Discover the Magic of Automated Invoicing

Slash costs by 70%. Begin your automated invoicing journey in minutes.

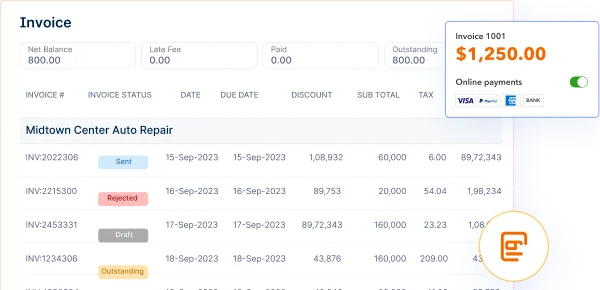

Create, send, and track e-invoices seamlessly with Invoicera’s mobile app anytime, anywhere.

Transactions

Subscribers

Ensure your business meets international e-invoicing standards with ease.

Meet all e-invoicing regulations effortlessly for businesses with an annual turnover exceeding ₹5 crore.

Generate precise e-invoices with built-in security, validation, and automated formatting as per GSTN guidelines.

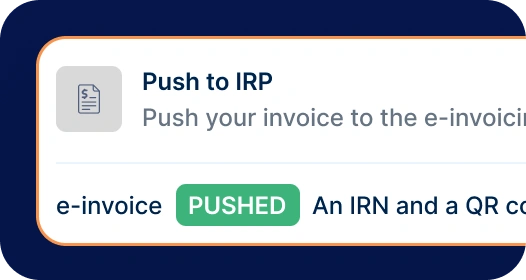

Manage and submit your invoices to the Invoice Registration Portal (IRP) with our seamless integration process.

Ensure accuracy before submission with Invoicera’s automatic validation, reducing manual errors by 95%.

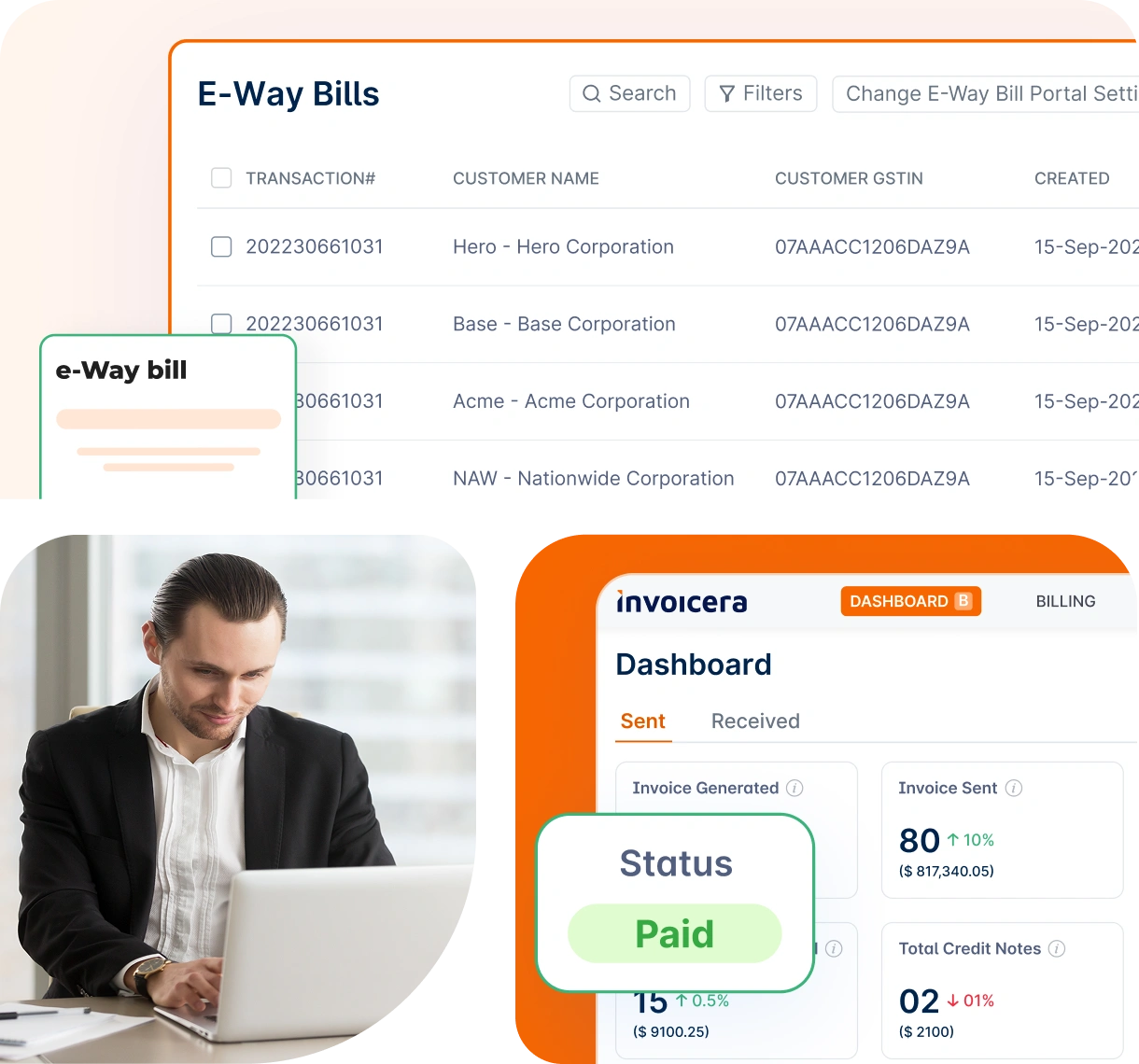

Get real-time invoice tracking, speed up approvals, and quickly resubmit rejected invoices.

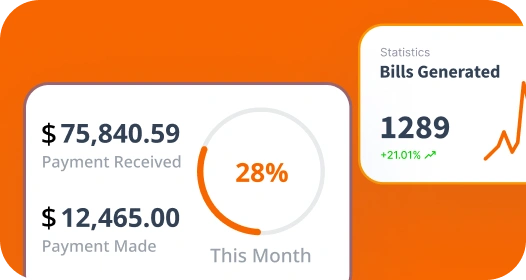

Get real-time insights for efficient financial management and seamless business progress.

A SaaS company reduced manual work by 60% using Invoicera’s automated recurring billing, invoice scheduling, and reminders.

Get Started with Smarter Billing

Digital marketing firm increased payment collection with Invoicera’s automated invoicing, project hour tracking & follow-up reminders.

Improve Your Cash FlowInvoicera takes only one click to empower your logistics invoicing workflow with its user-friendly platform.

Create e-way bills quickly without extra effort.

Ensure correct details and stay updated effortlessly.

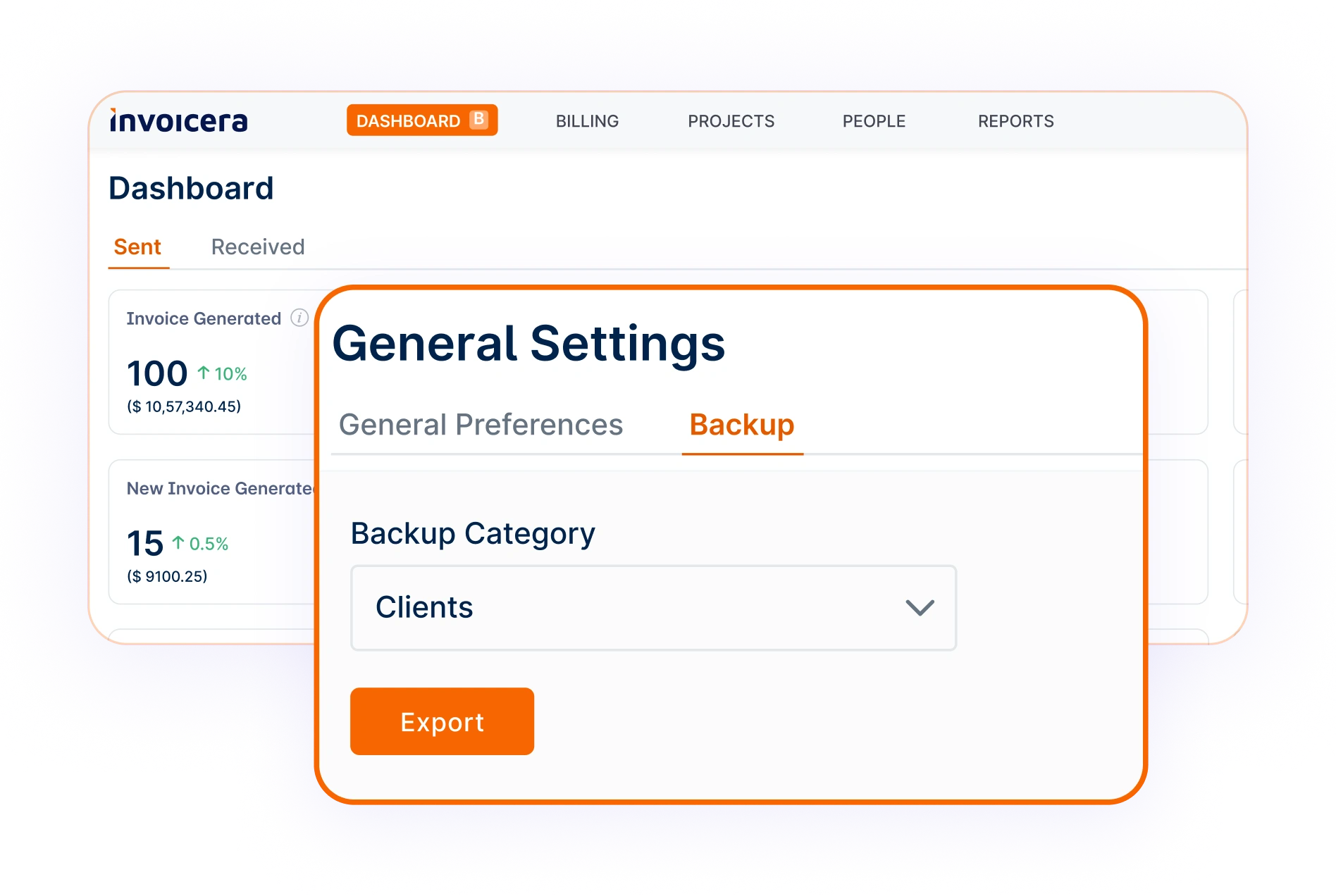

We use top technology so you don’t lose any data, keeping your confidential information totally secure.

Ensure proactive system assessments, prompt security fixes, and continuous monitoring.

Set up and streamline your e-invoicing process with these simple steps.

Sign up on the e-invoice portal or connect via the e-Way Bill system.

Create API credentials with Fynamics Techno Solutions and enter them in Invoicera.

Submit invoices to IRP and get validated, signed e-invoices with IRN.

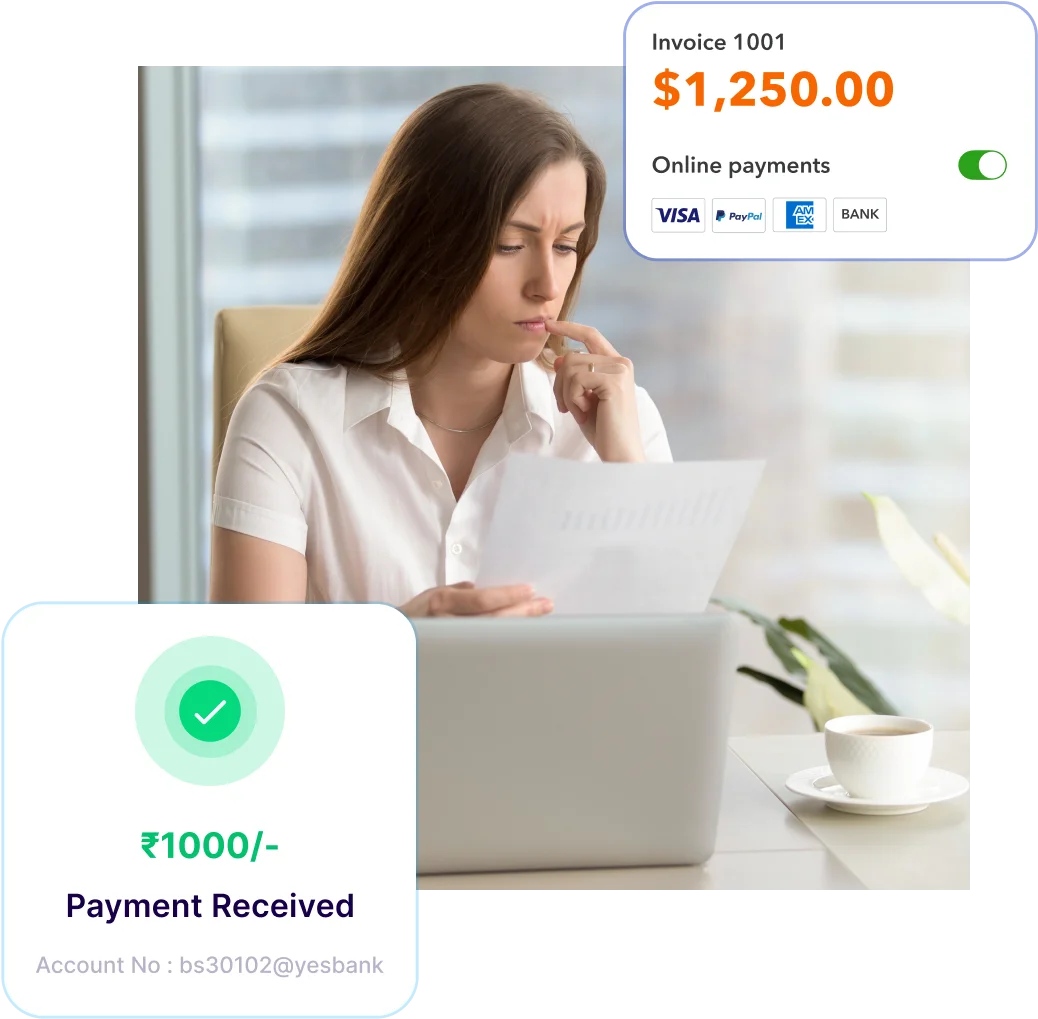

All-in-one invoicing software to manage & track payments, expenses, bills & more.

Maximize your revenue and drive growth with efficient invoicing.

Create professional invoices in minutes. Automatically add tracked time and expenses.

Learn MoreOptimize your finances with credit control, secure payments & streamlined cash flow.

Learn MoreManage everything in one place - time, estimates, and more, hassle-free.

Learn MoreStay safe and in control with our watchful eye on your data and smooth admin tools.

Learn MoreScale effortlessly with a platform that adapts to the unique needs of any business, large or small.

Stay on top of your cash flow

Turn hours into accurate invoices

Master complex billing effortlessly

Discover reliable payment integration gateways, offering diverse

payment options tailored to your business needs.

Yes, IRN generation is vital for e-invoices. Every e-invoice generated has an Invoice Reference Number or IRN that ensures its validity & checks in compliance with regulations.

Absolutely! The bulk generation of IRNs is a straightforward process that serves as a boon for businesses handling large invoices.

The user will receive a digitally signed JSON, IRN, and QR code. This indicates the approval from the IRP.

Though printing a PDF for an e-invoice is solely up to the user, acquiring & sharing a hard copy fosters transparency between a client & business.

Yes, the IRP can reject the invoice. This usually happens when an invoice fails to comply with the required format or contains errors. Users can file their invoices again after removing errors.

The QR code on an invoice is its identity. It generally contains prime details of the invoice that help in further verification. Hence, printing the QR code on the invoice is mandatory.

Yes, importers must generate IRNs for invoices. This ensures that all invoices, irrespective of their types, are rightly documented & comply with e-invoicing regulations.

Failing to generate the IRN for an invoice can prevent it from being recognized under GST laws. Furthermore, it could lead to:

Thus, linking the invoice process to the IRP is necessary to generate the IRN automatically. Periodic auditing can help identify that all invoices go through the right channels & IRNs are issued whenever required.

A business or organization having a turnover of more than 500 crores, e-invoicing becomes important for all B2B transactions. Invoices for such transactions must have the QR code generated by the IRP.

Though according to e-invoicing rules, it is not necessary to include a QR code for B2C transactions, some businesses might include it to maintain transparency. Producing a QR code for B2C transactions is advisable to enable e-transactions. Businesses must follow the existing GST regulations to keep an eye on potential changes in rules.

Yes! You can set up recurring invoices to send automatically on different schedules. It saves a lot of time and helps you get timely payments without manual effort.

E-invoicing software like Invoicera uses strong encryption, secure servers, and access controls to keep your data safe from cyber threats, ensuring privacy and compliance.

Pricing starts at around $15 per month, depending on features and provider. Some offer free plans, while others have higher-tier options for larger businesses.

We value your feedback and love sharing user experiences.

Streamline billing and generating invoices with Invoicera.

Invoicera is a true value for money software. It offers great features which are suited to all professions.

Explore More

The best Invoice app for managing your finance and generating online invoices. Simple to create invoices and to share with our customers.

Explore MoreStart Risk-Free. No Credit Card Needed. Cancel Anytime.

Seamless integration with your existing software.