Discover the Magic of Automated Invoicing

Slash costs by 70%. Begin your automated invoicing journey in minutes.

Invoicera’s secure invoicing features help you prevent invoice fraud and maintain the integrity of your payment system.

Invoicera provides customizable, tamper-proof invoice templates, making it nearly impossible for anyone to alter or forge your invoices.

Automated e-invoice verification system cross-checks invoice details against your existing data, reducing the risk of fraudulent activities.

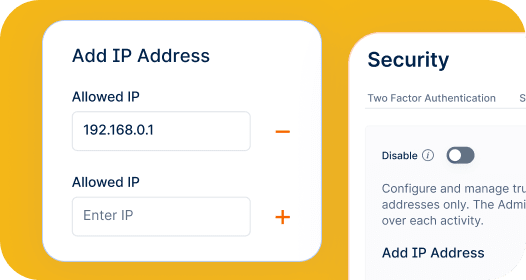

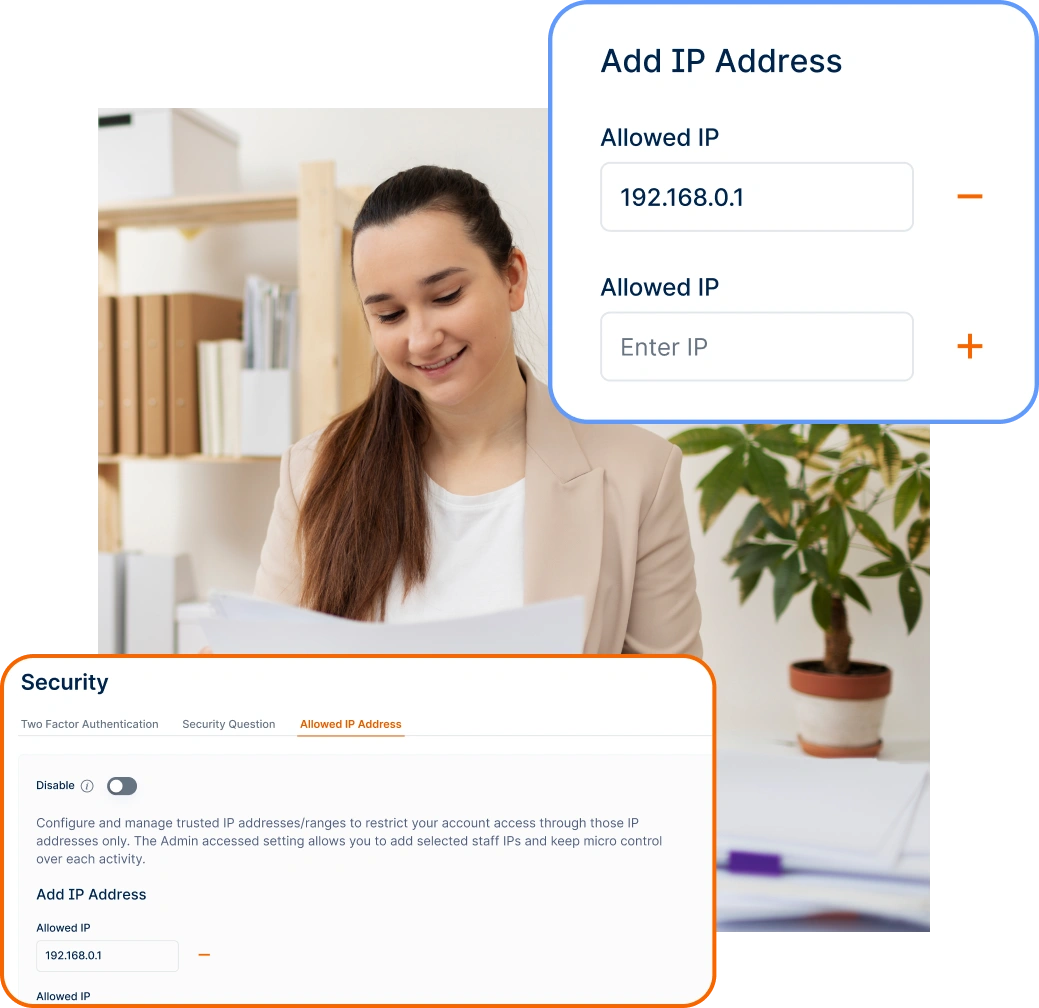

Invoicera implements advanced security measures to safeguard your data from unauthorized access and potential breaches.

Strong password policies prevent unauthorized access to your account.

