Discover the Magic of Automated Invoicing

Slash costs by 70%. Begin your automated invoicing journey in minutes.

Choosing the right tool can be tricky, so we’ve put together a side-by-side comparison to make your decision easier.

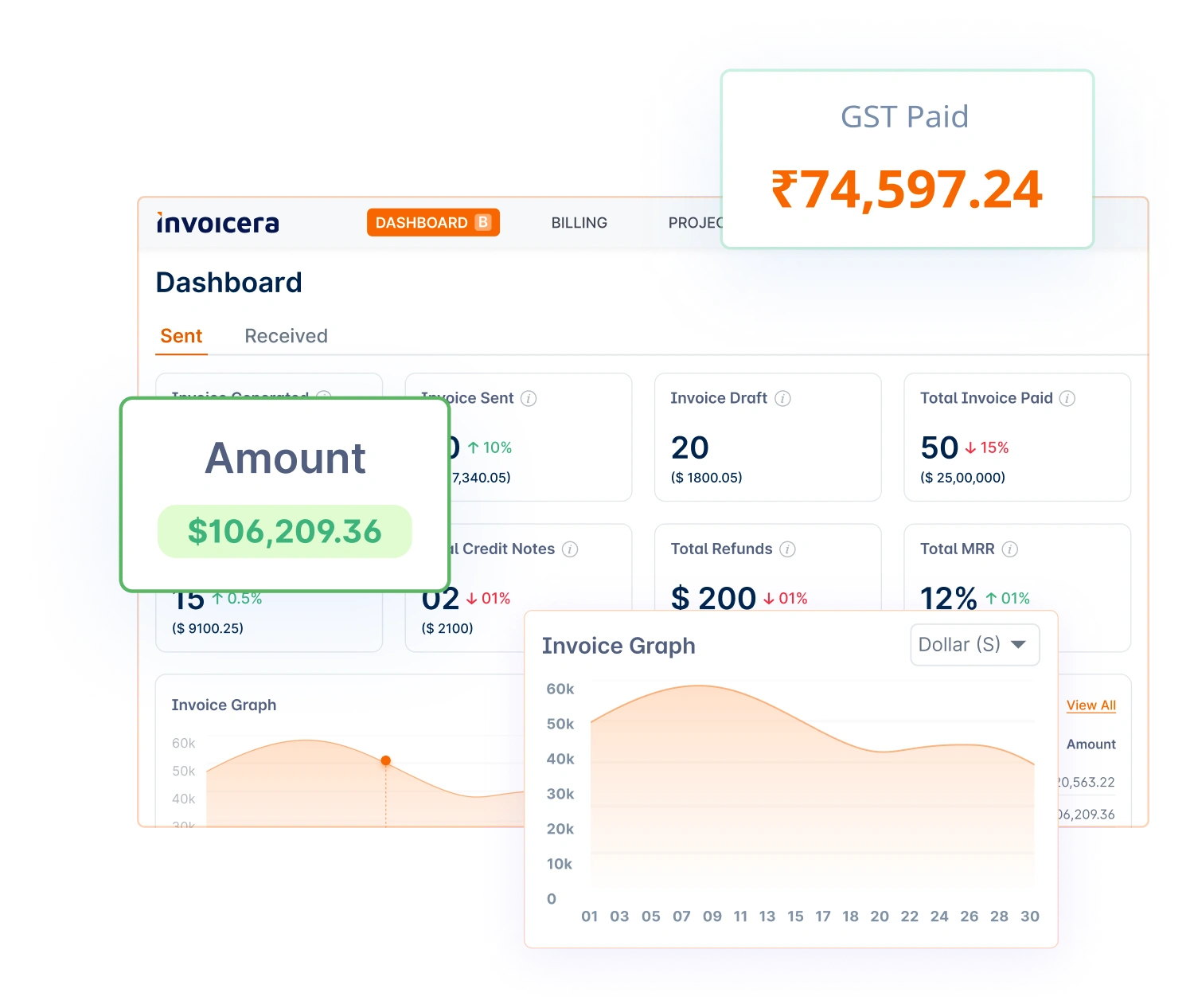

Streamline your billing with Invoicera; packed with features that deliver, without fees.

