Top 5 Cash Management Software to Optimize Your Finances

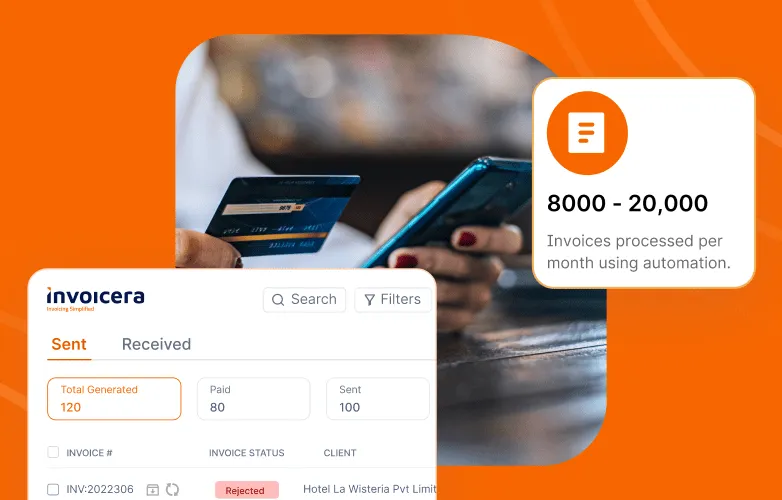

A retail company saw steady sales growth, a loyal customer base, and expanding market presence. Despite the operational success, it faced challenges due to limited cash availability. Invoices piled up, payments were delayed, and financial planning felt more like guesswork than strategy. The problem wasn’t the business model; but It was the lack of visibility. […]