All data transmission between your browser and Invoicera servers is encrypted using industry-standard protocols.

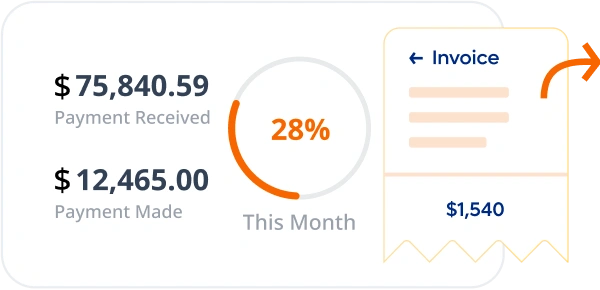

Get real-time insights for efficient financial management and seamless business progress.

A SaaS company reduced manual work by 60% using Invoicera’s automated recurring billing, invoice scheduling, and reminders.

Get Started with Smarter Billing

Digital marketing firm increased payment collection with Invoicera’s automated invoicing, project hour tracking & follow-up reminders.

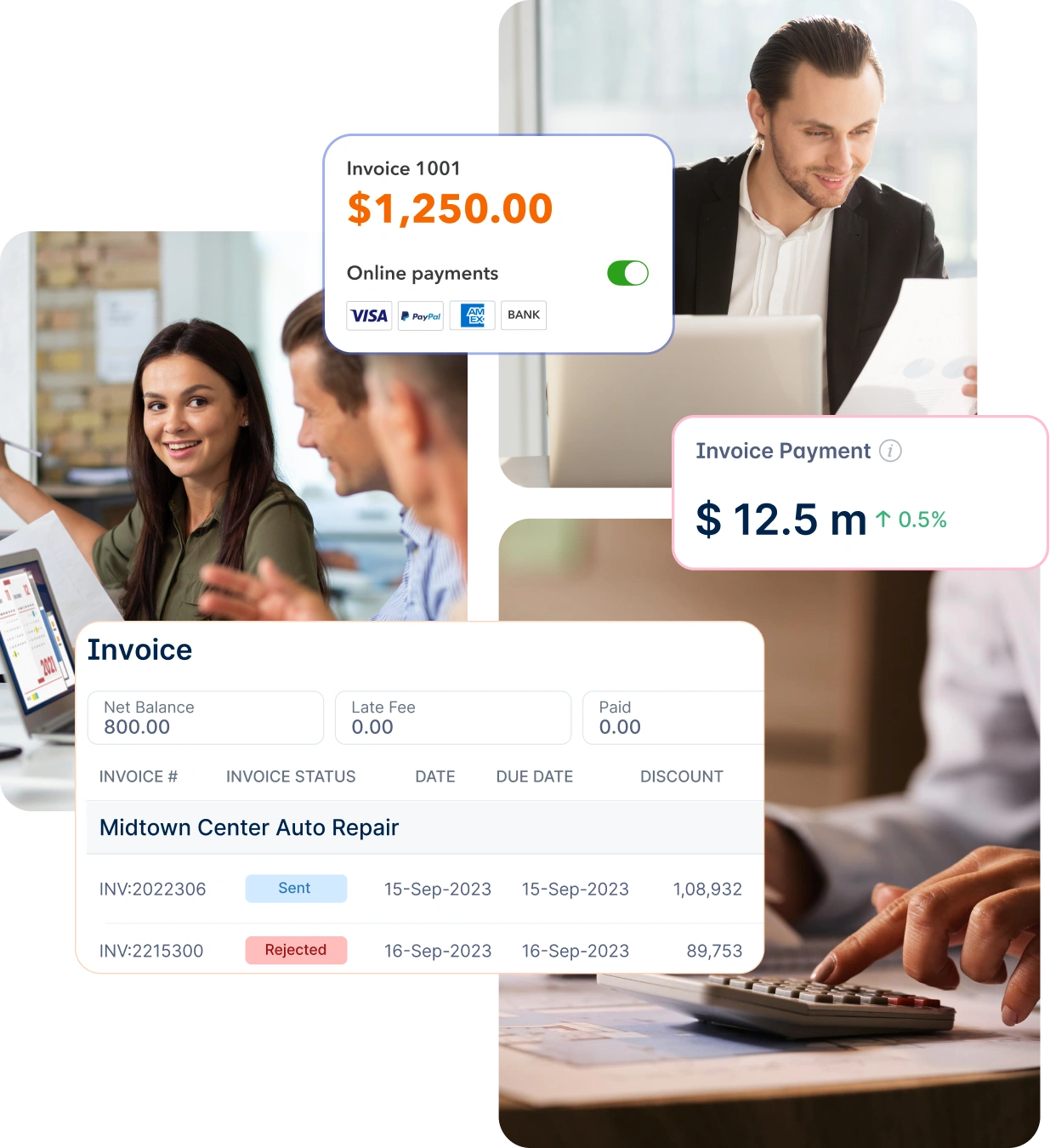

Improve Your Cash FlowInvoicera integrates with trusted and secure online payment methods, giving you peace of mind regarding your online transactions.

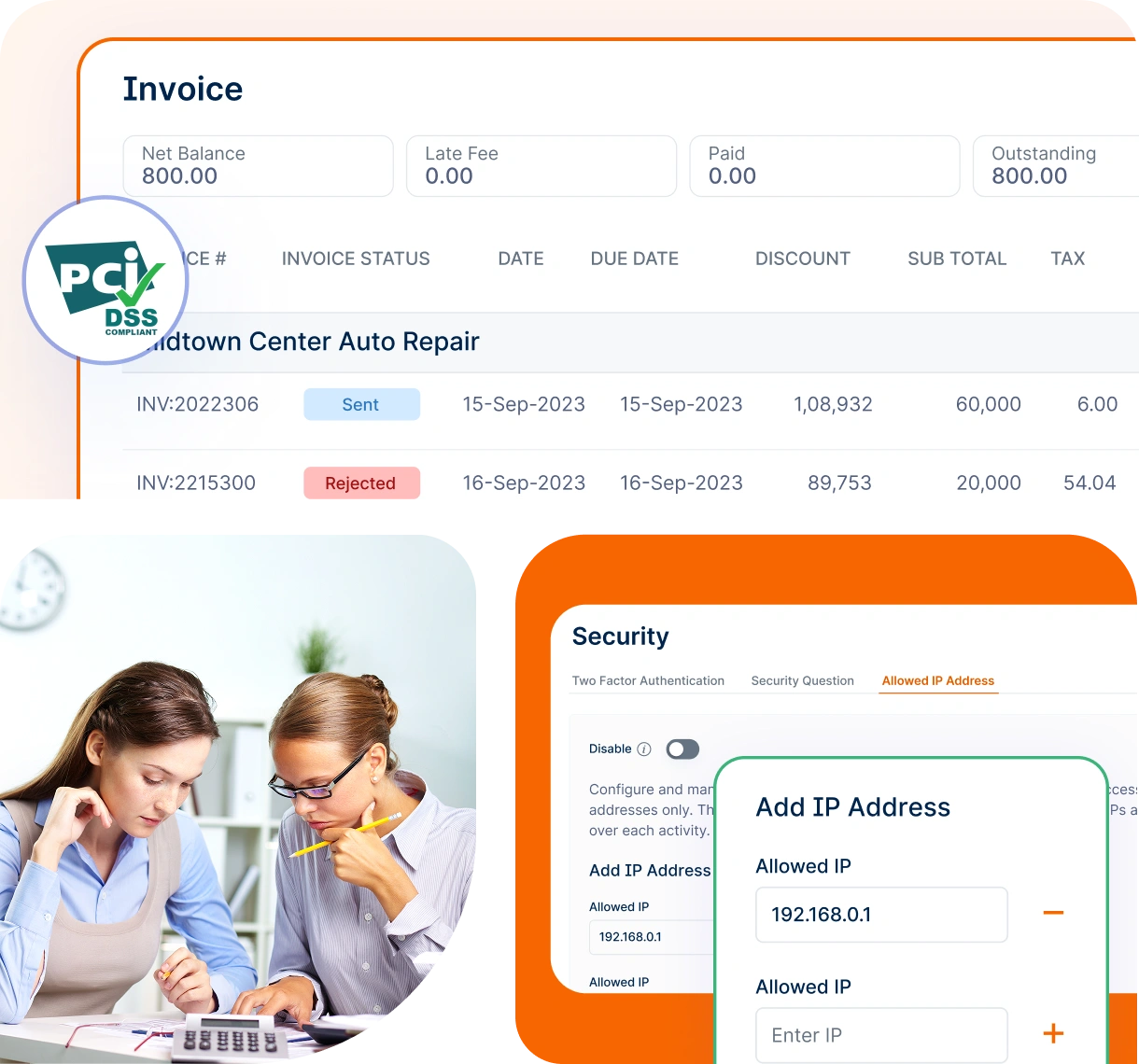

Invoicera complies with the Payment Card Industry Data Security Standard (PCI DSS), ensuring the security of your payment data.

Your payment information is tokenized and encrypted before being stored, protecting you from data breaches.

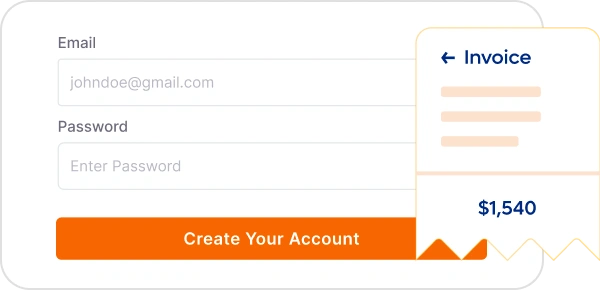

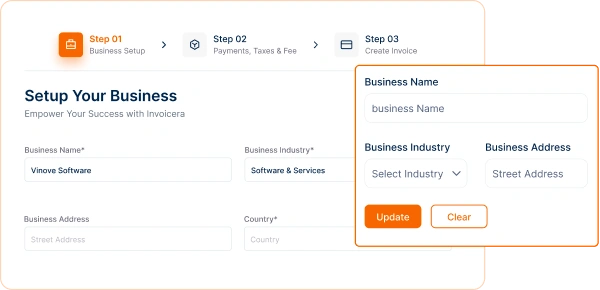

Ready for the most-secured billing process? Here’s how to start your invoicing journey with Invoicera.

Log in to your Invoicera account to access secure invoicing features.

Activate 2FA from the Apps & Integrations settings for added security.

Send and manage invoices securely, protecting your data from fraud.

All-in-one invoicing software to manage & track payments, expenses, bills & more.

Maximize your revenue and drive growth with efficient invoicing.

Create professional invoices in minutes. Automatically add tracked time and expenses.

Learn MoreOptimize your finances with credit control, secure payments & streamlined cash flow.

Learn MoreManage everything in one place - time, estimates, and more, hassle-free.

Learn MoreStay safe and in control with our watchful eye on your data and smooth admin tools.

Learn MoreScale effortlessly with a platform that adapts to the unique needs of any business, large or small.

Stay on top of your cash flow

Turn hours into accurate invoices

Master complex billing effortlessly

Discover reliable payment integration gateways, offering diverse

payment options tailored to your business needs.

No, fraud protection is important for businesses of all sizes. Small businesses can be particularly vulnerable to invoice fraud, making it crucial for them to have adequate protection in place.

If you suspect any fraudulent activity on Invoicera or have security concerns, please contact our support team immediately. We take such matters seriously and will investigate promptly.

Invoicera helps prevent fraud by offering secure invoicing, encrypted transactions, role-based access controls, and real-time monitoring of financial activities. With automated invoice validation, fraud detection algorithms, and compliance with global security standards, Invoicera ensures safe and transparent transactions.

The basic fraud protection features are included in your Invoicera subscription. You might contact our support team to know if there is any additional cost for highly advanced security features.

Invoicera implements multiple security measures, including:

✅ End-to-End Encryption – Protects sensitive payment data.

✅ AI-Powered Fraud Detection – Identifies unusual transaction patterns.

✅ Role-Based Access Control (RBAC) – Restricts user permissions to prevent unauthorized actions.

✅ Invoice Verification – Flags duplicate or altered invoices.

✅ Audit Logs & Reporting – Tracks user activity for enhanced oversight.

Yes, Invoicera offers real-time fraud detection by continuously monitoring transactions and flagging unusual activities. The system analyzes payment behavior, detects anomalies, and alerts businesses about potential risks, helping them take immediate action.

Yes, Invoicera can detect and block suspicious transactions through automated risk analysis. It identifies unusual payment behavior, flags potentially fraudulent invoices, and restricts high-risk transactions based on predefined security rules. Businesses can set up alerts and automate approval workflows to prevent unauthorized payments.

Yes, Invoicera supports multi-factor authentication (MFA) to enhance payment security. This ensures that only authorized users can process payments by requiring multiple verification steps, such as passwords, OTPs, or biometric authentication, reducing the risk of unauthorized access and fraud.

We value your feedback and love sharing user experiences.

Streamline billing and generating invoices with Invoicera.

Invoicera is a true value for money software. It offers great features which are suited to all professions.

Explore More

The best Invoice app for managing your finance and generating online invoices. Simple to create invoices and to share with our customers.

Explore MoreStart Risk-Free. No Credit Card Needed. Cancel Anytime.

Seamless integration with your existing software.