Bill.com may have served your invoicing needs, but growing businesses need more than just payment processing. Invoicera delivers a powerful, all-in-one platform for billing, automation, and cash flow management.

Invoicera offers highly customizable invoicing solutions, unlike Bill.com, which focuses more on automated payments and accounts payable.

FreshBooks provides intuitive invoicing and time tracking, while Bill.com is primarily designed for handling vendor payments and approvals.

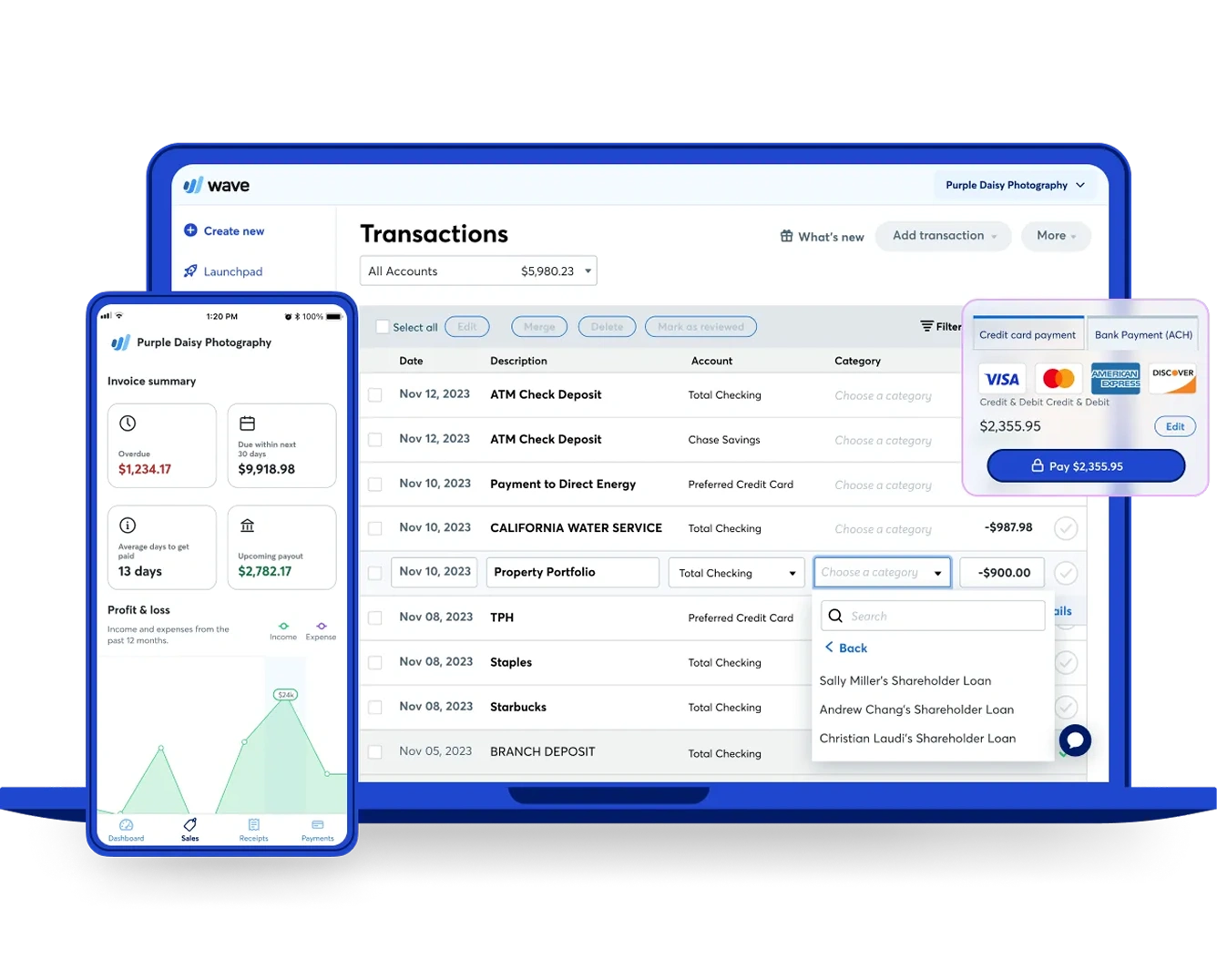

Wave is a cost-effective invoicing tool, while Bill.com is more specialized in automating payment workflows.

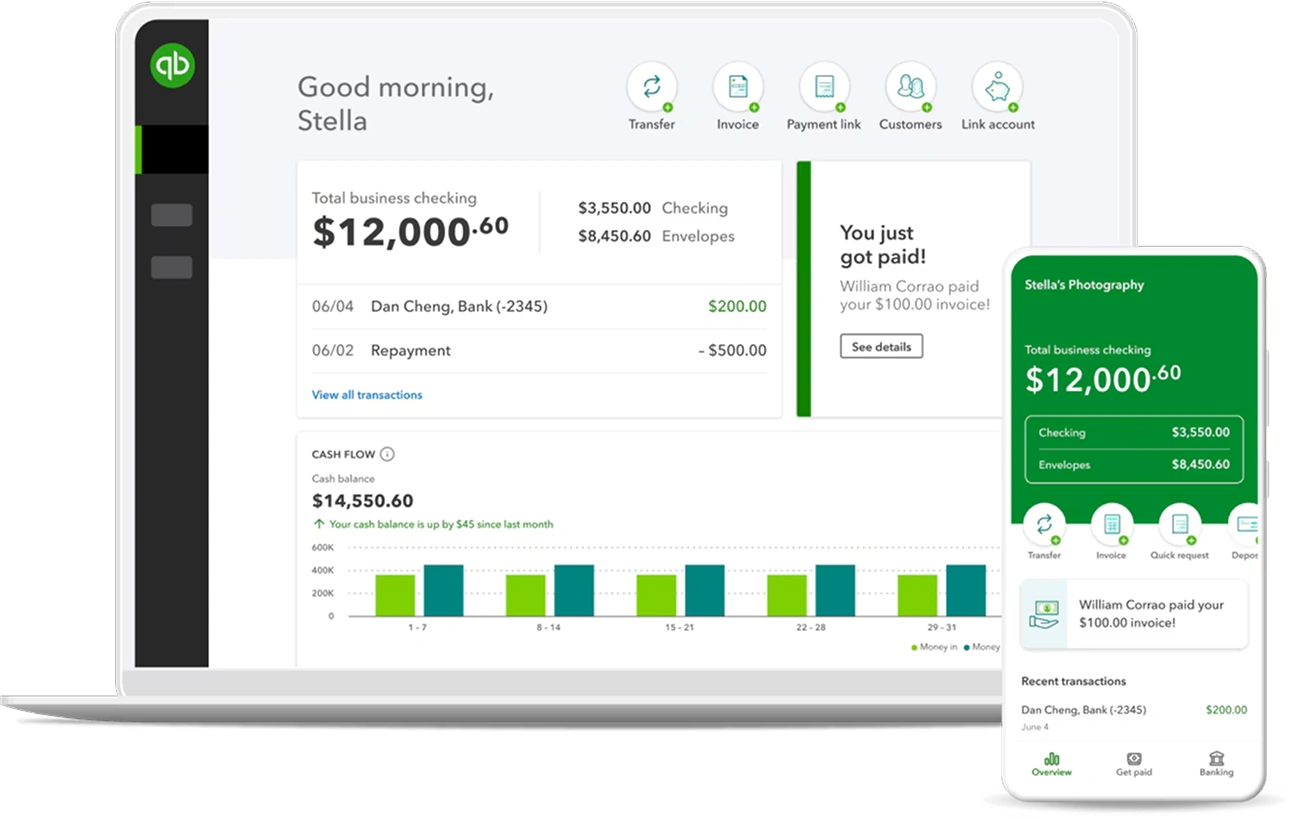

QuickBooks offers full-fledged accounting and invoicing, whereas Bill.com is better suited for accounts payable and receivable automation.

