Introduction

Have you ever been overwhelmed by stacks of paperwork, especially when sorting through invoices? We have a simpler way to handle all that.

Picture this: reducing your time on invoicing, eliminating manual/human errors, and getting your payments quicker.

Doesn’t it sound like a game-changer?

Statistics show businesses waste an average of 21 hours every week on manual invoicing processes.

But here’s the good news: automated systems save you time, impress clients, and make the process error-free!

Switching from manual to automated invoicing systems isn’t just a modern trend but a necessity.

And guess what? We have got five compelling reasons why you should choose them.

Let’s dive in and learn how to handle finances and save time & hassle.

Role Of Invoicing In Business

Invoicing is the backbone of corporate transactions and financial administration.

It is more than just delivering a bill; it marks the end of a transaction and creates an official record of the products sold or services provided.

Impact of efficient invoicing

- Management of Cash Flow: Managing your cash flow is essential. Ensuring timely payment by delivering accurate bills on time contributes to a healthy cash flow. This assists companies in paying suppliers, fulfilling their financial commitments, and even looking for expansion prospects.

- Client Relationships: Your relationship with clients matters. When you create clear and professional invoices, it boosts positive connections with them. Professional invoices show reliability, building trust and confidence. Messing up or delaying invoices can strain these relationships, impacting future business.

- Financial Planning and Analysis: Invoices are crucial in financial planning; they are more than just paperwork. They provide information about your company’s overall financial health, revenue, and overdue payments. Making better business decisions is aided by these insights.

- Compliance and Record-Keeping: It’s critical to maintain organization and compliance. Invoicing correctly guarantees that you adhere to tax regulations and accounting standards. It also makes record-keeping easier, facilitating faster and more accurate financial reporting and audits.

Read More – How To Choose The Right Invoicing Software: 10 Questions To Ask

What Are Automated Invoicing Systems?

Automated Invoicing Systems are advanced tools that simplify creating, sending, managing, and tracking invoices.

They harness technology to automate invoicing tasks, replacing manual efforts with streamlined digital processes.

How do automated systems streamline the invoicing process?

Automated Invoicing Systems are basically high-tech tools that make the whole invoicing a lot smoother. They’re like digital assistants that handle everything from creating and sending invoices to keeping tabs on them.

These systems use technology to take over tasks that used to eat up our time, like adding in data, doing the calculations, setting up when invoices get sent, and even giving gentle nudges for pending payments.

The best part? They cut down on human errors, save time, and keep things consistent.

They’re not all the same, though. Depending on what a business needs, there’s a variety to pick from.

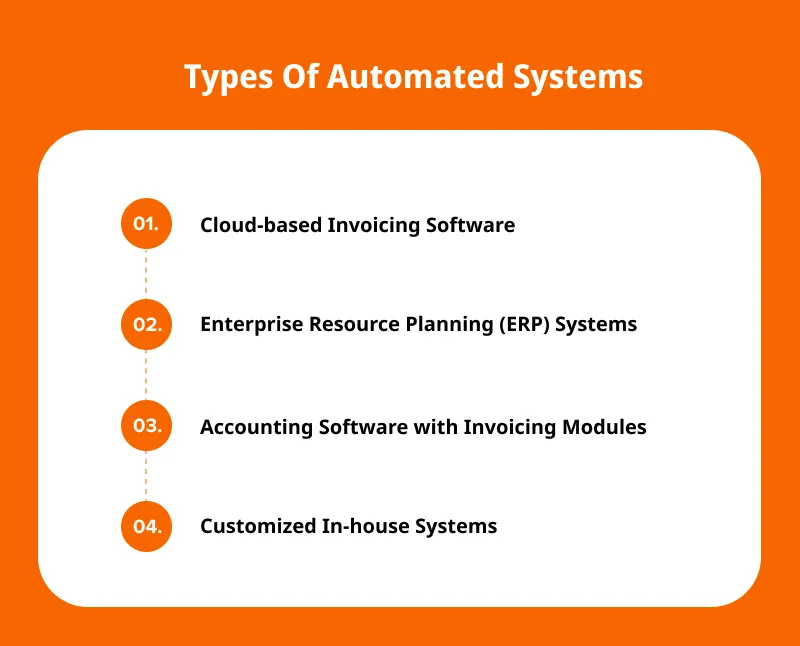

Several automated invoicing systems are available, catering to diverse business needs. Some common types include:

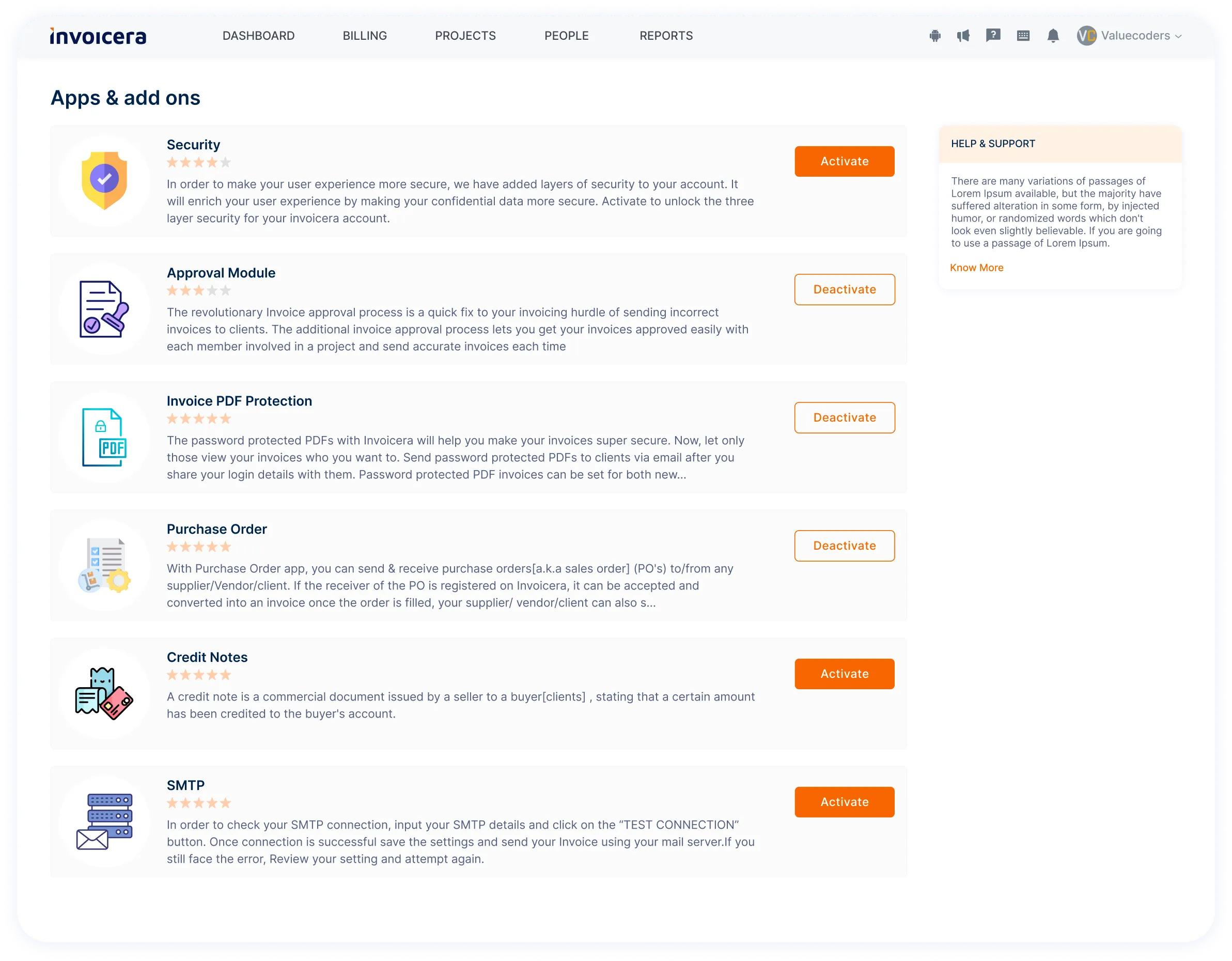

- Cloud-based invoicing software: It runs online and is accessible to everyone. Platforms such as Invoicera are prime examples of these systems; they include periodic invoicing features, customizable templates, and easy interaction with other business tools.

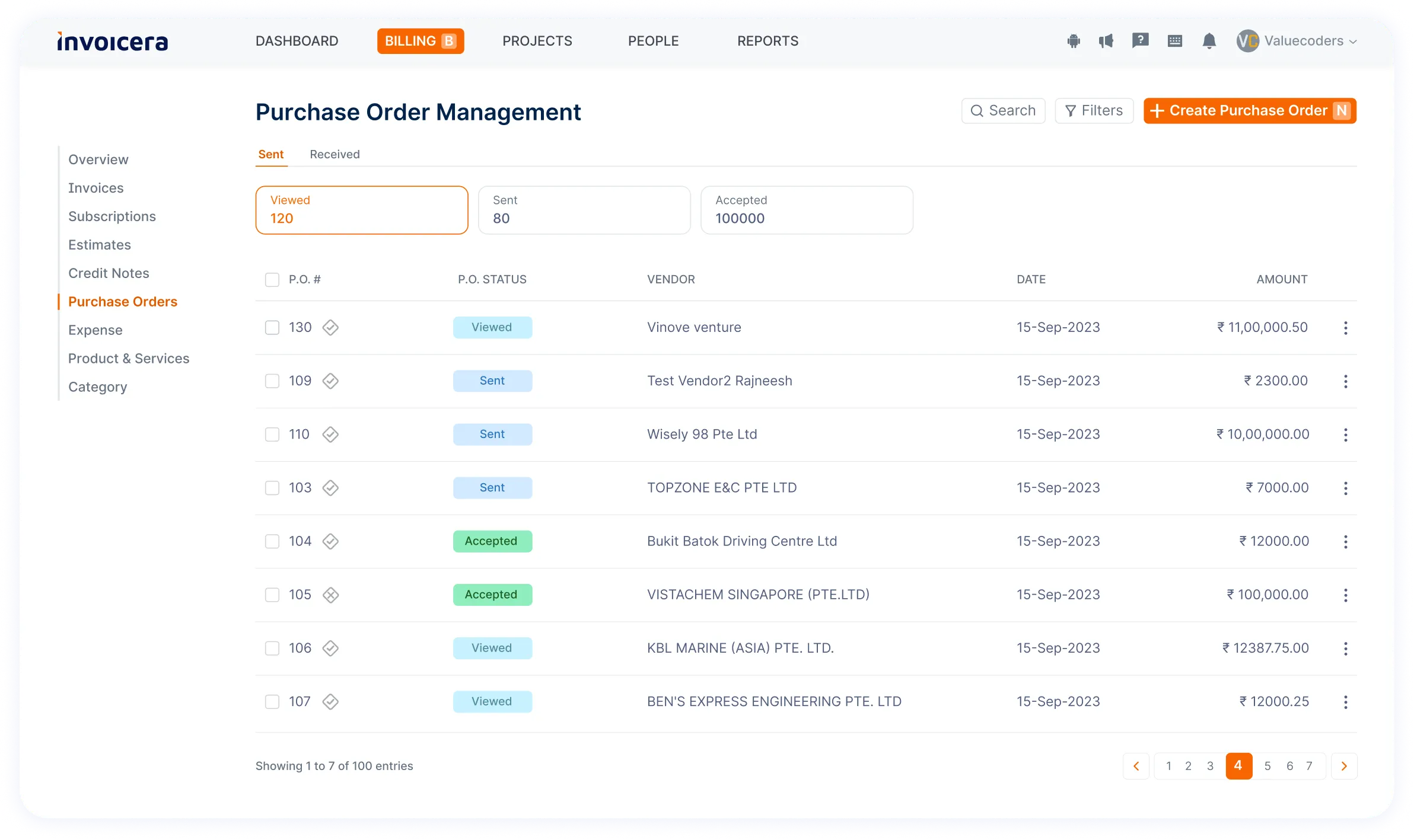

- Systems for enterprise resource planning (ERP): These are comprehensive business solutions that integrate accounting, inventory control, and invoicing into a single, unified platform.

- Accounting software with invoicing modules: Accounting software with invoicing modules offers parts dedicated to invoicing inside larger accounting frameworks, ensuring consistency between financial records and invoicing processes.

- Customized in-house systems: These are specially designed automated invoicing solutions adapted to meet each business’s unique demands and closely align with organizational requirements and particular invoicing processes.

Each type has its perks, allowing businesses to pick the one that fits them, suiting their needs and where they aim to grow.

5 Reasons To Switch To Automated Invoicing

1. Time Efficiency

In business, time is of the essence. There are several phases involved in manual invoicing, including producing invoices, reminding people to pay, and monitoring payments.

Automated systems, however, greatly simplify these procedures.

According to a study, “Businesses that switch to automated invoicing reduce the time spent on invoice processing by up to 80%.”

Because of the reduced manual labor, staff may focus on more strategic activities, increasing productivity and efficiency.

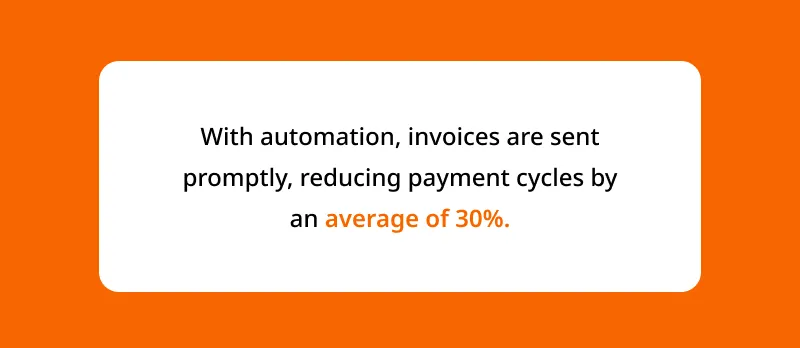

Automated systems also facilitate instant invoice generation and delivery.

It ensures quicker payments, improving cash flow and reducing the need for follow-ups.

Moreover, the system’s ability to schedule and send reminders for overdue payments frees up additional time.

A small business owner notes, “Automated reminders significantly cut down the time spent chasing late payments. This gives me more time to focus on growing my business.“

2. Reduction in Human Errors

Manual invoicing leads to human errors, which result in costly mistakes. These errors could be anything from incorrect data entry to miscalculations, leading to discrepancies in billing and payments.

Automation significantly reduces these errors.

By eliminating manual data entry, automated systems ensure accuracy in calculations and minimize the risk of oversights or discrepancies. This accuracy not only enhances the reliability of financial records but also fosters stronger client relationships built on trust and professionalism.

Beyond just the financial impact, reducing human errors frees up valuable time for your team.

Automated systems have validation checks and standardized processes that decrease the chances of errors.

These systems can detect discrepancies before sending out bills, ensuring the billing process is precise and efficient.

Furthermore, it is a proactive strategy to ensure data integrity, critical for any business’s long-term success.

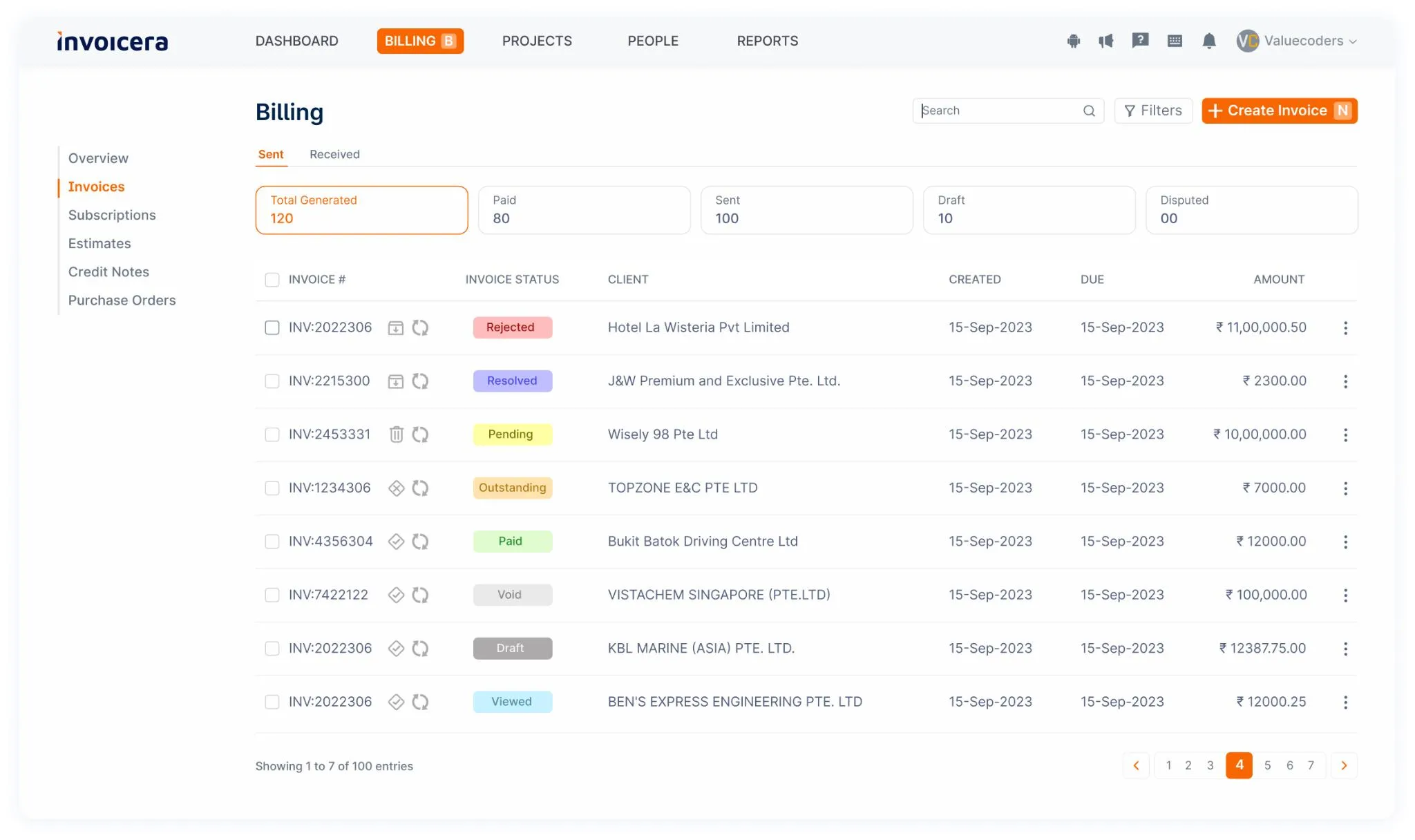

3. Enhanced Organization and Tracking

Making the shift from manual to automated invoicing brings some serious benefits.

First up: Enhanced Organization and Tracking. With manual systems, things can get messy quickly. Paperwork piling up, details scattered—who needs that headache?

Automated systems keep everything neat. They sort invoices, track payments, and ensure you know who’s paid and who hasn’t.

For instance, Invoicera, a solid automated invoicing platform, streamlines this process, making it easy to keep tabs on all your invoicing needs without the fuss of paperwork overload.

4. Cost Savings

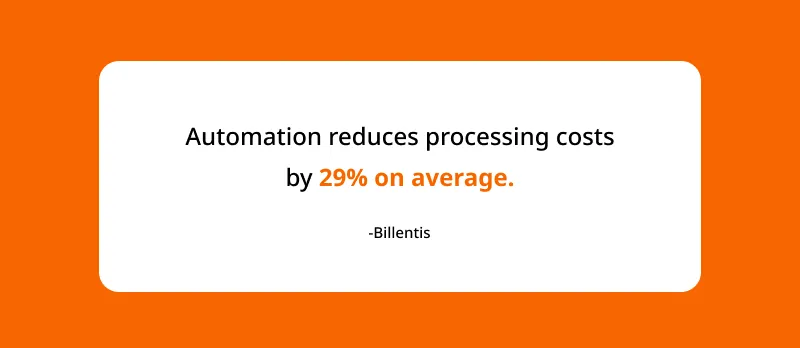

Automated systems bring down the costs related to paper, printing, and postage significantly.

The Institute of Financial Operations notes that businesses spend between $12 to $30 manually processing each paper invoice. However, utilizing automated systems slashes this cost to about $3 to $10 per invoice.

These numbers highlight the considerable potential for cost reduction by adopting automation.

Automated invoicing has other advantages beyond only saving money. It also reduces hidden expenses that come with late payments or billing errors.

When late payments are late, it can negatively affect your business’s cash flow, impacting daily operations and business growth.

By using automated systems, invoicing becomes more accurate, enabling swift sending and tracking of invoices, thus decreasing late payments.

This improved efficiency saves money and boosts the company’s overall financial well-being.

Automating the invoicing process also reduces the need for labor-intensive manual labor, freeing up workers to concentrate their skills and time on revenue-generating strategic initiatives.

This move has the potential to increase productivity and efficiency across various areas.

The cost savings from automated invoicing extend beyond immediate monetary benefits.

5. Integration and Scalability

- Streamlined Integration:

Automated invoicing brings everything together.

It integrates with different company apps like inventory management, CRM tools, and accounting software, making it easier to sync data across platforms.

This smooth connection boosts accuracy and gives a better view of financial data, helping organizations make smarter, real-time decisions.

Invoicera doesn’t just sync with your accounting software – it also works with various payment channels to keep things running smoothly.

- Scalability for Business Growth:

Scalability is one of the most compelling reasons to choose automated invoicing. Manual systems frequently fail to keep up with rising transaction volume as firms grow.

In contrast, automated systems are built to scale easily, meeting growing needs without sacrificing efficiency.

- Scalability for Business Growth:

Scalability is one of the most compelling reasons to choose automated invoicing. Manual systems frequently fail to keep up with rising transaction volume as firms grow.

In contrast, automated systems are built to scale easily, meeting growing needs without sacrificing efficiency.

These systems adapt to fluctuating workloads, ensuring consistent performance during periods of growth or high transaction volumes.

Whether a company doubles its customer base or diversifies its product offerings, automated invoicing systems can readily accommodate these changes without imposing significant overheads.

Invoicera: Your Automated Invoicing Solution

Nowadays, almost everyone is moving from manual to automated invoicing and embracing tools like Invoicera.

Features and Benefits

1. Time and Resource Efficiency

Manual invoicing can be boring and a time-consuming task.

Invoicera makes processes such as data entry, invoice generation, and delivery automated and effortless.

This effectiveness saves your team time and money so they may concentrate more on other crucial business tasks.

2. Error Reduction and Accuracy

In manual operations, human error is unavoidable. Problems might range from calculation concerns to inaccurate data entry, resulting in delayed payments and damaged customer relations.

The automated solution, Invoicera, reduces such risks by ensuring correctness in billing details, decreasing discrepancies, and improving overall reliability.

3. Improved Cash Flow Management

Invoices must be created and sent on time to ensure a healthy cash flow.

Invoicera automates the invoicing cycle by sending out reminders for past-due payments and facilitating quicker transactions.

This proactive approach improves cash flow by decreasing delays and increasing financial stability.

4. Customization and Branding

Invoicera offers customizable templates that fit your company’s branding.

Adding your logo, colors, and unique messaging to invoices enhances professionalism and strengthens your brand image.

This personalized touch adds professionalism to your transactions, leaving clients with a lasting impression.

