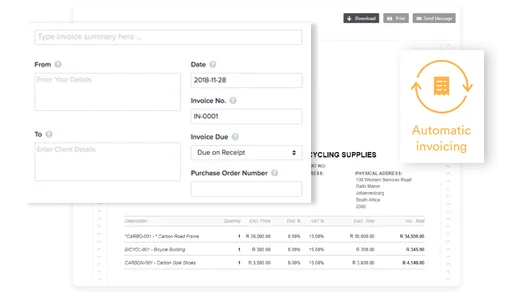

Discover the Magic of Automated Invoicing

Slash costs by 70%. Begin your automated invoicing journey in minutes.

The client is a Bulgaria-based company that provides tax auditing services to the Bulgarian government. The client required automation of the tax and invoicing processes for clients. Along with this, the client wanted to submit tax reports to Bulgarian Tax authorities on behalf of their customers. It was also required for the client to verify their clients’ VAT numbers before implementing the tax on invoices, and based on the verification, the tax would be automatically applied.

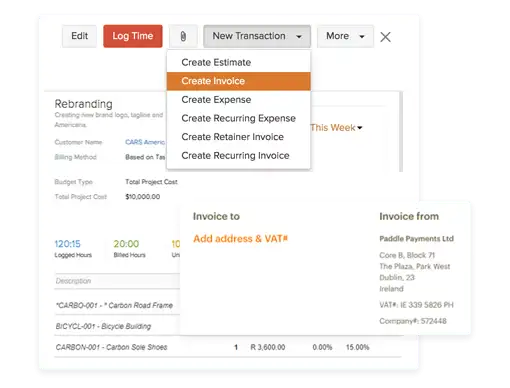

We had to automate the taxation process for the Bulgarian Government indirectly. For this, we were required to verify the VAT number of companies on every invoice that was sent out of the system. To verify the VAT number, we customized an invoice system and added additional fields for verifying the VAT of companies. Along with this, we integrated the Bulgarian Government. VAT verification API in our existing system through which the VAT number of companies will be verified.

The complete invoicing solution with all its existing features was provided to the client. The client opted for self-hosting, so this instance of Invoicera is hosted on their own server. Along with this, we provided:

The customized invoicing solution successfully automated taxation for the Bulgarian Government, incorporating VAT verification by adding specific fields and integrating the government’s VAT verification API. The client’s self-hosted Invoicera instance now seamlessly handles automatic taxation, VAT verification, invoice creation, expense tracking, and report submissions to the Bulgarian Government.