Invoicera offers 14+ payment gateway integrations, ensuring seamless transactions. Bill.com requires additional integrations for similar functionality.

Invoicera supports multi-language invoicing, e-invoicing, and GST billing, making it ideal for global businesses. Bill.com lacks these essential invoicing capabilities.

With features like dunning management, invoice scheduling, and customizable financial reports, Invoicera streamlines billing operations more effectively than Bill.com.

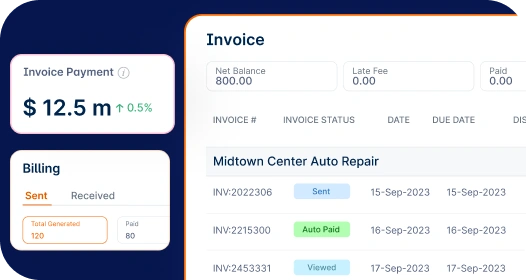

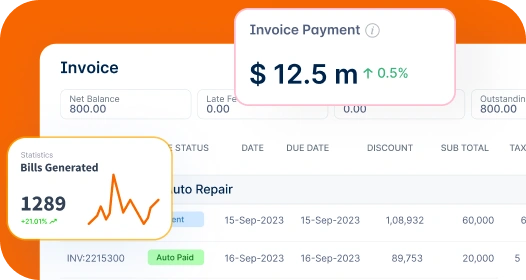

Invoicing automation helps businesses streamline billing, reduce errors, and accelerate payments. Here’s how each tool simplifies invoicing.

Invoicera offers advanced invoicing automation, enabling businesses to send recurring invoices, set up auto-payments, and reduce manual work.

As one of the top Bill.com alternatives, it combines automation with flexibility to meet various business needs.

With multi-currency support, tax compliance, and integrated payment solutions, Invoicera ensures smooth cash flow management. It’s an excellent choice for those seeking an online and automated billing software on one platform.

Key features include:

Additionally, it’s widely recognized among the best invoicing software for small to mid-sized enterprises.

