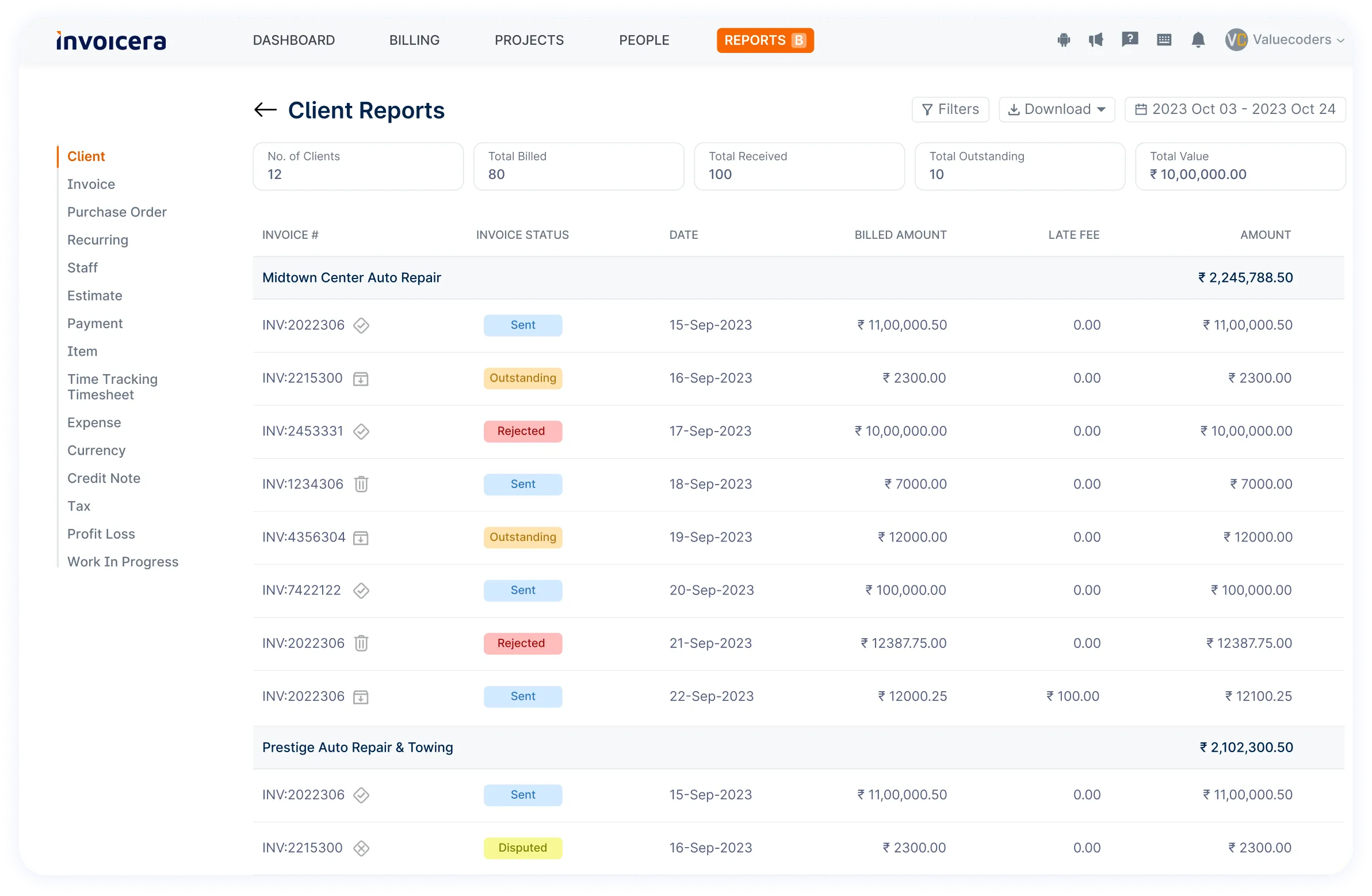

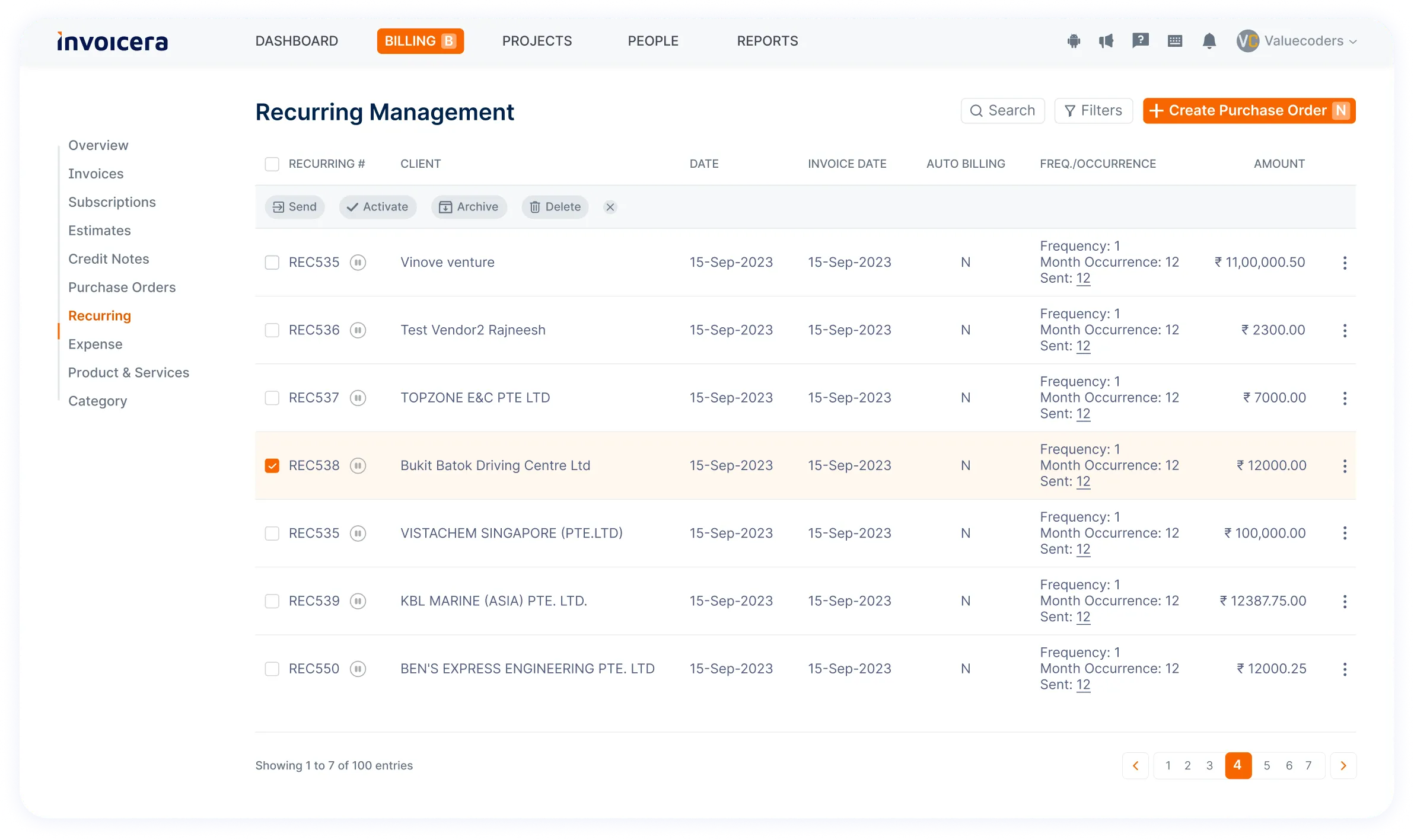

- Invoicera: This tool streamlines invoicing, expense tracking, and time management. It allows for shared access, enabling CPAs and clients to monitor financial aspects collaboratively.

Communication Tool:

- Slack: Enables instant communication, file sharing, and seamless collaboration via dedicated channels tailored to individual projects or tasks.

Document Sharing And Storage:

- Google Drive: Enables secure storage and sharing of documents, ensuring accessibility and version control for both CPAs and clients.

Project Management Tools:

- Trello or Asana: Helps in task management, assigning responsibilities, setting deadlines, and tracking progress, ensuring alignment between CPAs and clients.

Video Conferencing:

- Zoom or Microsoft Teams: Enables face-to-face meetings, enhancing communication and understanding between CPAs and clients regardless of physical locations.

Selecting the appropriate software tailored to specific requirements can improve the efficiency and effectiveness of collaborative accounting methods.

Streamline Collaborative Accounting With Invoicera

Invoicera isn’t just a tool; it’s a game-changer for collaborative accounting.

Its user-friendly interface and robust features simplify complex accounting tasks, allowing CPAs and clients to work seamlessly.

How Invoicera Enhances CPA-Client Collaboration?

- Real-time Communication: The platform facilitates seamless communication, allowing instant messaging and file sharing, fostering swift decision-making and clarity in discussions.

- Transparency and Accessibility: With shared access to financial data and reports, CPAs and clients stay on the same page, enhancing transparency and trust.

- Efficiency and Accuracy: Invoicera’s automated features reduce errors and streamline processes, saving time for both parties and ensuring accurate financial records.

- Empowering Clients: Clients feel empowered with self-service options, accessing invoices and relevant documents anytime, anywhere, reducing dependency on constant CPA interaction.

Bonus Features And Capabilities Of Invoicera

Invoicera packs a punch with various features tailored for collaborative accounting success.

Here are some standout capabilities:

- Customizable Invoices: Tailor invoices to suit your brand, ensuring a professional touch that resonates with clients.

- Time Tracking: Effortlessly monitor billable hours and manage tasks, ensuring accurate invoicing for services rendered.

- Secure Client Portals: Establish secure client portals for document sharing, fostering transparent collaboration while keeping sensitive information safe.

Automated Recurring Billing: Set up recurring invoices, ensuring timely payments without manual intervention.

Multi-Currency Support: Seamlessly handle international clients by invoicing in their preferred currency, simplifying cross-border transactions.

- Expense Management: Easily track and categorize expenses, streamlining the reimbursement process and financial tracking.

Challenges In Collaborative Accounting

Collaborative accounting, while incredibly beneficial, isn’t without its challenges. Here are a few common hurdles that CPAs and clients might encounter:

- Communication Barriers:

Smooth collaboration heavily relies on effective communication. Sometimes, misunderstandings or lack of clear communication channels can hinder the flow of information and impact the quality of work.

- Data Security Concerns:

Sharing sensitive financial data and documents is essential for collaborative accounting. However, ensuring the security of this data can be a concern for both CPAs and clients, especially with increasing cyber threats.

- Workflow Coordination:

Coordinating tasks and workflows between CPAs and clients can be challenging. Aligning schedules, setting deadlines, and ensuring everyone is on the same page can sometimes pose difficulties.

Invoicera As A Solution

Addressing these challenges requires a reliable and robust solution. Invoicera is an invaluable tool that addresses these hurdles:

- Invoicera offers a centralized platform where CPAs and clients can communicate seamlessly. Its messaging features, comments section, and real-time notifications promptly address discussions and queries.

- Its project management tools assist in organizing tasks, deadlines, and project milestones. This streamlines workflows, making collaboration smoother and more efficient.

- With Invoicera, security is a priority. It employs top-notch encryption methods and secure servers to safeguard sensitive financial information, providing both CPAs and clients peace of mind.

Future Trends And Growth Opportunities

Evolving Landscape Of Accounting Practices

Over the years, accounting practices have significantly transformed. With the advent of technology, traditional methods have given way to more automated and streamlined processes.

The shift from paper-based ledgers to digital software has revolutionized how CPAs manage finances and collaborate with clients.

Cloud-based accounting systems have gained popularity, providing instant access to financial information from around the globe.

This accessibility has not only improved efficiency but has also strengthened the collaboration between CPAs and clients.

The future of accounting is undoubtedly intertwined with technology, paving the way for more dynamic and interactive ways of working together.

Potential Developments In Collaborative Accounting

In the future, collaborative accounting is set to grow even more. The emphasis on collaboration tools and software will continue to grow, aiming to enhance communication and transparency between CPAs and clients. Innovations in data sharing and analysis will facilitate quicker decision-making processes, enabling more proactive financial management strategies.

Additionally, integrating artificial intelligence (AI) and machine learning in accounting software holds immense potential. These technologies can automate repetitive tasks, allowing accountants to focus on higher-value activities and providing clients with more personalized insights into their financial matters.

Moreover, as businesses expand globally, collaborative accounting practices will evolve to accommodate diverse regulatory environments and international standards. This evolution will necessitate greater adaptability and flexibility in collaborative tools to ensure seamless cooperation across borders.

Thus, the future of collaborative accounting looks promising, driven by technological advancements, a focus on enhanced communication, and the continuous quest for efficiency and accuracy in financial management. As these trends unfold, CPAs and clients can anticipate a more integrated and productive partnership in accounting.

Conclusion

Collaborative Accounting changes how CPAs and clients work together. It’s all about sharing tasks, talking openly, and aiming for the same financial goals.

This not only makes accounting better but also builds stronger bonds.

Invoicera is the go-to for smooth collaboration. Its features help everyone communicate, share data, and handle invoices easily.

Its easy-to-use design makes it perfect for boosting teamwork between CPAs and clients.

Try Invoicera for free!

Happy Collaborative Accounting!

FAQs

For which businesses Collaborative Accounting is the best?

Collaborative accounting particularly benefits businesses that value transparency, real-time communication, and shared decision-making between CPAs and clients.

It’s especially effective for small to medium-sized enterprises (SMEs), startups, and businesses with evolving financial needs.

Can collaborative accounting help manage remote or distributed teams?

Absolutely. Collaborative Accounting tools like Invoicera facilitate seamless communication and shared access to financial data regardless of geographical location.

This capability makes it ideal for managing remote or distributed teams, ensuring everyone is on the same page in real-time.

Are there specific training requirements for adopting Collaborative Accounting practices?

While familiarity with Collaborative Accounting tools like Invoicera is beneficial, they often come with user-friendly interfaces requiring very little training. However, a quick tutorial helps CPAs and clients get comfortable with the platform.

Automated Recurring Billing:

Automated Recurring Billing:  Multi-Currency Support:

Multi-Currency Support: