Discover the Magic of Automated Invoicing

Slash costs by 70%. Begin your automated invoicing journey in minutes.

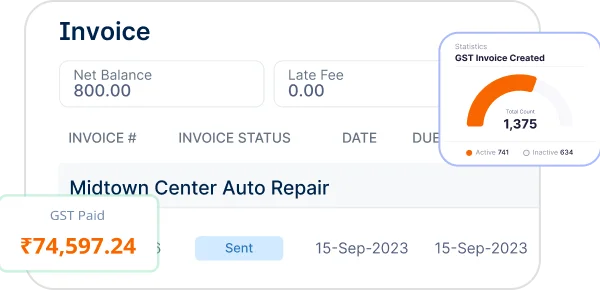

Easily generate, manage, and track GST-compliant invoices from Invoicera’s mobile app.

Transactions

Subscribers

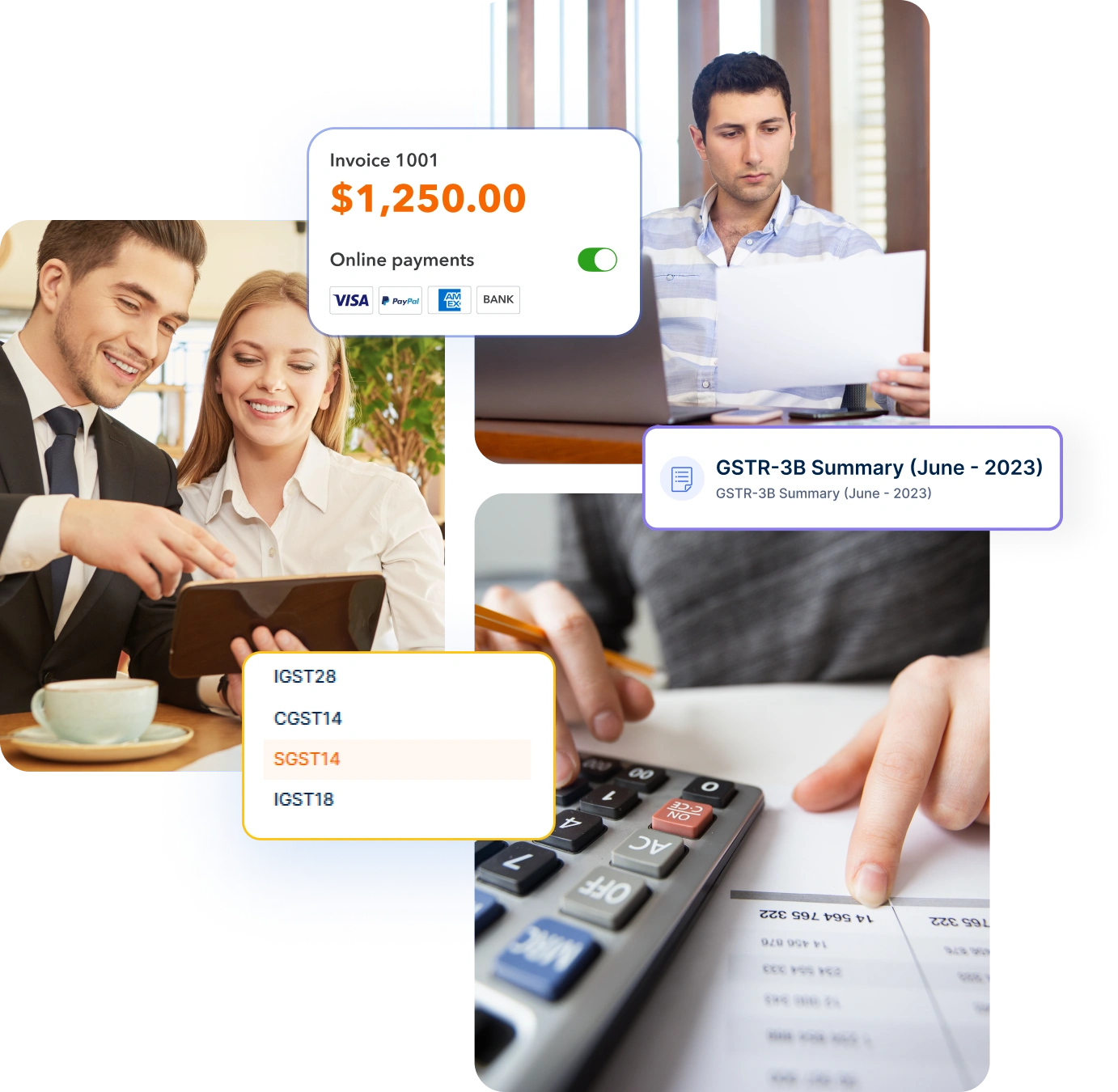

Create professional invoices that reflect your brand while meeting government mandates using our GST Billing software for small businesses.

Design professional invoices with GST details, HSN/SAC codes, and tax rates.

Instantly generate e-way bills for transactions requiring GST-mandated documentation.

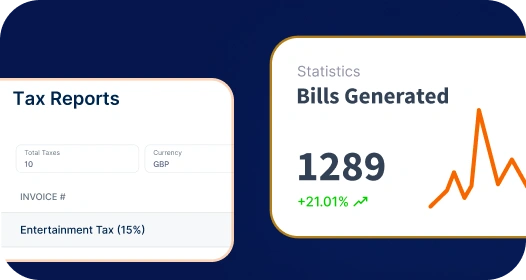

Generate comprehensive summaries and annual reports for hassle-free tax filing.

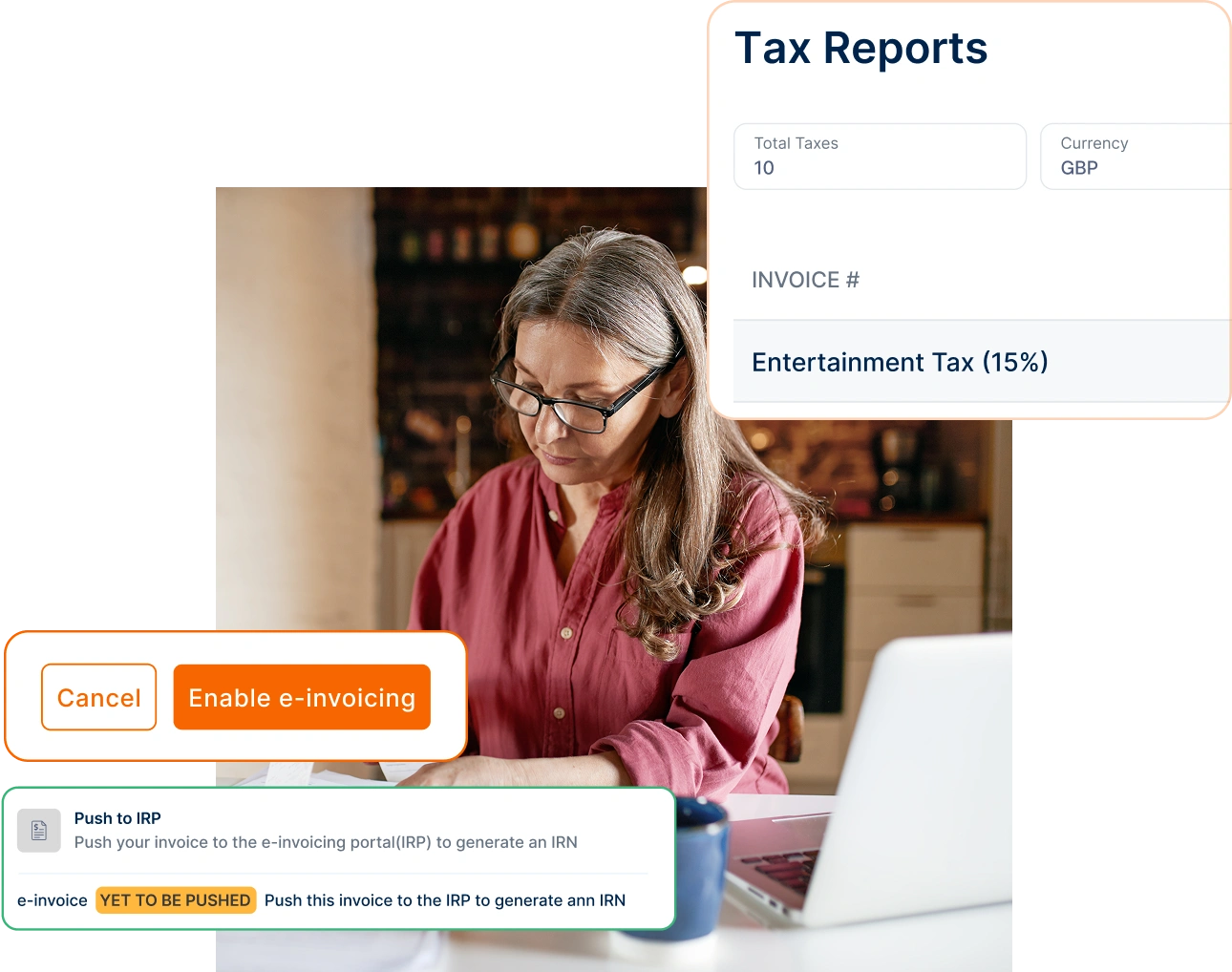

Generate GSTN-authenticated e-invoices for all B2B transactions effortlessly.

Access detailed tax and reconciliation reports for accurate financial tracking.

Get real-time insights for efficient financial management and seamless business progress.

A SaaS company reduced manual work by 60% using Invoicera’s automated recurring billing, invoice scheduling, and reminders.

Get Started with Smarter Billing

Digital marketing firm increased payment collection with Invoicera’s automated invoicing, project hour tracking & follow-up reminders.

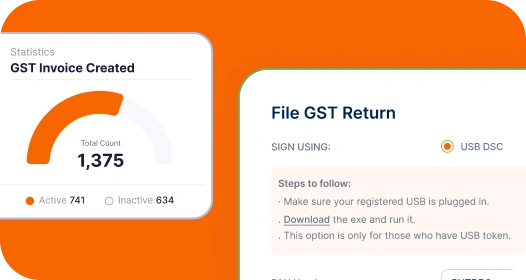

Improve Your Cash FlowImprove accuracy in filing your GST returns with customizable approval workflows.

Set up approval workflows for reviewing GST returns before submission.

Monitor input tax credits and reverse charges for accurate tax claims.

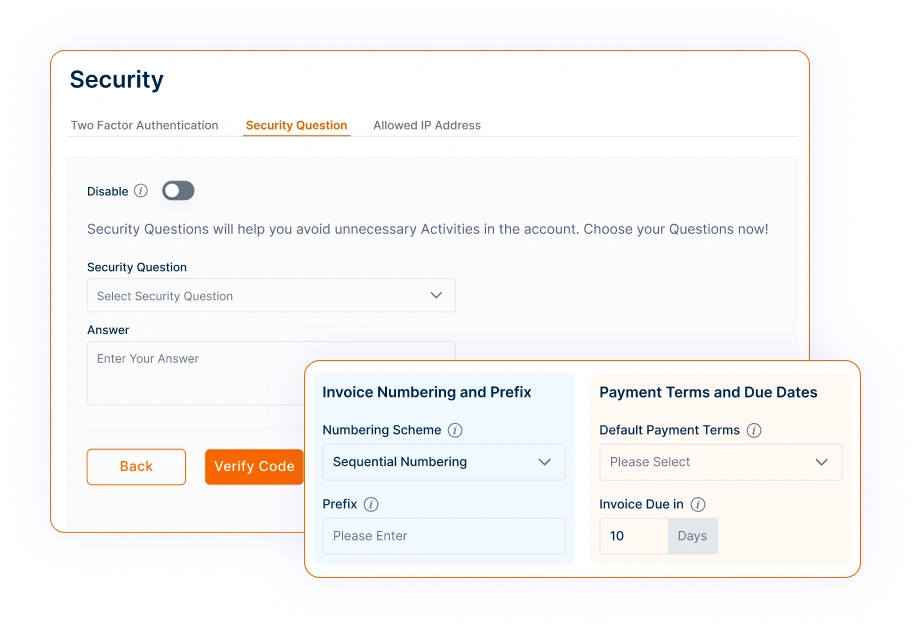

We take your security seriously. Our top-notch tech keeps your data locked down tight so you can focus on running your business.

Whether you’re sending invoices or receiving payments, every transaction stays protected.

Your path to invoicing excellence starts with our online GST invoicing software – take the step that transforms your business landscape.

Visit the Invoicera website and quickly sign up to experience efficient invoicing.

Easily add GSTIN and payment terms to create customized, professional invoices.

Schedule or email your GST invoice instantly and track its status and payments.

All-in-one invoicing software to manage & track payments, expenses, bills & more.

Maximize your revenue and drive growth with efficient invoicing.

Create professional invoices in minutes. Automatically add tracked time and expenses.

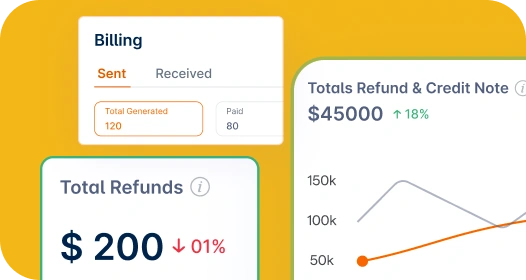

Learn MoreOptimize your finances with credit control, secure payments & streamlined cash flow.

Learn MoreManage everything in one place - time, estimates, and more, hassle-free.

Learn MoreStay safe and in control with our watchful eye on your data and smooth admin tools.

Learn MoreScale effortlessly with a platform that adapts to the unique needs of any business, large or small.

Stay on top of your cash flow

Turn hours into accurate invoices

Master complex billing effortlessly

Discover reliable payment integration gateways, offering diverse

payment options tailored to your business needs.

Invoicera provides a user-friendly platform that allows you to generate GST & VAT-compliant invoices easily. It automates the process of including required GST & VAT details, ensuring compliance with GST & VAT laws.

A GST invoice should include details like the supplier’s and recipient’s name and address, GSTIN, invoice number, date of issue, description of goods or services, taxable value, applicable GST rates, and more.

A VAT invoice must include specific details to ensure compliance with tax regulations. These include:

Mistakes on a GST & VAT invoice should be corrected through a ‘Credit Note‘ or a ‘Debit Note,’ depending on the nature of the error. You can also edit your invoice even after it is sent.

Yes, Invoicera’s platform is designed to handle different GST & VAT rates for various products and services, making it flexible and compliant with GST & VAT regulations.

Yes, Invoicera allows you to create invoices with multiple tax rates, including CGST, SGST, IGST, and UTGST, ensuring seamless GST compliance.

Absolutely! Invoicera enables easy reconciliation of GST data by tracking your purchases and sales, ensuring accurate tax calculations and compliance.

Yes, Invoicera integrates with GSTN, allowing automated tax filing and real-time GST compliance, reducing manual efforts and errors.

Yes, Invoicera supports multiple languages, making it easy for businesses across regions to manage GST billing in their preferred language.

We value your feedback and love sharing user experiences.

Streamline billing and generating invoices with Invoicera.

Invoicera is a true value for money software. It offers great features which are suited to all professions.

Explore More

The best Invoice app for managing your finance and generating online invoices. Simple to create invoices and to share with our customers.

Explore MoreStart Risk-Free. No Credit Card Needed. Cancel Anytime.

Seamless integration with your existing software.