GST stands for goods and services tax is an indirect tax reform system introduced in India on 1st July 2017. GST levied both on Goods & services helps to create efficiencies in the tax administration. It consolidates various indirect tax levies such as central excise duty, service tax, VAT, Entry tax, Octroi, LBT, Countervailing duty, special additional customs duty, surcharges. Also, there are taxes that will continue post-GST such as basic customs duty, stamp duties, export duties, electricity duties, tax on professions, traders, callings and employment.

GST compliant invoices is the necessity for every business to boosts digitalization process with secure database storage and easy online transactions. GST regime not only helps companies in meeting new regulations but it also supports financial records. GST compliant invoices is a smart choice to run your business keeping your operations smooth.

Equally Important Post: Basics of GST: Tips to Prepare GST tax invoice together with Impact Of GST on Various Sectors In India

Here are steps to create GST compliant invoices in few clicks with Invoicera:

1. CONFIGURING YOUR GST ACCOUNT:

It is a few minutes set up process to configure your GST account in Invoicera. The first step is GST registration, visit: www.gstn.org website.

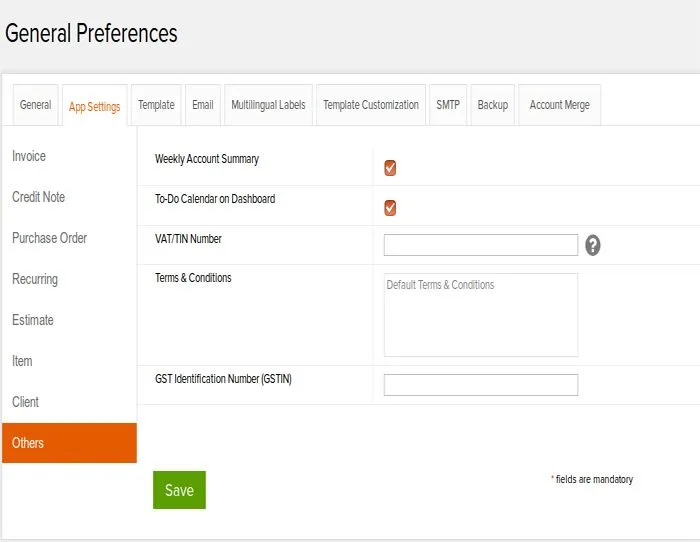

1) Login to Invoicera Account

2) Go to ‘Preferences’ link and click on App Settings

3) Under ‘Other’ section, a new text field is included to enter the 15 digit registered GSTIN of the respective organization.

2. SETTING UP GLOBAL TAXES

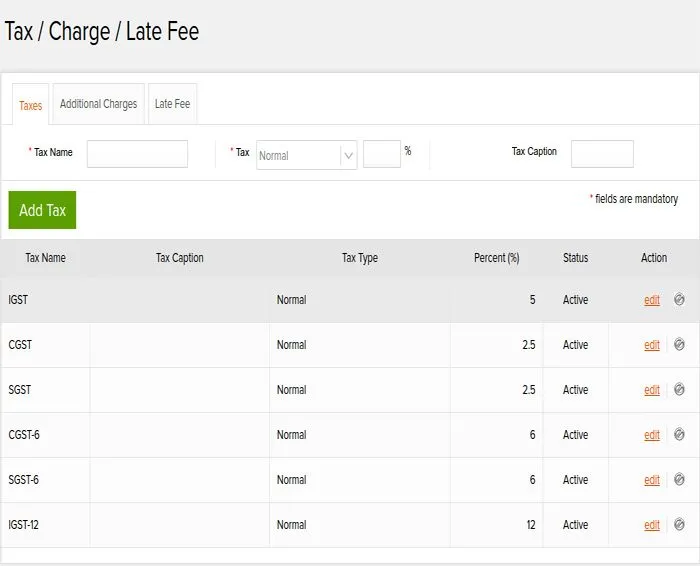

Once you’ve added the GST details, the next step is to set up default tax preferences for intrastate and interstate transactions. The tax rates are already added for the customers, plus you can even change the tax value as per your business analysis. The rates depend on the type of goods and services you sell. GST regime has the new way to calculate and track taxes for all your transactions. Follow these steps:

1) Click on ‘Tax/charges/ Late fees’ under Settings section

2) Under ‘taxes’ column: Add tax name, in-state & out-state tax, tax caption and percentage according to preferences

3) Submit as ‘Add tax’ options

3. PRODUCT/SERVICE LEVEL TAX RATE:

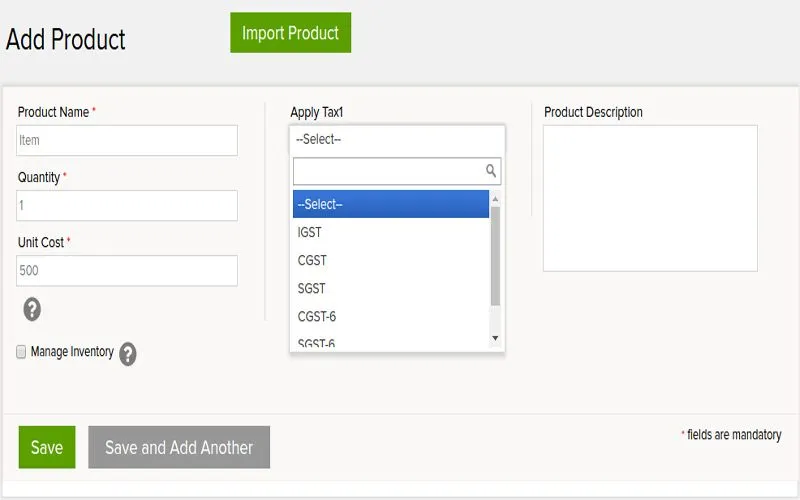

You don’t have to configure the tax rates to the items if it is same for all your products and services. When you apply different tax values for different products, then pre-configure the tax rates by editing the products and services recorded in the system. Follow these steps:

1) Under the ‘Billing’ option, Click on Products- Add

2) Edit the details with the preferences

3) Submit Save

4. UPDATE CLIENTS DETAILS WITH GSTIN NUMBER

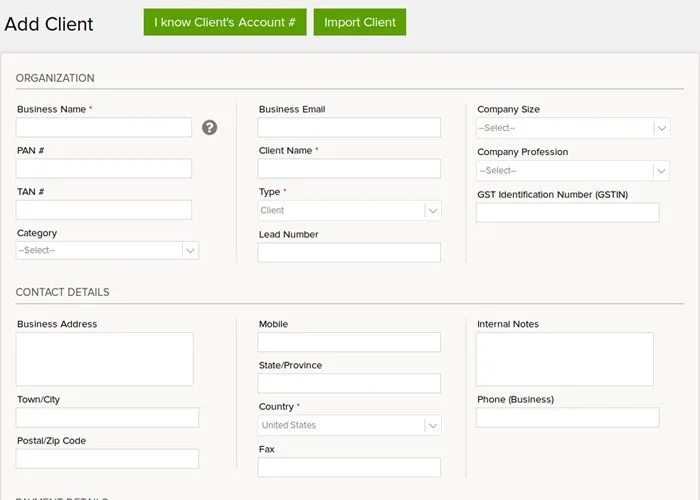

The proper client management can streamline the entire process, reduce inaccuracies in your tax preparations. The contact details of all the clients get saved into the system with the GSTIN number for further invoicing. You can easily update GSTIN number, access and share files from secure client portal, import clients, manage additional client email address and more.

5. SAMPLE SCHEMES OF INVOICING

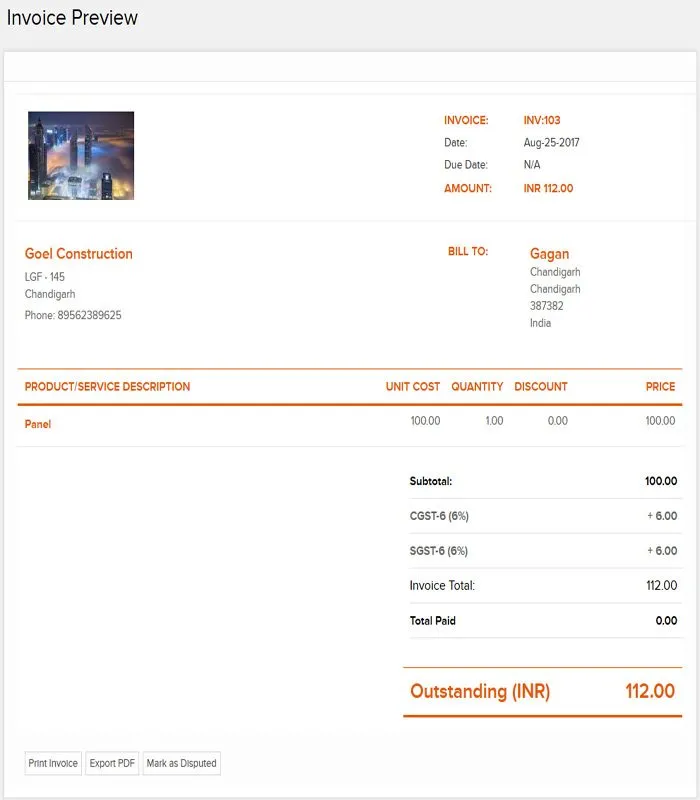

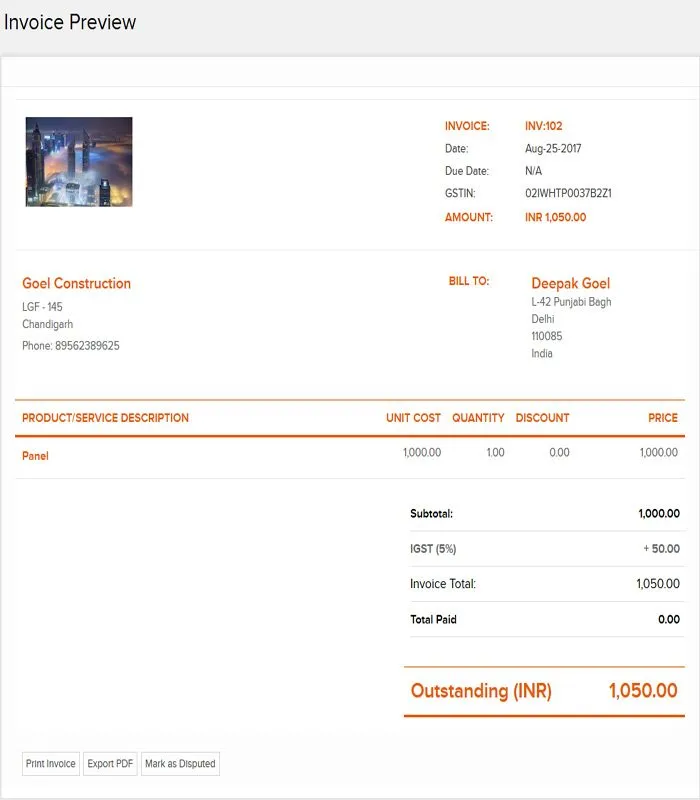

After capturing all the details you need, you’re ready to send GST compliant invoices in the GST format. Take a note if the products are sold within the state, the in-state GST rates i.e. SGST and CGST to be preselected. When you select the tax region as in-state in the invoice, it will automatically assign CGST and SGST rates.

If the products or services are sold in the different state, then the out-of-state tax rates IGST is applied. In that case it will assign 0% rate for CGST and SGST, 5% for IGST as shown in sample.

TO PUT IT ANOTHER WAY

Invoicing under GST certainly defines a new approach and changes the way you make your finances in the future. It is vital to use the online invoicing software like Invoicera that can help you create GST compliant invoices in a few clicks. Versatility that adapts to your business needs with the GST invoicing.