Introduction

Small businesses offering professional services must invoice their clients frequently to get paid faster.

Did you know?

61% of invoice late payments are the result of incorrect invoicing.

Source: Amalto

A service invoice must include all the necessary details to make a self-explanatory invoice.

Including an itemized list of services, business transactions, last date for payments, and total balance is essential.

How to make a service invoice: Mastering the skills to create service invoices is the basic need for any professional services small business owner. It enables keeping track of sales, payments, revenues, and expenses.

Today, we will briefly discuss the topics that will help business owners to make service invoices and get quickly paid for the work:

- How to make an invoice for services offered?

- Key invoicing tips for creating service invoice

- Examples of service bills

- Types of Customization in Service Invoice

What Is A Service Invoice?

A service invoice is a formal document issued by a service provider to clients or customers to request payment for services rendered.

Its primary purpose is to clearly outline the details of the services provided, the associated costs, and the payment terms.

Service invoices facilitate transparent financial transactions between service providers and clients. They help establish a record of the services performed, enable the calculation of fees, and provide both parties with a document to reference in case of disputes or inquiries.

In essence, a service invoice is a financial communication tool that ensures service providers receive timely and accurate compensation for their work. At the same time, clients have a documented record of the services they’ve received and the corresponding charges.

How To Create an Invoice For The Service Offered?

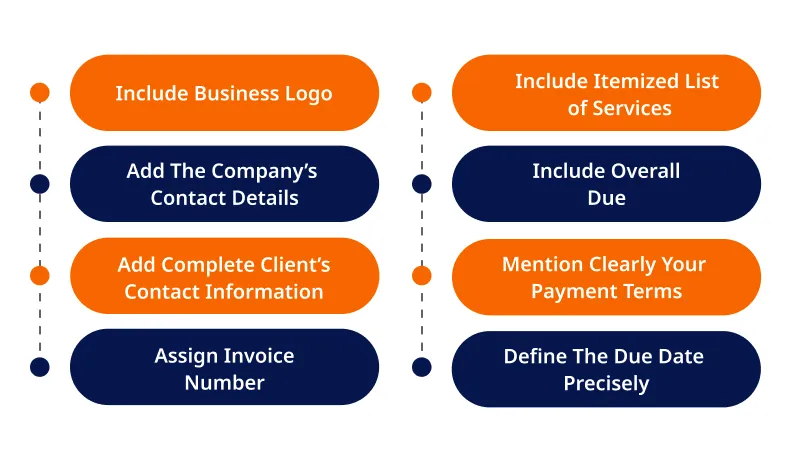

Businesses need to create a self-explanatory service invoice to request payments for the services offered. To create an aesthetically complete service bill, follow our simple guide:

1. Include Business Logo

Start creating your invoice by adding your business logo on the top of your service invoice template.

Invoicera is an online billing software that allows you to customize invoices with many templates. You can choose any preferable template that suits your business needs and add your business logo to make it authentic.

2. Add The Company’s Contact Details

In this step, add your company’s complete contact information, including your company’s name, address, contact details, and email address.

Including these details ensures your clients can easily reach you for payment-related inquiries or clarifications, fostering trust and facilitating smooth communication between both parties.

3. Add Complete Client’s Contact Information

Make sure to include your client’s complete contact information, including name, address, and phone number, just below the header. Because the billing address could differ from the contact information given, confirming the billing information with your clients is crucial.

This confirmation ensures that invoices are delivered correctly and helps to prevent billing difficulties.

4. Assign Invoice Number

Never create an invoice without an invoice number. Assigning a unique invoice number to each invoice helps in invoice record-keeping and tracking.

Moreover, an invoice number could be helpful to both parties, making it easier to identify and reference specific invoices in the future.

A systematic numbering system enhances professionalism and builds trust in your clients, showcasing a well-organized and reliable business approach.

Invoicera generates an automatic invoice number to make your tasks easier. It even allows you to customize your invoice numbers as per your needs. An Invoice number makes it easy to record and track invoices when needed.

5. Define The Due Date Precisely

Include the soonest payment deadline as possible with precisely mentioned dates. For example, write “Payment Due on or before March 25th, 2024 rather than mentioning “Payment due in 45 days”. Make your due date stand out in the invoice by highlighting the section for more emphasis.

