Studies reveal that 78% of businesses credit their growth to adopting sophisticated accounting software.

Source: Business News Daily

Among the top software, FreshBooks, Xero, QuickBooks, and Invoicera stand out.

FreshBooks offers user-friendly features, Xero boasts a robust cloud-based platform, QuickBooks is versatile for businesses of all sizes, and Invoicera excels in diverse invoicing capabilities.

This exploration delves into their strengths, aiding businesses in selecting the ideal financial solution.

Explore the power of these tools to foster business growth and efficiency. So, let’s begin with Freshbooks vs QuickBooks vs Xero

FreshBooks

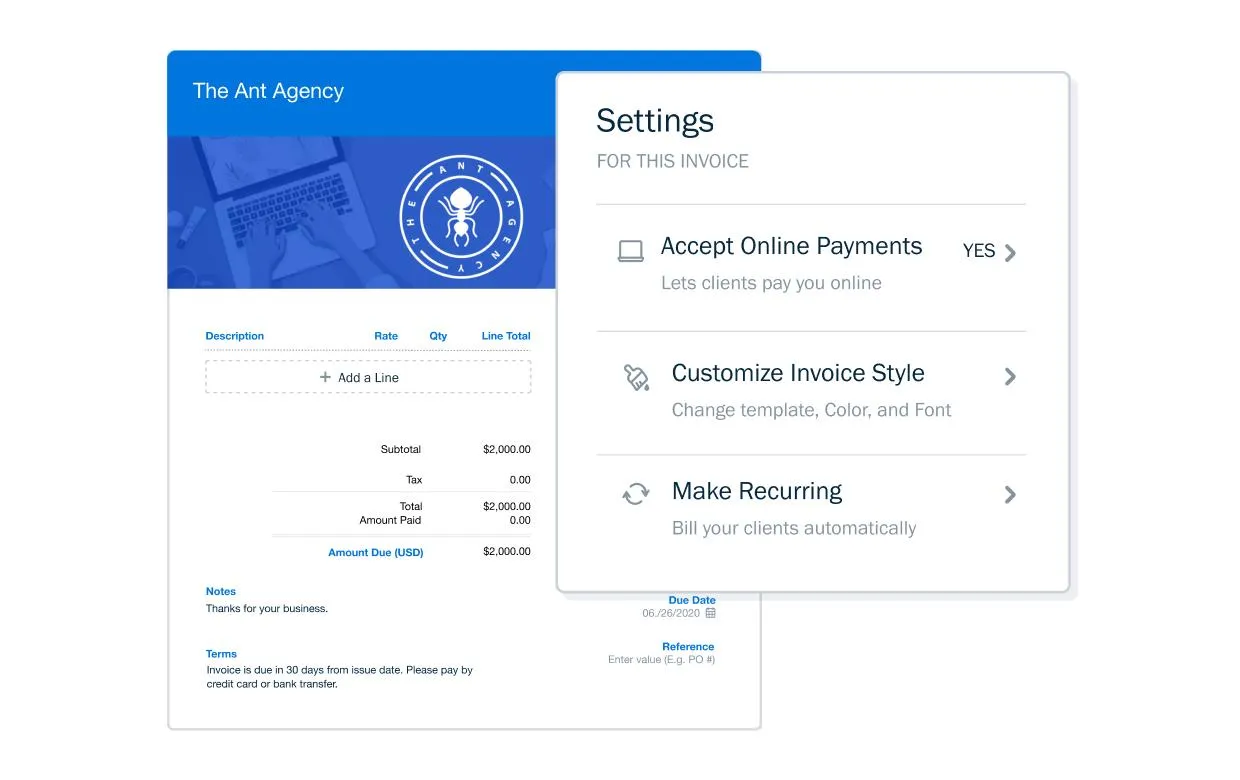

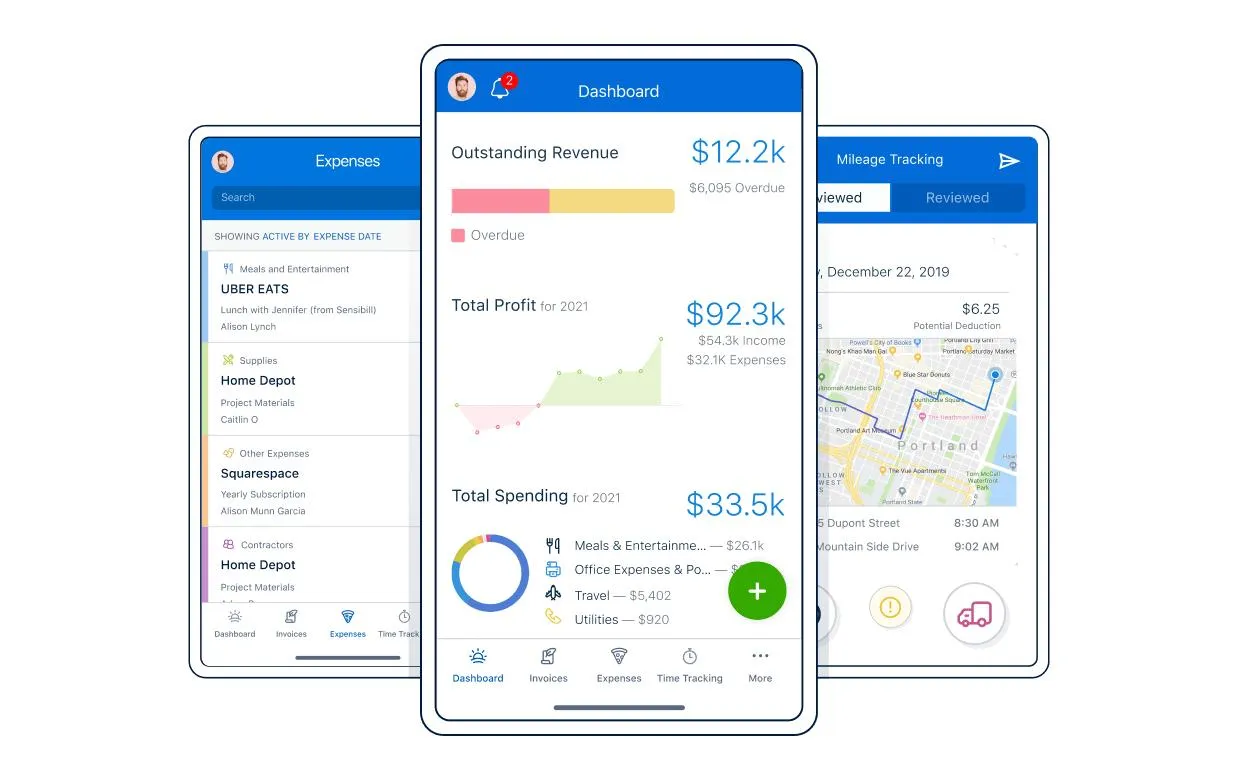

FreshBooks redefines financial management, specially tailored for freelancers and small businesses, offering an intuitive platform that prioritizes invoicing, seamless payments, and meticulous expense tracking.

Its reputation for a user-friendly interface makes managing billing processes a breeze while facilitating effective client communication.

With the added advantage of a cloud-based system, FreshBooks empowers users with the flexibility to streamline invoicing and financial tasks effortlessly.

Features And Capabilities

-

Professional Invoicing

Show off your expertise with sleek, detailed invoices highlighting your work and pricing—then simply hit send! Plus, never worry about late payments with automated reminders gently nudging your clients to settle.

-

Accounting

Whether your finances are straightforward or intricate, they’re like a report card for your business. FreshBooks’ user-friendly Double-Entry Accounting tools and reports give you a clear picture of your profits, cash flow, and where your money’s going.

-

Payments

With FreshBooks’ handy automated online payment features, such as recurring billing, your clients can quickly pay using their preferred method, leading to getting your payments twice as fast.

-

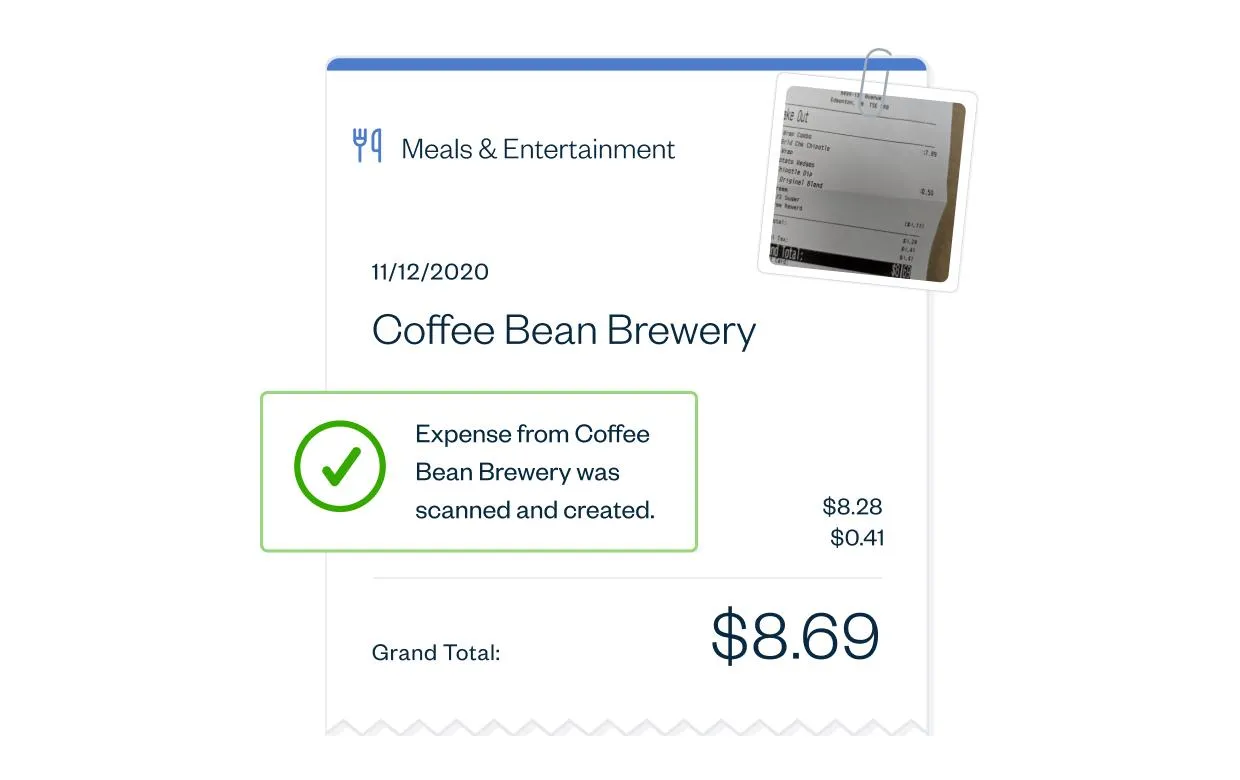

Expenses

With FreshBooks, you can take pictures of receipts, send email receipts straight to your account, and bring in expenses from your bank. Plus, you can neatly sort and link them to specific clients. Keeping tabs on every buck sets you up for tax season success.

