Introduction

Going over your expenses and keeping track of where your money goes is an important part of budgetary control, but it can seem confusing at first. If you’re new to budgeting, the information may overwhelm you that comes with it, especially if this isn’t the first time you’ve attempted to create and stick to a budget.

You’ve developed your budget, and you feel confident that it will help you achieve your financial goals this year. But have you thought about the things that can go wrong?

To ensure you don’t waste any of your hard-earned money on frivolous purchases or bills you can’t afford, here are ten questions to ask yourself when developing budgeting and budgetary control strategies for your business

You can determine whether your budget will be effective and make the necessary changes if it isn’t. These questions are geared toward larger businesses, but one can easily adapt them to suit smaller budgets as well.

Let’s first understand what budgetary control is!

What Is Budgetary Control?

Budgetary control is a systematic process used by organizations to manage and regulate their financial resources effectively.

It involves creating budgets, continuously monitoring financial activities, and making adjustments to ensure that the company’s financial goals align with its strategic objectives.

This financial management approach aims to enhance organizational efficiency, allocate resources wisely, and facilitate better decision-making.

Importance of Comprehensive Budget Development

Budget development is crucial for various reasons. It serves as a financial roadmap, guiding the organization towards its objectives.

A well-constructed budget:

- Provides a clear overview of anticipated income and expenditures.

- Facilitates resource allocation based on priority areas.

- Enhances accountability by assigning responsibilities for financial targets.

- Offers a basis for performance evaluation and strategic planning.

- Enables proactive identification and mitigation of financial risks.

The Foundation: Understanding Your Business

Identify your Business Goals and Objectives

Understanding and defining business goals and objectives are foundational steps in the budgetary control process. This involves identifying both short-term and long-term goals, such as revenue targets, market expansion, or product development.

Aligning the budget with these objectives ensures financial resources are allocated in a way that supports the overall business strategy.

Analyze Past Financial Performance

Analyzing past financial performance provides valuable insights into spending patterns, revenue trends, and areas that require financial adjustments.

This historical data aids in setting realistic budgetary targets and identifying potential challenges.

By learning from past financial experiences, organizations can make informed decisions and develop budgets that are more accurate and reflective of the business environment.

Key Components Of Effective Budgeting Process

1. Revenue Projections:

Accurate revenue projections are fundamental to budgeting. Organizations must assess market trends, customer behavior, and other factors influencing income generation.

By incorporating realistic revenue projections, businesses can set achievable financial targets, allocate resources appropriately, and foster sustainable growth.

2. Expense Categories and Allocation:

Categorizing and allocating expenses are critical components of budget development.

Identifying fixed and variable costs, as well as discretionary and non-discretionary spending, helps create a comprehensive overview of financial commitments.

This categorization enables organizations to prioritize spending and allocate resources efficiently, aligning expenditures with strategic priorities.

3. Contingency Planning:

Incorporating contingency planning into the budget ensures preparedness for unforeseen circumstances.

Whether it’s economic downturns, market fluctuations, or unexpected expenses, having a contingency plan allows organizations to respond promptly and mitigate financial risks.

Contingency planning adds flexibility to the budget, making it more resilient in the face of uncertainties.

10 Budget Questions to Ask!

Question 1 – What Is The Goal Behind Developing A New Budget?

The goal behind developing a new budget is to know what is budget control, which is the ability to execute your new budget according to plan consistently. This means knowing exactly what’s in your accounts payable and receivable balances daily, monitoring project budgets every week, and ensuring you’re sticking with the budgetary control process every day. Effective project budget management is a key component of this approach.

By asking this question, you can get a fair idea about what’s essential for your company and where your budgetary control is going in the future. It also allows you to discuss what goals you can accomplish by developing a new budget.

Knowing the goal behind developing the new budget is an essential for developing and executing a new budget. It will help you keep track of your expenses and ensure that you are sticking with your budgetary control process.

Question 2 – Is It Worth The Cost?

The second of the questions to ask about budgeting is whether the cost you are spending is worth it or not? An example of something that may be expensive but worth it would be insurance.

To make sure that you are paying for something that is actually needed, consider if it will be better in the long run than spending less money upfront. This will allow you to create an efficient spending plan, which will ultimately help you save money for future investments.