6. Include Itemized List of Services

Now comes the important section. Include an itemized list of services provided in the service bill to help your client understand the due amount he needs to pay.

- Mention and describe the services you’ve provided.

- Quantity of products/workforce used.

- Rate of every service

- Taxes

- Finally, the subtotal

Use a more tabled template from the service invoice templates to make your invoices more readable and understandable.

7. Include Overall Due

After adding all the details, including the total amount payable in the end. Make sure your total amount payable is inclusive and exclusive of all the taxes, overhead costs, and credit notes issued, if any.

8. Mention Clearly Your Payment Terms

In the footer of your invoice, include all your payment terms to offer seamless payment transfer for your client.

- Mode of payments

- Transfer details

- Late payment policy

It’s also important to include any late fees you plan to charge on overdue invoices in the payment terms section of the invoice so clients know your late policy.

Key invoicing tips to create service invoice

Mastering service invoicing is essential for smooth financial operations. Here are a few invoicing tips for creating efficient and professional service invoices.

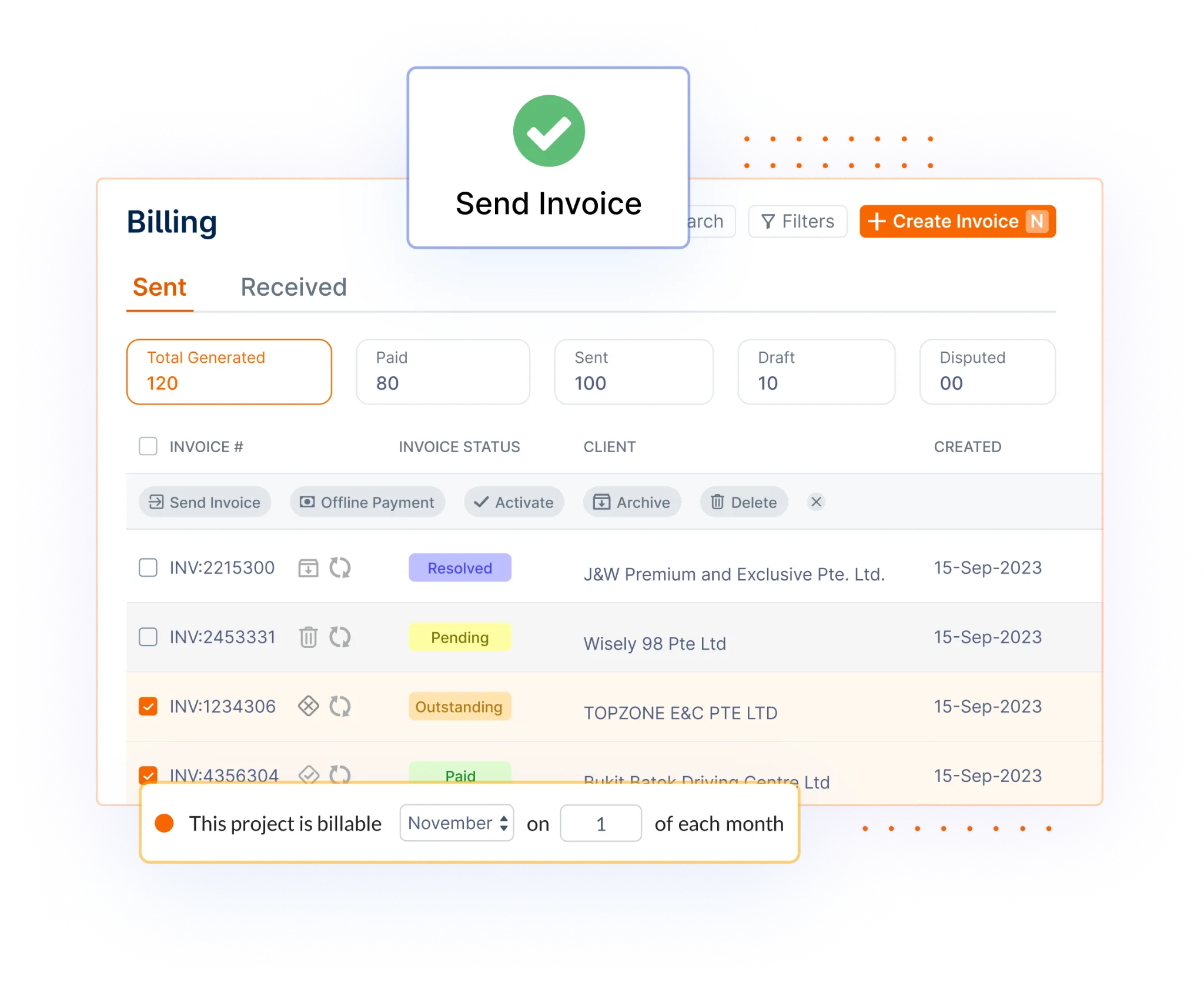

1. Proactively Send Service Invoices

Promptly invoice your clients as soon as you complete a client’s project. The quicker you will be in sending out invoices, the faster you can expect revenues. It boosts your overall cash flow and ensures obstacle-free business activities.

Creating a service bill right away means the job is fresh in your mind and you tend to forget less. It overall increases invoice efficiency by eradicating the chances of errors.

2. Keep Your Payment Deadlines Short

Keeping extended deadlines hamper processes for a service-based small business like yours. Ideally, a service-based company should expect and accept payments on the specific day of project completion because your jobs are usually short hours. Moreover, even if you have to give deadlines, stay within three days while invoicing your clients. Clearly mention in your policies about strict no delay in payments to make a statement.

3. Offer Multiple Payment Methods

Create a seamless flow of payment for your clients. Offer multiple payment methods to ensure zero delays in payment processing. Talk to your client about their most chosen payment option and offer them the same for added convenience. With other modes of payments, online payments are on much higher acceptance because of the convenience they provide to clients and businesses. Remember to add it to your processes too. If you work with your clients frequently, offer them recurring payment facilities with automation so that the processes occur without any hassles.

4. Introduce offers/early payment discounts

If your business margins allow you to consider different offers, do not hesitate to give your clients extra discounts to encourage frequent transactions and early payments. It will not only boost goodwill but also increase loyalty and boost transactions in your organization.

5. Do not Leave Late Payments on their fate-FOLLOW UP

While manually you might skip it, an automated software like Invoicera notifies you of the real-time status of your invoice (sent, received, opened, paid, or due date missed); it helps you clearly track each of your invoices and stay up to date with automated notifications. Invoicera also offers automated personalized payment reminders, frequently reminding your clients of due or missed dates.

6. Handle Disputes and Revisions Smoothly

When it comes to handling disputes and revisions on your invoices, it’s crucial to maintain open and transparent communication with your clients. If a client raises concerns or disputes a charge, don’t hesitate to address it promptly.

Listen to their perspective, and if there’s a valid issue, be willing to make revisions as necessary. Approach these discussions professionally, aiming for an amicable resolution that both parties can agree on.

Open communication and timely resolution play a pivotal role in getting paid quickly.

When you address disputes or revisions promptly and professionally, it demonstrates your commitment to providing quality service and resolving issues swiftly, which, in turn, can bolster client confidence and encourage on-time payments.

7. Keep A Record Of Data

Maintaining organized records of all your invoices is not just good practice; it’s essential for your business’s financial health.

Accurate record-keeping allows you to track your income, monitor outstanding payments, and simplify tax reporting. It also provides a historical record of your financial transactions, which can be valuable for business analysis and planning.

To streamline record-keeping, consider using accounting software or tools designed for this purpose. Such software can help automate invoice creation and management, track payment status, and generate financial reports.

This not only saves you time but also reduces the risk of errors and ensures that you have a clear and comprehensive record of your financial transactions.

8. Send Recurring Invoices

Recurrence and subscription-based invoicing models can be a game-changer for businesses seeking consistent and predictable cash flow.

Recurring invoices are typically used for services provided on an ongoing basis, such as monthly marketing services or software subscriptions. By setting up recurrence invoicing, you ensure that invoices are automatically generated and sent at specified intervals, reducing the administrative burden.

Managing such invoicing structures requires careful planning and the use of invoicing software that supports recurring billing.

It’s essential to set clear expectations with clients regarding the frequency and terms of recurring payments and to be responsive to any changes or cancellations. This approach not only minimizes invoicing overhead but also fosters a sense of predictability and reliability for both you and your clients.

