Ensuring GST compliance is often a very difficult job, especially when e-way bills need to be made for every shipment in transit.

It is important for anyone running a logistics firm or overseeing supply chains across states to be aware of e-way bill rules all the time. Having the suitable top e way bill software set up can automate tasks, help you avoid mistakes, and never allow you to break the law.

This blog has selected the best e way billing software to help you meet GST requirements more easily.

If you need a more intelligent way to handle e-way bills, you’re in the right place. We’ll explore the tools and choices that help your business follow the rules and move smoothly using a reliable e-way billing system.

Let’s get into it!

Comparison Table

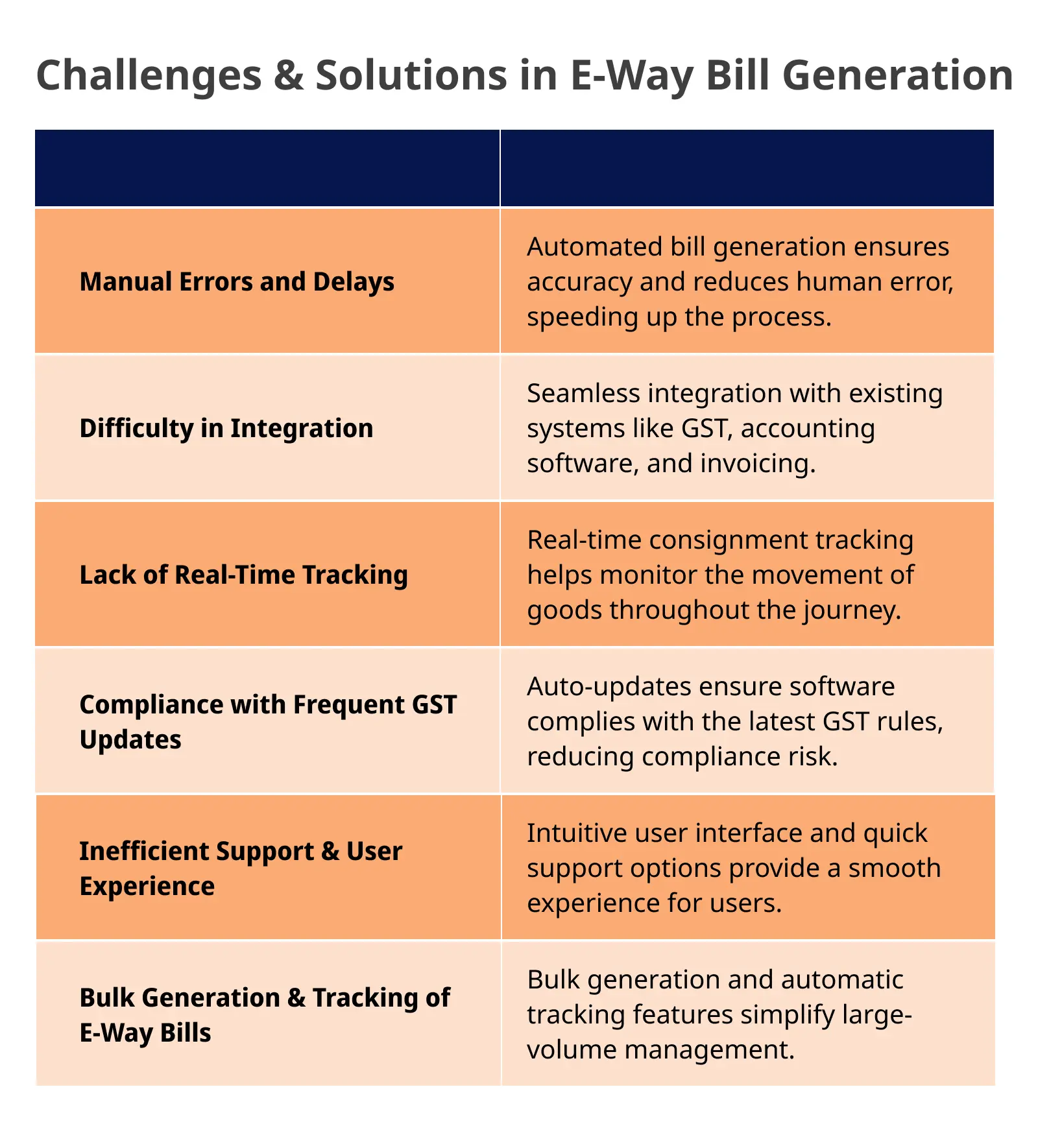

Must-Have Features of Modern E-Way Bill Software

The e-way bill software you choose needs to be more than just functional; it should be a well-rounded tool that can make your life easier. Here are the key features that modern software must have:

1. Automated E-Way Bill Generation

No more manual data entry! When it comes to the preparation of e-way bills, the software should be able to do this on its own using the details of the invoice.

2. Real-Time Tracking and Monitoring

There is no reason for not knowing where your goods are located [or their current status]. A real-time tracker enables you to monitor your consignment.

3. Seamless GST Integration

E-way bill software should be able to work well and seamlessly with your accounting or ERP solutions. This results in a smooth data exchange between platforms, a factors that helps avoid data difference and makes compliance easier.

4. User-Friendly Interface

A not-so-smooth interface can make an already complex process even more difficult. The right e-way bill system is user-friendly, and the users do not require extensive training to generate e-way bills.

5. Compliance Updates and Alerts

GST rules evolve, and so are the requirements for e-way bills. Your software should be set to update on its own based on the current rules and laws and notify you whenever there are changes.