Knowing the worth of the cost you are spending helps you in the budget monitoring process. For example, if your goal is to save money for business development, but you find yourself constantly out of money towards that goal, maybe it is time to cut back on some of those expenses that are not worth spending on. This will help you save your resources to achieve your goals.

————————————————————————————————————————-

Also Read: Tips for Business Budgeting – Steps to Drastic Success!

————————————————————————————————————————–

Question 3 – How Likely Are You To Stick To This?

This budget will probably be one of your most concrete and specific plans for achieving your financial goals. You’ll need some reason or motivation not to quit it before starting it. Asking yourself this question will help you know how concerned you are about your new budget.

If you’re already having trouble with self-control when it comes to spending money, then the chances are that the budget will not stick around very long. If you’ve been doing well at sticking to your budget so far and have been able to control your spending habits, then the chances are good that you’ll maintain a budget for yourself in the future.

Question 4 – Have You Tried Something Similar Before?

If you’ve tried something similar before, what did you do differently?

Any experience can offer insights into how to get your budgeting on track and eliminate unnecessary waste. You may want to tweak or refine your previous efforts to develop an improved budgetary control project.

By making changes while developing a new budget plan for your company, you can experience the benefits of the budgeting and budgetary control. If you are going to make changes, it’s important that you know how past budgets have gone so that you can avoid common pitfalls and unnecessary waste.

The key is learning from experiences so that when it comes time to develop a budget, you’re prepared with a practical budgetary control project.

Question 5 – What Are The Risks?

By knowing and understanding your accounts payable and receivable, you can see how much business you’re bringing in and how much it costs. This gives you an indication of what risks your business is taking on.

If your accounts payable are increasing more than your accounts receivable, you may be at risk of not being able to pay back money lent to you by suppliers or other businesses. If these debts are going unpaid for too long, they could eventually be written off as bad debt. And while bad debt is inevitable in any business operation, having too much will hurt both your reputation and bottom line, which is not something any company wants.

That’s why asking yourself about the risks is so important. Make sure you keep an eye on such risks and try not to let them get out of hand.

Question 6 – How Will This Affect Others Involved In The Financial Matter?

If you own a business, you may think that budgets should only pertain to your company. However, that isn’t true! Other financially involved people with your business must also be aware of how money is being spent and where it is going.

If everyone knows what is going on with your budget, it will be easier for you to determine if there are any problems with how money is being spent. And, if there are any problems, then you can make adjustments accordingly.

In addition, by explaining how your budget affects others involved in financial matters, it may help you gain support from those individuals who will be affected by any changes that need to be made.

————————————————————————————————————————

Also Read: Want to Accept Recurring Payments? It’s as Easy as 1-2-3

————————————————————————————————————————-

Question 7 – Is There An Alternative That Would Be Cheaper Or More Effective?

Ask yourself before giving final confirmation to the new budget plan. Is there an alternative that would be cheaper and/or more effective?

For example, if you’re planning to spend $10,000 on software licenses, is there an open-source solution that will do what you need to do for less money? Or, is there a way to re-purpose something in your office that will get you what you need at no cost? These questions help keep costs down and can also save time.

Always be on guard for these options. You may find that an alternative solution is significantly cheaper and/or more effective, giving you more bang for your buck and helping you achieve your goals faster.

Question 8 – What Happens If Things Go Wrong Or You Don’t Reach Your Goals?

If you don’t reach your financial goals, it could be because things didn’t go according to plan or because you misread your expenses and income. If that happens, ask yourself these budget questions.

Why didn’t I reach my goals? What went wrong? What do I need to correct in order for me to achieve my goal next year? How can I fix it? And then look at ways of correcting your mistakes and not repeating them in future years.

You need to be prepared in case something unexpected happens. This will help ensure that your business stays on track.

Financial advisors recommend that you have money set aside in an emergency fund for three months’ worth of operating costs. If something unforeseen occurs, you don’t risk going into debt and losing your business.

Question 9 – How Much Does The Amount Of Extra Money Affect Other Decisions?

If you are adding some extra money into your budget, ask yourself how much it will affect other decisions. The amount of extra money added to a budget can significantly impact what else you can do with that money.

For example, if you add $50 more dollars per month to your business’s operating expenses, then you might be able to hire another employee or purchase new equipment for your company.

