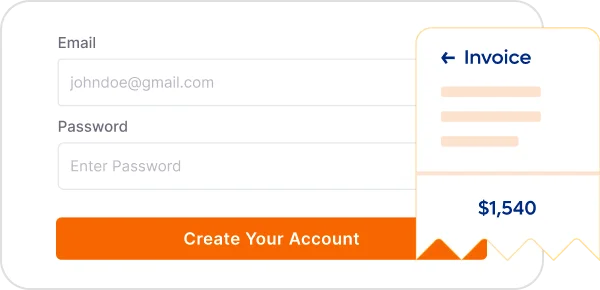

Discover the Magic of Automated Invoicing

Slash costs by 70%. Begin your automated invoicing journey in minutes.

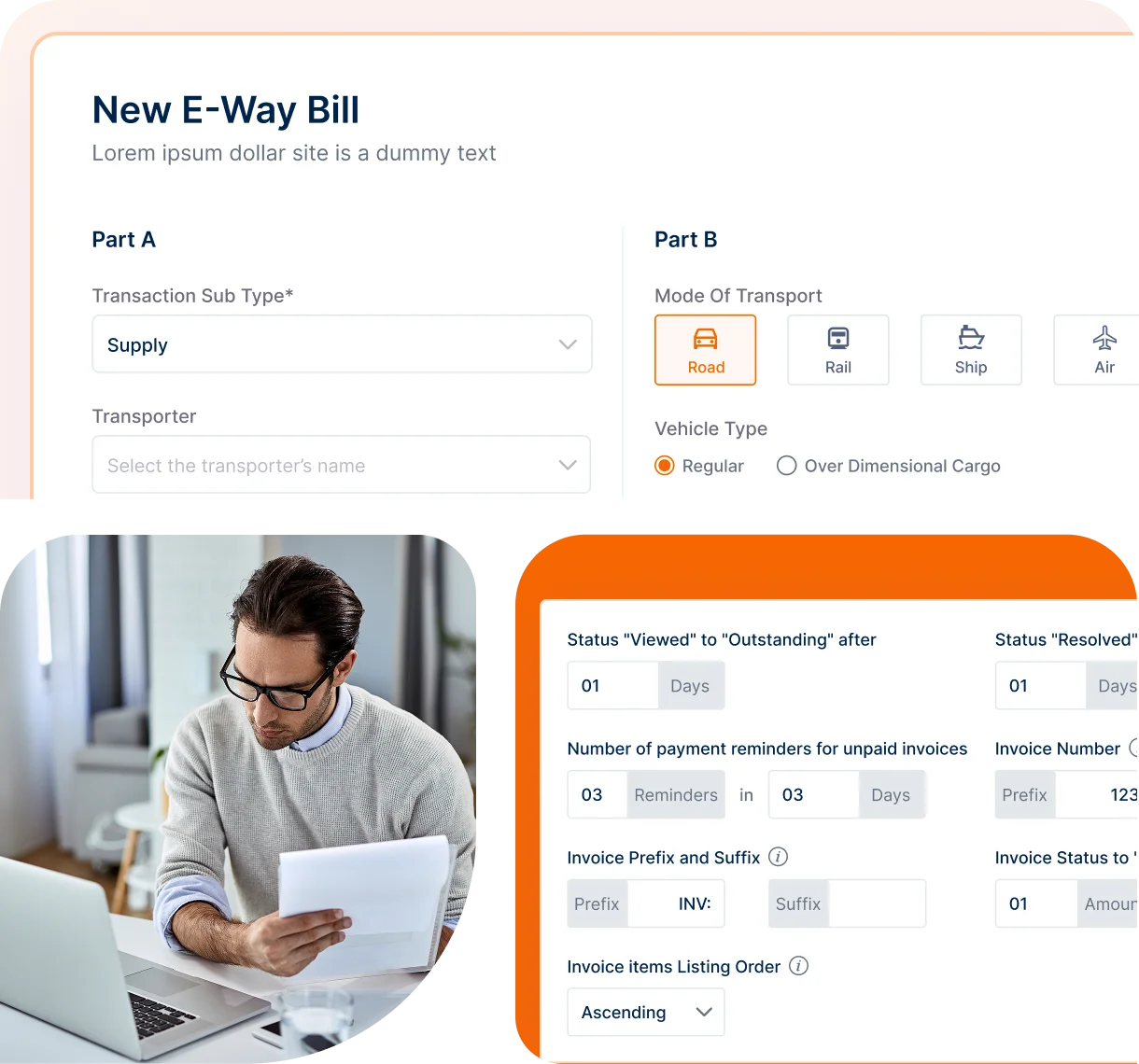

From logistics to retail and manufacturing, Invoicera’s e-way billing feature helps industries streamline processes.

Transactions

Subscribers

Stay updated with live tracking of e-way bills, ensuring you have the latest information on your shipments at all times.

Access and modify all bill details in real-time with Invoicera’s intuitive portal.

Easily cancel e-way bills with a few clicks to optimize workflow.

Create e-way bills confidently with precise built-in data validation features and error-checking.

Automatically detect required transactions and generate error-free e-way bills for compliance.

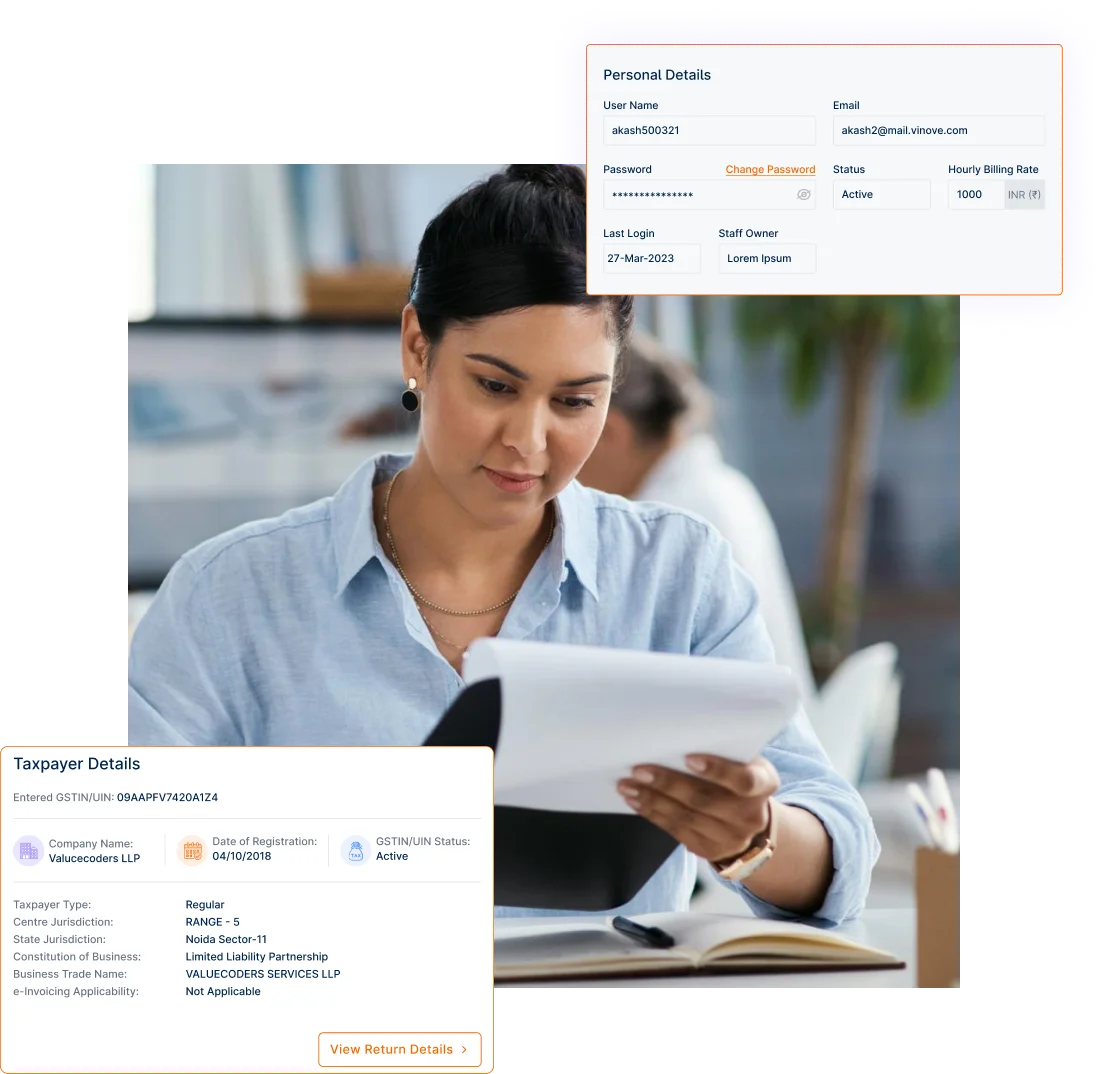

Automate validation and cross-check all details against GSTIN and historical data.

Get real-time insights for efficient financial management and seamless business progress.

A SaaS company reduced manual work by 60% using Invoicera’s automated recurring billing, invoice scheduling, and reminders.

Get Started with Smarter Billing

Digital marketing firm increased payment collection with Invoicera’s automated invoicing, project hour tracking & follow-up reminders.

Improve Your Cash FlowEnhance your operations and productivity from any location. Make a way to smooth logistics billing and reduce administrative burden.

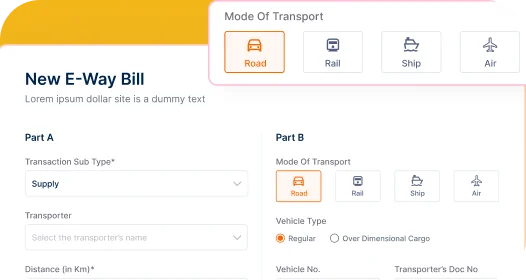

Bulk update vehicle information and access data securely through cloud integration.

Generate e-way bills for multiple states with a single, centralized platform.

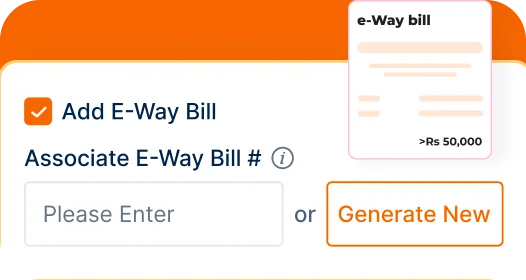

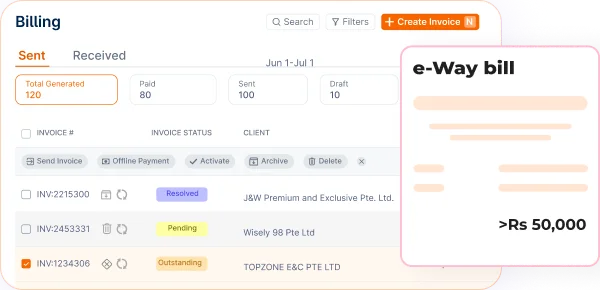

Generate, share, and manage e-way bills seamlessly with Invoicera’s smart e-way billing feature.

Log in to Invoicera, choose invoices, and review auto-filled data.

Provide extra info like vehicle number if needed for compliance.

Click “Generate E-Way Bill” to create, track, sort, or cancel.

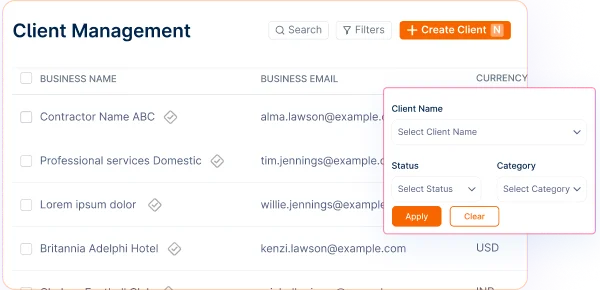

All-in-one invoicing software to manage & track payments, expenses, bills & more.

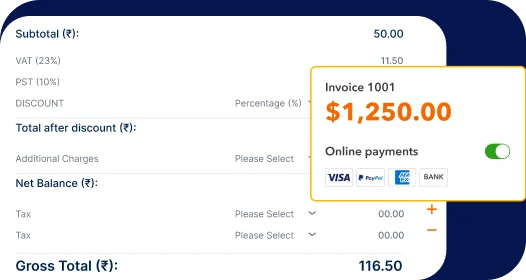

Maximize your revenue and drive growth with efficient invoicing.

Create professional invoices in minutes. Automatically add tracked time and expenses.

Learn MoreOptimize your finances with credit control, secure payments & streamlined cash flow.

Learn MoreManage everything in one place - time, estimates, and more, hassle-free.

Learn MoreStay safe and in control with our watchful eye on your data and smooth admin tools.

Learn MoreScale effortlessly with a platform that adapts to the unique needs of any business, large or small.

Stay on top of your cash flow

Turn hours into accurate invoices

Master complex billing effortlessly

Discover reliable payment integration gateways, offering diverse

payment options tailored to your business needs.

Using smart algorithms, Invoicera saves your valuable time by checking e-way bill data for any missing or incorrect input. This helps you avoid generating an e-way bill without some information, thus saving you time and making the process as accurate as possible.

Failure to produce e-way bill when necessary may attract penalties from the authorities. Such penalties are applicable depending on the severity of the violation and they can range from fines to possible disruptions of your carrier operations. Using Invoicera to create e-way bills saves you from facing such penalties.

You can freely use the software for creating the e‑way bills as there is no restriction on number of bills one can produce. Our platform is scalable to the level of the number of transactions you need, it may be two, it may be hundreds.

Services we offer include creating e-way bills through Invoicera. Our platform does not charge any extra fees or hidden charges to register or generate e-way bills. Mainly, it is an integrated and inexpensive approach to providing your business requirements.

Yes, absolutely! To elaborate, Invoicera enables its users to create e-way bills for intrastate and inter-state transportation of goods. Our platform is built for inter-state operations which means you will be in compliance with e-way bill rules no matter the destination of your goods.

One thing you need to remember is that if there is any data mismatch in your e-way bill, you should resolve it on the spot. Invoicera offers options to modify e-way bill information, and therefore, clients have proper documentation up until the completion of transportation and delivery.

In cases where a change of vehicle is required during transit, you can easily make this modification on the e-way bill through a feature provided by Invoicera. It helps to prevent your e-way bill from expiring and to show the state of your transportation process.

Security of your data is never a joke at Invoicera. Our platform also utilizes standard encryption protocols and security measures to ensure that your e-way bill data is protected from excessive access or misuse. Rest assured that we will safeguard your information while using it to generate the e-way bill.

We value your feedback and love sharing user experiences.

Streamline billing and generating invoices with Invoicera.

Invoicera is a true value for money software. It offers great features which are suited to all professions.

Explore More

The best Invoice app for managing your finance and generating online invoices. Simple to create invoices and to share with our customers.

Explore MoreStart Risk-Free. No Credit Card Needed. Cancel Anytime.

Seamless integration with your existing software.