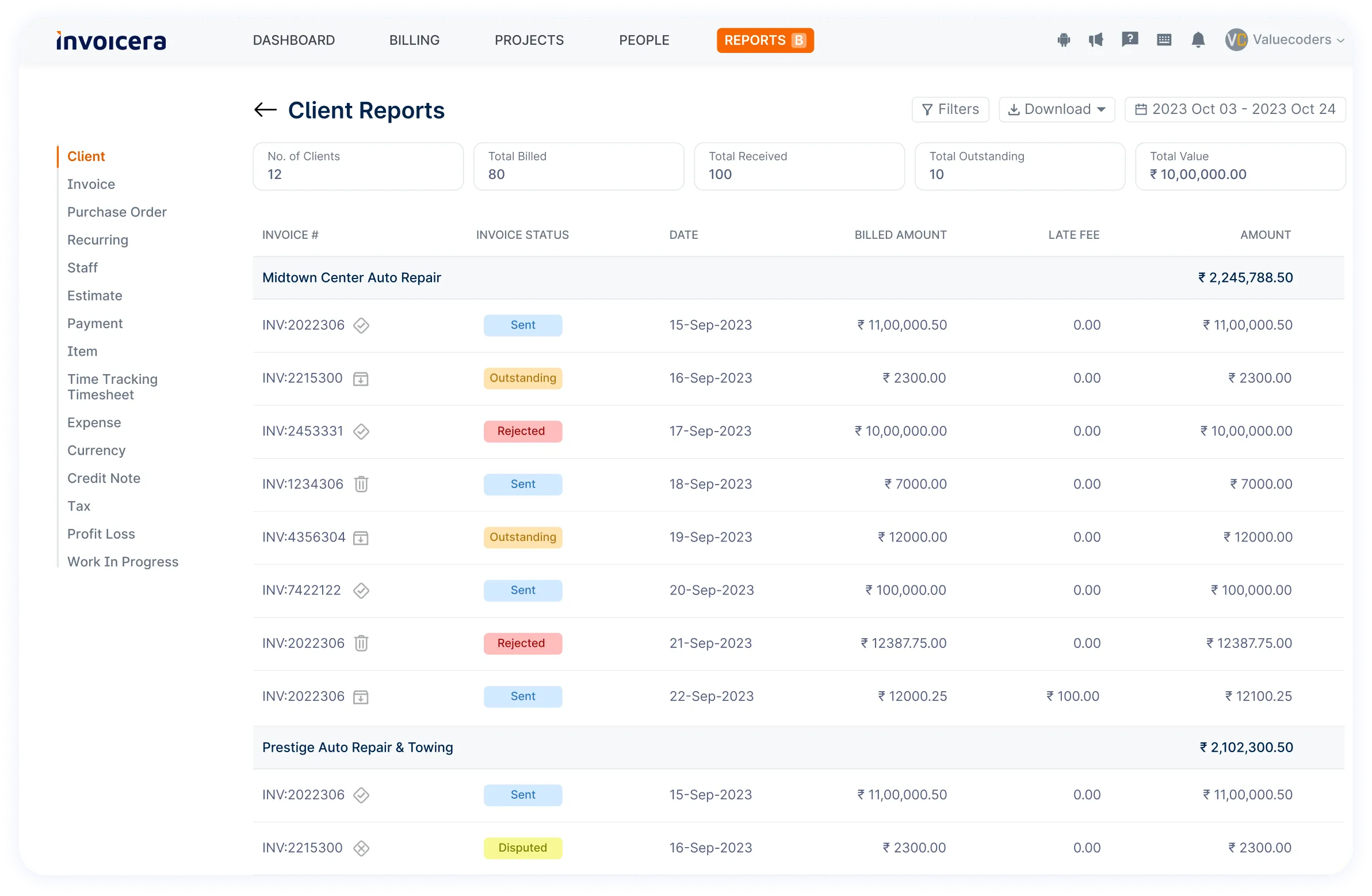

5. Enhanced Reporting and Analytics

It is important to know your financial data so that you can make effective decisions in your business.

Invoicera generates detailed analytical reports through which you can get clear insights about payments, outstanding invoices, and overall financial health.

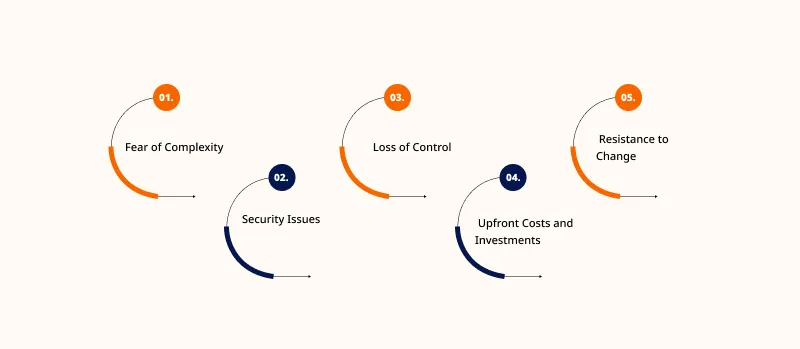

Common Concerns And Resistance To Automation

Transitioning from manual to automated invoicing systems can bring about a wave of apprehension and resistance within organizations. Let’s address some of the most prevalent concerns:

1. Fear of Complexity

Resistance often stems from the perceived complexity of new systems. Many worry that automation might be too intricate or require extensive training.

However, modern automated invoicing platforms are designed with user-friendliness in mind. They offer intuitive interfaces and streamlined processes to simplify adoption.

2. Security Issues

Security is a valid concern when dealing with sensitive financial data. Some might hesitate due to worries about data breaches or system vulnerabilities.

However, reputable automated systems prioritize robust security measures, employing encryption, multi-factor authentication, and regular security updates to safeguard information.

3. Loss of Control

Moving from manual to automated processes can invoke a feeling of losing control. There’s a fear that automated systems might malfunction, leading to errors or a lack of oversight.

Yet, these systems are often equipped with features allowing for greater transparency and control, offering real-time tracking and audit trails.

4. Upfront Costs and Investments

The initial investment in automated systems can appear daunting. Businesses, especially smaller enterprises, may worry about the cost implications.

However, many automated invoicing solutions offer scalable pricing models, ensuring that organizations pay only for the services they need, often resulting in long-term cost savings.

5. Resistance to Change

Human resistance to change is one of the most significant hurdles in adopting automation. People might prefer the familiarity of manual processes or fear of becoming redundant.

To alleviate these concerns, it’s crucial to emphasize the benefits of automation, such as time savings, reduced errors, and enhanced productivity.

Overcoming Resistance:

Educating stakeholders about the advantages of automated invoicing, addressing concerns proactively, and providing comprehensive training and support are key steps in overcoming resistance.

It’s vital to demonstrate how automation streamlines processes, minimizes errors, and saves valuable time for more strategic tasks, benefiting the organization in the long run.

Tips To Adopt Automated Invoicing

Switching from manual to automated invoicing is a significant step toward streamlining your business operations. Embracing this change can bring many advantages, but navigating this transition smoothly is important.

Here are some actionable tips to help you adopt automated invoicing seamlessly:

1. Understand Your Requirements

Begin by comprehensively understanding your invoicing needs. Assess the volume of invoices, the complexity of your billing processes, and the specific features you require in an automated system. This groundwork will guide you in selecting the most suitable software for your business.

2. Choose the Right Software

Research and explore various automated invoicing software options available. Look for features that align with your business requirements. Factors to consider include interface, scalability, integrations with existing systems, and security measures.

3. Plan for Implementation

Create a detailed plan for implementing the new automated system. Allocate resources, set realistic timelines, and involve relevant stakeholders. A structured implementation plan will facilitate a smoother transition without disrupting your ongoing operations.

4. Conduct Training Sessions

Provide adequate training to your team members using the automated invoicing system. Ensure your team understands the functionalities and benefits of the new system. Training sessions can significantly reduce the learning curve and enhance the adoption rate among your staff.

5. Test and Refine

Before fully transitioning, thoroughly test the automated invoicing system. Identify any glitches or areas that need refinement. Solicit user feedback and make necessary adjustments to optimize the system’s performance.

6. Monitor and Evaluate

Once implemented, continually monitor the system’s performance and gather user feedback. Regular evaluations will help you determine areas for improvement or other features that could enhance efficiency further.

7. Embrace Continuous Improvement

Invoicing processes evolve, and technology advances. Stay up-to-date with the current trends in automated invoicing. Embrace a culture of continuous improvement to leverage the full potential of your automated system.

Conclusion

Transitioning to automated invoicing is a smart move to boost efficiency, accuracy, and time management.

By embracing automation, companies reduce errors, improve cash flow, and strengthen client relationships.

The scalability and adaptability of automated systems future-proof operations while enhancing productivity.

Ultimately, this shift isn’t just about modernizing—it’s a strategic investment paving the way for sustained success in a competitive landscape.

And do not forget to check out Invoicera for the easiest invoicing process.

Happy Invoicing!

FAQs

Can automated systems handle customized invoicing formats or templates?

Yes, most automated systems offer customizable templates, allowing businesses to maintain their branding and unique invoicing formats.

How secure are automated invoicing systems in terms of protecting sensitive financial data?

Top automated systems like Invoicera use encryption and secure servers and comply with industry standards to safeguard sensitive financial information.

Are there options for multiple currencies and languages in automated invoicing systems?

Many systems support multiple currencies and languages, accommodating global transactions and diverse client bases.

Invoicera supports 125+ currencies and 15+ languages