If you add $500 extra dollars per month, then maybe you could afford a new vehicle or even open up an additional location in another city. The amount of money added to your budget can be used for many different things and should be considered when deciding how it will be spent. This will help you make sure that every dollar counts for something and that you are using all of your resources wisely.

Question 10 – Are You Willing To Give Up Anything Else In Exchange For This New budget?

Are you willing to give up anything else in exchange for your new budget? For example, is it possible that you can forget about that vacation you’ve been dreaming of if it means maintaining your new budget plan? You’ll want to be clear on what sacrifices you’re willing to make as part of your new budget. Weighing these options helps to ensure your budget works for you rather than against you.

By being clear on what you’re willing to give up, you can be sure that your budget is in line with your financial goals and priorities so that it doesn’t cause unnecessary stress when it comes to implementing changes or giving up anything else to make everything work.

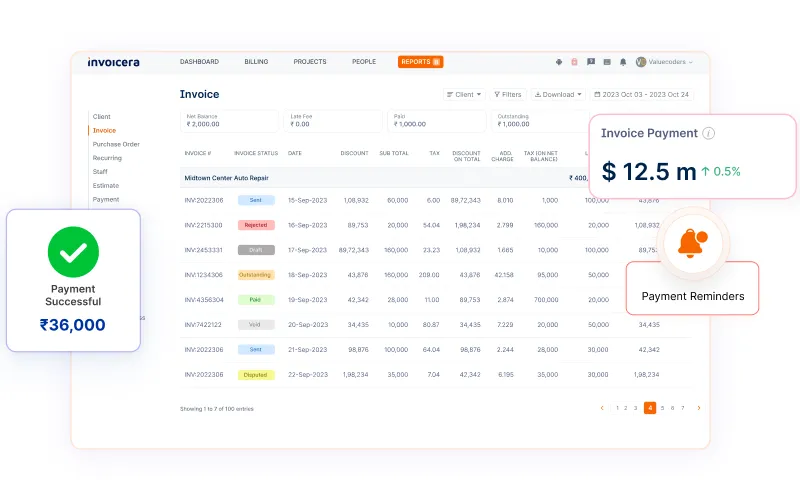

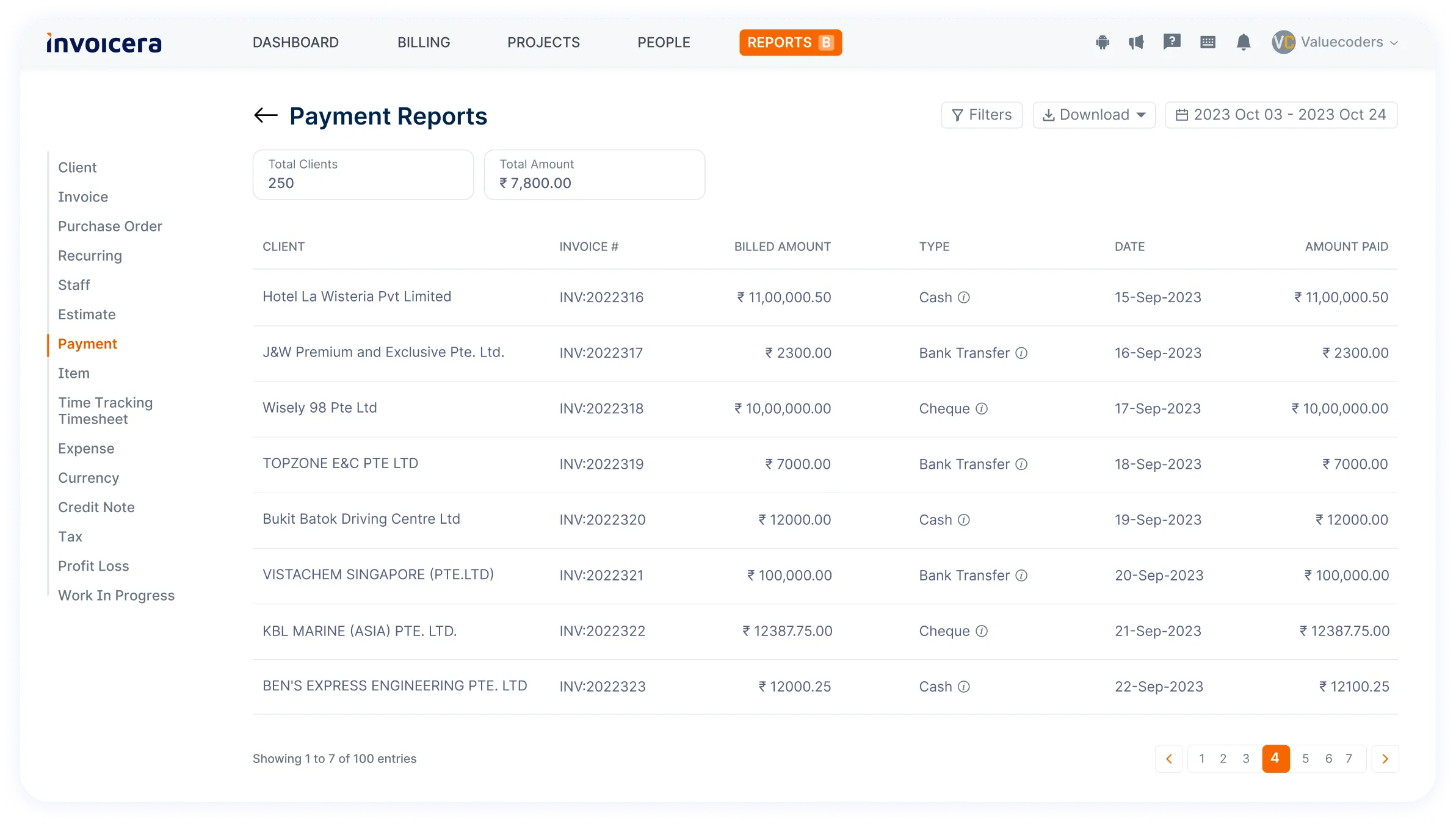

Invoicera – Best Software For Financial Management

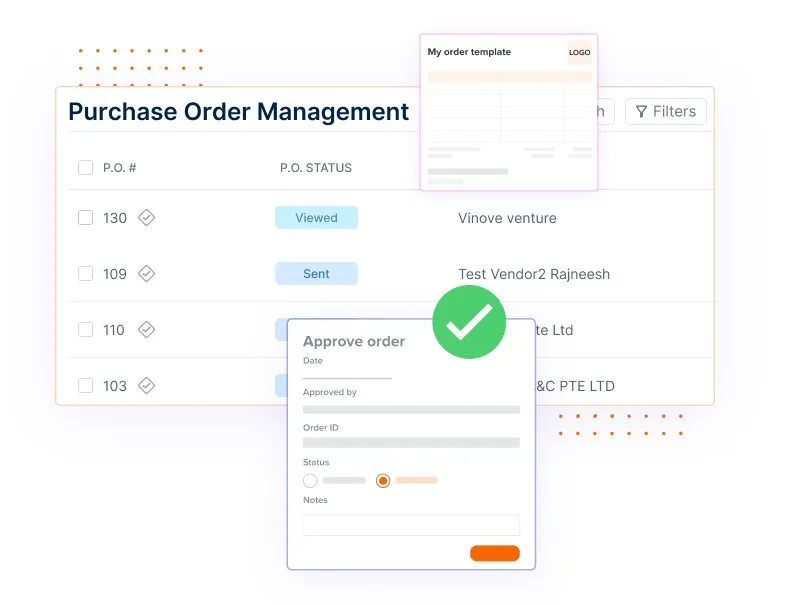

Here are a few features for effective financial management and budget control:

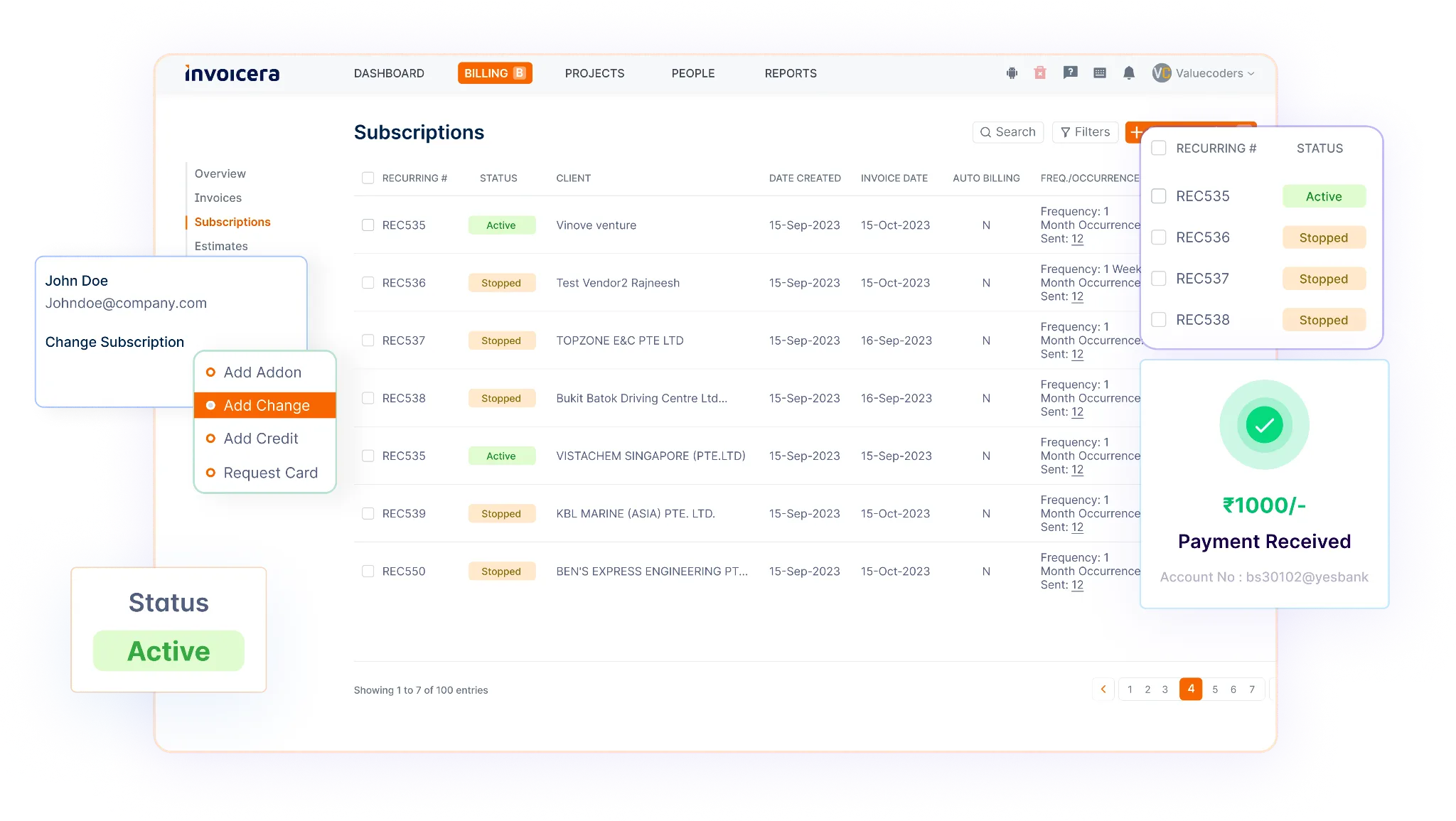

1. Comprehensive Subscription Billing: Invoicera offers a comprehensive subscription billing solution beyond traditional billing software. It includes all-inclusive features for managing accounts payable and receivable efficiently.

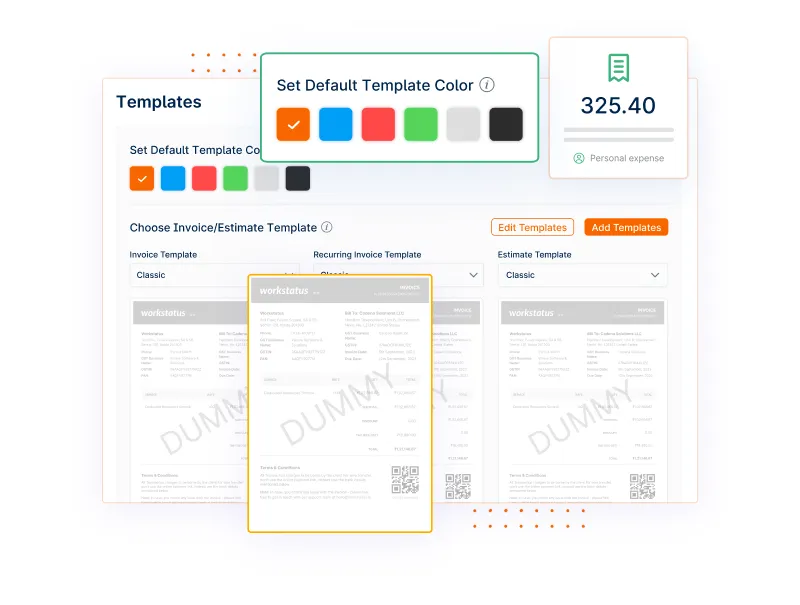

2. User-Friendly Interface: Easy-to-use interface makes Invoicera suitable for businesses of all sizes. Seamlessly navigates through the software, enhancing user experience.

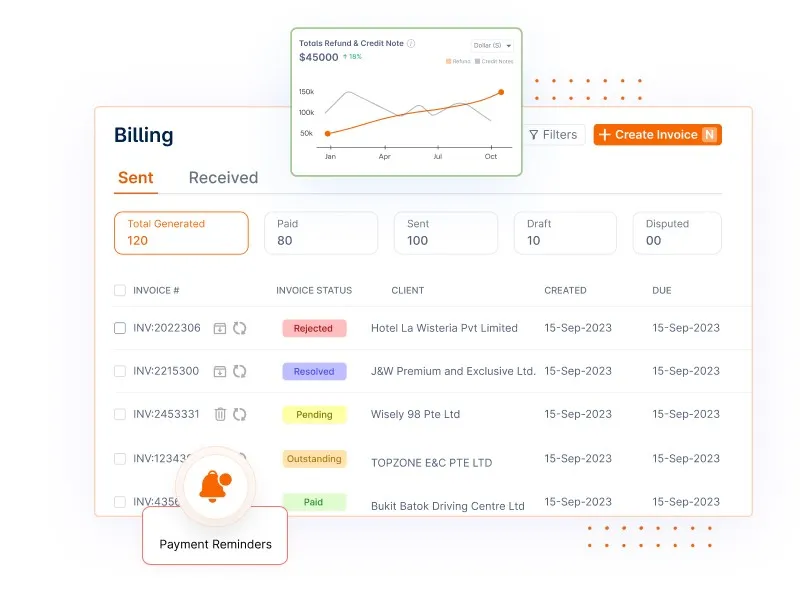

3. Instant Access to Payment Reports: Users gain instant access to detailed payment reports upon signing up. Facilitates quick insights into financial transactions and improves decision-making.

5. Versatility Across Business Types: Designed to cater to a diverse range of businesses, from freelancers and contractors to large enterprises and small businesses. Adaptable to various business models, making it a versatile choice.

6. Effortless Accounts Payable and Receivable Management: Enables users to effortlessly manage both accounts payable and receivable. Consolidates financial processes for a more streamlined approach.

7. Budget Management Made Easy: Invoicera emerges as an excellent solution for managing budgeting resources effectively. It assists in maintaining financial control and optimizing resource allocation.

8. Tailored for Varied Business Needs: Recognizes the diverse needs of businesses and tailors its features accordingly. Adaptable to specific requirements, ensuring a customized experience.

9. Continuous Updates and Enhancements: Invoicera commits to regular updates and enhancements, staying current with industry standards. Users can benefit from its latest features for an ever-improving experience.

Conclusion

By asking yourself these ten questions while developing a budget, you can determine if you are on track or if there is room for improvement. Remember that having a healthy relationship with your resources is one of the best ways to maintain control over your finances and budgets.

That’s all for today.

We hope you find our blog helpful.

If you do share it with your friends and family, and if you have any questions, feel free to comment below. We will be happy to answer your queries.

Thank You !!

FAQs

How does developing a comprehensive budget benefit my business?

A comprehensive budget acts as a financial roadmap, guiding your business towards its objectives. It provides clarity on income, expenses, and resource allocation, enhancing accountability and supporting strategic decision-making.

What are common pitfalls to avoid in budget development?

Common pitfalls include setting unrealistic goals, neglecting to consider unforeseen circumstances, and failing to involve key stakeholders. Awareness of these pitfalls is essential for creating a robust budget.

How can I measure the success of budgetary control in my business?

The success of budgetary control can be measured through key performance indicators (KPIs), such as meeting financial targets, maintaining healthy cash flow, and achieving strategic objectives. Regular assessments and adjustments contribute to ongoing success.