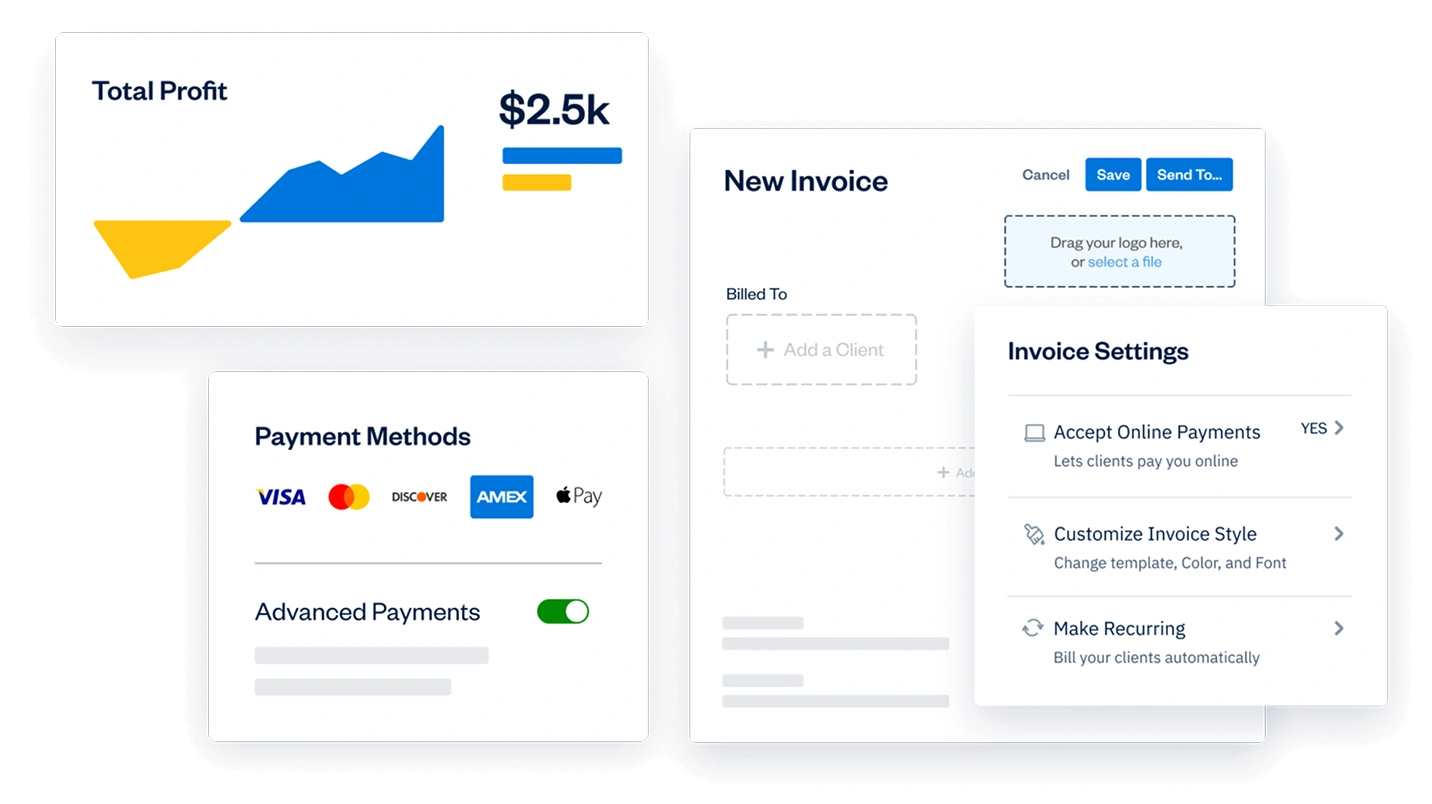

QuickBooks provides invoicing features with automated reminders and online payment options. As one of the major Bill.com competitors, it works well for businesses already using it for accounting.

While it supports multiple payment methods, invoice customization options are limited compared to Invoicera.

FreshBooks offers a user-friendly invoicing system with payment tracking and expense management.

It is ideal for freelancers and small businesses but lacks enterprise-level automation features.

Zoho Invoice provides free invoicing with automation features such as recurring billing and expense tracking.

However, it is limited to small businesses and lacks robust integrations for enterprise users, making other alternatives to Bill.com more appealing for scaling operations.

Paymo includes invoicing as part of its project management suite, allowing users to convert billable hours into invoices.

It does not provide advanced automation for large-scale invoicing needs, making this software less competitive among Bill.com alternatives.

Effective expense management helps businesses control costs and optimize financial planning. Here’s how each finance management software supports tracking expenses.

Invoicera offers a robust expense management system that helps businesses track, categorize, and analyze spending effortlessly.

With automated receipt capture, tax calculations, and detailed reports, Invoicera ensures financial transparency. As an all-in-one online billing software and expense manager, it’s a solid alternative to Bill.com.

Businesses can:

The software also syncs with multiple accounting tools for seamless financial management, setting it apart from many Bill.com competitors.

QuickBooks provides expense tracking with bank reconciliation and tax categorization.

However, it lacks advanced automation features for real-time cost control, making it one of the simpler Bill.com alternatives for smaller firms.

FreshBooks offers basic expense tracking with receipt scanning and categorization.

It is easy to use but lacks enterprise-level financial management tools, placing it in the category of light-use Bill.com alternatives.

Zoho Invoice includes expense tracking but does not offer in-depth analytics or integration with major accounting platforms.

This software is often bypassed for more feature-rich alternatives to Bill.com.

Paymo allows users to track expenses related to projects but lacks automated cost analysis features.

Its focus on project management makes it less viable as dedicated finance management software.

Multi-currency support ensures smooth global transactions and billing. Here’s how each tool manages currency conversions.

Invoicera offers seamless multi-currency invoicing, helping businesses handle international transactions without complications.

With automatic exchange rate updates and tax compliance, Invoicera simplifies global payments.

Ideal for businesses looking for online billing software with international capabilities.

Key features include:

Businesses can bill clients in their preferred currency while receiving payments in their local currency, giving Invoicera an edge over many Bill.com alternatives.

QuickBooks supports multiple currencies but requires manual updates for exchange rates.

It remains a common choice among Bill.com competitors for businesses already using it for accounting functions.

FreshBooks allows businesses to invoice in different currencies but does not offer automated currency conversions.

This limits its appeal as a full-featured alternative to Bill.com for international operations.

Zoho Invoice provides multi-currency support with automatic exchange rate updates.

However, it lacks flexibility in setting different tax rates per currency, which other alternatives to Bill.com handle more effectively.

Paymo offers limited multi-currency support, primarily focusing on project-related billing rather than full-scale invoicing.

It may not meet the demands of companies needing comprehensive online billing software.

Client management ensures businesses maintain strong relationships and manage client billing effectively. Here’s how each tool helps businesses handle clients.

Invoicera offers a comprehensive client management system centralizing client communication, invoicing history, and payment tracking.

With its robust automation features, it stands out among the best invoicing software options that also serve as Bill.com alternatives.

With role-based access, businesses can:

This ensures efficient client handling while reducing payment delays. Invoicera is especially useful when paired with time tracking software for service-based businesses.

QuickBooks provides basic client tracking with invoicing history and reports but lacks advanced automation.

FreshBooks offers a simple client portal for freelancers and small businesses to manage clients and payments.

Zoho Invoice includes a client portal with basic features but does not offer extensive automation for managing multiple clients.

Paymo includes client tracking but primarily focuses on project-based billing rather than full client management.

It’s more suited to time-tracking-focused teams than those needing full finance management software.

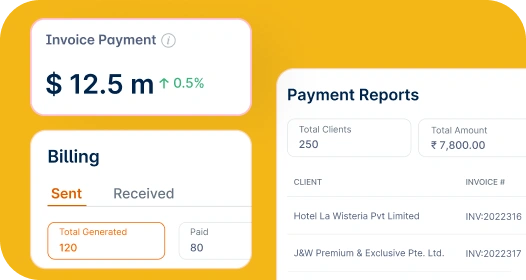

Invoicera stands out as the most feature-rich tool compared to QuickBooks, FreshBooks, Zoho Invoice, and Paymo. It provides advanced automation, global invoicing support, and detailed client management features, making it the ideal choice for businesses.

For businesses looking for an efficient, automated, and scalable invoicing solution, Invoicera is the best choice.

Invoicera offers a more comprehensive and feature-rich solution for financial management.

Unlike Bill.com, it provides:

With Invoicera, businesses can manage finances more efficiently while reducing costs.

Yes, Invoicera ensures you streamline payment processing and manage clients effectively by offering:

Yes, Invoicera offers customizable reports with:

With data-driven insights, businesses can make better decisions and improve workflows.

The best and popular alternatives include Invoicera, QuickBooks, FreshBooks, Wave, and Tipalti. These platforms offer features like automated invoicing, expense tracking, and seamless integrations with accounting software.

We value your feedback and love sharing user experiences.

Streamline billing and generating invoices with Invoicera.

Invoicera is a true value for money software. It offers great features which are suited to all professions.

Explore More

The best Invoice app for managing your finance and generating online invoices. Simple to create invoices and to share with our customers.

Explore MoreStart Risk-Free. No Credit Card Needed. Cancel Anytime.

Seamless integration with your existing software.