-

Time-Tracking

When you and your team juggle multiple projects, losing track of billable hours can hurt your wallet. With FreshBooks’ Time Tracking feature, logging hours becomes a breeze for teams. It automatically adds those hours to your invoices, ensuring every bit of time gets counted and billed accurately.

-

Project

Running a business and juggling multiple projects can be a real challenge. FreshBooks’ project feature simplifies collaboration between clients, team members, and contractors. It’s the go-to spot for sharing files and updates, and working together seamlessly.

-

Reporting

Follow the money effortlessly! Keep tabs on every penny flowing in and out of your business. Later, generate reports to gauge your business performance.

When tax season swings around, take charge yourself or grant your accountant quick access to all the necessary details they crave. Easy-peasy financial management!

-

Mobile Compatibility

Never miss a beat with FreshBooks’ mobile app! Stay linked to your clients and team effortlessly, whether you’re out and about or on the move.

Send invoices, manage expenses, and oversee projects—all at your fingertips.

Freshbooks Is the Best Choice For

- Freelancers and Self-Employed: FreshBooks makes invoicing easy, helping freelancers and self-employed people create hassle-free personalized invoices for each client.

- Small Businesses: It simplifies payment tracking and invoice management, making life easier for small businesses. Even if accounting isn’t your strong suit, its simple setup can be a game-changer.

Also Read: Top Alternatives to FreshBooks | A Detailed Comparison

Pricing And Subscription Options

Freshbooks is giving 80% off for the first four months.

- Lite: Starting at $3.40 monthly, billed annually, suitable for self-employed professionals. It includes features for basic invoicing and expense tracking for up to 5 clients.

- Plus: Priced at $6 per month, this plan expands the Lite features, accommodating up to 50 clients. It also includes time tracking and team collaboration options.

- Premium: Geared towards growing businesses, this tier starts at $11 per month and supports up to 500 clients. It includes advanced features like automated recurring invoices and double-entry accounting reports.

- Select: Tailored to large businesses, this plan offers custom pricing based on specific needs, accommodating over 500 clients. It includes personalized training, dedicated account managers, and other enterprise-level features.

Pros And Cons

| Pros | Cons |

|

● Operates safely and robustly with large amounts of information. ● Mobile app accessibility ● Real-time invoice tracking |

● Accounting side is not as developed as invoicing ● Mobile version has issues with a few features ● No ability to customize interest/late fees per client or per invoice |

Xero

Xero is another powerful tool designed to streamline your financial tasks. From managing invoices to tracking expenses, Xero offers comprehensive features to keep your business finances in top shape.

Features And Capabilities

-

Billing

Never miss a payment again! Stay organized and on track with your bills. Track, schedule, and pay your bills hassle-free while maintaining a clear view of what’s due and when.

With everything stored in one convenient spot online, managing your payments has never been easier.

-

Claim Expenses

With the expense manager tools in Xero, keeping track of costs, submitting expense claims, and getting reimbursed is a breeze. Snap a picture of receipts, file claims quickly without paper, and get your expenses back pronto.

Approve claims in a jiffy, keep an eye on spending, and track everything in real time. Whether you’re on the move or at your desk, managing expenses, claiming mileage, and handling costs is as easy as a few taps on your phone.

-

Accept Payments

Get paid faster with Xero. Accept card payments directly from invoices.

Easy setup, free of charge. Multiple payment options, click-to-pay buttons, and fraud protection are included.

-

Reporting

Take charge of your finances with precise reports, collaborating online with your advisor in real-time.

Customize, compare, and generate insights effortlessly for informed decision-making.

-

Online Invoicing

Xero’s invoicing software streamlines your billing process.

Customize invoices with your logo, offer multiple payment options, and set automatic reminders for hassle-free payments from your phone or computer.

-

Purchase Orders

Xero’s purchase order software streamlines ordering and tracking.

Customize orders, create digital POs using templates, and easily convert them into bills upon delivery for seamless management.

-

Quotes

Create quotes effortlessly with Xero’s desktop or app, enabling swift customer acceptance and seamless conversion into invoices, all in just a few simple steps.

Xero Is the Best Choice For

Xero is a top choice among small business accounting tools, offering a standout perk: unlimited users without added charges.

It’s a comprehensive solution catering to the diverse financial needs of emerging startups and expanding enterprises, making it an ideal fit for businesses of all sizes aiming for financial success.

Pricing And Subscription Options

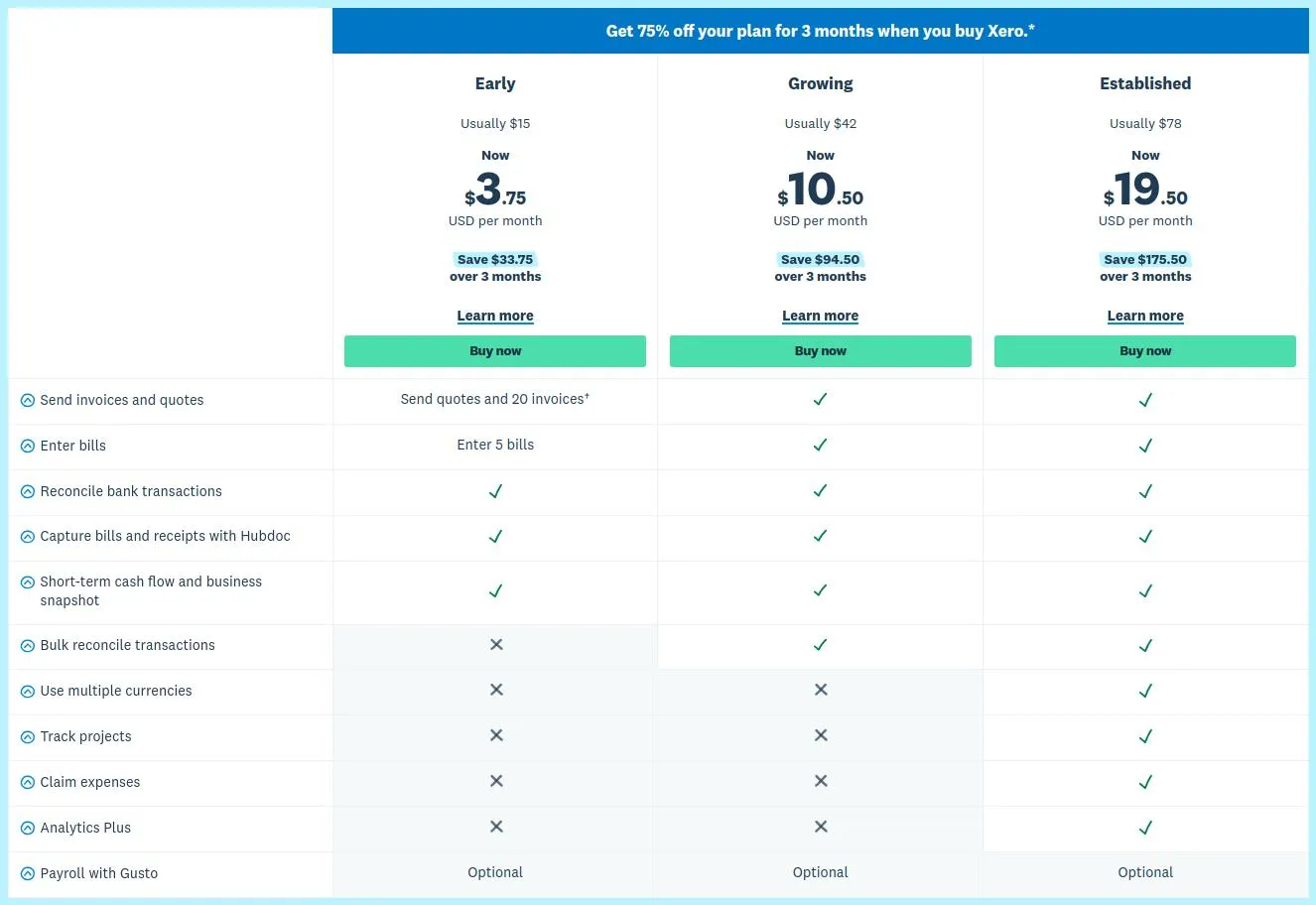

Xero offers three pricing tiers, all activating post a 30-day free trial and supporting unlimited users. There’s a special discount available for the initial three months.

Here’s the breakdown:

- Xero Early ($3.75 per month) includes 20 invoices and quote limits monthly, along with five bills, allowing receipt capturing and report generation.

- Xero Growing ($10.50 per month) offers unlimited billing, invoicing, and quoting.

- Xero Established ($19.50 per month), the version we tested, uniquely provides multiple currency support among its features.

Pros And Cons

| Pros | Cons |

|

● Cloud-Based Accessibility ● Seamless collaboration with advisors ● Offers a free 30-day trial ● Adaptable to business growth, suits startups ● Easy integration with various apps and plugins ● Constant software upgrades |

● Difficult to use for new users ● No built-in payroll ● Limited inventory features ● Heavy online operations may slow the software ● Mixed reviews for customer service

|

QuickBooks

Features And Capabilities

-

Cloud Accounting

You can reach your account, handle your business, and stay organized no matter where you are, whether on your computer, phone, or tablet.

By using QuickBooks, which stores your financial information online, you can keep an eye on sales, make invoices, and stay updated on your business performance whenever you need to.

QuickBooks’ cloud accounting tool lets your bookkeeper, accountant, or team members access and work with your data together in real-time online.

-

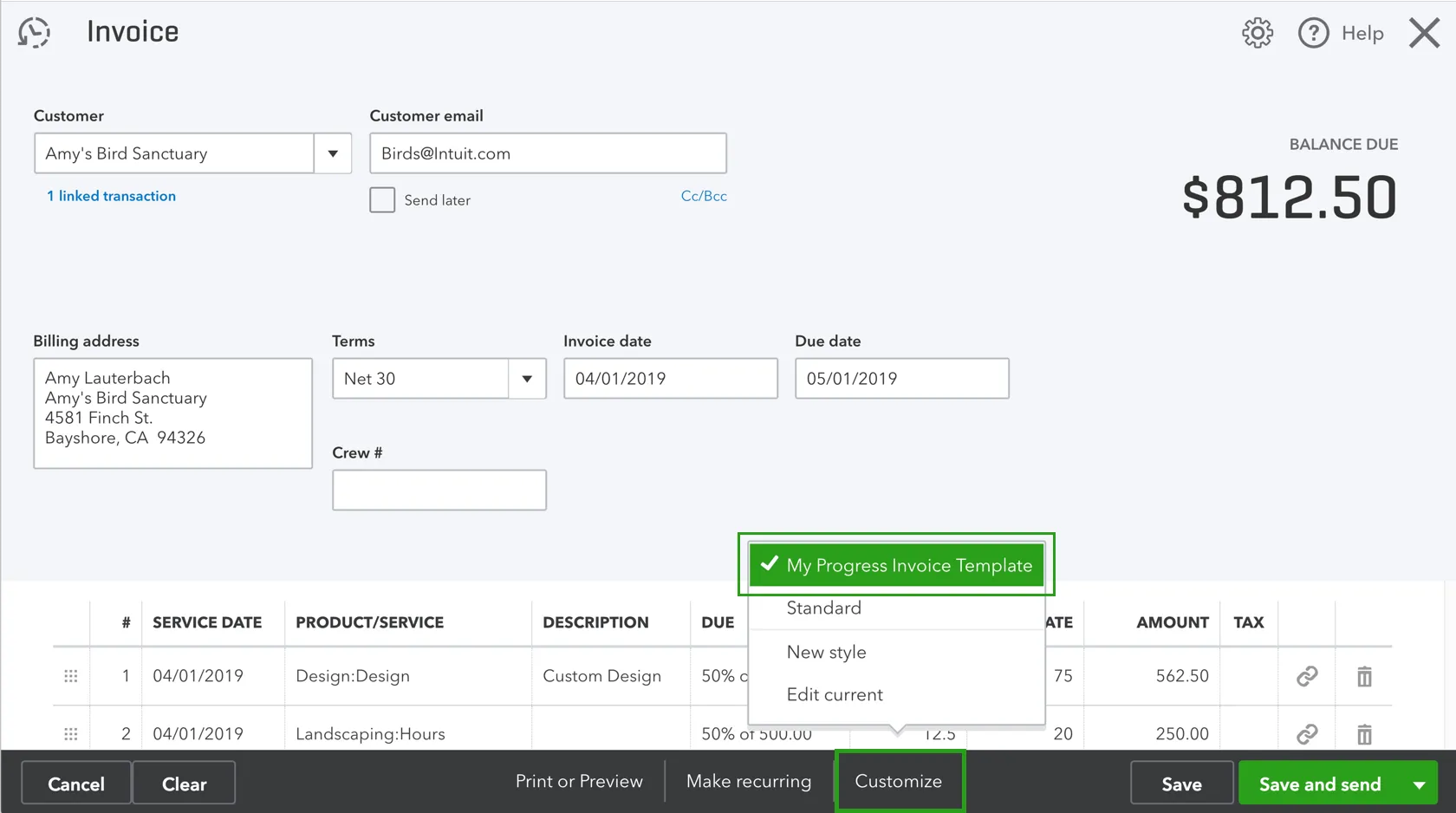

Invoicing

Effortlessly craft professional-looking invoices, sales receipts, and estimates within minutes.

Tailor these invoices to your brand’s identity by adding your company logo, choosing colors that represent your brand, and including essential contact information.

Simplify the process of generating GST-compliant invoices by selecting built-in data fields designed to meet GST requirements.

-

Online Banking

When you use QuickBooks Online Software, your bank statements and transactions update themselves. Just link your bank accounts to QuickBooks.

You can also easily add receipts and notes to your transactions.

-

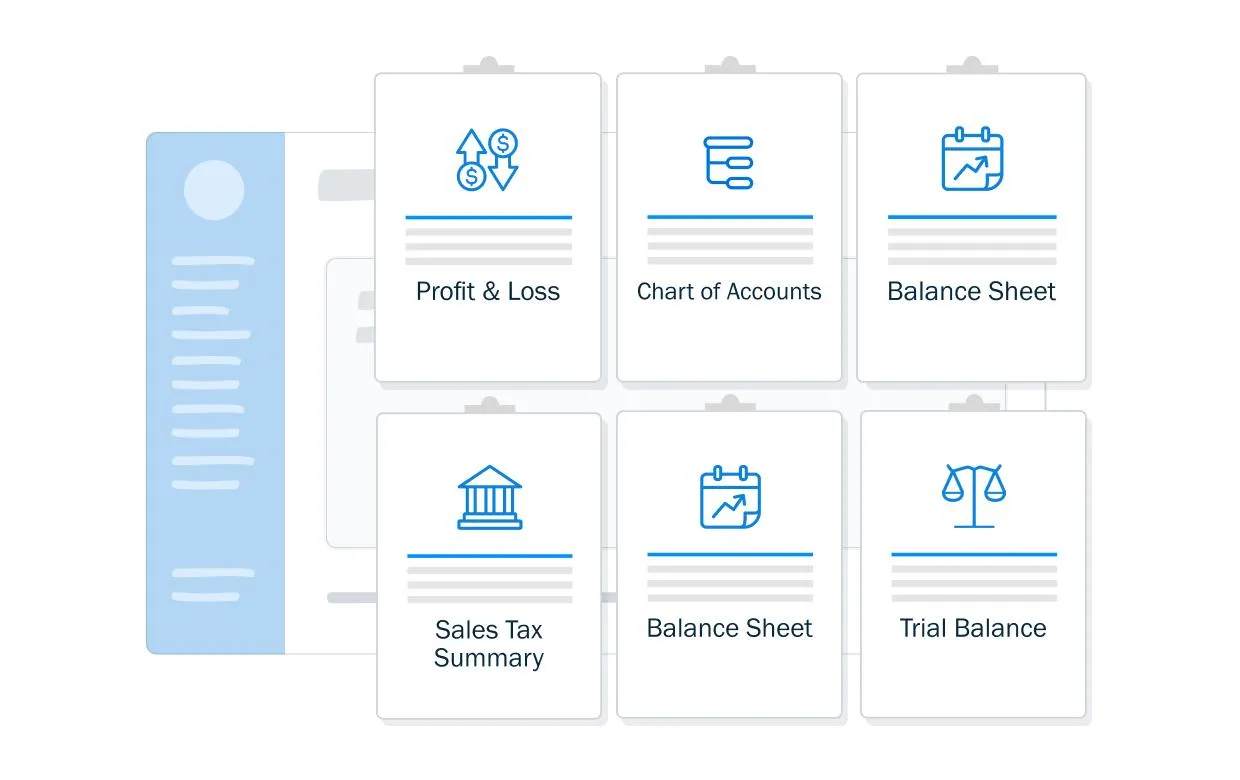

Accounting Reports

Immediately view how well your business is doing using reports and dashboards you can change to fit your needs. Get current reports, like your balance sheet, profit & loss, and cash flow statement.

Easily spot all invoices that haven’t been paid or are late so you can follow up on getting paid.

-

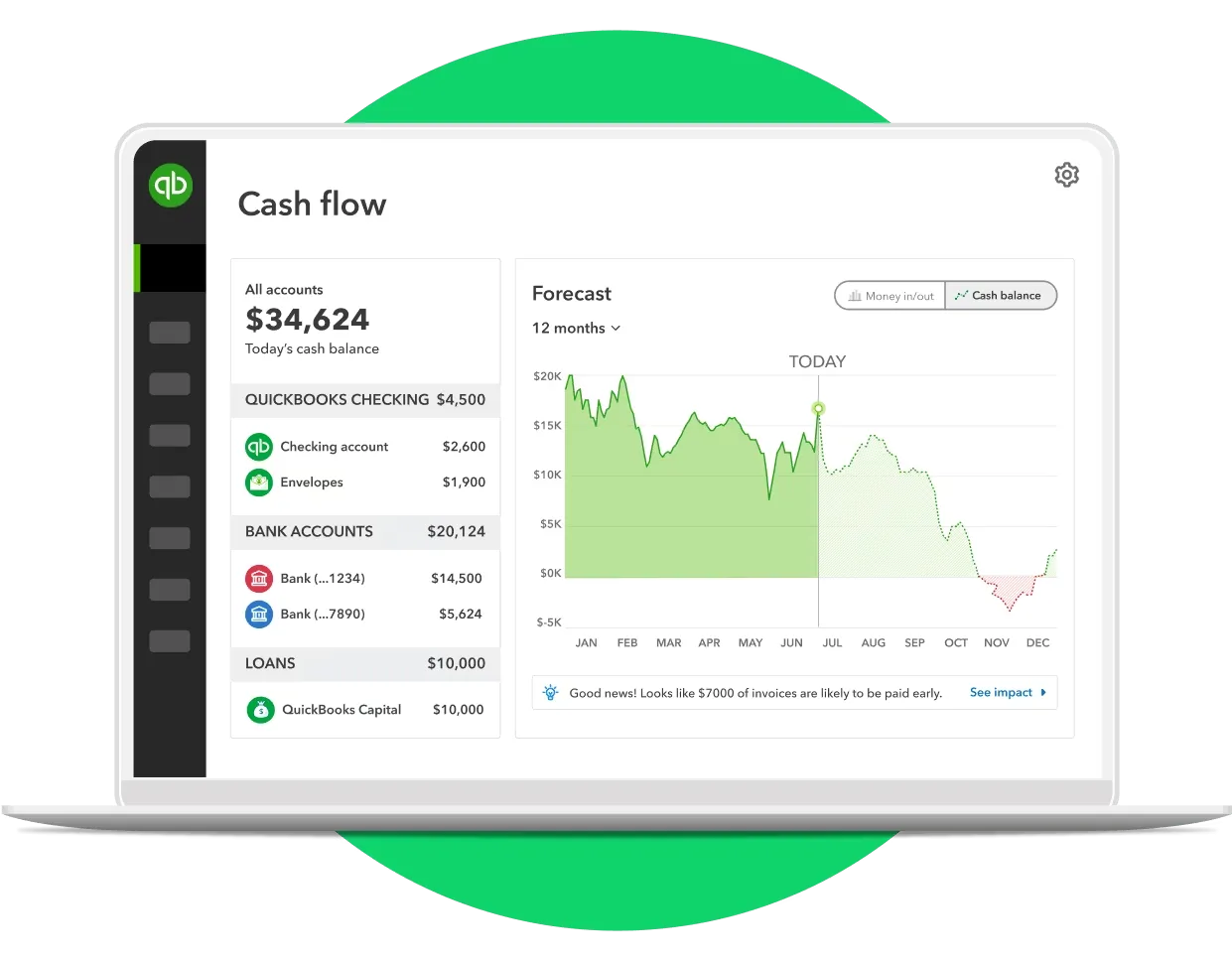

Cash Flow Management

In QuickBooks, handling your money flow becomes easy. You can quickly put in the bills you get from people you buy stuff from and pay them at the right time.

You can also make regular payments, saving time and always paying what you owe without any problems.

-

Time Tracking

Keeping track of time becomes easier with QuickBooks’ easy-to-use features. You can easily record how long employees work and keep track of hours spent on projects for clients or by specific team members.

QuickBooks smoothly combines these records. It even does the math for you, automatically adding billable hours to your invoices. This saves you the trouble of having to do calculations by hand.

-

Multiple Users

Using QuickBooks makes it super simple to have many people using it. Using different roles and permissions, you can easily control who gets to see what.

Inviting them to see your books is easy if you’re working with an accountant, making teamwork smooth.

-

Free unlimited support

One great thing about QuickBooks is that it gives you free, unlimited help whenever needed. If you ever need assistance, QuickBooks offers a lot of support, giving you answers and useful info to help you manage your business better.

Having this kind of support ready to use can make a difference when facing any problems that come up.

Quickbooks Is the Best Choice For

- Entrepreneurs and Startups: Its user-friendly interface and accessible features suit those new to accounting software, helping them manage finances efficiently.

- Freelancers and Self-Employed Individuals: QuickBooks simplifies invoicing, expense tracking, and tax preparation, making it a go-to option for those managing their finances.

- Small to Medium-Sized Businesses: Its scalability allows businesses to grow without switching to a different platform, offering tools for inventory management, payroll, and more.

- Non-Accountants: QuickBooks caters to users who aren’t accounting experts, providing guidance, support, and easy-to-understand functionalities that don’t require an accounting background.

- Companies Requiring Collaboration: Its multiple-user access and collaborative features suit businesses working with accountants, teams, or remote collaborators.

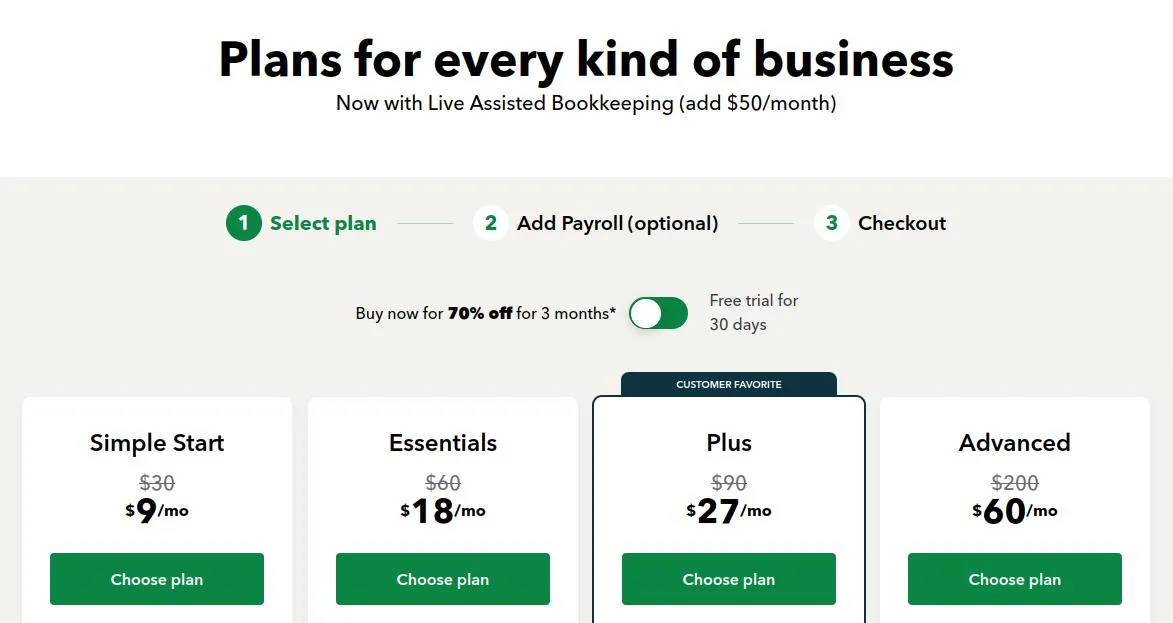

Pricing And Subscription Options

- Simple Start: This plan usually starts at around $9 per month. It’s ideal for small businesses and offers essential features like tracking income and expenses, invoicing, and basic reporting.

- Essentials: Priced at approximately $18 per month, this plan includes additional features such as bill management, time tracking, and more robust reporting options.

- Plus: Around $27 per month, this plan extends the capabilities further, offering inventory tracking, project profitability analysis, and advanced features.

- Advanced: The QuickBooks Advanced plan, priced at $60 per month, offers an extensive suite of features tailored for growing businesses.

Pros And Cons

| Pros | Cons |

|

● Simple to learn and use ● Seamless integration with other tools ● Generates comprehensive accounting reports ● Budget-friendly pricing ● Accessible across devices ● Quick error detection and fixing ● Effortless customer data retrieval

|

● Missing specialized features like lot tracking and barcode scanning ● Limited key reports beyond basic accounting ● Prone to instability and system crashes ● Lacks direct professional support ● File-size constraints affecting transactions ● Limits on user numbers ● Geared towards small businesses ● Inconsistent data backup risks information loss ● Absence of invoice design tools ● Vulnerable to easy error manipulation |

Invoicera

Features And Capabilities

-

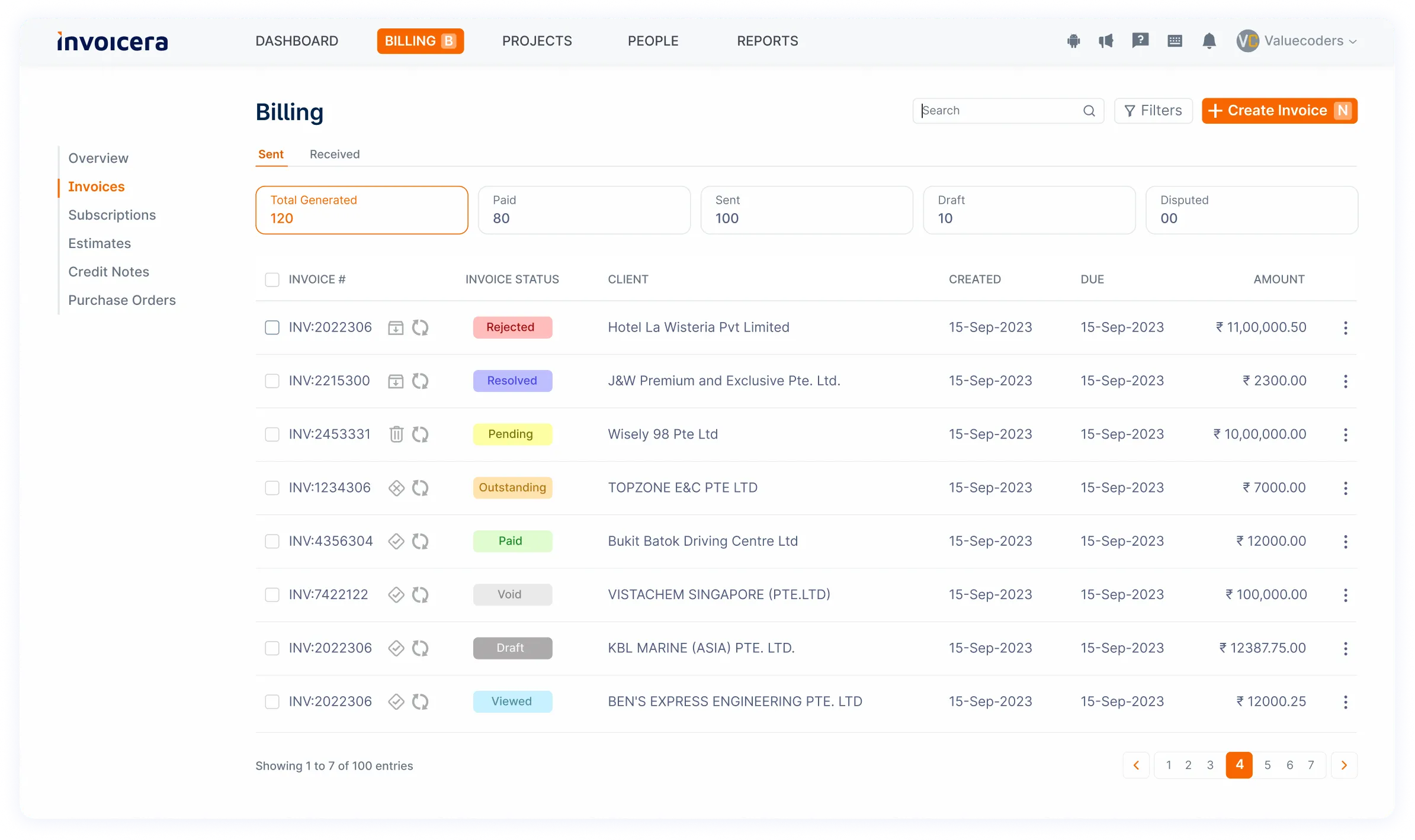

Online Invoicing

Elevate your invoicing game with Invoicera’s personalized templates. Stand out by tailoring your invoices to match your brand’s vibe. It’s like giving your invoices a makeover—professional and uniquely yours.

– Reflect your brand identity with custom templates

– Include detailed line items for transparent billing

-

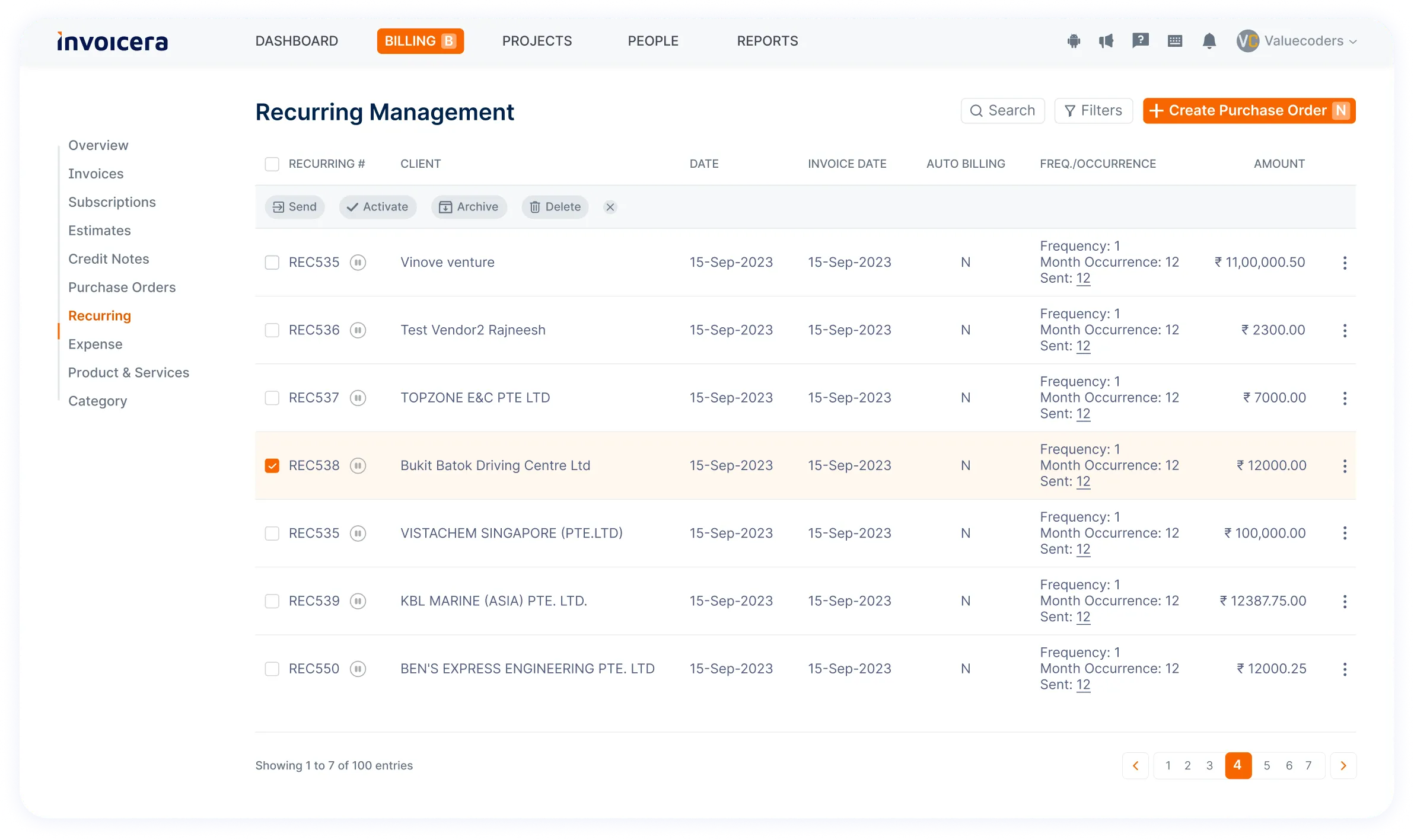

Recurring Billing

Say goodbye to repetitive invoicing tasks. Invoicera takes the hassle out of billing cycles by automating those recurring invoices. Set it and forget it – let Invoicera handle the billing while you focus on what you do best.

– Set up automated schedules for invoicing convenience

– Eliminate manual generation of recurring invoices

-

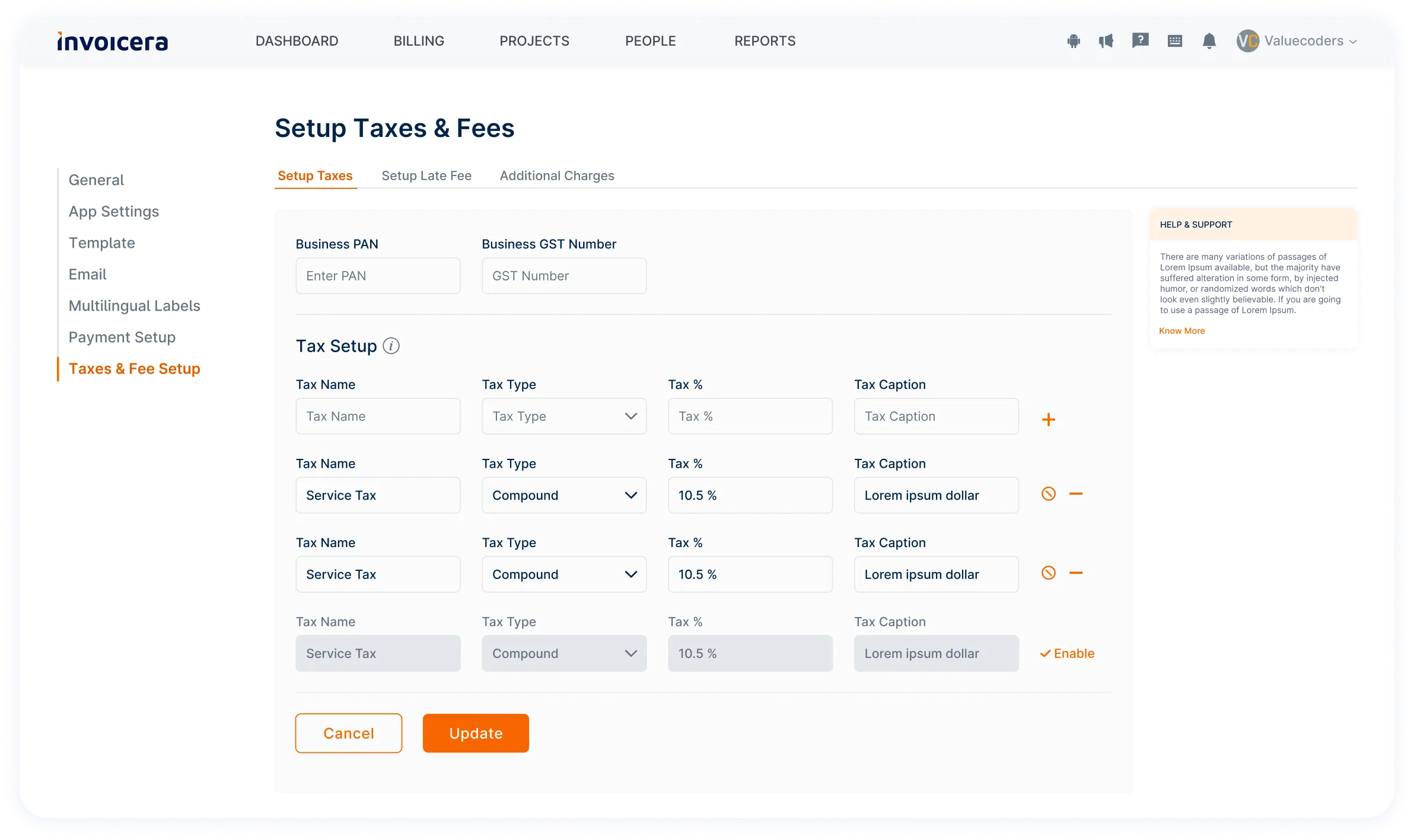

GST Invoicing

Keep your invoicing on the right side of regulations. With Invoicera, know that your invoices meet Goods and Services Tax (GST) requirements. Compliance is made easy so that you can invoice worry-free.

– Automated and accurate tax calculations for GST compliance

– Easy invoicing while adhering to GST requirements

-

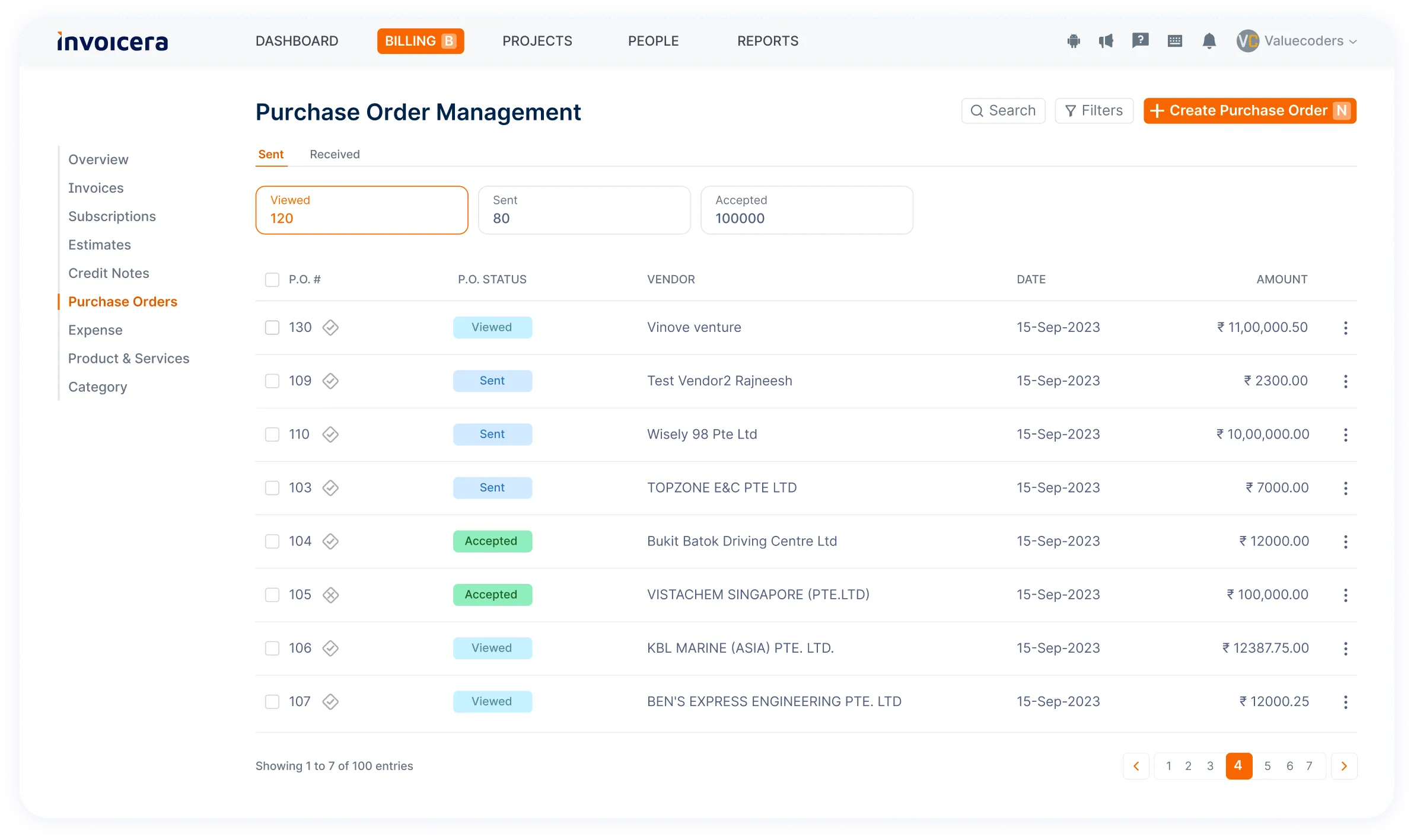

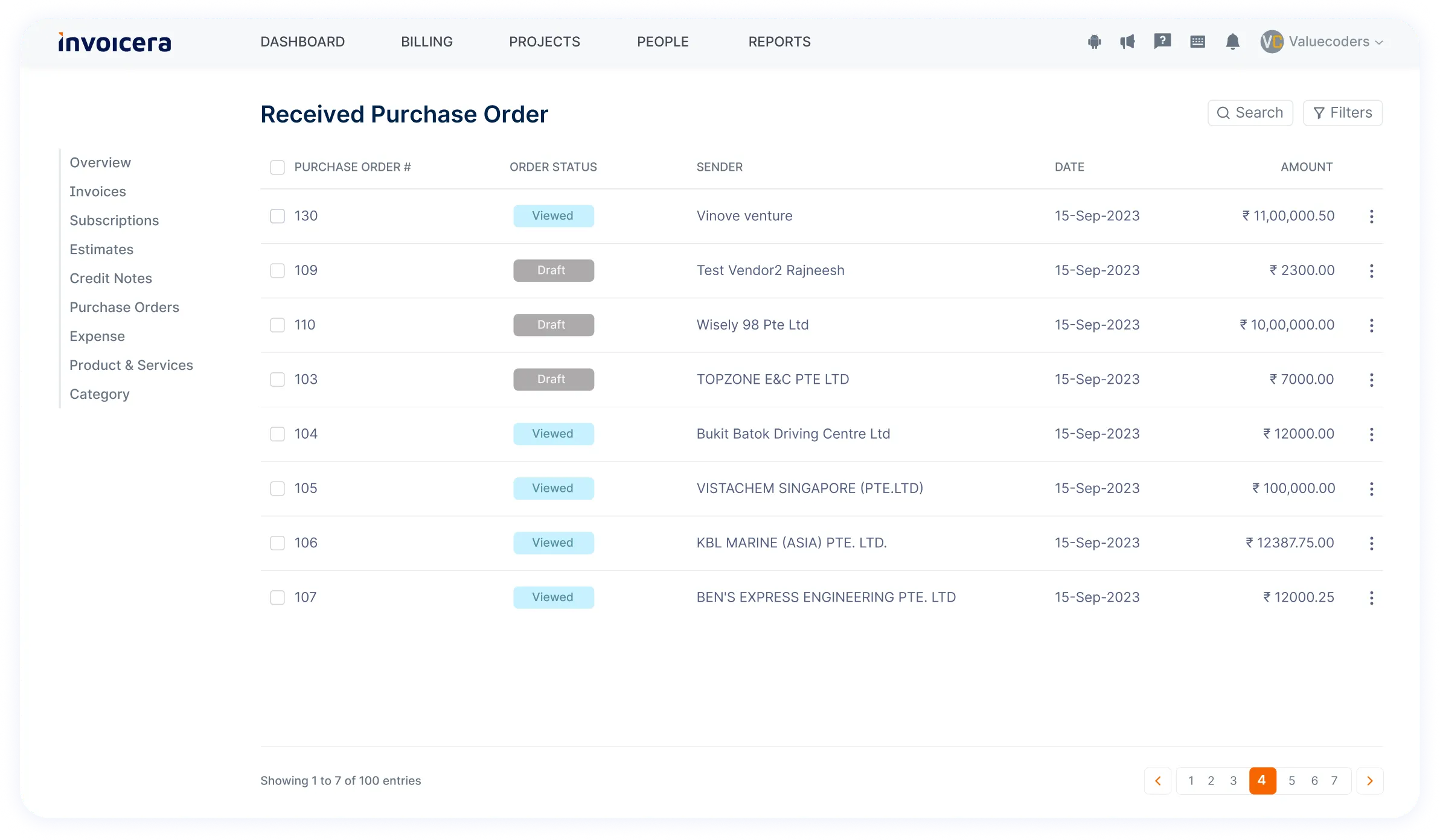

Estimates & Purchase Orders

Get your project specs crystal clear with Invoicera’s estimates and purchase orders. Outline project details, set expectations, and seal the deal—no more confusion, just clear-cut communication.

– Communicate cost expectations for future work

– Outline procurement details for smoother transactions

-

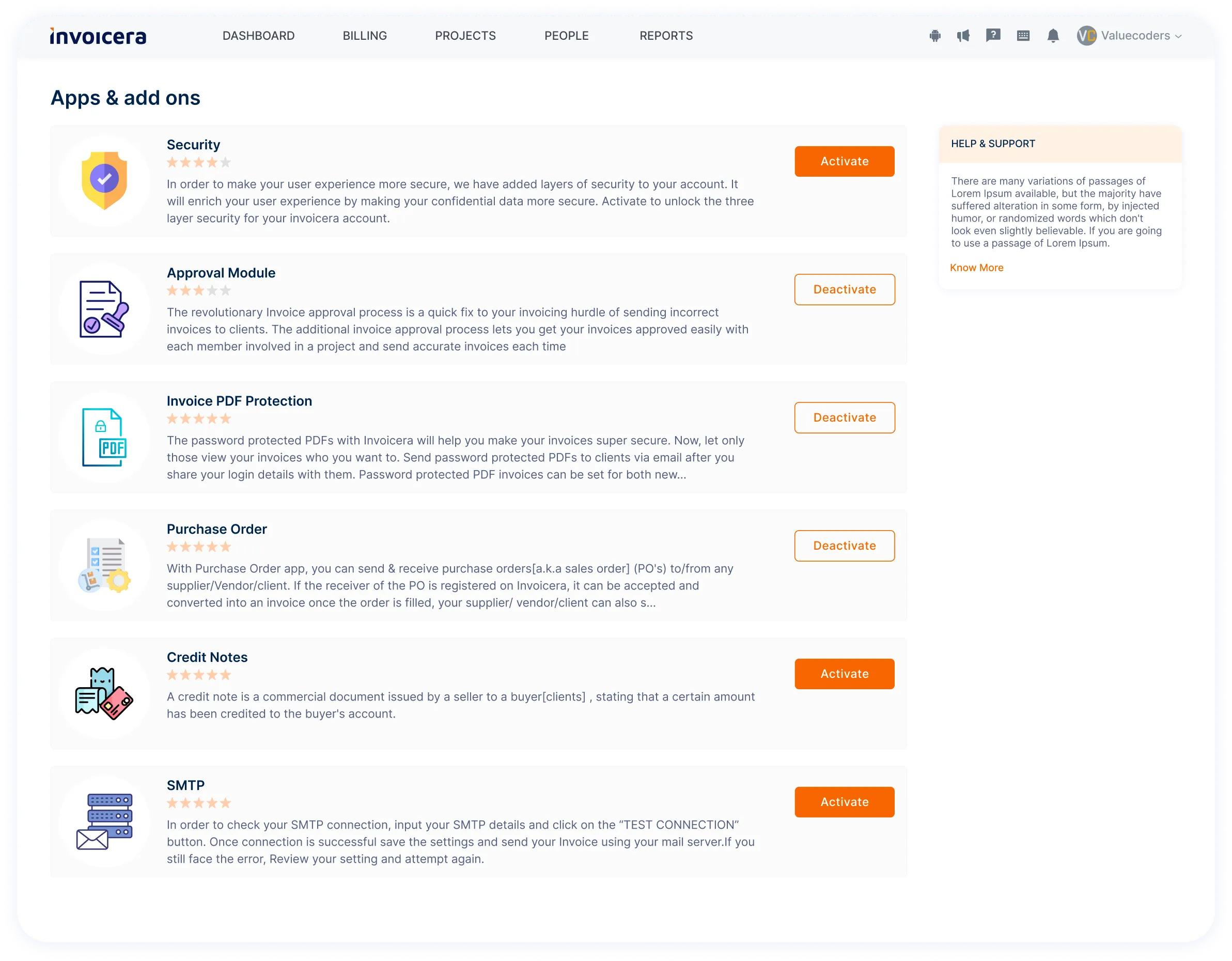

Integration with 3rd Party Systems

Invoicera plays well with others! Integrate effortlessly with your favorite apps and tools. It’s like connecting the dots—smooth workflows, all in one place.

– Streamline workflows with CRM or accounting software integration

– Ensure data consistency across integrated platforms

-

Client Portal

Step up your client game with Invoicera’s secure client portal. Impress clients by providing a private space to view invoices and project details, and communicate securely. It’s like rolling out the red carpet for your clients—professional, secure, and impressive.

– Provide clients access to invoices and project details

– Foster transparency and facilitate direct communication

-

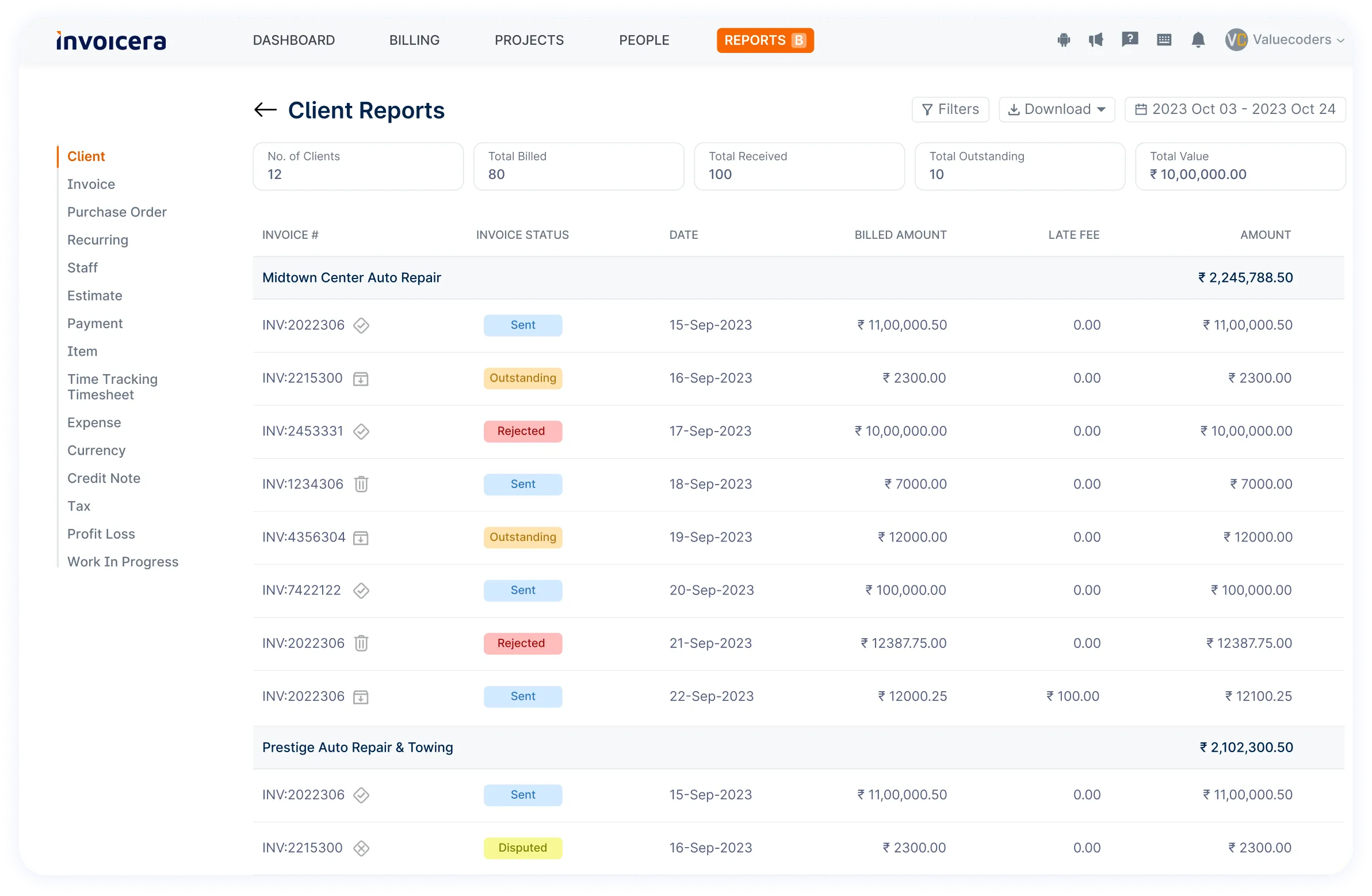

AR & AP Management

Simplify handling money coming in and going out. Invoicera helps you effortlessly keep track of who owes you money and who you owe, making sure your financial flow stays smooth.

– Monitor outstanding balances and track incoming/outgoing payments

– Simplify financial processes for efficient management

-

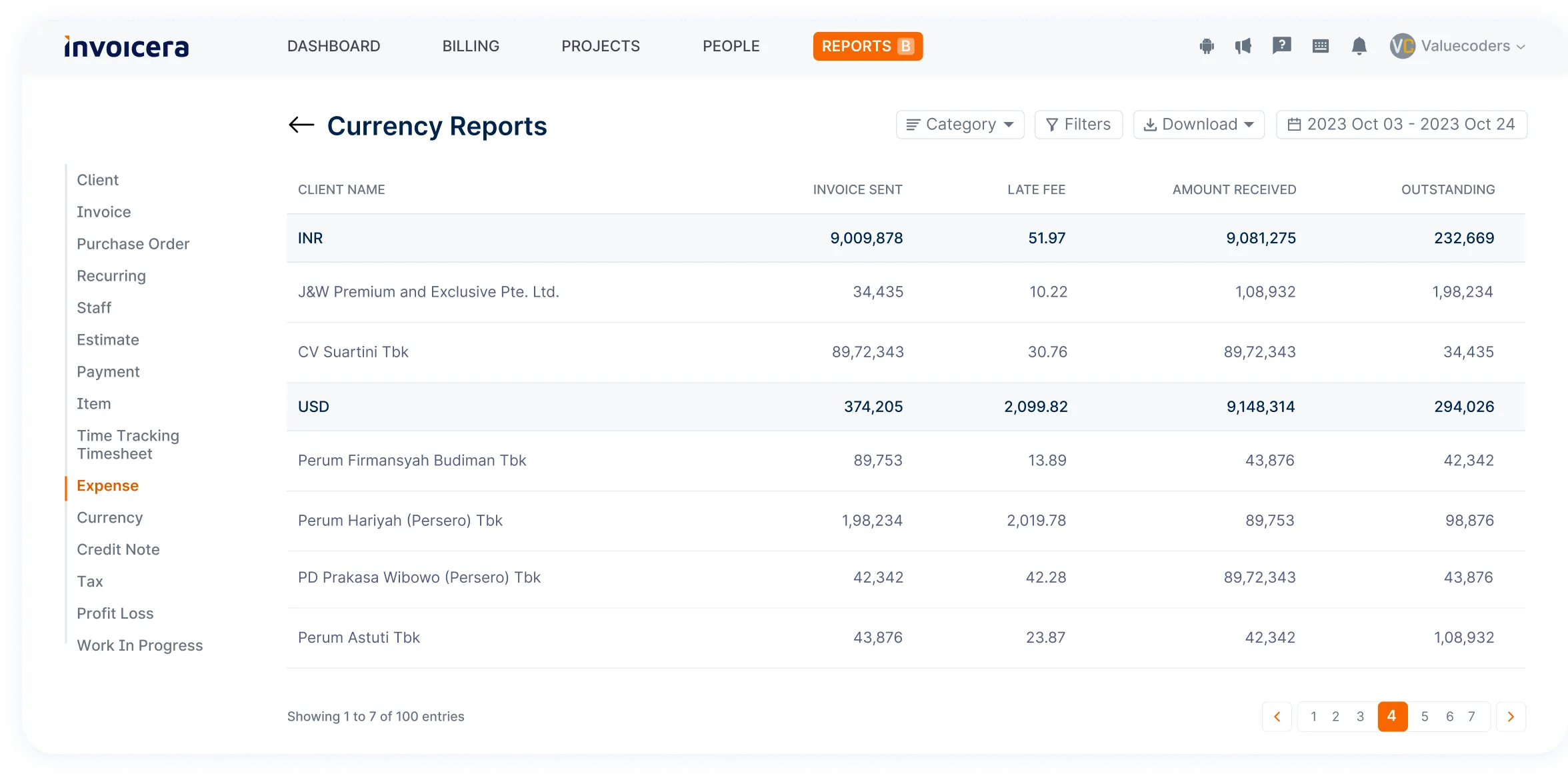

Multi-currency & Multi-lingual Support

With Invoicera, you’re not limited by borders or languages. Go global and do business in 15+ languages and currencies, making transactions with international clients a breeze.

– Simplify transactions by accommodating diverse currencies

– Communicate effectively with clients worldwide in their language

-

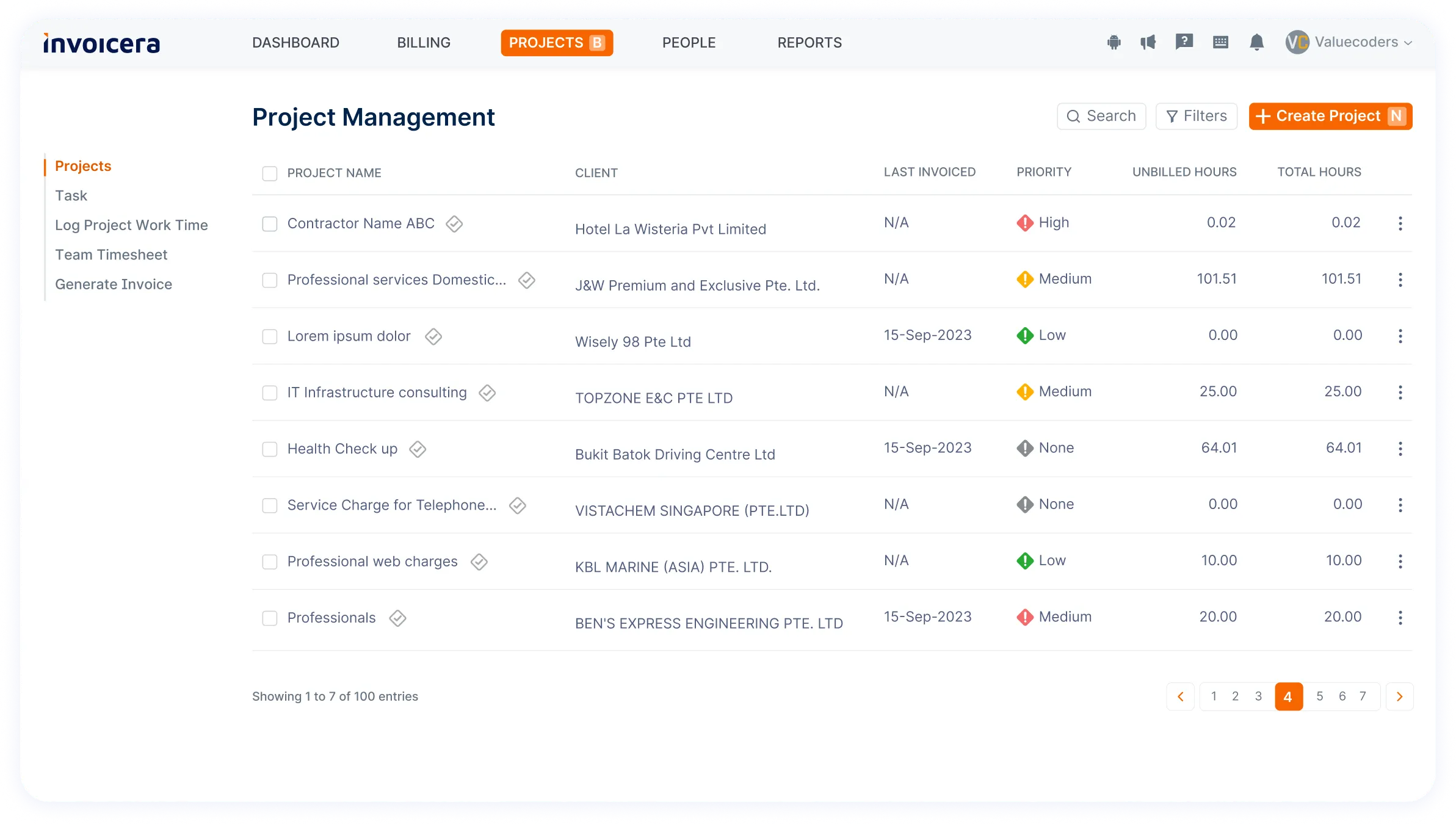

Projects & Tasks

Keep all your projects organized in one place. Invoicera lets you manage projects and tasks efficiently, so you never miss a deadline and can keep your team’s work on track.

– Track project progress and allocate resources efficiently

– Ensure timely completion of tasks for successful project delivery

-

Time Tracking

Never miss a minute! Invoicera’s time-tracking feature helps you keep precise records of billable hours spent on projects or services, ensuring you get paid for every second of your hard work.

– Associate tracked hours with clients or specific projects

– Convert tracked time seamlessly into invoiced hours

-

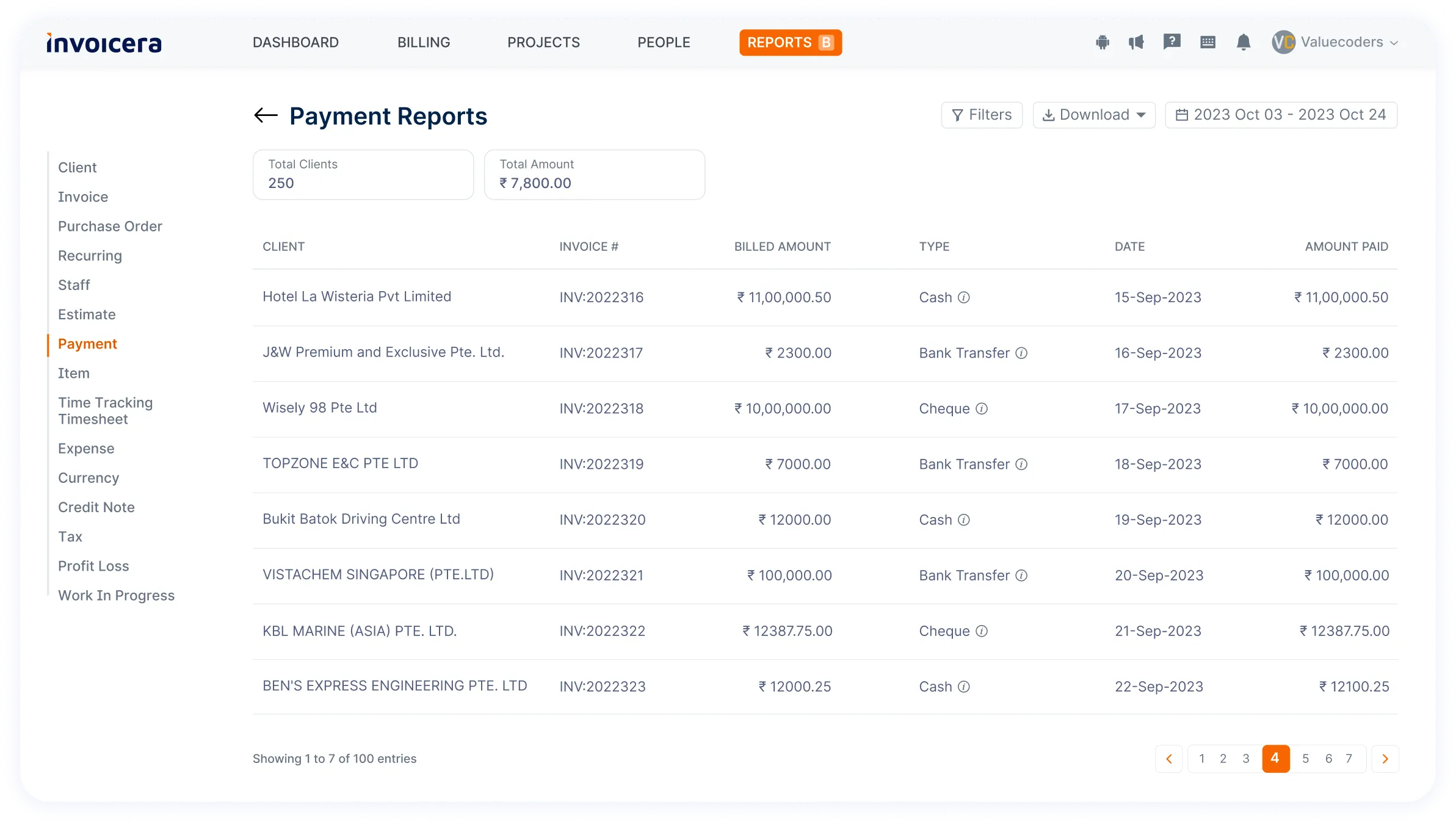

Online Payments

Make paying easy for your clients. Invoicera allows you to offer various secure and hassle-free online payment methods, giving your clients flexibility and convenience.

– Facilitate faster payments through 14+ integrated gateways

– Provide clients with multiple secure payment choices

-

Data Security & Backups

Your data’s safety is our priority. Invoicera implements top-notch security measures to protect your sensitive financial information, providing peace of mind and reliability.

- Regular backups safeguard against potential data loss

- Implement security protocols for sensitive financial data protection

Invoicera Is Best Choice For

- Freelancers: Offering customizable invoicing and time tracking features.

- Small Businesses: Providing easy-to-use invoicing with recurring billing options.

- Mid-sized Enterprises: Needing a balance between invoicing and project management tools.

- Businesses Seeking Integration: Offering seamless integration with third-party systems for streamlined workflows.

- Global Operations: Supporting multi-currency and multi-lingual functionalities for businesses working internationally.

Pricing And Subscription Options

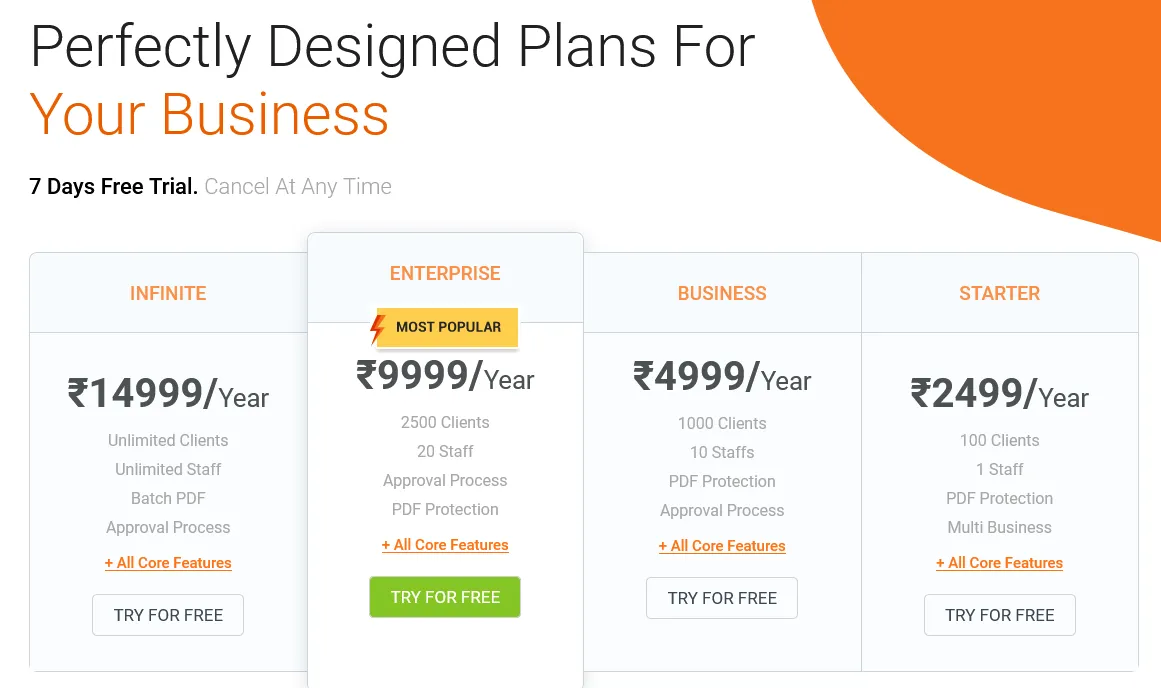

While Invoicera offers a free plan, its premium plans are competitively priced, ensuring businesses get value for their money.

- The ‘Infinite’ plan offers everything unlimited at ₹14999/Year.

- The most famous ‘Enterprise’ plan costs ₹9999/Year.

- Small and medium-sized businesses can choose a ‘Business’ plan at ₹4999/Year.

- The ‘Starter’ plan is for startups or small businesses at ₹2499/Year.

Pros And Cons

Pros:

● User-Friendly Interface: Its intuitive design makes it easy for beginners and seasoned users.

● Comprehensive Reporting: Gain deep insights into your finances through detailed reports.

● Automation Capabilities: Automate recurring invoices and payments, saving time and reducing errors.

Cons:

● Customization Limitations: There might be restrictions in certain areas while offering customization.

FreshBooks Vs. Xero Vs. Quickbooks Vs. Invoicera

How To Choose The Right Invoicing Tool?

Choosing the right invoicing software is a crucial decision that can significantly impact your business’s efficiency and client relationships.

Here are key factors to consider:

- Assess Your Business Needs: Identify your specific requirements, considering whether you need basic invoicing or additional features like expense tracking and recurring billing. Also, think about scalability to accommodate future business growth.

- Check for Suitable Features: Look for software that allows customization of invoices and reports to match your brand. Consider automation features like recurring invoices and payment reminders to streamline processes.

- Prioritize User-Friendly Interface: Opt for software that’s easy to use for you and your team, reducing the learning curve. Ensure it’s accessible across devices for flexibility.

- Evaluate Integration and Compatibility: Seek software that integrates well with your existing tools and is compatible with various file formats and platforms to ensure seamless workflow.

- Ensure Security and Support: Verify the software’s security measures for protecting financial and client data. Check for reliable customer support channels and resources.

- Consider Cost vs. Value: Understand the pricing structure and compare it with the offered features. Evaluate the potential benefits against the cost to ensure a good return on investment.

Conclusion

Choosing between FreshBooks, Xero, QuickBooks, and Invoicera comes down to what your business truly needs. Each has its strengths—FreshBooks for simplicity, Xero for finance control, QuickBooks for versatility, and Invoicera for specialized invoicing.

Finding the right fit means understanding your business, considering costs, and checking out trial versions. It’s not about finding the best, but what works best for you. Pick the software that helps you manage finances hassle-free and supports your business’s growth.

FAQs

Which software is the most cost-effective for a small business?

Invoicera and FreshBooks typically offer more budget-friendly options, especially for smaller businesses or freelancers, while QuickBooks and Xero might be more comprehensive but could come with a higher cost.

Can these platforms handle international transactions?

FreshBooks and Invoicera are often better able to manage international transactions and multiple currencies than Xero and Quickbooks.

Can these platforms integrate with other business tools?

Yes, they all offer integrations with third-party applications like payment processors, CRM software, and project management tools, but the extent of integrations may vary.