Invoices are vital to any business transaction as they record the products or services delivered, the payment due, and the payment terms.

As a business owner or freelancer, it is crucial to understand the

- Different types of invoices

- Their purpose

- The essential elements that must be included

To ensure timely payment and avoid disputes.

This comprehensive guide will cater to you with all the knowledge that you need about invoices. We will cover the

- Different types of invoices

- Their purpose

- Crucial elements must be included in an invoice

- Steps involved in creating an invoice and providing tips on ensuring timely payment

So, whether you’re a

- Freelancer

- A business owner

This post will provide the knowledge you need to create effective invoices that get paid on time.

Let’s get started by understanding

A Quick Introduction To Invoices

It contains details such as

- The name & address of the business & customer

- A description of the products or services

- The price

- The payment terms

The main purpose of an invoice is twofold:

- It provides evidence of the transaction made between the two parties.

- To ensure timely payment, it communicates all important details, such as

- Total cost

- Due date

- Payment terms

- It also serves as a legal document showing proof of the amount owed if the customer or client cannot pay.

- Invoices help businesses manage their accounts receivable and ensure timely payment from customers and clients.

How Do Invoices Facilitate Payment And Record-Keeping By Providing Transparency?

Invoices are an essential tool for facilitating payment and record-keeping in business transactions.

Here are five ways how invoices provide the transparency that helps in payment facilitation and record-keeping:

1) Clarity:

Invoices provide a clear and detailed breakdown of the

- Products or services

- The payment due

- The payment terms

This clarity ensures that both parties understand what is being paid for and when the payment is due.

2) Accuracy:

Invoices help ensure the payment amount is accurate. They provide a clear record of the goods or services and associated costs, reducing the chances of errors in the payment calculation.

3) Payment terms:

Invoices specify the payment terms, such as the

- Payment due date

- Any applicable late payment fees

This ensures both parties know the payment terms and can make payments accordingly.

4) Dispute resolution:

Invoices provide a transaction record that can be used in case of any disputes. It helps to resolve any issues by delivering clear evidence of what was agreed upon.

5) Audit trail:

Invoices provide an audit trail of the transaction, essential for record-keeping.

They can be used to

- Track payments

- Monitor outstanding balances

- Provide documentation for tax purposes.

III. Different Types of Invoices

Invoices come in different types and formats, depending on the

- Country

- Industry

- City

- Specific Requirements

The most common types of invoices are:

- Pro-forma Invoice:

A pro-forma invoice informs buyers of an estimated cost before a transaction occurs. It is issued before an agreement is made and doesn’t constitute a legally binding document.

- Commercial Invoice:

A commercial invoice is used when

- Goods or services have been provided

- Payment is due immediately after the transaction

This type of invoice documents the sale for record-keeping and tax purposes.

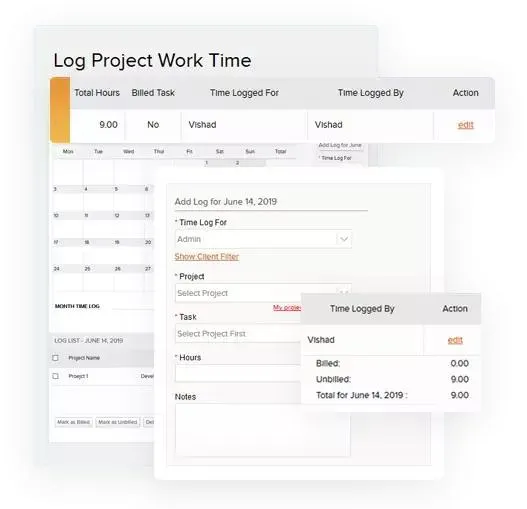

- Timesheet invoices:

Timesheet invoices are used by businesses that charge clients based on the time spent on their projects.

They include a list of the hours worked by each employee on the project and the hourly rate for each employee.

- Recurring invoices:

Recurring invoices are used by businesses that provide subscription-based services.

These invoices are sent to customers regularly and include the same products or services each time.

Now that we know the various types of invoices let’s look at their essential elements.

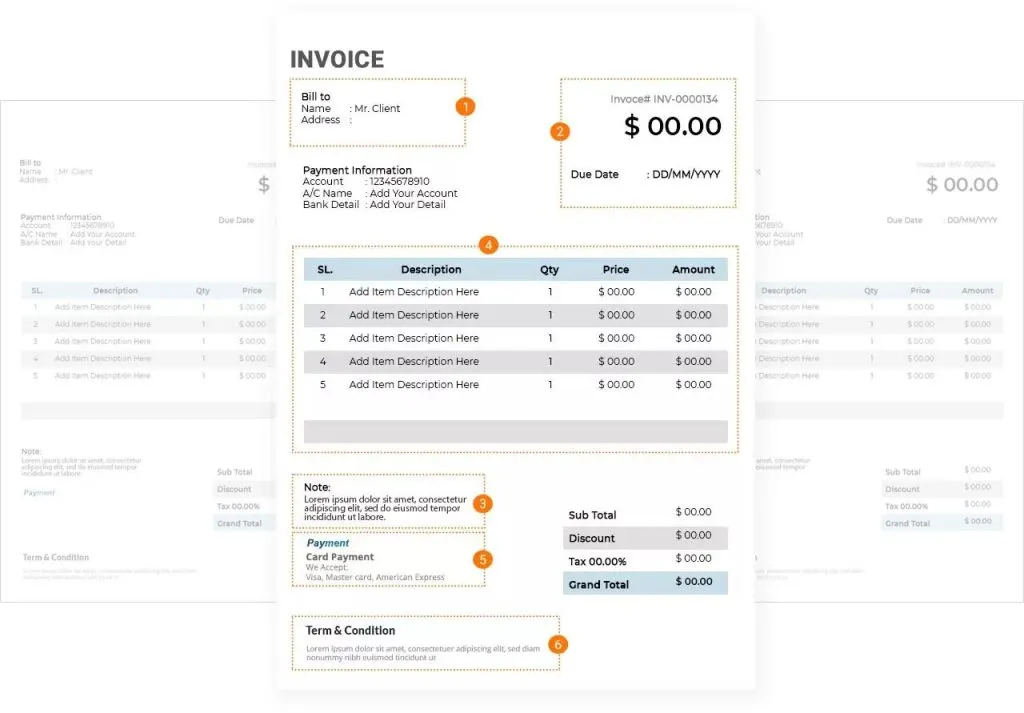

Essential Elements Of An Invoice

As mentioned earlier, invoices are legal documents and must be detailed and accurate.

A well-structured invoice should include all the essential elements to ensure timely payment.

Here are the important elements that should be included in every invoice:

1. Invoice Number:

1. Invoice Number:

The seller assigns a unique identifier to each invoice. The invoice number helps track invoices and ensures that each invoice is accounted for.

2. Invoice Date:

The date when the seller issues the invoice. This is important for record-keeping purposes and to establish a timeline for payment.

3. Seller & Buyer Information:

The invoice should include the

- Name

- Address

- Contact information of both the seller & the buyer

Helping to ensure that the invoice is sent to the correct party and the correct buyer is making the payment.

4. Description of Goods or Services:

The invoice should have a brief description of the provided goods or services, such as

- Quantity

- Type of product or service

- Unit costs

This helps to avoid confusion and disputes over what was provided.

5. Payment terms & methods:

The invoice should clearly state the payment methods, including the

- Due date

- The acceptable payment methods

This helps to ensure that the buyer knows when and how to pay.

6. Total Amount Due:

The invoice should clearly state the amount due for the goods or services, including any taxes or fees.

This helps to avoid confusion & ensures that the buyer knows exactly how much they owe.

7. Due Date:

The invoice should clearly state the due date and the payment date.

This helps ensure the buyer knows when to pay and avoids late fees or penalties.

Now that we have learned about the different types of invoices and the essential elements that must be included in an invoice, let’s look at

How To Create An Invoice

Creating an invoice can appear daunting at first, but with some know-how, it doesn’t have to be.

Here are the steps involved in developing an effective invoice:

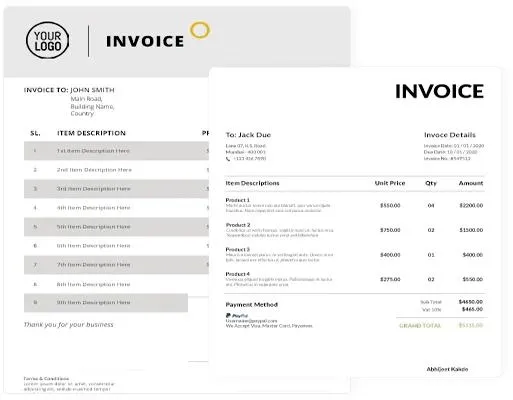

1) Choosing The Right Invoice Format –

Various formats, including paper-based or digital invoices, are created using software programs or online platforms.

Consider the format best for your business and clients’ needs.