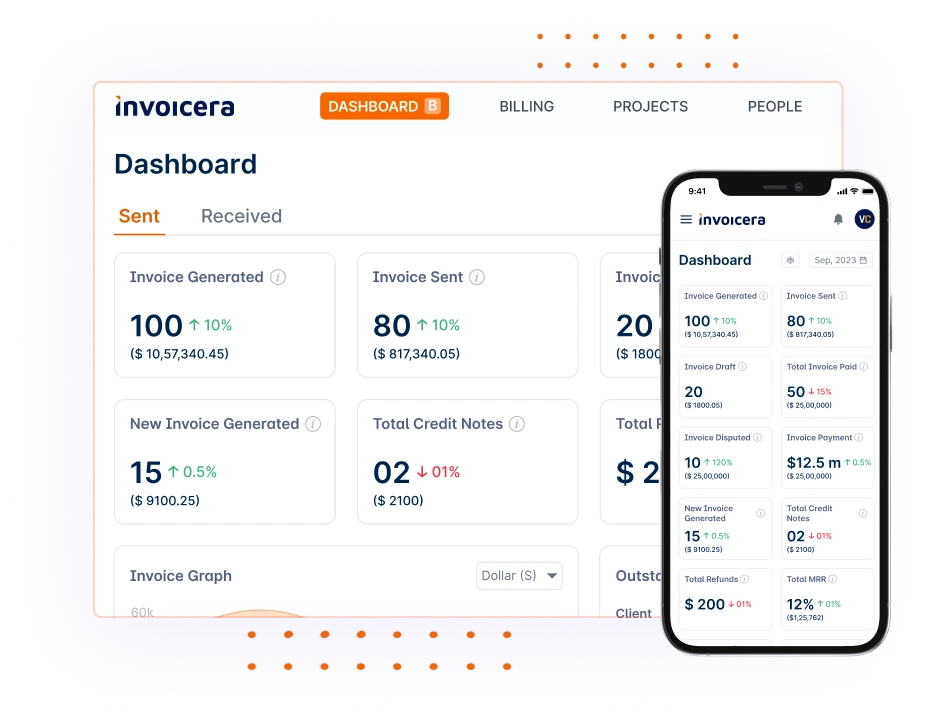

6. Multi-Device Access

The software should ideally be available for use on both laptops in the office and on the go from mobile devices.

7. Batch Upload and Bulk Generation

For companies that make numerous shipments, the ability to upload invoices in batches and generate hundreds of e-way bills at once is a game-changer.

8. Advanced Reporting and Analytics

Your billing tool should also help you analyze your results, identify patterns and inefficiencies, delay, and address other critical compliance problems.

All these features are a cornerstone for any high-quality e-way bill software. It should not only assist you with compliance issues but also make your work easy.

The Top 8 E-Way Bill Software

Here are the best E Way Billing Software for you to consider:

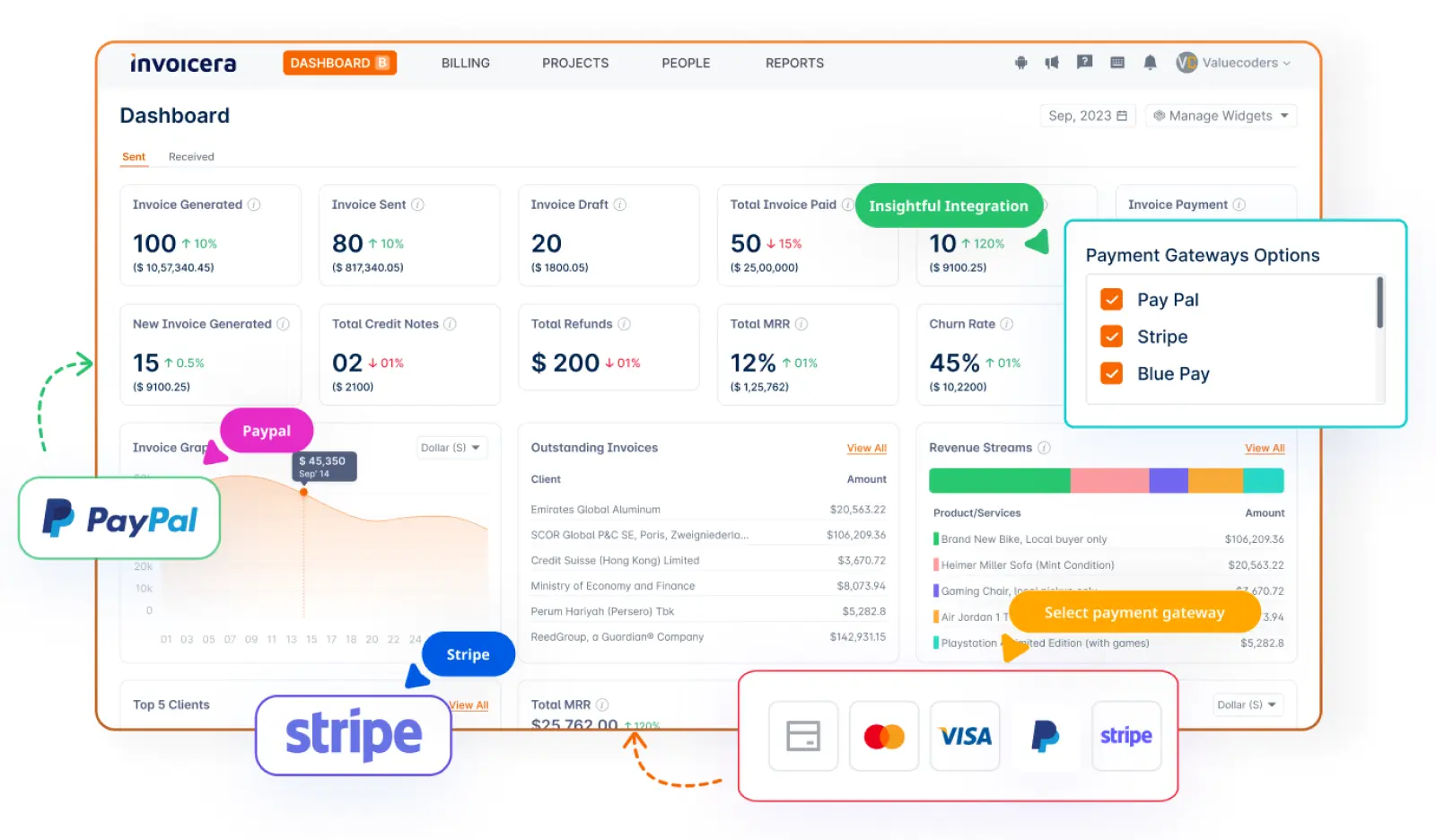

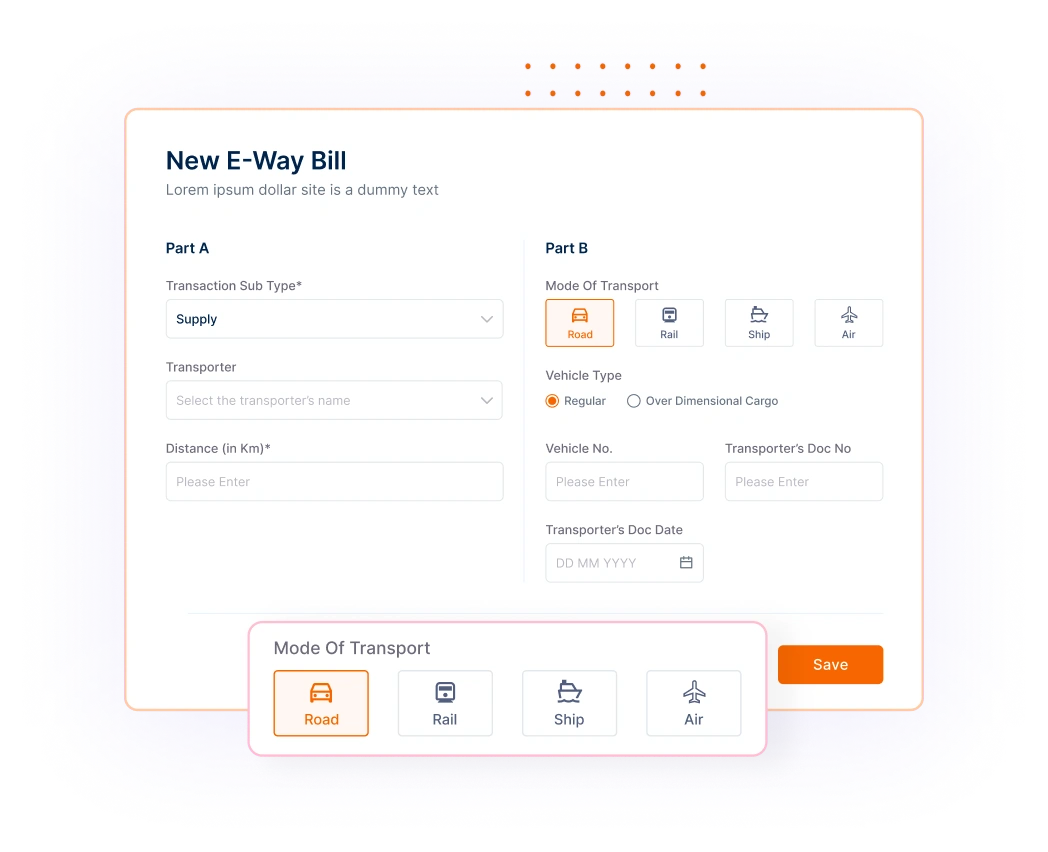

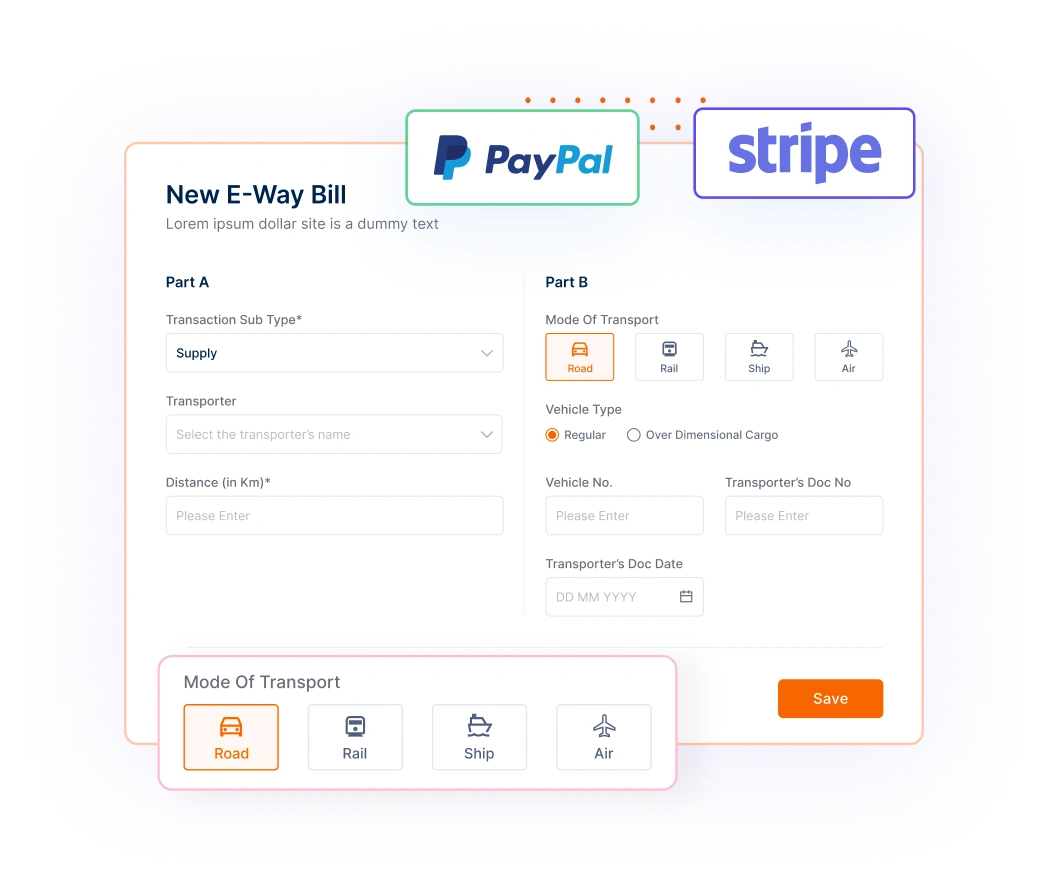

1. Invoicera

Invoicera is a comprehensive invoicing and e way bill software that simplifies e-way bill generation for businesses of all sizes. It ensures GST compliance while streamlining transport documentation, saving both time and effort.

Key features

Easy E-Way Bill Generation

- Generate e-way bills directly from your invoices

- Auto-populates required details to reduce manual work

GST-Compliant Billing

- Pre-designed invoice templates with GST Billing software

- Automated tax calculations and GST reports

Real-Time Tracking

- Monitor the status of each e-way bill

- Track expiry, rejection, or updates instantly

Centralized Dashboard

- Manage and view multiple e-way bills in one place

- Access records anytime for audits or compliance checks

Seamless Integration

- Connect with transporters and logistics systems

- Works smoothly with your existing billing workflow

Pricing

- Free trial available

- Pricing plan starts at $15/month

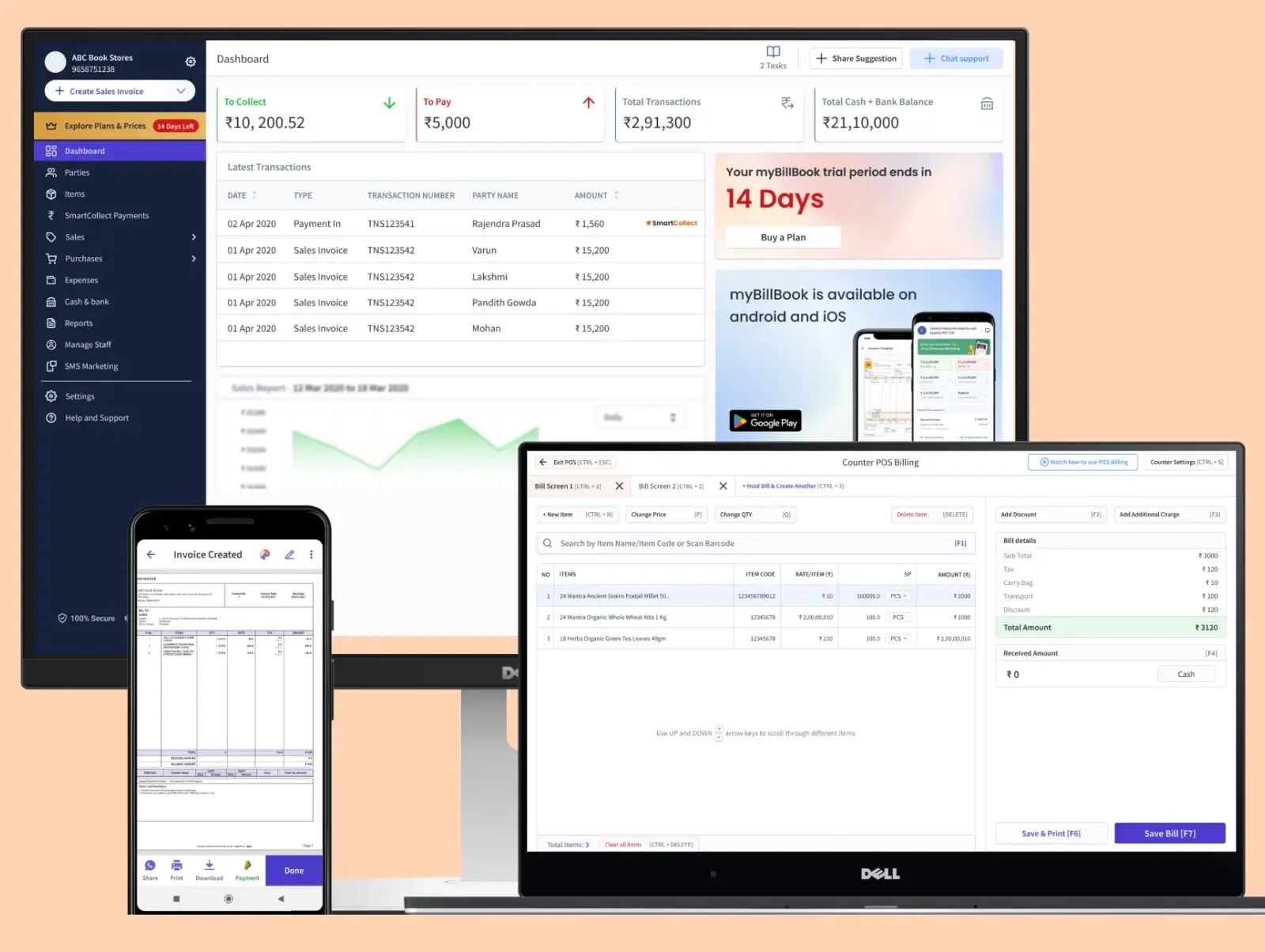

2. myBillBook

Enter myBillBook. This tool is all about speed, accuracy, and accessibility, ensuring you spend less time on logistics headaches and more time growing your business.

Features

Instant E-Way Bill Generation with Auto-Validation: Say goodbye to errors and delays. Create error-free e-way bills in under 30 seconds with smart auto-validation and 25+ compliance checks.

Seamless Integration with GST and E-Invoicing: Turn invoices into e-way bills without lifting a finger—compliance has never been this easy.

Multi-Device Support with Real-Time Sync: Whether you’re on your phone, laptop, or tablet, your data stays updated across all devices, keeping you in control, no matter where you are.

Pricing

Diamond Plan: ₹217/month (billed annually, excludes GST @18%).

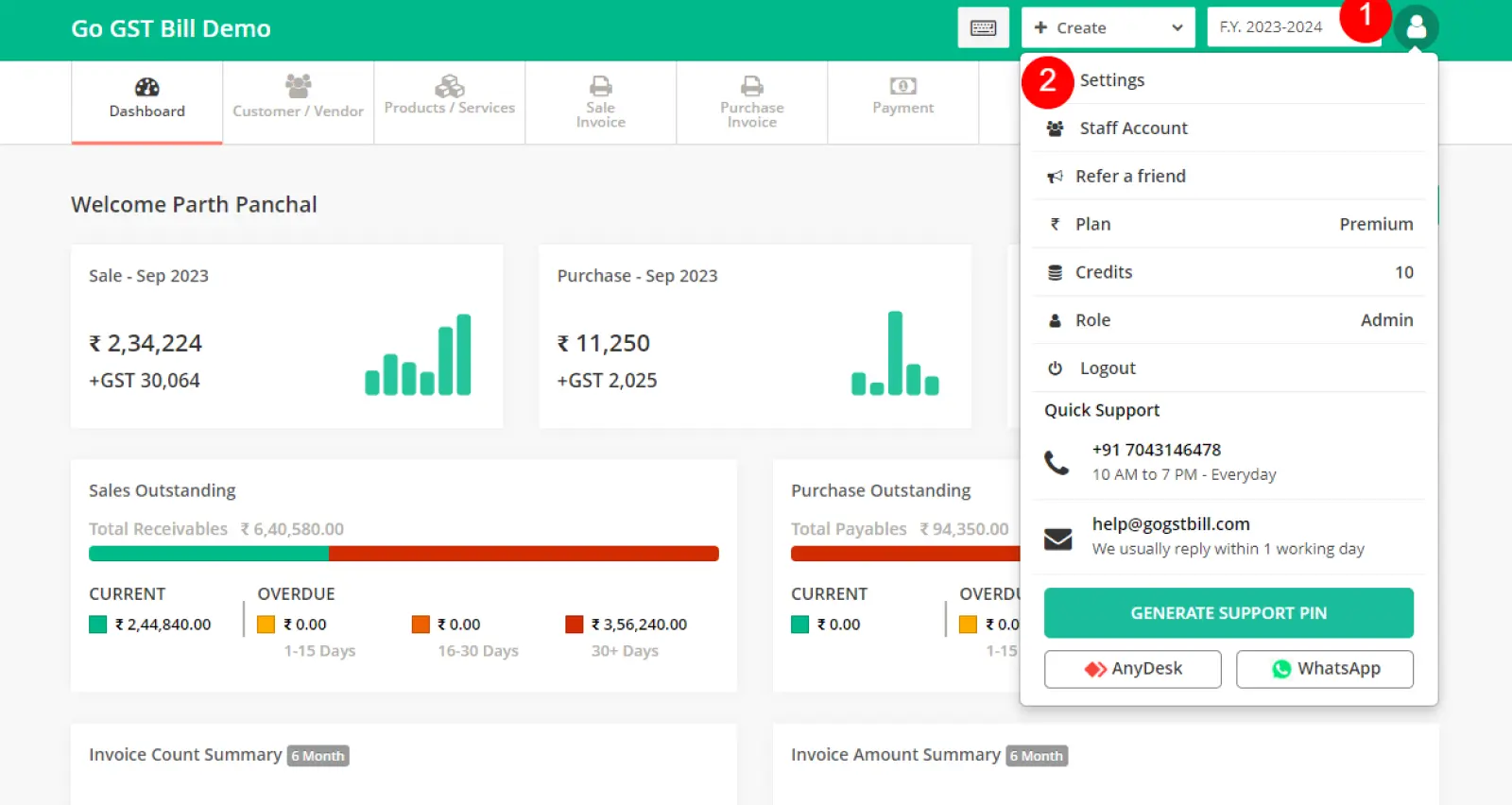

3. Go GST Bill

With Go GST Bill, creating, managing, and sharing e-way bills is so easy, you’ll wonder why you ever did it manually. Plus, it’s got enough security to make even your IT team relax.

Features

Single-Click E-Way Bill Generation: Simplify your process and generate e-way bills with zero fuss.

Instant Cancellations: Plans changed? Cancel your e-way bill with a single click.

Share Bills via WhatsApp or Email: Keep stakeholders in the loop without breaking a sweat.

Smart Validation: Ensure compliance with automated error-checking.

High-Grade Data Security: Rest easy knowing your data is protected by top-tier encryption.

Invoice Integration: Print e-way bill details directly on invoices—no portal hopping required.

Organized Records: Manage all your e-way bill data in one tidy, accessible place.

Pricing

Premium Plan: ₹1499/year + GST.

4. Zoho Invoice

This tool simplifies compliance with a single click, helping you stay organized and in control. Zoho’s got your back—efficient, smart, and straightforward.

Features

Quick e-way bill creation: Generate bills instantly by selecting transactions like invoices or credit notes.

Smart detection: Automatically identifies transactions that need an e-way bill based on government rules.

Intuitive filters: Easily sort through bills to track pending, cancelled, or completed ones.

Compliance made easy: Capture and attach the bill info directly to invoices and transport copies.

Real-time tracking: Monitor consignment status and bill validity right from your account.

Centralized portal: Generate bills for multiple states without switching between portals.

Pricing

Starts at ₹899 per organization/month.

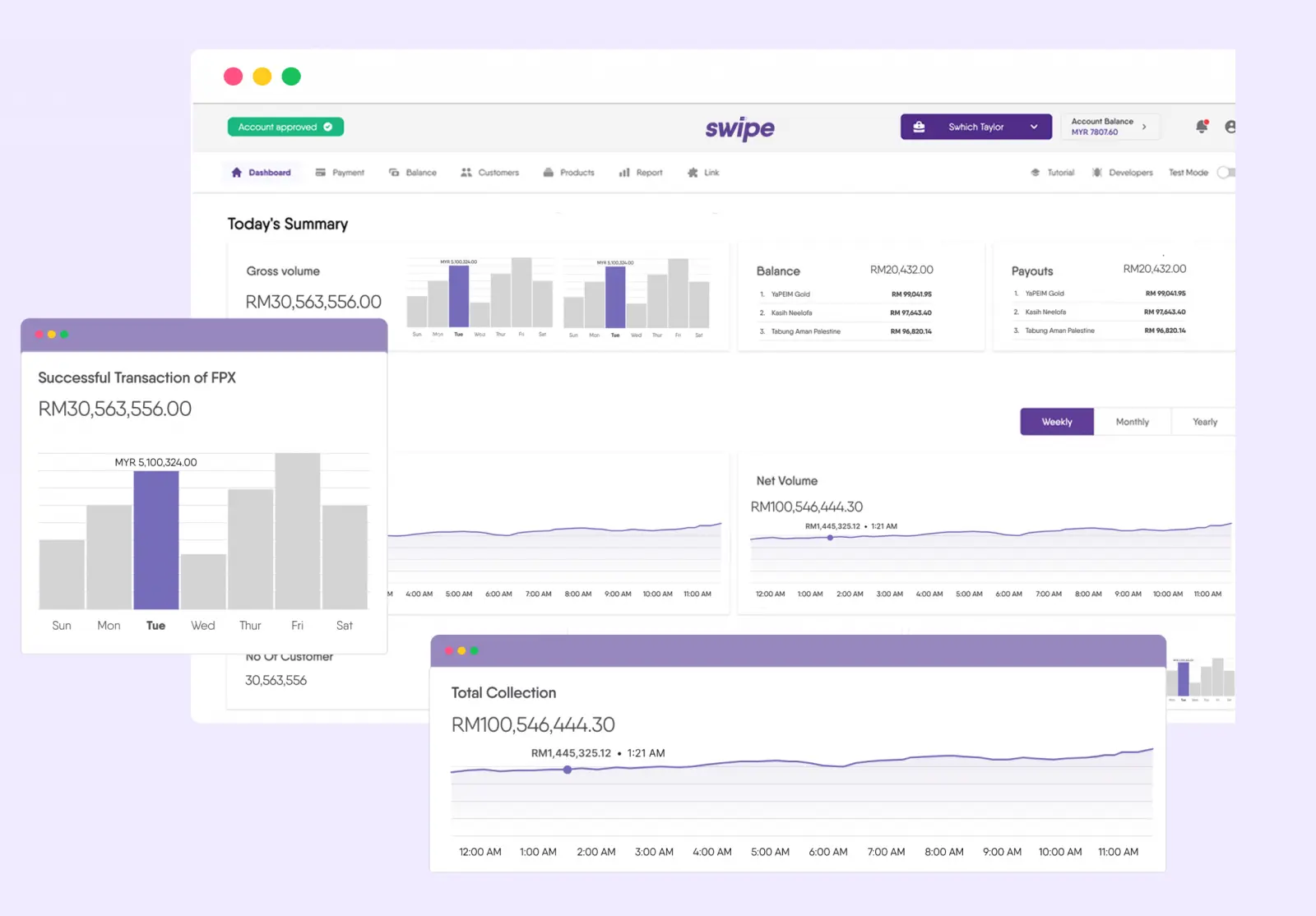

5. Swipe

If simplicity is your thing, Swipe is here to streamline your e-way bill journey. Designed with ease of use in mind, it ensures smooth compliance while saving you time and effort.

Features

One-click e-way bill generation: Create e-way bills in seconds with minimal effort.

Consignment tracking: Monitor your shipment status with real-time updates.

Automatic data entry: No need to type manually; Swipe takes care of it.

Seamless integration: Works effortlessly with your billing and invoicing systems.

Accessible anywhere: Manage your bills on any device, anytime.

Pricing

Pro plan starts at ₹233 per month.

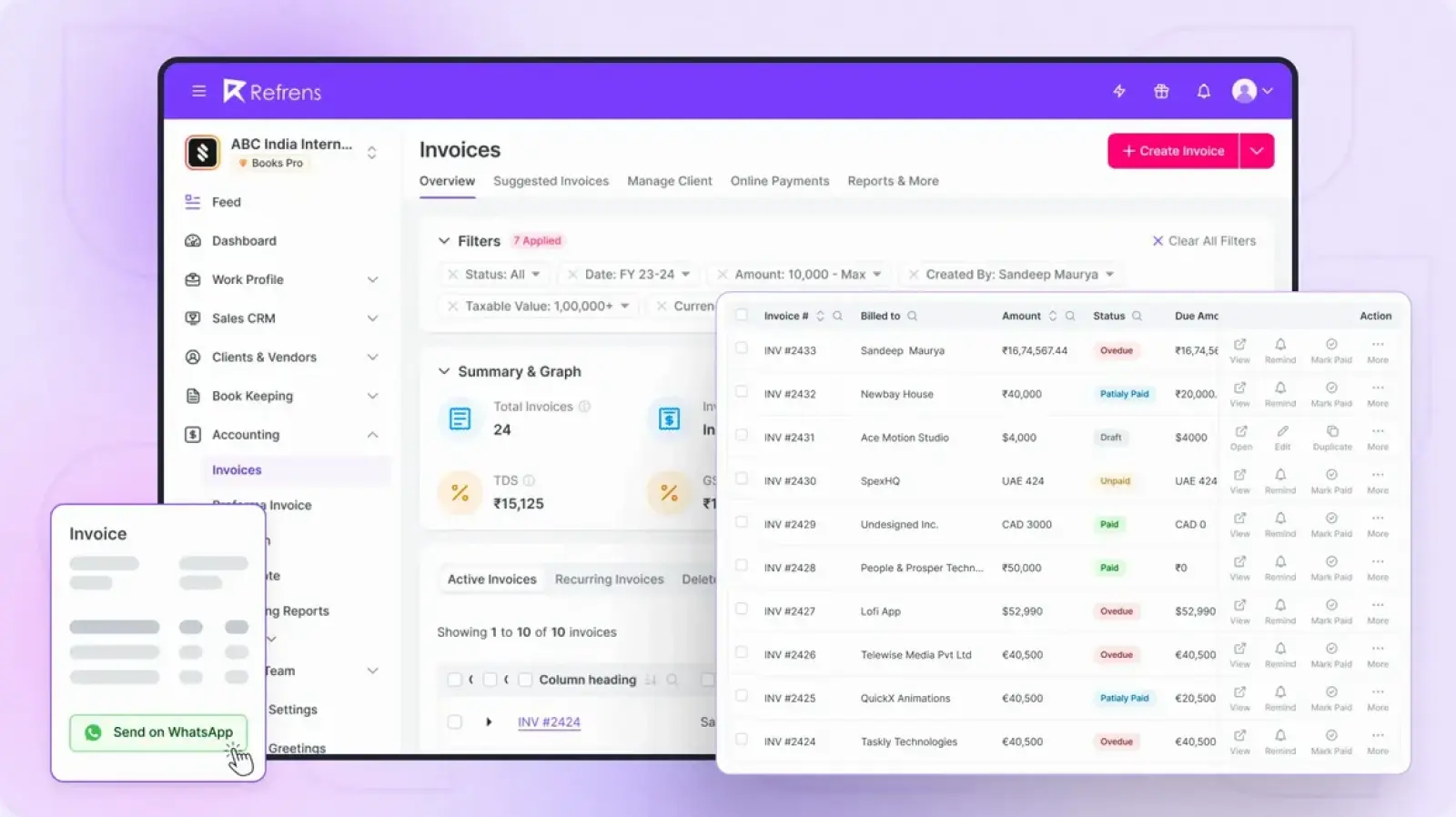

6. Refrens

Refrens is your go-to tool for hassle-free e-way bill management, blending automation with accuracy. Generate e-invoices and e-way bills in seconds, all while sipping your coffee.

Features

One-click generation: Create both e-way bills and e-invoices without switching platforms.

Automation magic: Let Refrens handle the data entry while you relax.

Auto-validation: Ensures all your data is compliant and error-free.

Cloud access: Manage your e-way bills anytime, anywhere, from any device.

Pricing

₹4,700 per year, per business.

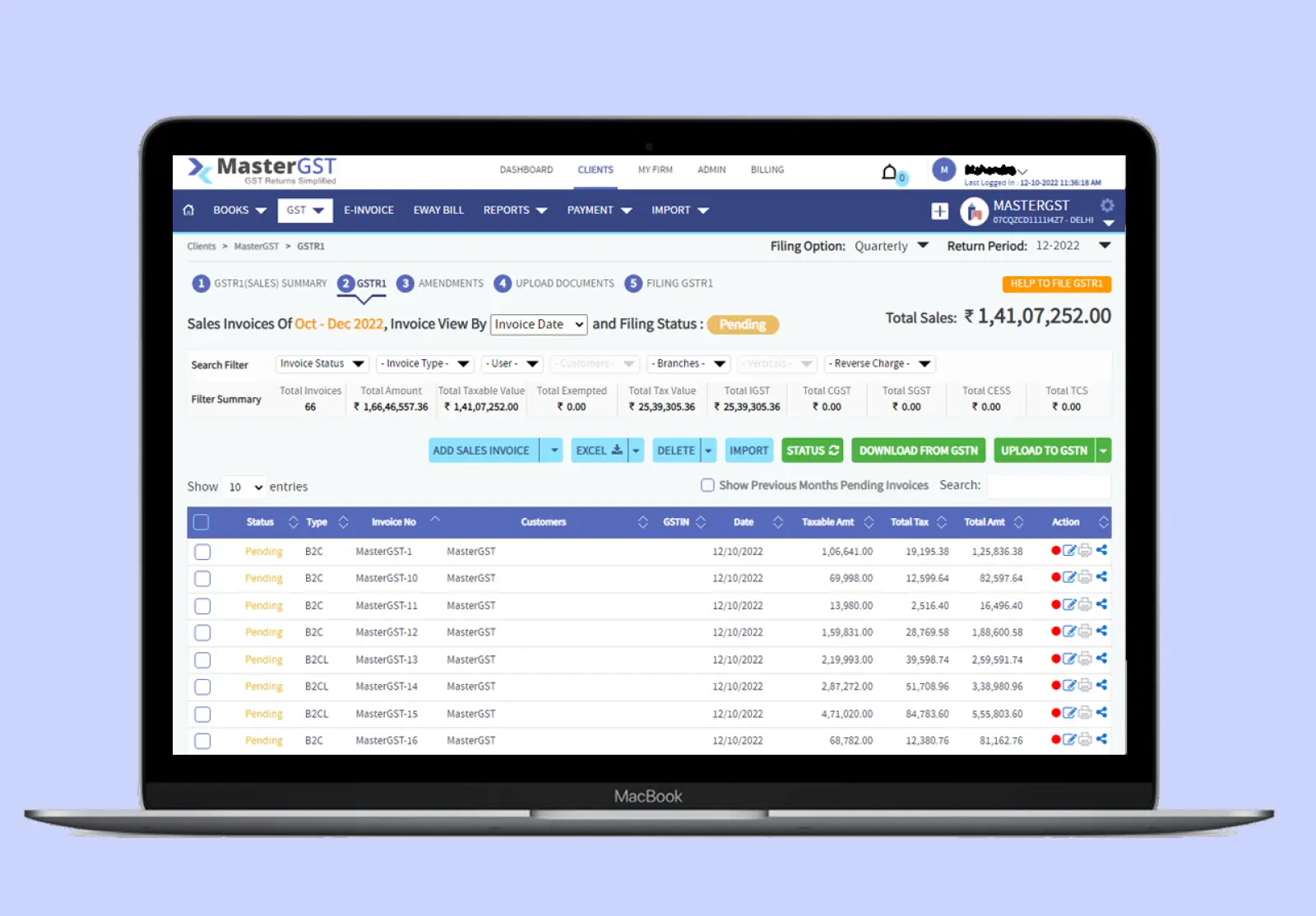

7. MasterGST

MasterGST simplifies your e-Way Bill generation by enabling you to input invoice and vehicle details with ease. It also offers access to historical e-Way Bill data from the government portal for added convenience.

Features

Data Management Made Easy: View, edit, update, cancel, or delete e-Way Bill data effortlessly. Even bulk updates of multiple vehicles can be handled at once.

Quick Cancellations: Cancel e-way Bills swiftly by simply providing a reason.

Insightful Reports: Generate detailed e-Way Bill reports, categorized month-wise, year-wise, or customized as needed. Easily export this data to Excel for offline use.

Pricing

Pricing details are available upon request.

8. ClearTax

ClearTax offers a robust and user-friendly solution for generating e-Way Bills, regardless of your company’s size or ERP platform. It’s packed with intelligent automations, high-security standards, and seamless ERP integration to keep your logistics operations smooth and error-free.

Features

Faster Bill Creation: Enjoy a 10x faster experience with 100+ validations to eliminate errors.

ERP-Friendly: Integrates seamlessly with popular platforms like SAP, Oracle, Tally, and more.

Smart Scheduling: Automate bill generation after office hours and receive timely alerts for expirations.

Error-Free Operations: Validate HSN codes, tax rates, and distances with built-in intelligence.

Bulk Data Handling: Update vehicle details, split or merge e-Way Bills, and download historical data in bulk.

Bank-Level Security: Data protection includes SSL encryption, SOC 2 compliance, and ISO-certified storage facilities.

Custom Controls: Enable branch-level access and use personalized templates for printing.

Actionable Dashboards: Track your goods’ movement through intuitive dashboards and powerful reports.

Pricing

ClearTax provides flexible pricing options. You can try their services for free or request a custom demo for tailored solutions.

Benefits of Using E-Way Bill Software

Using e-way bill software brings efficiency and accuracy to GST compliance, smoothing the entire business process. Let’s learn the key benefits of using top e way bill software:

1. Time-Saving Automation

- Instantly generates e-way bills from invoice data

- Reduces time spent on manual entries and paperwork

2. Error Reduction

- Validates data before submission to prevent rejections

- Minimizes human errors and ensures accuracy

3. Bulk Processing

- Uploads multiple invoices at once

- Generates e-way bills in batches; ideal for high-volume businesses

4. Seamless Integration

- Connects with ERP and accounting systems, including popular e-invoicing software

- Syncs invoice data automatically for consistency

5. Real-Time Updates

- Tracks shipment status and vehicle changes live

- Sends alerts for expiry and compliance issues

6. Regulatory Compliance

- Stays aligned with the latest GST laws using trusted top e way bill software

- Reduces the risk of penalties or missed deadlines

7. Audit Readiness

- Generates detailed, downloadable reports

- Keeps records organized for quick audits

8. User Access Control

- Enables secure, role-based access for teams

- Improves workflow management and accountability

9. Reduced Operational Costs

- Cuts down on manpower and compliance delays

- Saves money through process efficiency, especially when paired with online payment gateways

Thus, adopting the right best e way billing software simplifies compliance, boosts productivity, and cuts costs.

Conclusion

To sum up, dealing with GST compliance may be difficult, but using the right e-way billing software takes much of the strain away. These 8 options include some of the top e way bill software that help you use your time wisely, avoid errors, and remain within the rules.

That’s why Invoicera is a good option: it’s simple, works well with other platforms such as trusted global invoicing software, and handles many tasks automatically, including integration with online payment gateways and e-invoicing software.

The right software can relieve some compliance pressures, so you can spend more time on business growth and less on paperwork.

FAQs

Ques: Can e-way bill software integrate with existing accounting or ERP systems?

Ans: Yes, most top e-way bill software offers integration with popular accounting and ERP platforms to automate data syncing and reduce manual work.

Ques: Can e-way bills be generated in bulk using such software?

Ans: Yes, bulk generation is a key feature, allowing businesses to upload multiple invoices and create several e-way bills at once.

Ques: How does e-way bill software help reduce errors during GST compliance?

Ans: The software validates data before submission, flags mistakes, and ensures all details meet GST rules, reducing the chances of rejection or penalties.

Ques: Do these e-way bill solutions provide real-time tracking of shipments?

Ans: Many top solutions include live tracking and alert features so businesses can monitor the status and expiry of e-way bills instantly.

Ques: Is it secure to use e-way bill software for managing sensitive business data?

Ans: Yes, leading software uses encryption and role-based access controls to protect your data and keep operations secure.