9. Don’t Forget Client Feedback and Reviews

Client feedback and reviews can have a significant impact on payment timeliness. Positive feedback from satisfied clients can instill trust and confidence in your services, making clients more inclined to honor their payment commitments.

On the other hand, negative feedback can raise concerns and potentially lead to payment delays, so it’s essential to address client concerns and issues proactively.

Maintaining a positive reputation through exceptional service and responsiveness can serve as an incentive for clients to pay promptly. Encourage clients to provide feedback and reviews and take constructive criticism seriously.

Leveraging client testimonials and positive reviews on your website or marketing materials can further solidify your reputation and prompt clients to uphold their payment agreements.

Service Invoice Template Example

This sample service invoice template is for service-based small business owners to understand the structuring of a service invoice template free to create for all industry types.

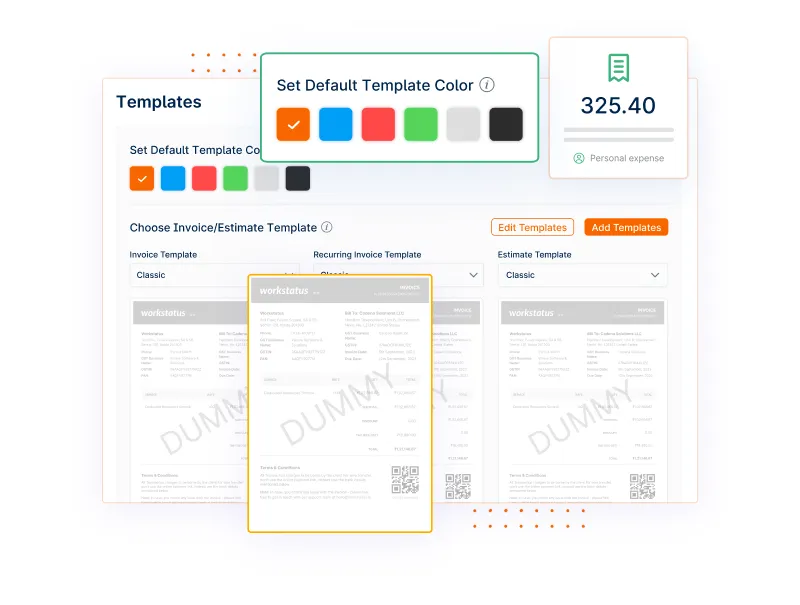

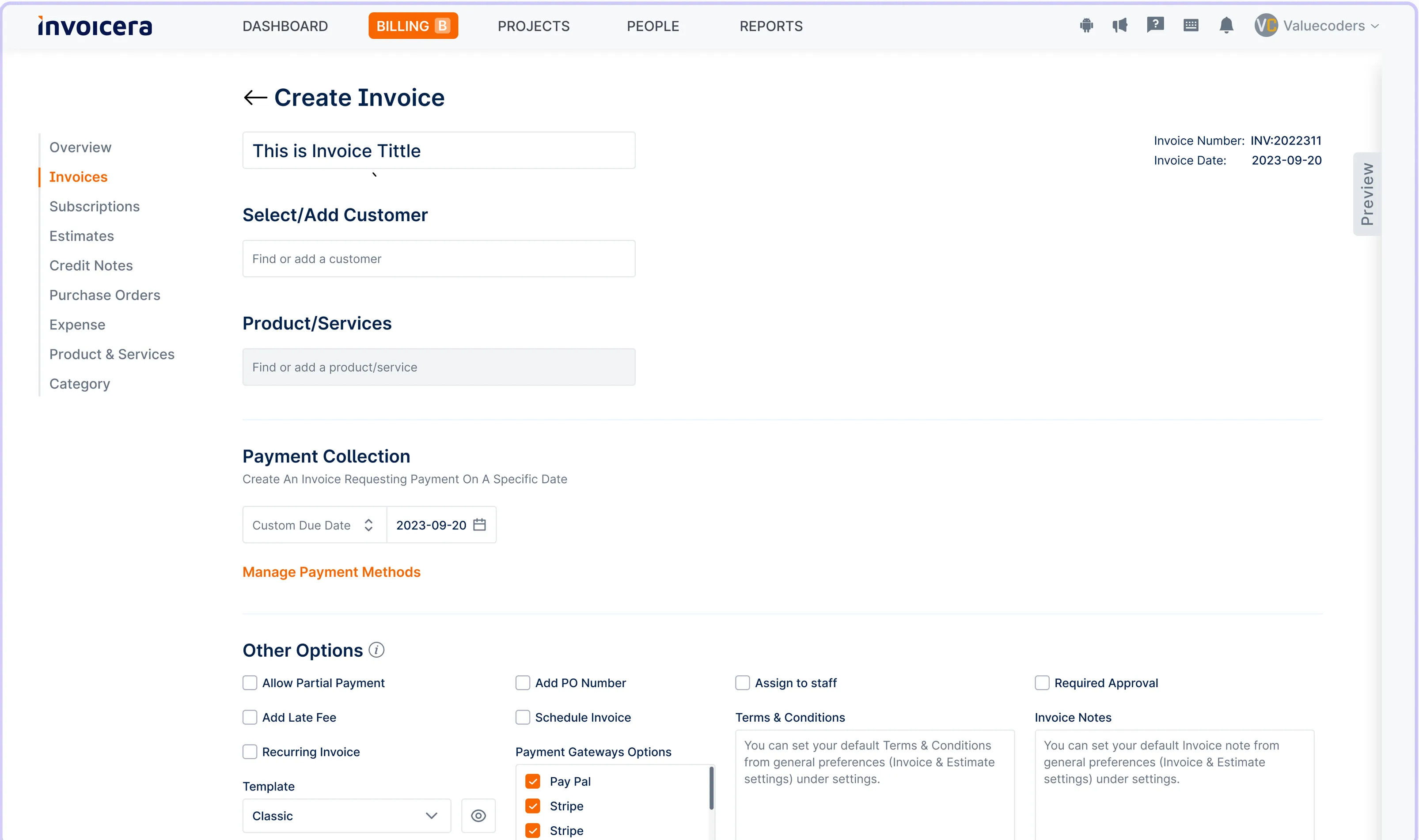

Send Service Invoice With Invoicera

In a service invoice, Invoicera offers multiple pre-designed templates to choose from. All of these templates are easily customizable and offer professionally beautiful invoices. Other than that, you can even customize your own brand service invoices with blank templates and save them for further usage.

Embrace a few more of Invoicera’s features:

- Clear Itemization: You can break down services and costs clearly, reducing confusion and disputes over payments.

- Organized Layout: Invoicera’s neat and tidy format makes it easy for clients to grasp the invoice details quickly.

- Swift Delivery: Invoicera ensures your invoices reach clients without delay, encouraging them to act promptly.

- Online Payments: It offers online payment options, making it convenient for clients to settle their bills and hasten the process.

- Time Saver: Using Invoicera saves you time, so you can focus on your work while invoices take care of themselves.

- Happy Clients: The hassle-free experience of Invoicera can lead to satisfied clients willing to pay on time.

- Healthy Cash Flow: Streamlined invoicing means quicker payments, contributing to a healthier cash flow for your business.

- Security and Trust: Invoicera ensures your data and transactions are safe and trustworthy.

- User-Friendly: It’s super easy to use, even if you’re not tech-savvy.

To offer more assistance to companies that have unique needs, experts at Invoicera help you create completely personalized invoices as per your workflow and branding needs.

Want to connect with our experts to know more? Connect with us.

Conclusion

You can increase your chances of getting paid promptly by considering the above-mentioned tips and techniques for writing a service invoice. An organized and understandable invoice speeds up the payment process, demonstrates your professionalism, and develops strong client connections.

To create a perfect billing experience, keep in mind to include all necessary information, specify clear payment terms, and use professional invoice templates. These will definitely help your business succeed.

FAQs

How can I ensure my service invoices are legally compliant?

You must research and follow the invoicing and tax regulations in your jurisdiction. You can also consult an accountant or tax professional to verify your invoices meet all legal requirements.

Can I add late payment penalties to my service invoices?

Yes, you can add late payment penalties or interest charges for overdue invoices. Be sure to communicate these terms clearly on your invoice and in your contract or payment agreement.

Should I personalize my service invoices for each client?

While it’s not necessary to customize every detail for each client, adding a personalized touch, such as a thank-you note or a customized message, can enhance your client relationships and make the invoice more engaging.