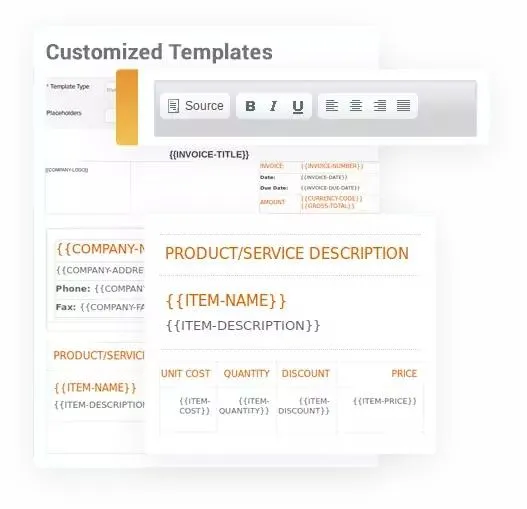

You can opt for Invoicera, the best online invoicing software that comes with the feature of multiple invoice templates and formats.

Streamline your invoicing process and access inbuilt templates; try Invoicera today!

2) Adding Essential Elements-

- Invoice number

- Date

- Seller and buyer information

- Descriptions of goods or services provided

- Payment terms and methods

- The total amount due

- The due date

This helps track invoice data and ensure payments are made on time.

3) Eye-catching Design-

An effective invoice should communicate the essential details, stand out, & leave a lasting impression on the customer.

4) User-Friendly Format-

Make use of tables or grids to break up long paragraphs of text.

This makes it easier for customers to interpret the information and make timely payments.

5) Email Invoice-

This can be done by emailing a digital version of the invoice or by physically mailing a paper-based invoice.

Creating an effective and comprehensive invoice helps businesses to ensure timely payment and avoid disputes with customers or clients.

Now the main question arises:

Which Software Or Solution Should You Use For Creating And Sending Invoices?

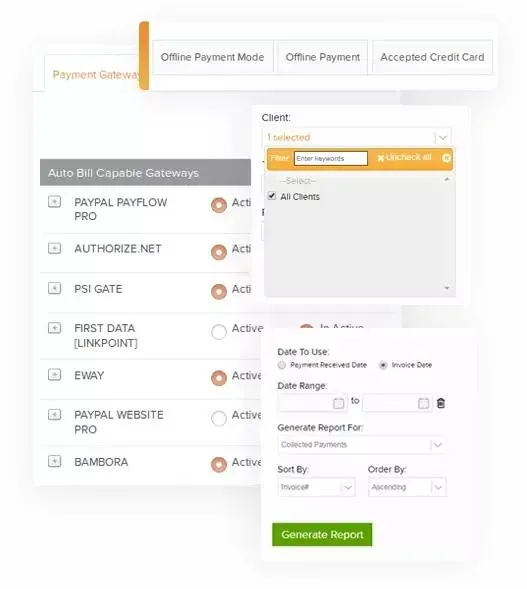

Invoicera is one of the most popular and trusted cloud-based invoice software, making creating, managing, and tracking invoices easier.

It comes with various features, such as

- Customizable Invoice Templates

- Multiple Payment Methods

- Automatic Reminders For Due Payments

- Online Invoicing

- Online Payment

- Subscription Billing

- Project Management

- Time Tracking

- Expense Management

This makes it easier for organizations to manage their invoices and get paid on time leading to better cash flow.

Next Step

In conclusion, invoices are crucial in facilitating transactions between businesses and their clients.

Understanding the different types of invoices and their essential elements can assist you in creating accurate and efficient invoices that will assist you in getting paid on time.

Whether running a small business or a large enterprise, Invoicera is an excellent invoicing software that can simplify your invoicing process and save time and effort.

With its

- User-friendly interface

- Customizable templates

- Advanced features

Invoicera can help you create professional invoices that reflect your brand and enable you to receive payments quickly and securely.

That’s all for today

Thank you for reading

FAQs

Q: What should I do if a buyer does not pay an invoice?

A: If a buyer does not pay an invoice, you can send a payment reminder or a follow-up email.

If the payment is still not received, you may need to send a formal demand letter or seek legal action.

It’s important to have clear payment terms and follow-up procedures to avoid payment delays or disputes.

Q: What are some common invoicing mistakes to avoid?

A: Some common invoicing mistakes to avoid include:

- Not including all essential elements of an invoice

- Inaccurate calculations or pricing errors

- Missing or incorrect buyer information

- Unclear payment terms and methods

- Late or incomplete invoices

- Inconsistency in invoice numbering or formatting

Q: How can I streamline my invoicing process?

A: You can streamline your invoicing process using accounting software that automates

- Invoice creation

- Tracks payments

- Sends reminders

By streamlining your invoicing process, you can save time and focus on growing your business.

1. Invoice Number:

1. Invoice Number: